Small businesses need several key documents for invoice factoring, including copies of outstanding invoices, proof of delivery or services rendered, and customer credit information. Financial statements such as balance sheets and income statements are often required to assess the business's financial health. A valid business license and accounts receivable aging report help establish credibility and ensure transparent transaction history during the factoring process.

What Documents Does a Small Business Need for Invoice Factoring?

| Number | Name | Description |

|---|---|---|

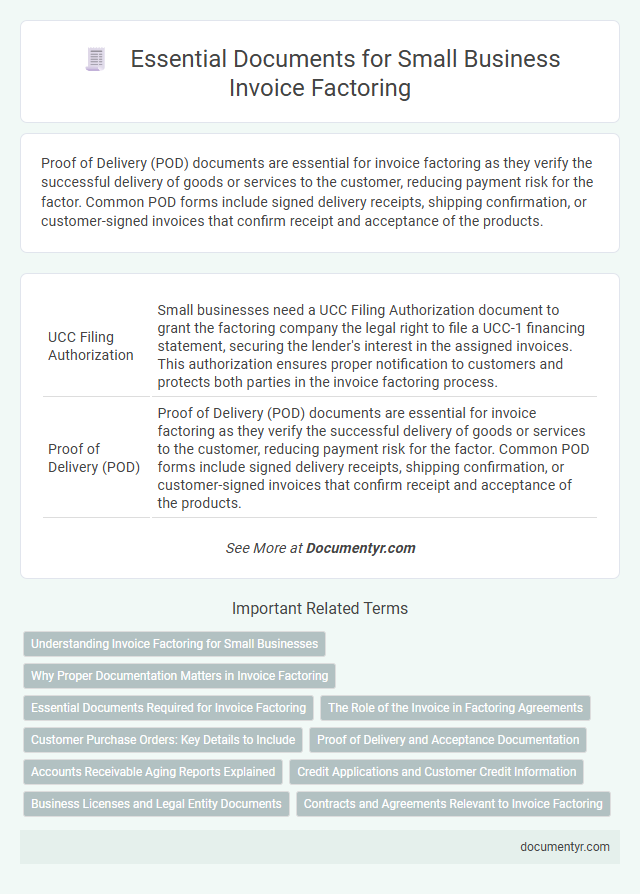

| 1 | UCC Filing Authorization | Small businesses need a UCC Filing Authorization document to grant the factoring company the legal right to file a UCC-1 financing statement, securing the lender's interest in the assigned invoices. This authorization ensures proper notification to customers and protects both parties in the invoice factoring process. |

| 2 | Proof of Delivery (POD) | Proof of Delivery (POD) documents are essential for invoice factoring as they verify the successful delivery of goods or services to the customer, reducing payment risk for the factor. Common POD forms include signed delivery receipts, shipping confirmation, or customer-signed invoices that confirm receipt and acceptance of the products. |

| 3 | Sale Assignment Agreement | A Sale Assignment Agreement is a crucial document for small businesses seeking invoice factoring, as it legally transfers the rights of outstanding invoices to the factoring company. This agreement ensures clear ownership of receivables, enabling the factor to collect payments directly from customers while providing immediate cash flow to the business. |

| 4 | Notice of Assignment Letter | A Notice of Assignment Letter is a critical document in invoice factoring that formally informs clients their invoices have been sold to a factoring company, ensuring proper payment routing. Small businesses must include this letter alongside original invoices and contracts to maintain transparency and validate the factoring process. |

| 5 | Debtor Verification Statement | A small business needs a Debtor Verification Statement to confirm the authenticity of outstanding invoices and verify that the debtor acknowledges the invoice balance. This document is essential for invoice factoring as it ensures that the factoring company can collect payments directly from the verified debtor. |

| 6 | Invoice Aging Report | An Invoice Aging Report is a critical document for small businesses seeking invoice factoring, as it categorizes outstanding invoices by the length of time they have been unpaid, providing factors with clear insight into accounts receivable health. This report enhances transparency by helping factoring companies assess payment patterns and risk, thereby expediting the approval process for cash advances. |

| 7 | Debtor Credit Approval | Debtor credit approval requires small businesses to provide detailed financial statements, customer payment histories, and proof of outstanding receivables to validate the reliability of their debtors. Accurate credit assessments and verified invoices enable factoring companies to minimize risk and ensure timely funding for business operations. |

| 8 | Factoring Master Agreement | A Small Business needs a Factoring Master Agreement for invoice factoring, which serves as a legally binding contract outlining the terms, responsibilities, and conditions between the business and the factoring company. This document is essential for establishing the framework of invoice purchase, payment advances, and dispute resolution processes in the factoring arrangement. |

| 9 | Receivables Purchase Statement | A Receivables Purchase Statement is a crucial document for invoice factoring as it details the specific invoices being sold to the factoring company, including invoice numbers, amounts, and due dates. This statement provides transparency and helps the factor verify the validity and collectability of the accounts receivable before advancing funds to the small business. |

| 10 | Anti-Fraud Compliance Declaration | Small businesses seeking invoice factoring must include an Anti-Fraud Compliance Declaration to verify the authenticity of invoiced goods or services and prevent fraudulent activities. This document is critical for ensuring transparency, securing trust from factoring companies, and meeting regulatory compliance standards in financial transactions. |

Understanding Invoice Factoring for Small Businesses

| Document Type | Description | Purpose in Invoice Factoring |

|---|---|---|

| Business Financial Statements | Balance sheets, profit and loss statements, and cash flow statements | Demonstrates business financial health and ability to manage repayments |

| Invoices for Factoring | Outstanding unpaid invoices issued to customers | Serves as the primary collateral for factoring and confirms receivable amounts |

| Customer Purchase Orders | Official purchase agreements from customers backing the invoices | Validates the legitimacy of invoices and confirms transaction details |

| Proof of Business Ownership | Business licenses, registration certificates, or articles of incorporation | Establishes legal standing and ownership of the business |

| Accounts Receivable Aging Report | Report showing outstanding invoices and their aging status | Helps factor assess the quality and collectability of receivables |

| Tax Returns | Recent business tax filings | Provides additional verification of business revenue and compliance |

| Bank Statements | Recent bank account statements | Shows cash flow trends and financial activity related to receivables |

Why Proper Documentation Matters in Invoice Factoring

Proper documentation is crucial for small businesses engaging in invoice factoring to ensure smooth transactions and secure funding. Accurate records minimize risks and enhance trust between the business and the factoring company.

- Proof of Invoice Ownership - Confirms the business's right to sell the invoices, preventing disputes over payment claims.

- Detailed Customer Information - Provides essential data for factoring companies to verify the legitimacy and creditworthiness of debtors.

- Payment History Records - Demonstrates the reliability of invoice payments and supports accurate risk assessment for funding.

Maintaining proper documentation safeguards small businesses by streamlining the factoring process and improving financial outcomes.

Essential Documents Required for Invoice Factoring

Invoice factoring requires specific documentation to ensure smooth processing and approval. Small businesses must prepare essential financial and legal papers that validate their invoices and operational legitimacy.

Key documents include the accounts receivable ledger, which lists all outstanding invoices eligible for factoring. Additionally, businesses need to provide the original invoices, sales contracts, and proof of delivery to confirm transaction authenticity.

The Role of the Invoice in Factoring Agreements

What documents are essential for small businesses when engaging in invoice factoring? Your invoice serves as the primary document in factoring agreements because it proves the sale and details the amount owed by your customer. The invoice enables the factoring company to verify the receivables and provide immediate cash flow based on those outstanding payments.

Customer Purchase Orders: Key Details to Include

Customer purchase orders are essential documents when applying for invoice factoring. They must clearly state the buyer's information, product or service details, and agreed payment terms. Including these key details helps your factor verify the legitimacy and value of the invoices efficiently.

Proof of Delivery and Acceptance Documentation

Invoice factoring requires clear evidence that goods or services were delivered and accepted by the client. Proof of delivery and acceptance documentation validates the legitimacy of the invoice and accelerates the payment process.

- Proof of Delivery (POD) - A signed delivery receipt or shipping document confirms that products have been received by the customer at the specified location.

- Customer Acceptance Form - A formal document or email from the customer acknowledging receipt and satisfaction with the delivered goods or services is essential for factoring approval.

- Shipping and Logistics Records - Detailed logs, tracking information, and carrier receipts provide additional verification of delivery dates and conditions.

Accounts Receivable Aging Reports Explained

Invoice factoring requires small businesses to provide detailed documentation to verify the validity and age of their receivables. One crucial document is the Accounts Receivable Aging Report, which categorizes outstanding invoices by their due dates.

The Accounts Receivable Aging Report helps factoring companies assess the credit risk and payment behavior of clients. It breaks down invoices into time brackets, such as 0-30, 31-60, and 61-90 days past due, offering clear insights into receivables management.

Credit Applications and Customer Credit Information

Small businesses require specific documents for invoice factoring, with credit applications being essential as they provide detailed information about the business's creditworthiness. Customer credit information is critical because it helps the factoring company assess the risk associated with the invoices being factored. These documents ensure a smooth approval process by verifying the legitimacy and financial stability of both the business and its customers.

Business Licenses and Legal Entity Documents

Invoice factoring requires specific documentation to verify your business legitimacy and legal standing. Business licenses and legal entity documents play a crucial role in this process.

- Business Licenses - Proof of valid business licenses ensures compliance with local and state regulations.

- Legal Entity Documents - Documents such as articles of incorporation or LLC operating agreements establish your business structure.

- Verification of Ownership - Ownership papers or partnership agreements confirm authorized representatives for invoice factoring agreements.

What Documents Does a Small Business Need for Invoice Factoring? Infographic