E-commerce sellers must have essential documents such as a valid business registration, tax identification number, and proof of product authenticity to issue compliant digital invoices. Accurate customer details, including billing and shipping addresses, are crucial for generating precise invoices. Maintaining digital records of all transactions ensures easy retrieval and compliance with tax regulations.

What Documents Does an E-commerce Seller Need for Digital Invoices?

| Number | Name | Description |

|---|---|---|

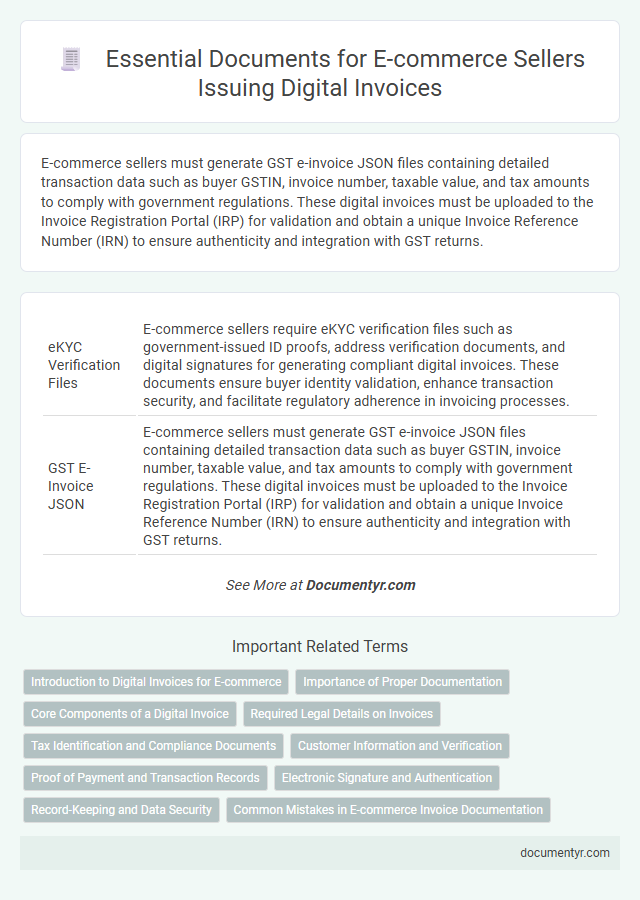

| 1 | eKYC Verification Files | E-commerce sellers require eKYC verification files such as government-issued ID proofs, address verification documents, and digital signatures for generating compliant digital invoices. These documents ensure buyer identity validation, enhance transaction security, and facilitate regulatory adherence in invoicing processes. |

| 2 | GST E-Invoice JSON | E-commerce sellers must generate GST e-invoice JSON files containing detailed transaction data such as buyer GSTIN, invoice number, taxable value, and tax amounts to comply with government regulations. These digital invoices must be uploaded to the Invoice Registration Portal (IRP) for validation and obtain a unique Invoice Reference Number (IRN) to ensure authenticity and integration with GST returns. |

| 3 | IRN (Invoice Reference Number) Receipt | E-commerce sellers must obtain an IRN (Invoice Reference Number) receipt as a crucial document for validating digital invoices, ensuring compliance with GST regulations in India. The IRN receipt contains a unique identifier generated by the Invoice Registration Portal (IRP), which authenticates the invoice for legal and tax purposes. |

| 4 | API Integration Logs | E-commerce sellers need API integration logs as crucial documentation for digital invoices to ensure accurate transaction tracking and compliance with tax regulations. These logs provide detailed records of data exchanges between the seller's system and invoicing platforms, enabling verification and auditing of issued invoices. |

| 5 | HSN Code Mapping Sheet | E-commerce sellers require an HSN Code Mapping Sheet to accurately classify goods for digital invoices, ensuring compliance with GST regulations and facilitating seamless tax calculations. This document links product descriptions with standardized HSN codes, enabling precise invoicing and reducing errors in tax reporting. |

| 6 | Digital Signature Certificate (DSC) Document | E-commerce sellers require a Digital Signature Certificate (DSC) to authenticate and validate digital invoices, ensuring compliance with legal standards and enhancing transaction security. The DSC verifies the seller's identity, facilitates secure electronic document exchange, and is essential for GST invoicing under the Indian e-invoicing system. |

| 7 | QR Code Embedded Invoice PDF | An e-commerce seller needs a digitally signed invoice PDF embedded with a QR code that links to the invoice details stored on government or tax authority portals. This QR code enhances invoice authenticity, streamlines verification processes, and facilitates automated tax reporting and compliance. |

| 8 | TCS (Tax Collected at Source) Report | E-commerce sellers must include a TCS (Tax Collected at Source) report along with their digital invoices to comply with GST regulations, detailing the tax collected on sales made through e-commerce platforms. This report ensures accurate tax reporting and aids in seamless reconciliation with the GST portal. |

| 9 | B2C v/s B2B Invoice Classifier Files | E-commerce sellers require distinct documents for generating digital invoices: B2C transactions typically need customer details, transaction receipts, and tax identification numbers, while B2B invoices demand comprehensive purchase orders, GST invoices, and vendor compliance certificates. Proper classification files and invoice templates ensure accurate tax reporting and regulatory adherence for both B2C and B2B sales channels. |

| 10 | E-Way Bill Reference Document | E-commerce sellers must include the E-Way Bill reference document when generating digital invoices to ensure compliance with GST regulations and enable seamless transportation tracking. This document serves as a critical proof of goods movement, linking the invoice with the logistics details. |

Introduction to Digital Invoices for E-commerce

Digital invoices simplify transaction management for e-commerce sellers by providing a secure and efficient way to document sales. Understanding the necessary documents for processing these invoices is essential for compliance and smooth business operations.

- Sales Order - A record of customer purchases that initiates the invoicing process.

- Payment Receipt - Proof of payment confirming the transaction has been completed.

- Shipping Details - Information documenting the delivery status related to the sale.

Your ability to organize these documents ensures accurate and legally compliant digital invoicing in your e-commerce business.

Importance of Proper Documentation

Proper documentation is essential for e-commerce sellers to generate accurate digital invoices, ensuring compliance with tax regulations and facilitating smooth financial audits. Key documents include order details, payment confirmations, product descriptions, and customer information.

Maintaining thorough records helps prevent disputes and supports efficient bookkeeping and inventory management. Accurate digital invoices enhance transparency, build customer trust, and streamline the overall sales process for e-commerce businesses.

Core Components of a Digital Invoice

What core components must an e-commerce seller include in a digital invoice? A digital invoice should contain essential details such as the seller's name, contact information, and tax identification number. It must also include the buyer's information, a unique invoice number, itemized list of products or services, quantities, prices, applicable taxes, total amount due, and the invoice date.

Required Legal Details on Invoices

E-commerce sellers must include specific legal details on digital invoices to comply with tax regulations and ensure transaction validity. These details serve as proof of purchase and facilitate proper accounting and auditing processes.

Required legal details typically include the seller's full name, business registration number or tax identification number, and the buyer's information. The invoice must also display the issue date, a unique invoice number, and a clear description of goods or services provided. Including the total amount payable, applicable taxes, and payment terms is essential for legal and financial transparency.

Tax Identification and Compliance Documents

An e-commerce seller must possess a valid tax identification number (TIN) to issue compliant digital invoices. Maintaining accurate tax compliance documents ensures adherence to local tax regulations during transactions. Your digital invoices should clearly display these identification details to avoid any legal complications.

Customer Information and Verification

| Document Type | Details |

|---|---|

| Customer Name | Full legal name of the customer for accurate billing and legal compliance. |

| Customer Address | Complete shipping and billing address including city, state, and postal code for verification and delivery tracking. |

| Contact Information | Email address and phone number to confirm order details and enable communication regarding the invoice. |

| Tax Identification Number (TIN) | For customers eligible for tax deductions or exemptions, the TIN must be verified to ensure accurate tax compliance. |

| Payment Verification Document | Proof of payment such as transaction ID, bank receipt, or online payment confirmation to validate purchase. |

| Government-Issued ID (Optional) | In certain cases, a scanned copy of a government-issued ID helps in verifying the customer's identity, especially for high-value transactions. |

Collecting and verifying this customer information ensures your digital invoices remain compliant, accurate, and trustworthy for both parties.

Proof of Payment and Transaction Records

E-commerce sellers must maintain accurate documentation to support digital invoices for compliance and auditing purposes. Proof of payment and detailed transaction records are essential components to validate each sale and payment received.

- Proof of Payment - This document confirms the completion of a financial transaction between the buyer and the seller, such as payment receipts or bank statements.

- Transaction Records - Detailed logs of each transaction, including date, amount, buyer information, and payment method, are critical for tracking sales and resolving disputes.

- Invoice Correlation - Linking digital invoices to proof of payment and transaction records ensures transparency and accuracy in financial reporting for e-commerce businesses.

Electronic Signature and Authentication

E-commerce sellers require specific documents for generating valid digital invoices, with a strong focus on electronic signature and authentication methods. Proper use of these tools ensures invoice integrity and compliance with legal standards.

- Digital Signature Certificate - Validates the identity of the e-commerce seller and secures the digital invoice against alterations.

- Authentication Tokens - Provide secure access and confirmation that invoices are issued by authorized personnel or systems.

- Invoice Audit Trail - Maintains a log of electronic signatures and authentication events to verify the invoice's authenticity over time.

Record-Keeping and Data Security

E-commerce sellers need digital invoices, purchase orders, and payment confirmations to ensure accurate record-keeping. Maintaining organized digital records helps streamline financial audits and tax reporting. Secure storage solutions with encryption protect sensitive customer and transaction data from unauthorized access.

What Documents Does an E-commerce Seller Need for Digital Invoices? Infographic