Accountants require a comprehensive set of documents for an effective year-end invoice review, including all issued and received invoices, payment receipts, and purchase orders. Detailed records of outstanding payments and vendor statements are essential to verify invoice accuracy and reconcile accounts. Maintaining organized financial documentation ensures compliance and facilitates a smooth auditing process.

What Documents Does an Accountant Need for Year-End Invoice Review?

| Number | Name | Description |

|---|---|---|

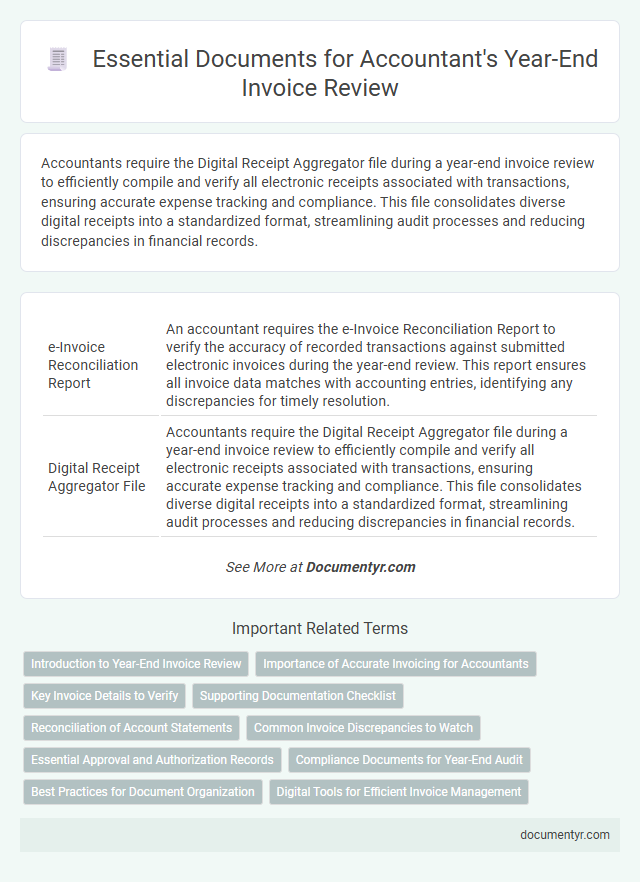

| 1 | e-Invoice Reconciliation Report | An accountant requires the e-Invoice Reconciliation Report to verify the accuracy of recorded transactions against submitted electronic invoices during the year-end review. This report ensures all invoice data matches with accounting entries, identifying any discrepancies for timely resolution. |

| 2 | Digital Receipt Aggregator File | Accountants require the Digital Receipt Aggregator file during a year-end invoice review to efficiently compile and verify all electronic receipts associated with transactions, ensuring accurate expense tracking and compliance. This file consolidates diverse digital receipts into a standardized format, streamlining audit processes and reducing discrepancies in financial records. |

| 3 | Blockchain-Verified Invoice Ledger | Accountants require access to a blockchain-verified invoice ledger, including all digitally signed invoices and transaction timestamps, to ensure data integrity and prevent tampering during the year-end review. This ledger, combined with supporting documents such as purchase orders and payment receipts, provides a comprehensive audit trail for accurate financial reporting. |

| 4 | Automated Expense Categorization Export | Accountants require detailed Automated Expense Categorization Export files to efficiently review year-end invoices, enabling precise tracking of expenses by category and ensuring accurate financial reporting. This export typically includes transaction dates, vendor information, amounts, and categorized expense codes, facilitating streamlined reconciliation and audit readiness. |

| 5 | AI-Powered Discrepancy Detection Summary | Accountants require detailed invoices, purchase orders, payment receipts, and bank statements to perform a comprehensive year-end invoice review. AI-powered discrepancy detection tools analyze these documents to identify inconsistencies, duplicate payments, and billing errors, streamlining the reconciliation process and enhancing financial accuracy. |

| 6 | Vendor Compliance Validation Sheet | The Vendor Compliance Validation Sheet is essential for an accountant's year-end invoice review as it verifies that all invoice details adhere to contractual terms and regulatory requirements. This document ensures accurate reconciliation by cross-referencing vendor compliance with purchase orders and payment approvals. |

| 7 | Real-Time Payment Status Dashboard | Accountants require access to the real-time payment status dashboard, along with invoices, payment receipts, and client billing records, to accurately verify transaction completeness during year-end invoice reviews. This dashboard provides up-to-date payment confirmations, outstanding balances, and discrepancies, enabling efficient reconciliation and timely financial reporting. |

| 8 | OCR-Extracted Invoice Data Archive | Accountants require a comprehensive OCR-extracted invoice data archive containing digitized invoice numbers, dates, vendor details, amounts, and tax information to streamline the year-end invoice review process. This digital repository enables accurate cross-referencing, error detection, and compliance verification essential for financial auditing and reporting. |

| 9 | ESG Invoice Allocation Statement | Accountants require the ESG Invoice Allocation Statement to accurately assess environmental, social, and governance-related expenses during the year-end invoice review, ensuring compliance with sustainability reporting standards. This document details the specific allocation of costs associated with ESG initiatives, enabling precise financial analysis and audit readiness. |

| 10 | Cross-Border Tax Compliance Invoice Matrix | For a thorough year-end invoice review focused on Cross-Border Tax Compliance, accountants require detailed invoices with clear tax jurisdiction markings, proof of tax payments, and relevant customs documentation. Access to the Invoice Matrix, outlining varying VAT rates and withholding tax obligations by country, ensures accurate tax treatment and compliance verification across international transactions. |

Introduction to Year-End Invoice Review

Year-end invoice review is a crucial process for accountants to ensure financial accuracy and compliance. This review helps verify that all transactions are recorded correctly before closing the fiscal year.

Accountants require specific documents to conduct a thorough year-end invoice review. These documents help identify discrepancies and confirm the validity of invoices.

Importance of Accurate Invoicing for Accountants

Accurate invoicing is crucial for accountants during the year-end review to ensure financial statements reflect true business performance. Proper documentation supports compliance, audit readiness, and transparent financial reporting.

- Invoice Records - Detailed and organized invoices allow accountants to verify revenue and expenses accurately.

- Payment Receipts - Proof of payment ensures the reconciliation of accounts and detection of discrepancies.

- Client Contracts - Contracts provide terms and conditions that validate invoiced amounts and service agreements.

Key Invoice Details to Verify

Accountants require specific documents to conduct a thorough year-end invoice review, ensuring all financial records are accurate. Key invoice details to verify include invoice number, date, and payment terms.

Verify the supplier's name and contact information to confirm authenticity. Check the list of goods or services provided, along with quantities and unit prices, to ensure accuracy. Confirm that tax amounts, discounts, and total payable figures match the supporting documentation.

Supporting Documentation Checklist

What documents does an accountant need for a year-end invoice review? An accountant requires comprehensive supporting documentation to verify the accuracy and completeness of invoices. This checklist includes purchase orders, delivery receipts, and payment confirmations necessary for thorough validation.

Which supporting documents are essential for matching invoices during the year-end review? Accurate matching depends on receiving original purchase orders, signed delivery notes, and vendor invoices. These documents help identify discrepancies and ensure all billed amounts are legitimate and properly authorized.

How do payment records contribute to the year-end invoice review process? Payment confirmations such as bank statements, canceled checks, or electronic payment receipts validate that invoices have been settled. These records prevent duplicate payments and support accurate financial reporting.

Why are contracts and agreements important for invoice verification? Signed contracts provide the terms and conditions that govern pricing and deliverables. Accountants use these documents to confirm that invoiced amounts align with agreed rates and services outlined in the agreements.

What role do expense reports play in supporting documentation for invoices? Expense reports provide detailed accounts of costs incurred, often linked to reimbursable invoices. Including these reports completes the audit trail, ensuring transparency and accountability in the year-end financial review.

Reconciliation of Account Statements

Reconciliation of account statements is essential for accurate year-end invoice review by accountants. It ensures that all transactions are verified and discrepancies are identified before closing the financial period.

- Bank Statements - Provide a record of all cash inflows and outflows to compare against invoices and payment records.

- Accounts Receivable Ledger - Lists all outstanding invoices to confirm payments received and outstanding balances.

- Supplier Statements - Detail amounts owed to vendors, helping identify any missed or duplicate payments on invoices.

Thorough reconciliation helps maintain financial accuracy and prevents errors in year-end reporting.

Common Invoice Discrepancies to Watch

Accountants require invoices, purchase orders, and payment receipts for a thorough year-end invoice review. Common invoice discrepancies to watch include mismatched amounts, incorrect billing dates, and missing approval signatures. Identifying these issues ensures accurate financial reporting and compliance.

Essential Approval and Authorization Records

An accountant requires essential approval and authorization records for a thorough year-end invoice review. These documents include signed purchase orders, authorized payment vouchers, and management approval emails to verify transaction legitimacy. Ensuring you provide these records helps maintain accurate financial reporting and compliance.

Compliance Documents for Year-End Audit

| Document Type | Description | Purpose in Year-End Invoice Review |

|---|---|---|

| Purchase Orders | Official authorization documents for purchases | Verify invoice legitimacy and ensure authorization compliance |

| Supplier Invoices | Detailed billing documents provided by vendors | Match billed amounts with received goods or services for accuracy |

| Payment Receipts | Proof of payment made to suppliers | Confirm payments align with invoiced amounts and terms |

| Tax Compliance Certificates | Documentation confirming adherence to tax regulations | Ensure correct tax rates applied and regulatory compliance |

| Contract Agreements | Legal agreements outlining terms with suppliers | Validate invoice terms and conditions against contractual obligations |

| Audit Trail Reports | Logs showing transaction histories and modifications | Support transparency and traceability of invoice processing |

| Expense Reports | Records of internal approval and expense justification | Corroborate the necessity and approval of invoiced expenses |

Best Practices for Document Organization

Organizing documents effectively is crucial for accountants conducting a year-end invoice review. Proper document management ensures accuracy and efficiency in financial reporting.

- Collect All Invoices - Gather original and digital copies of all invoices to verify transactions and support audit trails.

- Sort by Date and Vendor - Arrange invoices chronologically and by supplier to streamline cross-referencing and tracking.

- Maintain Supporting Documents - Include purchase orders, delivery receipts, and payment confirmations to validate invoice accuracy and completeness.

What Documents Does an Accountant Need for Year-End Invoice Review? Infographic