A business must attach a commercial invoice, packing list, and certificate of origin when issuing an international invoice. Shipping documents such as the bill of lading or airway bill are also essential to facilitate customs clearance. Including these documents ensures compliance with international trade regulations and smooth cross-border transactions.

What Documents Does a Business Need to Attach When Issuing an International Invoice?

| Number | Name | Description |

|---|---|---|

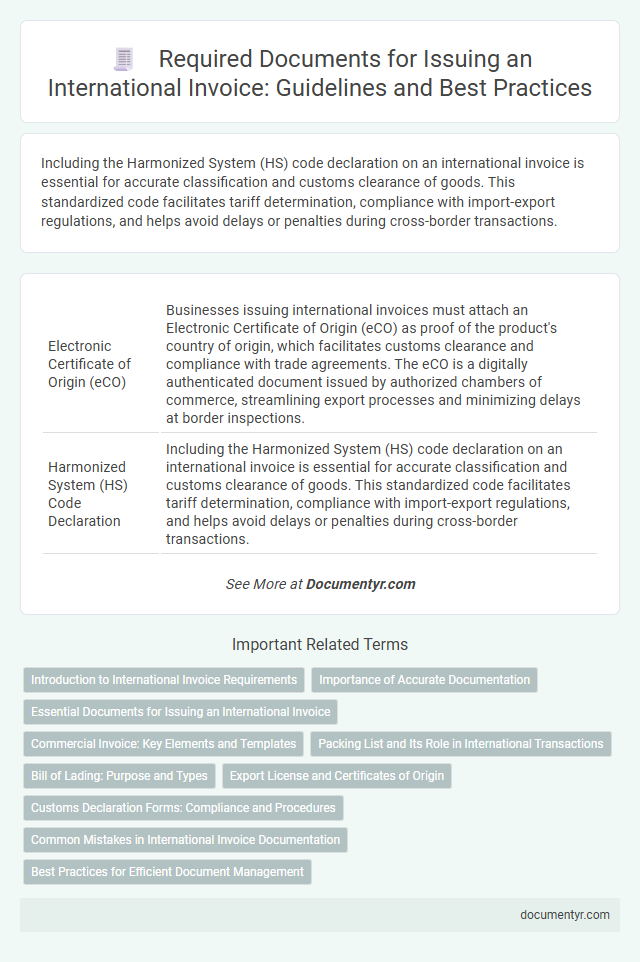

| 1 | Electronic Certificate of Origin (eCO) | Businesses issuing international invoices must attach an Electronic Certificate of Origin (eCO) as proof of the product's country of origin, which facilitates customs clearance and compliance with trade agreements. The eCO is a digitally authenticated document issued by authorized chambers of commerce, streamlining export processes and minimizing delays at border inspections. |

| 2 | Harmonized System (HS) Code Declaration | Including the Harmonized System (HS) code declaration on an international invoice is essential for accurate classification and customs clearance of goods. This standardized code facilitates tariff determination, compliance with import-export regulations, and helps avoid delays or penalties during cross-border transactions. |

| 3 | Incoterms 2020 Statement | A business must attach a clear Incoterms 2020 statement on the invoice to specify the agreed delivery terms, defining the responsibilities for costs, risks, and customs clearance between buyer and seller. Including this statement ensures compliance with international trade regulations and facilitates smooth customs processing and payment reconciliation. |

| 4 | Proforma Invoice Confirmation | A business must attach a proforma invoice confirmation when issuing an international invoice to provide a preliminary agreement outlining the transaction details, including product descriptions, quantities, and prices, ensuring clarity and mutual consent before shipment. This document serves as a formal commitment that facilitates customs clearance and payment processes in international trade. |

| 5 | Digital Bill of Lading | A Digital Bill of Lading must be attached to an international invoice to verify the shipment details, ownership, and terms of delivery for cross-border transactions. This electronic document enhances transparency, reduces paperwork, and facilitates faster customs clearance and payment processes. |

| 6 | Importer Security Filing (ISF) Documents | When issuing an international invoice, businesses must attach Importer Security Filing (ISF) documents, including detailed shipment data such as the manufacturer, supplier, buyer, and consignee information for accurate customs processing. Proper ISF documentation ensures compliance with U.S. Customs and Border Protection regulations, preventing shipment delays and penalties. |

| 7 | Cross-Border e-Invoice Compliance Report | Businesses issuing international invoices must attach documents such as the Cross-Border e-Invoice Compliance Report, which ensures adherence to tax regulations and electronic invoicing standards across different jurisdictions. This report verifies transaction authenticity, supports customs clearance, and facilitates seamless cross-border trade by providing audit trails and compliance evidence. |

| 8 | Foreign Exchange Control Certificate | When issuing an international invoice, businesses must attach a Foreign Exchange Control Certificate to comply with regulatory requirements governing currency transactions and cross-border payments. This document verifies authorization for foreign exchange operations, prevents currency misuse, and ensures transparency in international trade settlements. |

| 9 | Export Control Classification Number (ECCN) Sheet | When issuing an international invoice, businesses must attach the Export Control Classification Number (ECCN) Sheet to ensure compliance with U.S. export regulations by identifying controlled goods accurately. This document helps customs authorities assess export restrictions and verify that the shipment adheres to legal requirements, preventing export violations and potential penalties. |

| 10 | Blockchain-based Smart Contract Attachment | When issuing an international invoice, businesses must attach blockchain-based smart contracts to ensure secure and transparent verification of transaction terms and compliance. These digital contracts provide immutable proof of agreement, facilitating seamless cross-border payments and reducing disputes in global trade documentation. |

Introduction to International Invoice Requirements

Issuing an international invoice requires specific documentation to ensure compliance with global trade regulations. Proper documentation helps facilitate customs clearance and accurate payment processing.

- Commercial Invoice - This document details the transaction, including buyer and seller information, product descriptions, quantities, and prices.

- Packing List - A detailed list of the shipment's contents, including weights and dimensions, necessary for customs inspections.

- Export Licenses and Certificates - Legal permits required for certain goods, demonstrating compliance with export controls and international trade laws.

Attaching all required documents reduces delays and errors in international shipping and payment settlements.

Importance of Accurate Documentation

| Document Type | Description | Importance |

|---|---|---|

| Commercial Invoice | A detailed statement that outlines the goods or services provided, including quantity, price, and terms of sale. | Serves as the primary document for customs clearance and proof of transaction value. |

| Packing List | Details the contents of each package, dimensions, and weight. | Ensures proper inspection, handling, and delivery of shipments. |

| Certificate of Origin | Certifies the country where the goods were manufactured or produced. | Required to apply tariffs, taxes, and comply with trade agreements. |

| Bill of Lading or Air Waybill | Transport document that acts as a receipt and contract for shipment. | Provides legal evidence and tracking information for the shipment in transit. |

| Export Licenses or Permits | Official authorization for exporting certain restricted or regulated goods. | Necessary to comply with export control laws and avoid legal penalties. |

| Insurance Certificate | Proof of shipment insurance coverage. | Protects against financial loss due to damage or loss during transit. |

| Proforma Invoice (if applicable) | Preliminary invoice sent before the sale, indicating commitment to supply goods or services. | Helps the buyer secure financing and approvals before final transaction. |

Accurate documentation is critical when issuing an international invoice. Errors or missing documents can cause delays, customs issues, or additional costs. Ensure your paperwork is complete and precise to facilitate smooth cross-border transactions and maintain compliance with global trade regulations.

Essential Documents for Issuing an International Invoice

What documents does a business need to attach when issuing an international invoice? A complete international invoice requires essential documents to ensure smooth customs clearance and payment processing. Attaching the correct paperwork minimizes delays and compliance issues in cross-border transactions.

Which documents are essential for an international invoice? Key documents include the commercial invoice, packing list, bill of lading, export license, and certificate of origin. These documents verify the shipment details, prove legal export status, and support customs declarations.

Why is the commercial invoice important in international trade? The commercial invoice acts as the primary document listing goods, prices, terms, and payment instructions. Customs authorities rely on it to assess duties and taxes accurately.

What role does the packing list play when attached to an international invoice? The packing list details the contents, quantity, and packaging of goods shipped. It assists customs officials and buyers in verifying shipment accuracy and condition.

How does a bill of lading support an international invoice? The bill of lading serves as proof of shipment and a contract between the shipper and carrier. It provides tracking information and confirms delivery terms agreed upon by parties involved.

When is an export license necessary for international invoicing? Export licenses are required for controlled or restricted goods depending on the country's regulations. Including the export license ensures compliance and avoids legal penalties.

What is the significance of a certificate of origin in an international invoice? This document certifies where the goods were manufactured, which affects tariffs and trade agreements. Customs use it to determine applicable import duties and eligibility for preferential treatment.

Commercial Invoice: Key Elements and Templates

When issuing an international invoice, attaching a commercial invoice is essential as it serves as the primary document for customs clearance and payment processing. Key elements of a commercial invoice include the seller's and buyer's details, a detailed description of the goods or services, their quantity, unit price, total amount, and the terms of sale. Your commercial invoice templates should be clear, accurate, and compliant with international trade regulations to avoid delays and ensure smooth transactions.

Packing List and Its Role in International Transactions

When issuing an international invoice, businesses must attach essential documents to ensure smooth customs clearance and accurate transaction records. One of the critical documents is the packing list, which details the contents, quantity, and weight of the shipped goods.

The packing list plays a vital role in international transactions by providing customs authorities with precise information needed for inspection and valuation. It helps verify the shipment against the commercial invoice, preventing delays and disputes during cross-border trade.

Bill of Lading: Purpose and Types

The Bill of Lading is a crucial document attached to an international invoice, serving as proof of shipment and receipt of goods. It outlines the terms of transportation, specifies the type of goods, and acts as a legal contract between the shipper, carrier, and consignee. Understanding the different types, such as negotiable, non-negotiable, or sea waybill, helps ensure proper documentation and smooth customs clearance for your shipment.

Export License and Certificates of Origin

When issuing an international invoice, businesses must attach essential documents to ensure smooth customs clearance and compliance with foreign regulations. Key documents include an export license and certificates of origin.

An export license authorizes the shipment of goods to a specific country, proving compliance with export control laws. Certificates of origin verify the country where the goods were manufactured, affecting tariffs and trade agreements. These documents help prevent delays at customs and support the authenticity of the transaction.

Customs Declaration Forms: Compliance and Procedures

When issuing an international invoice, attaching accurate Customs Declaration Forms is essential for seamless customs clearance. These forms provide detailed information about the goods being shipped, their value, and origin, ensuring compliance with international trade regulations.

You must ensure that all declarations correspond accurately to the invoice details to avoid delays or legal issues. Properly completed forms facilitate efficient customs procedures and help prevent potential fines or shipment holds at the border.

Common Mistakes in International Invoice Documentation

Issuing an international invoice requires attaching specific documents to ensure smooth customs clearance and payment processing. Missing or incorrect documentation often causes delays and disputes in cross-border transactions.

- Incorrect Commercial Invoice Details - Missing essential information like invoice number, buyer and seller details, or product descriptions leads to customs rejection.

- Omission of Packing List - Without a detailed packing list, customs officials cannot verify shipment contents, resulting in shipment holds or fines.

- Lack of Certificates of Origin - Failure to attach accurate certificates of origin affects tariff classification and may lead to higher import duties or shipment refusal.

What Documents Does a Business Need to Attach When Issuing an International Invoice? Infographic