Invoice reconciliation requires essential documents such as the original purchase order, the supplier's invoice, and the goods receipt or delivery note. These documents help verify the accuracy of billed amounts, quantities, and terms against the actual transaction details. Maintaining organized records ensures efficient dispute resolution and accurate financial reporting.

What Documents Are Essential for Invoice Reconciliation?

| Number | Name | Description |

|---|---|---|

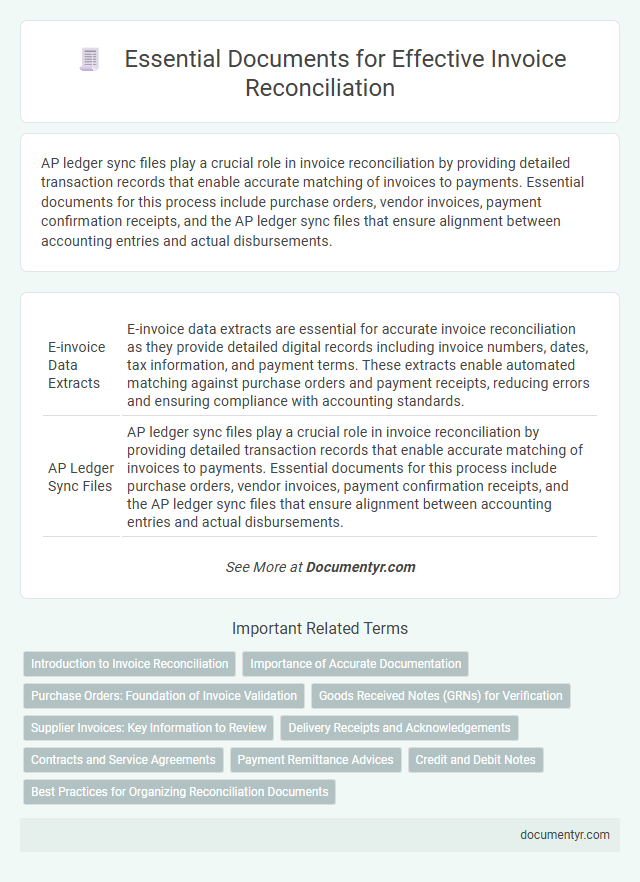

| 1 | E-invoice Data Extracts | E-invoice data extracts are essential for accurate invoice reconciliation as they provide detailed digital records including invoice numbers, dates, tax information, and payment terms. These extracts enable automated matching against purchase orders and payment receipts, reducing errors and ensuring compliance with accounting standards. |

| 2 | AP Ledger Sync Files | AP ledger sync files play a crucial role in invoice reconciliation by providing detailed transaction records that enable accurate matching of invoices to payments. Essential documents for this process include purchase orders, vendor invoices, payment confirmation receipts, and the AP ledger sync files that ensure alignment between accounting entries and actual disbursements. |

| 3 | Automated Remittance Advices | Automated Remittance Advices streamline invoice reconciliation by providing detailed transaction records, including payment dates, amounts, and invoice references, which are crucial for accurate matching. Integrating these digital documents with accounting systems reduces manual errors and accelerates the validation process. |

| 4 | Three-way Match Logs | Three-way match logs are essential for invoice reconciliation, ensuring alignment between purchase orders, receiving reports, and vendor invoices to prevent payment errors and discrepancies. Accurate documentation of these logs streamlines the verification process, enhancing financial control and audit compliance. |

| 5 | Blockchain Audit Trails | Invoice reconciliation requires essential documents such as purchase orders, delivery receipts, payment records, and blockchain audit trails that provide immutable, time-stamped transaction data enhancing transparency and accuracy. Blockchain audit trails enable secure verification of invoice authenticity and facilitate efficient dispute resolution by maintaining a tamper-proof ledger of all invoice-related activities. |

| 6 | Machine Learning Exception Reports | Machine learning exception reports play a crucial role in invoice reconciliation by automatically identifying discrepancies between purchase orders, delivery receipts, and invoices, enabling faster resolution of errors. These reports leverage algorithms to analyze large datasets, flagging anomalies such as duplicated or missing invoices and incorrect amounts, which streamlines the validation and approval process. |

| 7 | Supplier Onboarding Records | Supplier onboarding records, including signed contracts, tax identification details, and bank account information, are essential for accurate invoice reconciliation. These documents verify the legitimacy and payment terms of suppliers, ensuring proper matching of invoices to purchase orders and preventing payment discrepancies. |

| 8 | OCR-Validated Receipts | OCR-validated receipts are essential for invoice reconciliation as they ensure accurate data extraction from scanned documents, minimizing manual entry errors and expediting verification processes. These digitally validated receipts serve as reliable proof of transaction details, aligning closely with invoiced amounts to streamline account matching and audit compliance. |

| 9 | Digital Purchase Order Tokens | Digital Purchase Order Tokens serve as crucial verification elements in invoice reconciliation, providing a secure and transparent link between purchase orders and invoices. These tokens enable automated matching processes, reducing errors and ensuring accurate payment approvals based on authenticated order details. |

| 10 | Smart Invoice Attachments | Smart invoice attachments enhance invoice reconciliation by automatically linking purchase orders, delivery receipts, and payment confirmations, ensuring a seamless and accurate verification process. These digital documents reduce errors and expedite matching by providing comprehensive, context-rich data crucial for auditing and financial accuracy. |

Introduction to Invoice Reconciliation

Invoice reconciliation is a crucial financial process that ensures accuracy between purchase orders, invoices, and payment records. It helps organizations prevent discrepancies and maintain transparent accounting practices.

- Purchase Orders - These documents provide the initial agreement and details of goods or services purchased, serving as a primary reference during reconciliation.

- Supplier Invoices - Invoices specify the billed amounts and terms, enabling verification against purchase orders and delivery receipts.

- Payment Records - Payment confirmations and transaction records validate that payments align with invoiced amounts, completing the reconciliation cycle.

Importance of Accurate Documentation

Accurate documentation is crucial for effective invoice reconciliation, ensuring that all financial records align correctly. Essential documents include purchase orders, delivery receipts, and vendor invoices, which provide clear evidence of transactions. Maintaining organized and precise paperwork helps you resolve discrepancies quickly and maintain smooth financial operations.

Purchase Orders: Foundation of Invoice Validation

Purchase orders play a critical role in invoice reconciliation by serving as the primary reference for validating transaction details. Accurate matching of invoices to purchase orders ensures error-free payments and efficient financial management.

- Document Consistency - Purchase orders provide clear details on quantities, prices, and product descriptions to verify against invoiced amounts.

- Authorization Verification - They confirm that purchases were approved by the appropriate personnel before vendor payments are processed.

- Dispute Resolution - Purchase orders serve as evidence to quickly resolve discrepancies during the invoice reconciliation process.

Goods Received Notes (GRNs) for Verification

Invoice reconciliation requires precise verification to ensure accuracy and prevent payment errors. Goods Received Notes (GRNs) play a critical role in confirming that the invoiced items were actually delivered and accepted.

- Verification of Delivery - GRNs serve as proof that goods were received in the agreed quantities and conditions.

- Cross-Referencing Invoices - Matching GRNs with invoices helps detect discrepancies or overcharges before payment.

- Audit Trail Creation - GRNs provide a documented history that supports financial audits and compliance checks.

Your use of GRNs ensures reliable invoice reconciliation and strengthens your payment processes.

Supplier Invoices: Key Information to Review

Supplier invoices contain critical information necessary for accurate invoice reconciliation. Key details include invoice number, date, supplier name, and purchase order references.

Verify quantities, unit prices, and total amounts against your purchase orders and delivery receipts. Accurate review of these elements ensures your accounts remain error-free and compliant.

Delivery Receipts and Acknowledgements

| Document Type | Description | Importance in Invoice Reconciliation |

|---|---|---|

| Delivery Receipts | Official proof of goods or services delivered, signed by the recipient. | Verify that the products or services billed in the invoice were received as stated. Ensures accuracy in quantities and delivery dates. |

| Acknowledgements | Formal confirmation from the buyer acknowledging receipt and acceptance of goods or services. | Serve as evidence of agreement to the terms of delivery and conditions. Crucial for resolving disputes during invoice reconciliation. |

Contracts and Service Agreements

Contracts and service agreements serve as foundational documents for invoice reconciliation, ensuring accuracy and transparency. These documents outline the agreed terms, pricing, and scope of services, which are critical for verifying invoice details.

Having access to detailed contracts and service agreements allows you to cross-check invoiced amounts against agreed-upon terms. This verification process helps prevent disputes and ensures payments are made correctly and promptly.

Payment Remittance Advices

What documents are essential for accurate invoice reconciliation? Payment remittance advices play a crucial role by providing detailed proof of payment, linking transactions to specific invoices. These documents ensure your accounts remain accurate and disputes are minimized.

Credit and Debit Notes

Invoice reconciliation requires careful verification of supporting documents. Credit and debit notes play a crucial role in adjusting discrepancies between vendor and customer accounts.

Credit notes serve as official records for returns, refunds, or price adjustments, reducing the invoice amount. Debit notes indicate additional charges or corrections that increase the invoice total. Maintaining accurate credit and debit notes ensures your financial records reflect true transaction values and prevents payment errors.

What Documents Are Essential for Invoice Reconciliation? Infographic