An invoice for tax deductions should include essential documents such as a detailed receipt, proof of payment, and a clear description of the goods or services provided. It must also feature the seller's and buyer's contact information, tax identification numbers, invoice date, and total amount including taxes. Properly organized invoices ensure compliance with tax regulations and facilitate accurate deduction claims.

What Documents Should Be Included in an Invoice for Tax Deductions?

| Number | Name | Description |

|---|---|---|

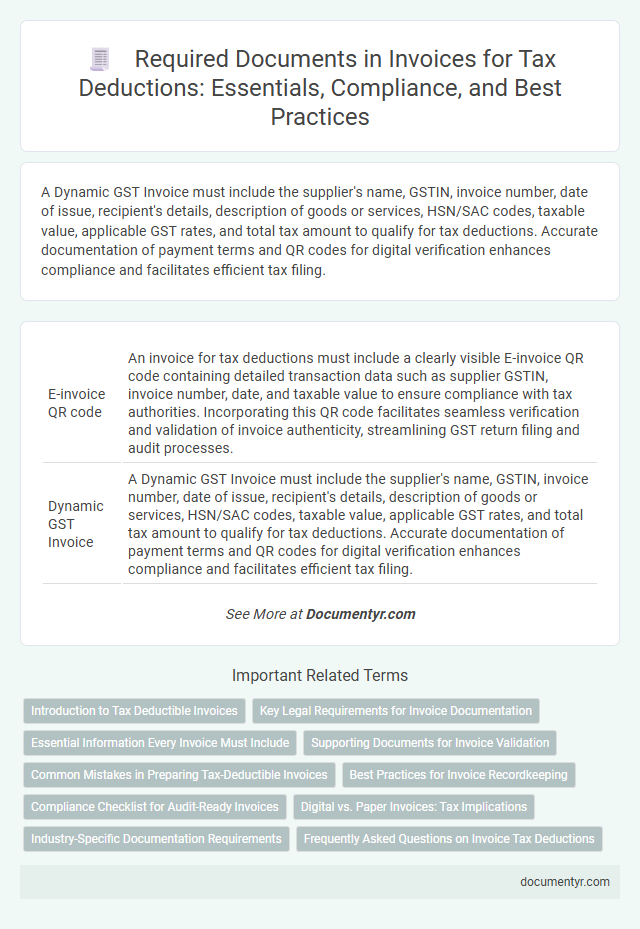

| 1 | E-invoice QR code | An invoice for tax deductions must include a clearly visible E-invoice QR code containing detailed transaction data such as supplier GSTIN, invoice number, date, and taxable value to ensure compliance with tax authorities. Incorporating this QR code facilitates seamless verification and validation of invoice authenticity, streamlining GST return filing and audit processes. |

| 2 | Dynamic GST Invoice | A Dynamic GST Invoice must include the supplier's name, GSTIN, invoice number, date of issue, recipient's details, description of goods or services, HSN/SAC codes, taxable value, applicable GST rates, and total tax amount to qualify for tax deductions. Accurate documentation of payment terms and QR codes for digital verification enhances compliance and facilitates efficient tax filing. |

| 3 | E-way Bill Reference | Including the E-way Bill reference in an invoice is crucial for validating the movement of goods and ensuring compliance with GST regulations, which supports seamless tax deductions. This reference confirms the legitimacy of the transaction and aids in accurate tax filing and audit processes. |

| 4 | HSN/SAC Code Breakdown | An invoice for tax deductions must include a detailed HSN (Harmonized System of Nomenclature) or SAC (Service Accounting Code) code breakdown to ensure accurate GST compliance and facilitate input tax credit claims. This breakdown helps tax authorities verify the nature of goods or services provided, streamlining audit processes and minimizing discrepancies in tax reporting. |

| 5 | Reverse Charge Mechanism Statement | An invoice subject to the Reverse Charge Mechanism must include a clear statement such as "Reverse Charge Applicable" along with the applicable GST rate to ensure compliance and eligibility for tax deductions. Including the supplier's and recipient's GSTIN, invoice number, date, and details of goods or services provided is crucial for proper validation under tax authorities. |

| 6 | Digital Signature Authentication | Invoices for tax deductions must include a digital signature authentication to verify the document's legitimacy and ensure compliance with tax regulations. This electronic signature serves as a secure proof of authorization, preventing fraud and facilitating accurate record-keeping for audit purposes. |

| 7 | TDS/TCS Declaration | An invoice for tax deductions must include a clear TDS/TCS declaration specifying the deduction amount, relevant tax rates, and the deductor's TAN (Tax Deduction and Collection Account Number) to ensure compliance with tax regulations. Additionally, the invoice should contain the supplier's GSTIN, invoice number, date, description of goods or services, and the recipient's details to validate the deduction claims. |

| 8 | Input Tax Credit (ITC) Ledger | An invoice for tax deductions must include a detailed Input Tax Credit (ITC) ledger reflecting the GST paid on purchases, supplier details, invoice number, date, and taxable value to ensure proper claim of credits. Accurate documentation in the ITC ledger is essential for verifying tax payments and facilitating seamless tax deduction and compliance audits. |

| 9 | Place of Supply Tagging | Invoices for tax deductions must include the Place of Supply tagging to accurately reflect the jurisdiction for GST or VAT purposes, ensuring compliance with local tax laws. Proper identification of the Place of Supply enables correct tax calculation and facilitates seamless input tax credit claims. |

| 10 | Cross-border Tax Compliance Annexure | For tax deductions in cross-border transactions, an invoice must include a detailed Annexure specifying the nature of goods or services, their origin, Harmonized System (HS) codes, and applicable tax treaty references. This annexure ensures compliance with international tax laws, minimizes withholding tax liabilities, and supports accurate claim submissions during cross-border audits. |

Introduction to Tax Deductible Invoices

An invoice plays a crucial role in documenting business transactions and supporting tax deductions. Properly prepared invoices ensure compliance with tax regulations and accurate financial reporting.

Invoices eligible for tax deductions must include specific documents to validate expenses. Key elements are the supplier's details, a clear description of goods or services, the transaction date, and the total amount paid. Including these documents within the invoice helps businesses claim legitimate tax benefits efficiently.

Key Legal Requirements for Invoice Documentation

An invoice for tax deductions must include essential legal details to ensure compliance with tax authorities. Key elements include the supplier's name, address, and tax identification number.

The invoice should also list the date of issue, a unique invoice number, and a detailed description of goods or services provided. Accurate totals with applicable taxes, such as VAT or sales tax, are required to validate deductions.

Essential Information Every Invoice Must Include

An invoice must contain specific documents to qualify for tax deductions and ensure accurate financial records. Properly detailed invoices help businesses comply with tax regulations and support expense claims.

- Seller's Information - The invoice must include the seller's legal name, address, and tax identification number for verification.

- Buyer's Details - The buyer's name and address should be clearly stated to establish the transaction parties.

- Invoice Date and Number - A unique invoice number and the date of issue must be present for proper tracking.

- Description of Goods or Services - Detailed descriptions, quantities, and unit prices are required to specify what is being invoiced.

- Total Amount and Taxes - The total payable amount including applicable taxes like VAT or sales tax must be clearly indicated.

- Payment Terms - Payment due date and accepted payment methods should be stated to avoid confusion during settlement.

Supporting Documents for Invoice Validation

What documents should be included in an invoice for tax deductions? Supporting documents such as purchase orders, delivery receipts, and payment proofs are essential for invoice validation. These documents help verify the transaction details and ensure compliance with tax regulations.

Common Mistakes in Preparing Tax-Deductible Invoices

Invoices for tax deductions must include essential documents such as the supplier's tax identification number, detailed description of goods or services, and the total amount with applicable taxes. Missing these elements may lead to rejection of tax deductions by authorities.

Common mistakes include omitting the invoice date, inaccurate or incomplete supplier details, and lack of proper tax codes. Ensuring accuracy prevents delays in processing and helps maintain compliance with tax regulations.

Best Practices for Invoice Recordkeeping

Proper invoice documentation is essential for maximizing tax deductions and maintaining clear financial records. Best practices for invoice recordkeeping ensure accuracy and compliance with tax authorities.

- Include the Supplier's Details - Ensure the invoice lists the supplier's name, address, and tax identification number for verification purposes.

- Detail the Goods or Services Provided - Specify descriptions, quantities, and prices of items or services to justify expenses clearly.

- Attach Supporting Documents - Keep receipts, purchase orders, and payment confirmations linked to the invoice to support your tax deduction claims.

Compliance Checklist for Audit-Ready Invoices

An invoice for tax deductions must include essential documents such as the seller's tax identification number, detailed description of goods or services, and the transaction date. Ensure compliance by including payment terms, buyer's information, and the total amount payable with applicable tax breakdowns. Maintaining this documentation supports audit readiness and helps validate expense claims to tax authorities.

Digital vs. Paper Invoices: Tax Implications

Invoices must include essential documents like a detailed purchase description, proof of payment, and tax identification numbers to qualify for tax deductions. Digital invoices offer advantages such as easy storage, quick access, and automated calculations, while paper invoices require physical filing and are prone to loss or damage. Your choice between digital and paper invoices impacts tax compliance and audit readiness, as digital formats often facilitate better record-keeping and submission accuracy.

Industry-Specific Documentation Requirements

| Industry | Required Invoice Documents for Tax Deductions |

|---|---|

| Retail | Detailed sales receipts, proof of purchase, credit card slips, inventory logs supporting transaction details |

| Construction | Work completion certificates, material supply invoices, labor cost reports, subcontractor agreements |

| Healthcare | Patient invoices, insurance claim forms, medical procedure codes, practitioner licenses |

| Manufacturing | Raw material bills, production logs, quality control reports, shipping and delivery confirmations |

| Freelance/Consulting | Service contracts, timesheets, payment acknowledgments, client correspondence supporting work completed |

| Hospitality | Guest receipts, booking confirmations, expense reports for supplies, vendor invoices for food and beverages |

What Documents Should Be Included in an Invoice for Tax Deductions? Infographic