To create an accurate invoice for pet services or products, essential documents include a detailed service agreement or purchase order outlining the scope and terms. Proof of transaction such as receipts or payment vouchers must be accessible to validate charges. Client information and tax identification details are also required to ensure compliance and proper record keeping.

What Documents are Needed for Invoice Creation?

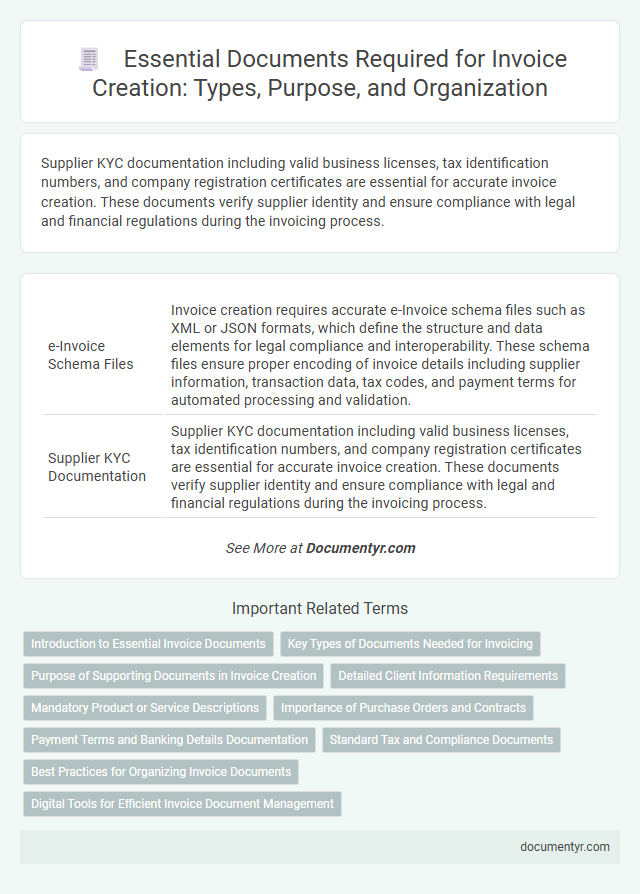

| Number | Name | Description |

|---|---|---|

| 1 | e-Invoice Schema Files | Invoice creation requires accurate e-Invoice schema files such as XML or JSON formats, which define the structure and data elements for legal compliance and interoperability. These schema files ensure proper encoding of invoice details including supplier information, transaction data, tax codes, and payment terms for automated processing and validation. |

| 2 | Supplier KYC Documentation | Supplier KYC documentation including valid business licenses, tax identification numbers, and company registration certificates are essential for accurate invoice creation. These documents verify supplier identity and ensure compliance with legal and financial regulations during the invoicing process. |

| 3 | Digital Signature Certificates (DSC) | Digital Signature Certificates (DSC) are essential for authenticating the identity of the signatory during invoice creation, ensuring security and legal validity in electronic transactions. These certificates prevent tampering and provide a trustworthy verification method, which is mandatory for businesses submitting invoices under government regulations. |

| 4 | QR Code Authentication Sheet | The QR Code Authentication Sheet is essential for invoice creation, containing a unique QR code that verifies the invoice's authenticity and links directly to the tax authority's database for real-time validation. This document ensures compliance with government regulations and prevents invoice fraud by enabling seamless cross-checking of invoice details. |

| 5 | Reverse Charge Declaration Form | The Reverse Charge Declaration Form is essential for invoice creation when the reverse charge mechanism applies, confirming the recipient's liability to pay VAT instead of the supplier. This document ensures compliance with tax regulations and validates the issuance of invoices without charging VAT by the supplier. |

| 6 | Dynamic Tax Jurisdiction Mapping | Invoice creation requires accurate input documents such as purchase orders, delivery receipts, and tax exemption certificates to ensure precise financial recording. Dynamic tax jurisdiction mapping relies on real-time location data and product tax codes to automatically apply the correct tax rates based on regional tax laws, streamlining compliance and minimizing errors. |

| 7 | Real-time Invoice Validation Report | Accurate invoice creation requires capturing essential documents such as purchase orders, delivery receipts, and vendor details, which support real-time invoice validation reports by ensuring data consistency and compliance. These validation reports cross-verify invoice entries with source documents, detecting discrepancies instantly to prevent payment errors and streamline financial workflows. |

| 8 | Unique Invoice Reference Number (IRN) Receipt | The Unique Invoice Reference Number (IRN) receipt is essential for invoice creation as it verifies the invoice's authenticity and prevents duplication in GST compliance. This digitally generated IRN is linked to the invoice details and must be included along with the supplier's GSTIN, invoice date, and itemized transaction information for valid invoice documentation. |

| 9 | Proforma Invoice Linkage Document | The Proforma Invoice Linkage Document serves as a crucial reference for the accurate creation of an official invoice by detailing agreed terms, product descriptions, prices, and quantities prior to shipment. It ensures consistency between the provisional agreement and the final invoice, facilitating smooth validation and payment processes. |

| 10 | API Submission Log File | The API submission log file is essential for invoice creation as it records all transaction data, submission timestamps, and error codes, ensuring accurate tracking and validation. This document verifies the integrity of data transmission between systems and supports audit compliance during invoice processing. |

Introduction to Essential Invoice Documents

Creating an accurate invoice requires gathering several essential documents to ensure proper billing and record-keeping. Understanding which documents are needed helps streamline the invoicing process and prevents errors.

- Purchase Order - A formal document from the buyer detailing the products or services requested and agreed prices.

- Delivery Note - Proof that goods or services have been delivered, confirming fulfillment of the order.

- Contract or Agreement - Specifies terms and conditions, payment details, and scope of work between parties.

Your invoice creation will be more efficient and accurate when you prepare these essential documents in advance.

Key Types of Documents Needed for Invoicing

Creating an accurate invoice requires specific key documents to ensure proper billing and record-keeping. These documents provide the essential information needed to generate a detailed and lawful invoice.

Purchase orders, delivery receipts, and contracts are primary documents often needed for invoice creation. Your invoice should also reference timesheets or service reports when billing for labor or services rendered.

Purpose of Supporting Documents in Invoice Creation

Supporting documents play a crucial role in the accurate creation of invoices by verifying transaction details. These documents ensure compliance, facilitate payment processing, and prevent disputes between parties.

- Verification of Transaction Details - Supporting documents confirm the products or services provided, quantities, prices, and agreed terms for accurate invoicing.

- Compliance and Legal Requirements - Documents such as purchase orders and contracts help meet regulatory standards and protect both buyer and seller in audits.

- Facilitation of Payment Processing - Proper documentation accelerates payment approval by providing clear evidence of delivered goods or completed services.

Detailed Client Information Requirements

| Document Type | Required Details | Description |

|---|---|---|

| Client Identification | Full Name or Business Name, Identification Number (e.g., Tax ID, VAT Number) | Essential for verifying the client's legal entity and tax status. Ensures invoice compliance and accurate record-keeping. |

| Contact Information | Address (Billing and Shipping), Phone Number, Email Address | Facilitates communication and ensures correct delivery of invoice and related documents. |

| Payment Details | Preferred Payment Method, Bank Account Information, Payment Terms | Critical for processing payments and setting payment expectations to avoid delays. |

| Purchase Order | Purchase Order Number (if applicable) | Links the invoice to an authorized purchase, ensuring proper authorization and internal tracking. |

| Additional Client Details | Company Registration Number, Industry Classification, VAT Exemption Status | Provides further validation and supports compliance with regulatory and tax requirements. |

Mandatory Product or Service Descriptions

What documents are essential for invoice creation? Mandatory product or service descriptions must be included to ensure clarity and compliance. Your invoice should detail the item name, quantity, unit price, and any applicable taxes or discounts.

Importance of Purchase Orders and Contracts

Creating an invoice requires accurate documentation to ensure seamless billing and payment processing. Purchase orders and contracts serve as essential references, verifying the agreed terms and quantities of goods or services. Your invoices should always align with these documents to prevent disputes and facilitate prompt payment.

Payment Terms and Banking Details Documentation

Creating an accurate invoice requires specific documents to ensure clear payment terms and banking details. These documents help define when and how payments should be made, reducing potential delays.

Payment terms documentation includes agreements specifying due dates, discounts for early payment, and penalties for late fees. Banking details documentation provides essential information such as account numbers, bank names, and SWIFT or IBAN codes. You must gather these documents to streamline the invoice creation process and facilitate timely transactions.

Standard Tax and Compliance Documents

Creating an invoice requires gathering specific documents to ensure accuracy and compliance with tax regulations. Standard tax and compliance documents provide essential information for proper invoice generation and legal adherence.

- Tax Identification Number (TIN) - Essential for verifying the taxpayer's identity and ensuring tax compliance on the invoice.

- Purchase Order (PO) - Confirms the transaction details and authorizes the billed amount between buyer and seller.

- Goods and Services Tax (GST) Certificate - Validates the applicable tax rates and obligations for invoicing under GST laws.

Best Practices for Organizing Invoice Documents

Accurate invoice creation requires essential documents such as purchase orders, delivery receipts, and payment terms agreements. Organizing these documents systematically ensures efficient processing and minimizes errors. You should maintain a clear filing system, either digital or physical, to easily access and verify invoice-related information.

What Documents are Needed for Invoice Creation? Infographic