A company must have a valid tax identification number, detailed buyer and seller information, and a clear description of goods or services provided to issue a tax-compliant invoice. The invoice should also include the date of issue, invoice number, payment terms, and applicable tax rates and amounts. Proper record-keeping ensures compliance with local tax regulations and facilitates smooth audits.

What Documents Does a Company Need to Issue a Tax-Compliant Invoice?

| Number | Name | Description |

|---|---|---|

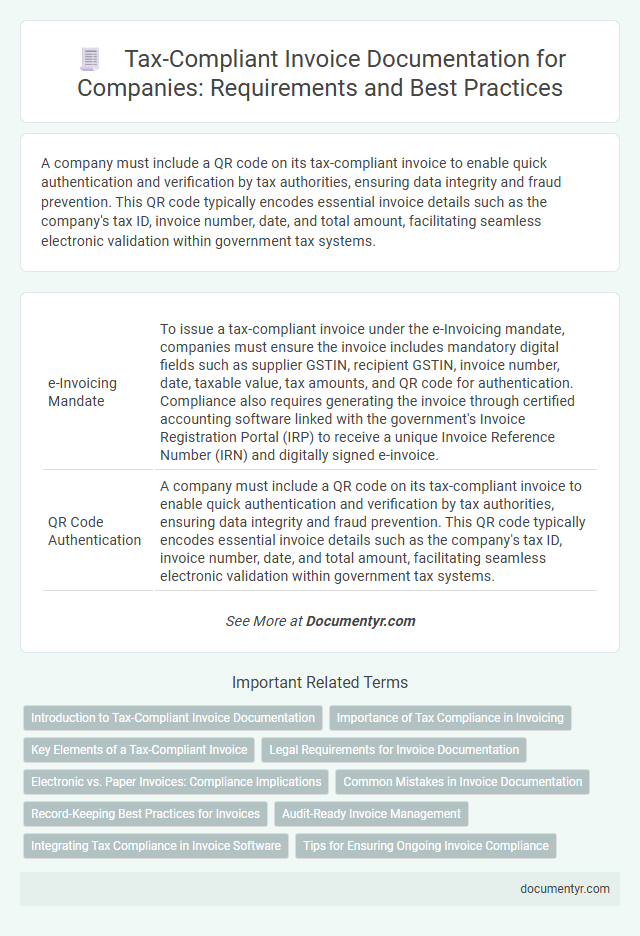

| 1 | e-Invoicing Mandate | To issue a tax-compliant invoice under the e-Invoicing mandate, companies must ensure the invoice includes mandatory digital fields such as supplier GSTIN, recipient GSTIN, invoice number, date, taxable value, tax amounts, and QR code for authentication. Compliance also requires generating the invoice through certified accounting software linked with the government's Invoice Registration Portal (IRP) to receive a unique Invoice Reference Number (IRN) and digitally signed e-invoice. |

| 2 | QR Code Authentication | A company must include a QR code on its tax-compliant invoice to enable quick authentication and verification by tax authorities, ensuring data integrity and fraud prevention. This QR code typically encodes essential invoice details such as the company's tax ID, invoice number, date, and total amount, facilitating seamless electronic validation within government tax systems. |

| 3 | Digital Signature Certificate (DSC) | A company must have a valid Digital Signature Certificate (DSC) to issue a tax-compliant invoice, as it ensures the authenticity and integrity of the electronic document. This secure digital signature is mandatory for businesses to comply with government regulations and facilitates seamless electronic filing and verification of invoices. |

| 4 | Invoice Reference Number (IRN) | A company must generate an Invoice Reference Number (IRN) by submitting the invoice details to the tax authority's portal, ensuring the document is uniquely identified and compliant with tax regulations. The IRN acts as a critical digital signature linking the invoice to the official government database, preventing duplication and facilitating audit trails. |

| 5 | GST-Compliant Invoice Template | A company must include key documents such as a GST-compliant invoice template featuring the supplier's GSTIN, recipient's GSTIN if registered, unique invoice number, date of issue, detailed description of goods or services, taxable value, GST rates, and amount. Accurate inclusion of HSN or SAC codes along with the place of supply ensures the invoice meets the legal requirements for GST compliance and facilitates proper tax filing. |

| 6 | Dynamic QR Code for B2C Invoices | To issue a tax-compliant invoice, a company must include essential documents such as the invoice template containing a dynamic QR code specifically designed for B2C transactions, which enables real-time verification and ensures compliance with tax authorities. This dynamic QR code integrates critical transaction data, enhancing transparency and simplifying audit processes while meeting regulatory requirements. |

| 7 | HSN/SAC Code Mapping | Companies must include accurate HSN (Harmonized System of Nomenclature) or SAC (Service Accounting Code) codes on invoices to ensure tax compliance and proper classification of goods or services under GST regulations. Proper HSN/SAC code mapping facilitates correct tax rate application, avoids invoice discrepancies, and supports seamless filing of returns with tax authorities. |

| 8 | API Integration Certificate | A company must obtain an API Integration Certificate to ensure its invoicing system is securely connected and compliant with tax authority requirements, enabling automated submission of invoice data. This certificate validates the company's software meets regulatory standards for accurate tax reporting and seamless electronic invoicing processes. |

| 9 | Invoice Registration Portal (IRP) | Companies must submit their invoice details through the Invoice Registration Portal (IRP) to generate a tax-compliant invoice, ensuring the issuance of a unique Invoice Reference Number (IRN). This digital process requires uploading transaction specifics, including GSTIN, invoice number, and invoice date, to comply with government regulations and facilitate real-time invoice verification. |

| 10 | Vendor Master Data Sheet | A company must use a Vendor Master Data Sheet containing accurate supplier information such as tax identification numbers, legal business names, and registered addresses to issue a tax-compliant invoice. Proper maintenance of this data ensures adherence to fiscal regulations and facilitates correct tax reporting for each transaction. |

Introduction to Tax-Compliant Invoice Documentation

A tax-compliant invoice is essential for accurate financial record-keeping and legal adherence. Understanding the required documents ensures your transactions meet regulatory standards.

- Business Registration Proof - Validates the legal existence of the issuing company for tax purposes.

- Tax Identification Number (TIN) - Required to link the invoice to the company's tax obligations.

- Customer Information - Includes valid identification and address details to ensure transparency and traceability.

Importance of Tax Compliance in Invoicing

Issuing a tax-compliant invoice requires specific documents such as a valid business registration, tax identification number (TIN), and detailed transaction records. Proper documentation ensures the invoice meets legal standards and facilitates accurate tax reporting.

Tax compliance in invoicing is crucial to avoid penalties, audits, and legal disputes with tax authorities. Accurate invoices support transparent financial management and contribute to the business's credibility and trustworthiness.

Key Elements of a Tax-Compliant Invoice

A tax-compliant invoice must include specific documents to meet legal requirements. These documents ensure accurate tax reporting and facilitate financial audits.

Key elements of a tax-compliant invoice include the seller's name, address, and tax identification number. The buyer's details and invoice date are essential for proper record-keeping. Itemized descriptions of goods or services, quantities, unit prices, and the total amount with applicable taxes must be clearly stated.

Legal Requirements for Invoice Documentation

What documents does a company need to issue a tax-compliant invoice? A tax-compliant invoice must include the company's tax identification number and the client's tax ID when applicable. It should also contain detailed descriptions of goods or services, quantities, prices, and applicable tax rates to meet legal standards.

Electronic vs. Paper Invoices: Compliance Implications

Companies must understand the specific documentation required to issue tax-compliant invoices, considering the differences between electronic and paper formats. Compliance implications vary significantly depending on the invoice type and the regulatory environment.

- Electronic Invoices Require Digital Signatures - Digital signatures authenticate the invoice, ensuring its origin and integrity in accordance with tax laws.

- Paper Invoices Demand Physical Copies - Hard copies must be preserved for audit purposes and meet specific layout and information standards.

- Tax Authority Submission Protocols Differ - Electronic invoices often require submission through certified platforms, while paper invoices may need manual filing.

Companies must align their invoicing practices with current tax regulations to avoid penalties and streamline compliance processes.

Common Mistakes in Invoice Documentation

To issue a tax-compliant invoice, a company must include essential documents such as a detailed purchase order, the client's tax identification number, and proof of transaction date. Common mistakes include missing or incorrect tax identification numbers, incomplete item descriptions, and lack of authorized signatures. Ensuring accuracy in these documents helps prevent tax audit issues and legal penalties for the business.

Record-Keeping Best Practices for Invoices

Issuing a tax-compliant invoice requires specific documentation to ensure accuracy and legal adherence. Proper record-keeping supports both compliance and efficient financial management.

- Maintain Original Invoices - Retain copies of all issued invoices for audit and verification purposes.

- Include Mandatory Details - Ensure invoices list the company name, tax identification number, date, itemized services or products, and total amount with applicable taxes.

- Store Digital and Physical Records - Organize invoices both electronically and in hard copy to meet legal retention requirements and facilitate easy retrieval.

Audit-Ready Invoice Management

A company must include essential documents such as a valid purchase order, proof of goods or services delivered, and taxpayer identification details to issue a tax-compliant invoice. Accurate record-keeping of these documents ensures audit-ready invoice management, enabling seamless verification during tax audits. Maintaining a systematic invoice filing system with digital backups further supports compliance and reduces the risk of penalties.

Integrating Tax Compliance in Invoice Software

| Required Documents for Tax-Compliant Invoices | Description |

|---|---|

| Tax Identification Number (TIN) | Unique identifier for a company issued by the tax authority, essential for invoice validation and tracking tax liabilities. |

| Official Company Registration Details | Includes legal company name, registration number, and address as registered with government entities to ensure legal recognition. |

| Customer Identification Information | Details such as customer's legal name, address, and tax ID required for cross-verification and compliance purposes. |

| Invoice Numbering System | Sequential and unique invoice numbers are mandatory for audit trails and compliance with tax regulations. |

| Tax Rates and Calculation Rules | Accurate application of applicable tax rates (e.g., VAT, GST) automatically computed based on product or service categories. |

| Invoice Date and Due Date | Clearly stated issue date and payment due date to meet statutory deadlines for tax reporting and payment. |

| Goods or Services Details | Detailed description, quantity, unit price, and total amount for transparent transaction records. |

| Payment Terms and Methods | Specifies acceptable payment options and conditions, supporting compliance and financial reconciliation. |

| Integration of Tax Compliance in Invoice Software | Benefits and Features |

| Automated Tax Calculations | Software applies correct tax rates based on jurisdiction and product/service type, reducing manual errors. |

| Real-Time Tax Rate Updates | Ensures compliance with current tax laws by updating tax tables automatically in the system. |

| Legal Invoice Template Compliance | Pre-configured templates that meet country-specific tax authority formatting and data requirements. |

| Digital Signatures and Secure Transmission | Enables encrypted invoice issuance and electronic signing to comply with e-invoicing mandates. |

| Audit Trail and Reporting Tools | Comprehensive logs and reports facilitate tax audits and support regulatory inspections. |

| Customer and Vendor Tax Data Management | Maintains updated tax status of trading partners to ensure valid invoicing and reduce risk of non-compliance. |

What Documents Does a Company Need to Issue a Tax-Compliant Invoice? Infographic