Freelancers must include essential documents such as a valid tax identification number, proof of services rendered, and client details to issue a legal invoice. The invoice should clearly state the freelancer's name, address, and payment terms alongside a detailed description of the services provided and the total amount due. Proper documentation ensures compliance with tax regulations and facilitates smooth payment processing for all parties involved.

What Documents Does a Freelancer Need to Issue a Legal Invoice?

| Number | Name | Description |

|---|---|---|

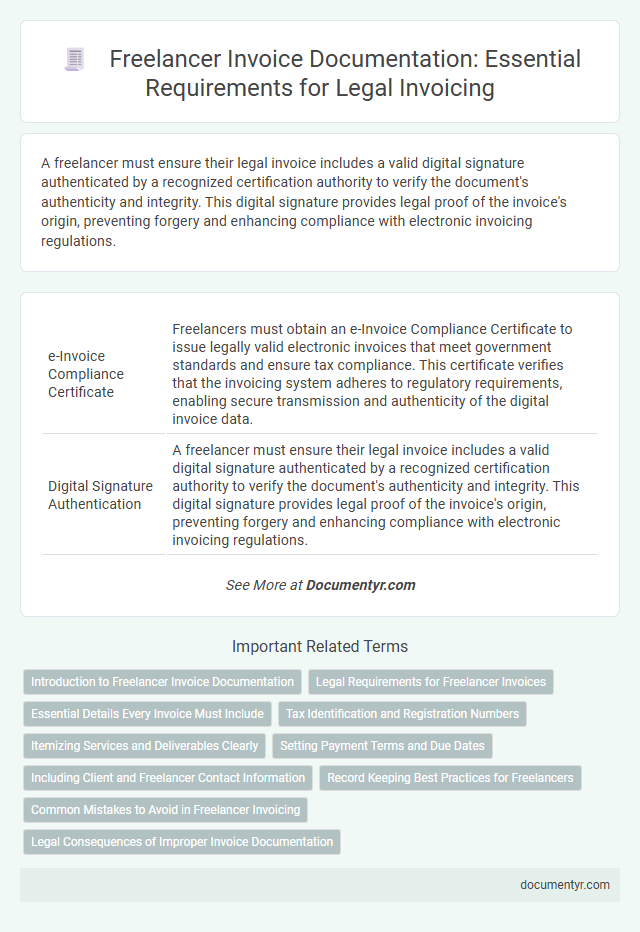

| 1 | e-Invoice Compliance Certificate | Freelancers must obtain an e-Invoice Compliance Certificate to issue legally valid electronic invoices that meet government standards and ensure tax compliance. This certificate verifies that the invoicing system adheres to regulatory requirements, enabling secure transmission and authenticity of the digital invoice data. |

| 2 | Digital Signature Authentication | A freelancer must ensure their legal invoice includes a valid digital signature authenticated by a recognized certification authority to verify the document's authenticity and integrity. This digital signature provides legal proof of the invoice's origin, preventing forgery and enhancing compliance with electronic invoicing regulations. |

| 3 | UPI Transaction Reference | Freelancers need to include the UPI Transaction Reference on their invoices to ensure secure and verifiable payment tracking, aligning with legal invoicing requirements. This unique identifier facilitates seamless reconciliation between client payments and issued invoices, enhancing financial transparency and audit compliance. |

| 4 | e-Way Bill Attachment | Freelancers must attach an e-Way Bill when their invoice involves the movement of goods exceeding Rs50,000 in value, as per GST regulations in India to ensure legal compliance and avoid penalties. The e-Way Bill contains critical details such as the consignor, consignee, goods description, and transport information, which must be accurately reflected alongside the invoice for seamless tax verification. |

| 5 | GSTIN Declaration Form | Freelancers must include a valid GSTIN Declaration Form when issuing a legal invoice to ensure compliance with Goods and Services Tax regulations and validate their tax identity. This form verifies the freelancer's GST registration status, enabling accurate tax calculation and reporting on the invoice. |

| 6 | Self-Employed KYC Sheet | Freelancers must provide a Self-Employed KYC Sheet containing personal identification, tax registration details, and bank account information to issue a legal invoice. This document verifies the freelancer's identity and business legitimacy, ensuring compliance with tax authorities and client requirements. |

| 7 | Payment Gateway Reconciliation Report | Freelancers must include a Payment Gateway Reconciliation Report along with their invoice to ensure accurate tracking and validation of received payments from platforms like PayPal, Stripe, or Square. This report helps reconcile transactions, verify payment dates, and confirm amounts, providing essential documentation for legal and financial auditing purposes. |

| 8 | Anti-Fraud Statement Appendix | Freelancers must include an Anti-Fraud Statement Appendix with their invoices to comply with legal requirements and prevent fraudulent claims; this document typically contains a declaration of authenticity, detailed service descriptions, and verification of identity. Including this appendix ensures transparency and protects both the freelancer and client from potential disputes or audits by tax authorities. |

| 9 | TDS Certificate Inclusion | Freelancers need to include a TDS (Tax Deducted at Source) certificate along with their legal invoice to validate tax deductions made by the client as per Income Tax regulations. This certificate ensures compliance and transparency, serving as proof for both parties when filing tax returns. |

| 10 | Place of Supply Documentation | Freelancers must include place of supply documentation on invoices to comply with tax regulations, specifying the location where the service was delivered or the goods were provided to determine the correct VAT or sales tax treatment. This documentation typically involves the client's address, contract details, or any relevant certificates verifying the supply location for accurate invoicing and tax reporting. |

Introduction to Freelancer Invoice Documentation

Issuing a legal invoice is essential for freelancers to ensure proper payment and maintain clear financial records. Your invoice must include specific documentation to comply with tax regulations and client requirements. Understanding these necessary documents helps streamline the invoicing process and protects your professional interests.

Legal Requirements for Freelancer Invoices

What documents does a freelancer need to issue a legal invoice? A legal invoice must include a valid tax identification number and proof of services rendered. You must also provide detailed descriptions of the work, the date of service, and payment terms.

Essential Details Every Invoice Must Include

Issuing a legal invoice requires specific documents to ensure compliance and clarity. Your invoice must include essential details such as your full name or business name, contact information, and a unique invoice number. It should also contain the date of issue, a clear description of the services provided, payment terms, and the total amount due including applicable taxes.

Tax Identification and Registration Numbers

Issuing a legal invoice requires specific documents to ensure compliance with tax regulations. Your invoice must clearly display essential tax identification and registration numbers to be valid.

- Tax Identification Number (TIN) - This unique number allows tax authorities to track your financial activities accurately.

- Business Registration Number - Proof of your legal business status, this number authenticates your operation as a registered freelancer.

- VAT Registration Number (if applicable) - Required for freelancers who are registered for Value Added Tax, this number must appear on invoices to comply with tax laws.

Itemizing Services and Deliverables Clearly

Clear itemization of services and deliverables is essential for a legal invoice issued by freelancers. Proper documentation ensures transparency and facilitates smooth payment processing.

- Detailed Description of Services - List each service provided with a precise explanation to avoid confusion.

- Quantified Deliverables - Specify the number of hours, units, or milestones completed for accurate billing.

- Separate Costs for Each Item - Assign distinct prices to individual tasks or deliverables to maintain clarity in charges.

Setting Payment Terms and Due Dates

Freelancers must clearly define payment terms and due dates on their invoices to ensure timely compensation. These details establish the timeline for payment and help avoid misunderstandings between the freelancer and the client.

Setting specific due dates, such as "Net 30" or "Due upon receipt," provides legal clarity and enforces expectations. Including terms about late fees or penalties further protects the freelancer's rights and encourages prompt payment.

Including Client and Freelancer Contact Information

```htmlA legal invoice must include accurate contact information for both the freelancer and the client. This ensures clear identification and communication between the parties involved.

Freelancers should list their full name or business name, address, phone number, and email. Client details such as company name, address, and contact person are equally important for invoice validity.

```Record Keeping Best Practices for Freelancers

Freelancers must maintain accurate and organized records to issue legal invoices compliant with tax regulations. Proper documentation ensures smooth financial audits and protects against disputes.

- Detailed Invoice Copies - Keep digital and physical copies of all issued invoices for reference and verification.

- Client Contract Records - Store signed agreements outlining service terms and payment conditions to support invoice legitimacy.

- Expense Documentation - Retain receipts and proof of business expenses to accurately report deductions and certifications.

Consistent record-keeping strengthens a freelancer's credibility and simplifies tax filing processes.

Common Mistakes to Avoid in Freelancer Invoicing

| Document | Description | Common Mistakes to Avoid |

|---|---|---|

| Personal Identification | Valid ID such as passport or driver's license for identity verification on the invoice. | Omitting identification details or using incorrect personal information. |

| Tax Identification Number (TIN) | Required for tax reporting and compliance; ensures the invoice is recognized by tax authorities. | Failing to include a correct or registered TIN, leading to non-compliance and payment delays. |

| Service Agreement or Contract | Defines agreed services, payment terms, and scope to reference on the invoice. | Neglecting to align invoice details with contract terms or missing key service descriptions. |

| Invoice Template | A standardized format that includes invoice number, date, client info, service details, and payment terms. | Using incomplete or non-professional templates that omit essential elements like invoice number or due date. |

| Supporting Documents | Timesheets, receipts, or deliverable confirmations that substantiate the billed amount. | Failing to attach or reference proof of services rendered, which can cause disputes or delays. |

| Bank Details or Payment Information | Clear payment instructions including account number, payment methods, and currency. | Providing inaccurate bank details or forgetting to specify payment terms leading to payment processing issues. |

What Documents Does a Freelancer Need to Issue a Legal Invoice? Infographic