An international invoice must be accompanied by key documents such as the commercial invoice, packing list, and bill of lading to ensure smooth customs clearance. Export licenses, certificates of origin, and insurance documents are often required depending on the destination country's regulations. Proper documentation minimizes delays, supports compliance, and facilitates accurate shipment tracking.

What Documents Must Accompany an International Invoice?

| Number | Name | Description |

|---|---|---|

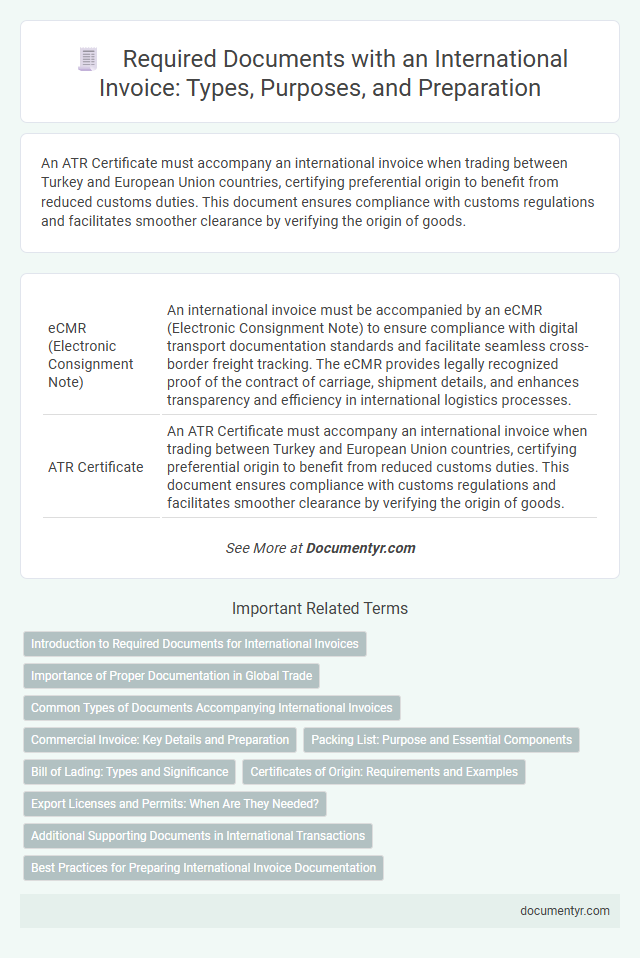

| 1 | eCMR (Electronic Consignment Note) | An international invoice must be accompanied by an eCMR (Electronic Consignment Note) to ensure compliance with digital transport documentation standards and facilitate seamless cross-border freight tracking. The eCMR provides legally recognized proof of the contract of carriage, shipment details, and enhances transparency and efficiency in international logistics processes. |

| 2 | ATR Certificate | An ATR Certificate must accompany an international invoice when trading between Turkey and European Union countries, certifying preferential origin to benefit from reduced customs duties. This document ensures compliance with customs regulations and facilitates smoother clearance by verifying the origin of goods. |

| 3 | Advance Shipping Notice (ASN) | An Advance Shipping Notice (ASN) is a critical document that must accompany an international invoice to provide detailed information about the shipment, including contents, packaging, and expected delivery dates. This notice enhances supply chain visibility, facilitates customs clearance, and ensures accurate verification against the invoice and purchase order. |

| 4 | Dual-Use Goods Declaration | International invoices for dual-use goods must be accompanied by a Dual-Use Goods Declaration that complies with the Export Control Classification Number (ECCN) specified by the exporting country's regulatory authority. This declaration ensures adherence to international export control regulations, preventing unauthorized use of items with both civilian and military applications. |

| 5 | DCSA-Compliant Digital Bill of Lading | An international invoice must be accompanied by a DCSA-compliant digital Bill of Lading, which ensures secure, standardized, and transparent shipping documentation aligned with Digital Container Shipping Association protocols. This digital Bill of Lading streamlines cargo tracking, enhances legal validity, and facilitates faster customs clearance across global trade routes. |

| 6 | Origin Data Blockchain Token | An international invoice must include an Origin Data Blockchain Token to verify the authenticity and provenance of the goods, ensuring compliance with customs regulations and facilitating smooth cross-border transactions. This token serves as a secure digital certificate, linking the invoice to immutable blockchain records that document product origin, manufacturing history, and shipment details. |

| 7 | Pre-Arrival Processing Statement (PAPS) | A Pre-Arrival Processing Statement (PAPS) must accompany an international invoice to expedite customs clearance by providing advance shipment data to border authorities. This document enables faster processing and reduces delays by allowing officials to verify cargo details before arrival. |

| 8 | Sanctions Compliance End-Use Certificate | International invoices must be accompanied by an End-Use Certificate to ensure sanctions compliance, detailing the final use and destination of the goods or services. This document verifies that the transaction does not violate export control regulations and helps prevent illegal diversion to sanctioned entities or countries. |

| 9 | Environmental, Social, and Governance (ESG) Statement | An international invoice must be accompanied by an Environmental, Social, and Governance (ESG) statement that outlines the company's commitment to sustainable practices, including carbon footprint reduction, ethical labor standards, and transparent governance structures. This document supports compliance with global trade regulations and enhances corporate accountability by ensuring that the transaction aligns with international ESG criteria. |

| 10 | Incoterms 2020 Digital Addendum | International invoices must be accompanied by documents specified in the Incoterms 2020 Digital Addendum, including the commercial invoice, packing list, certificate of origin, and relevant transport documents such as the bill of lading or air waybill. Compliance with these documents ensures clarity in responsibilities, costs, and risks between buyers and sellers under specific trade terms. |

Introduction to Required Documents for International Invoices

International invoices serve as crucial documents in global trade, ensuring transparent and accurate transactions between exporters and importers. To facilitate smooth customs clearance and compliance, specific accompanying documents are mandatory.

Required documents for international invoices typically include the commercial invoice, packing list, and bill of lading or airway bill. Customs authorities demand these papers to verify shipment contents, value, and origin. Proper documentation helps avoid delays, penalties, and shipment rejection at border crossings.

Importance of Proper Documentation in Global Trade

Proper documentation is essential for an international invoice to ensure smooth customs clearance and compliance with trade regulations. Key documents include the commercial invoice, packing list, bill of lading, and any required certificates such as origin or insurance. You must provide these documents accurately to avoid delays, fines, or rejection of shipments in global trade.

Common Types of Documents Accompanying International Invoices

What documents must accompany an international invoice? Common types of documents accompanying international invoices include the commercial invoice, packing list, and bill of lading. These documents ensure smooth customs clearance and accurate shipment tracking.

Commercial Invoice: Key Details and Preparation

An international invoice must be accompanied by specific documents to ensure smooth customs clearance and compliance with trade regulations. A commercial invoice is a critical document that details the transaction and serves as proof of sale between the exporter and importer.

- Accurate Product Description - The commercial invoice must include detailed information about the goods, such as quantity, type, and unit price.

- Consignee and Consignor Information - Clear identification of the buyer and seller with complete addresses and contact details is essential.

- HS Codes and Country of Origin - Harmonized System codes and the product's country of origin must be specified to facilitate customs classification and duties assessment.

Packing List: Purpose and Essential Components

The packing list is a critical document that must accompany an international invoice to ensure accurate shipment handling and customs clearance. It provides detailed information about the contents, quantity, and packaging of the goods being shipped.

- Purpose - The packing list serves to verify the contents of each package, facilitating smooth customs inspection and preventing shipment delays.

- Essential Components - It includes descriptions of items, quantity per package, weight, and dimensions to ensure precise identification and handling.

- Additional Details - The packing list often specifies the type of packaging used, marks and numbers on packages, and the shipper's contact information.

Bill of Lading: Types and Significance

The Bill of Lading is a crucial document that must accompany an international invoice during shipping transactions. It serves as a receipt for the goods and a contract between the shipper and carrier.

There are several types of Bills of Lading, including the straight, order, and bearer types, each serving different purposes in cargo ownership and transfer. Understanding the significance of your Bill of Lading ensures smooth customs clearance and legal protection of your shipment.

Certificates of Origin: Requirements and Examples

Certificates of Origin are essential documents that must accompany an international invoice to verify the country where the goods were manufactured. These certificates help customs authorities determine tariff rates and ensure compliance with trade regulations. Your shipment may require specific forms depending on the destination country, such as a non-preferential certificate or a preferential certificate under trade agreements.

Export Licenses and Permits: When Are They Needed?

International invoices require specific documents to ensure smooth customs clearance. Export licenses and permits are critical among these documents when shipping certain goods abroad.

- Export licenses - Required for controlled goods such as firearms, technology, or pharmaceuticals to comply with legal export regulations.

- Permits for restricted items - Necessary for items subject to trade restrictions, like endangered species or cultural artifacts, to prevent illegal export.

- Country-specific regulations - Vary depending on the import and export laws of the countries involved in the transaction.

You must verify whether your shipment necessitates these licenses or permits to avoid delays or legal issues.

Additional Supporting Documents in International Transactions

International invoices often require additional supporting documents to ensure smooth customs clearance and compliance with trade regulations. These documents provide detailed information about the shipment, product specifications, and transaction terms.

Common supporting documents include the commercial invoice, packing list, certificate of origin, and export licenses. Other essential documents might be insurance certificates, bills of lading, and inspection certificates depending on the nature of the goods and destination country requirements.

What Documents Must Accompany an International Invoice? Infographic