Small businesses require key documents for GST-compliant invoicing, including a valid tax invoice that displays the supplier's name, GSTIN, invoice number, date, and a detailed description of goods or services provided. The invoice must also specify the taxable value, GST rate, and the amount of GST charged. Maintaining accurate records of these documents ensures proper tax filing and seamless compliance with GST regulations.

What Documents Does a Small Business Need for GST-Compliant Invoicing?

| Number | Name | Description |

|---|---|---|

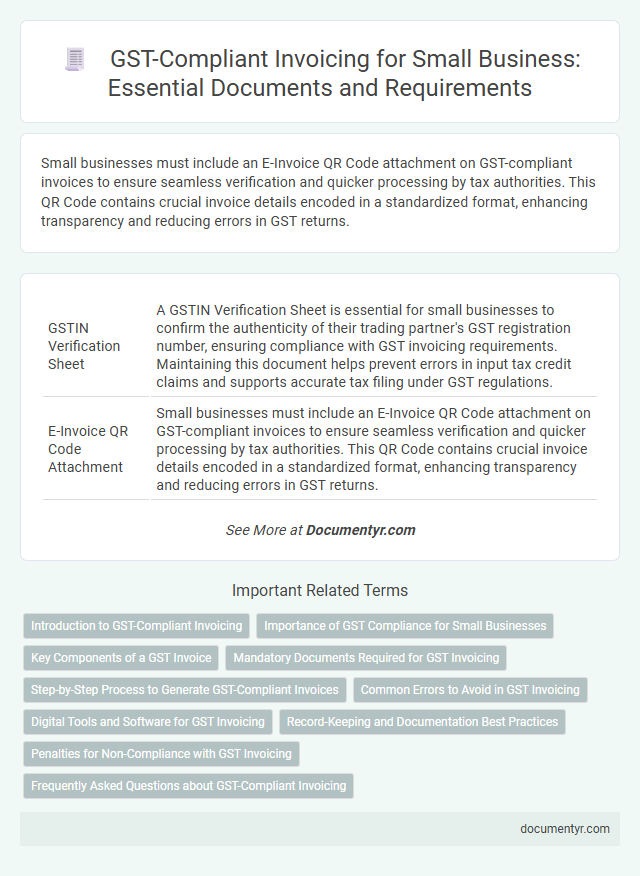

| 1 | GSTIN Verification Sheet | A GSTIN Verification Sheet is essential for small businesses to confirm the authenticity of their trading partner's GST registration number, ensuring compliance with GST invoicing requirements. Maintaining this document helps prevent errors in input tax credit claims and supports accurate tax filing under GST regulations. |

| 2 | E-Invoice QR Code Attachment | Small businesses must include an E-Invoice QR Code attachment on GST-compliant invoices to ensure seamless verification and quicker processing by tax authorities. This QR Code contains crucial invoice details encoded in a standardized format, enhancing transparency and reducing errors in GST returns. |

| 3 | Dynamic HSN/SAC Mapping Table | A small business requires a dynamic HSN/SAC mapping table to ensure GST-compliant invoicing by accurately categorizing goods and services according to their tax rates. This table updates with the latest GST notifications, enabling precise tax calculation and seamless input tax credit claims. |

| 4 | Reverse Charge Declaration Annexure | Small businesses must include a Reverse Charge Declaration Annexure in their GST-compliant invoices when the reverse charge mechanism applies, clearly stating the details of the supplier, recipient, and the nature of goods or services involved. This annexure ensures accurate tax liability reporting and compliance with GST regulations by documenting the shift of tax payment responsibility from the supplier to the recipient. |

| 5 | Digital Signature Log | Small businesses must maintain a digital signature log to ensure GST-compliant invoicing, tracking each digitally signed invoice's date, time, and signatory details. This log enhances invoice authenticity, supports audit processes, and helps meet GST regulatory requirements seamlessly. |

| 6 | E-Way Bill Integration Sheet | Small businesses require an E-Way Bill Integration Sheet as part of GST-compliant invoicing to ensure seamless tracking and validation of goods movement under GST regulations. This document links invoice details with the e-way bill system, facilitating accurate reporting and compliance during transportation of taxable goods. |

| 7 | Invoice Reference Number (IRN) Ledger | The Invoice Reference Number (IRN) Ledger is a crucial document for small businesses to maintain GST-compliant invoicing, as it records all generated IRNs linked to each invoice issued. This ledger ensures accurate tracking and validation of invoices with the GST portal, aiding in seamless compliance and audit readiness. |

| 8 | ITC (Input Tax Credit) Reconciliation Statement | A small business needs to maintain detailed GST-compliant invoices, purchase registers, and Input Tax Credit (ITC) reconciliation statements to accurately claim tax credits and ensure compliance with GST regulations. The ITC reconciliation statement verifies the matching of inward supplies and input tax credits claimed against vendor filings, preventing discrepancies during GST audits. |

| 9 | B2B, B2C, and Export Invoice Registers | Small businesses must maintain separate registers for B2B, B2C, and export invoices to ensure GST compliance, including detailed records of invoice numbers, dates, recipient GSTINs, values, and tax amounts. Accurate documentation of sales transactions in these registers supports seamless GST filing and audit readiness. |

| 10 | Self-Invoice Register for RCM (Reverse Charge Mechanism) | Small businesses must maintain a Self-Invoice Register specifically for transactions under the Reverse Charge Mechanism (RCM) to ensure GST compliance, documenting supplier details, GSTIN, invoice number, date, and tax amount. Accurate records in the Self-Invoice Register are crucial for timely GST reporting and audit readiness under RCM provisions. |

Introduction to GST-Compliant Invoicing

What documents does a small business need for GST-compliant invoicing? GST-compliant invoicing ensures your business meets legal requirements for tax reporting and input tax credit claims. It involves maintaining accurate records such as tax invoices, challans, and payment receipts to comply with GST regulations.

Importance of GST Compliance for Small Businesses

Small businesses must maintain accurate documentation to ensure GST-compliant invoicing. Proper records help avoid penalties and streamline tax reporting processes.

GST compliance is crucial for small businesses to maintain legal and financial integrity. Key documents include tax invoices, purchase receipts, and GST returns. Ensuring your invoices meet GST requirements supports smooth audits and timely input tax credits.

Key Components of a GST Invoice

| Key Component | Description |

|---|---|

| Invoice Number | Unique serial number that identifies the GST invoice for tracking and record-keeping purposes. |

| Supplier Details | Name, address, and GSTIN (Goods and Services Tax Identification Number) of the small business issuing the invoice. |

| Recipient Details | Name, address, and GSTIN of the recipient (buyer) if registered under GST. |

| Invoice Date | Date when the invoice is issued. It should be within the prescribed time limit under GST rules. |

| Description of Goods or Services | Clear and detailed information about the goods or services supplied, including quantity and unit of measurement. |

| HSN or SAC Code | Harmonized System of Nomenclature (HSN) for goods or Service Accounting Code (SAC) for services, identifying the classification under GST. |

| Taxable Value | The amount on which GST is calculated, excluding taxes. |

| GST Rates | Applicable CGST, SGST, IGST rates as per service or goods supplied. |

| GST Amount | Actual GST amount charged, segregated into CGST, SGST, and/or IGST components. |

| Total Invoice Value | Sum total of taxable value and GST amount. This is the amount payable by the recipient. |

| Signature or Digital Signature | Authorized signatory's signature or digital signature validating the GST invoice. |

Mandatory Documents Required for GST Invoicing

For GST-compliant invoicing, your small business must include mandatory documents such as the supplier's name, GSTIN, and invoice number. The invoice should clearly state the date of issue, description of goods or services, quantity, and value. Additionally, it must display the applicable GST rates and the total tax amount charged.

Step-by-Step Process to Generate GST-Compliant Invoices

Small businesses must generate GST-compliant invoices to comply with tax regulations and ensure smooth input tax credit claims. Essential documents include the GST registration certificate, customer's GSTIN, and purchase order details.

The first step is obtaining the GST registration certificate, which verifies your business's eligibility to collect GST. Next, gather accurate buyer information such as name, address, and GSTIN to include on the invoice.

Invoice creation involves listing clear descriptions of goods or services, quantity, and their taxable values. Accurate tax rates and the total GST amount must be calculated following the latest government guidelines.

Include a unique invoice number and the issuance date to maintain proper records and avoid duplication. Finally, review the invoice thoroughly and provide it promptly to the customer, either digitally or in printed form.

Common Errors to Avoid in GST Invoicing

Ensuring your invoice is GST-compliant requires careful attention to specific documentation. Avoiding common errors can prevent delays in tax processing and penalties.

- Omission of GSTIN - Forgetting to include the Goods and Services Tax Identification Number leads to invalid invoices.

- Incorrect Tax Rates - Applying wrong GST rates causes discrepancies in tax calculation and compliance issues.

- Missing Invoice Details - Leaving out mandatory fields such as invoice date or supply descriptions results in rejection.

Digital Tools and Software for GST Invoicing

Small businesses must maintain accurate GST-compliant invoices to meet tax regulations. Essential documents include GST invoice templates, purchase orders, and payment receipts, all synchronized within digital tools.

Software like QuickBooks, Zoho Books, and TallyPrime automate GST invoicing and ensure real-time tax calculations. These digital solutions simplify compliance, reduce errors, and generate detailed GST reports for audits.

Record-Keeping and Documentation Best Practices

Maintaining accurate and organized records is essential for GST-compliant invoicing in a small business. Proper documentation supports tax reporting and audit readiness.

- Invoice Copies - Keep original and duplicate copies of all GST invoices issued and received to ensure accurate transaction tracking.

- Payment Receipts - Retain receipts and payment proofs linked to invoices to verify timely GST payments and collections.

- Accounting Records - Maintain detailed ledger entries and accounting software data to reconcile GST amounts and prepare returns efficiently.

Your adherence to these record-keeping practices minimizes compliance risks and streamlines GST filing processes.

Penalties for Non-Compliance with GST Invoicing

Small businesses must maintain accurate GST-compliant invoices, including essential details such as the supplier's GSTIN, invoice number, date, description of goods or services, and the applicable tax rates. Failure to issue correct GST invoices can lead to significant penalties, including fines and interest on unpaid tax amounts. You may also face legal actions and disruptions in input tax credit claims, affecting cash flow and business credibility.

What Documents Does a Small Business Need for GST-Compliant Invoicing? Infographic