An exporter must submit several key documents along with an invoice, including a packing list, bill of lading, and certificate of origin to ensure smooth customs clearance. Proper documentation such as export licenses, insurance certificates, and inspection certificates verify compliance and guarantee shipment authenticity. Accurate and complete paperwork facilitates timely payment and minimizes the risk of delays or penalties in international trade.

What Documents Does an Exporter Need to Submit with an Invoice?

| Number | Name | Description |

|---|---|---|

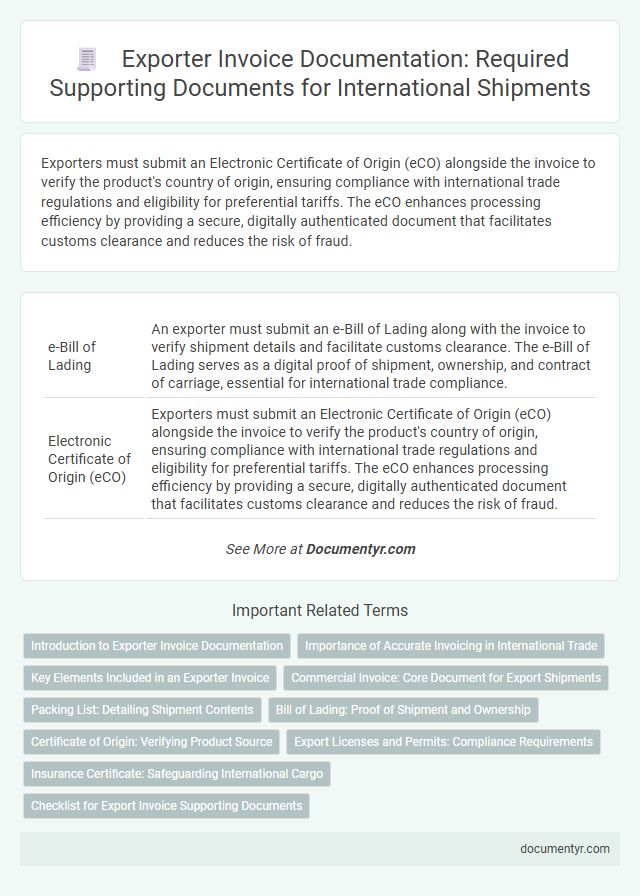

| 1 | e-Bill of Lading | An exporter must submit an e-Bill of Lading along with the invoice to verify shipment details and facilitate customs clearance. The e-Bill of Lading serves as a digital proof of shipment, ownership, and contract of carriage, essential for international trade compliance. |

| 2 | Electronic Certificate of Origin (eCO) | Exporters must submit an Electronic Certificate of Origin (eCO) alongside the invoice to verify the product's country of origin, ensuring compliance with international trade regulations and eligibility for preferential tariffs. The eCO enhances processing efficiency by providing a secure, digitally authenticated document that facilitates customs clearance and reduces the risk of fraud. |

| 3 | Advance Cargo Information Declaration | Exporters must submit an Advance Cargo Information Declaration (ACID) alongside the invoice to comply with customs regulations and facilitate smooth cargo processing. The ACID provides detailed shipment data, enabling authorities to perform risk assessments and expedite clearance procedures. |

| 4 | Export Compliance Statement | An Exporter must submit an Export Compliance Statement with an invoice to certify adherence to international trade regulations, including export control laws and sanctions. This document ensures that the shipment complies with all relevant export requirements and helps prevent legal penalties or shipment delays. |

| 5 | Dual-Use Goods Certificate | Exporters must submit a Dual-Use Goods Certificate alongside the invoice when shipping items that have both civilian and military applications, ensuring compliance with international export control regulations. This certificate verifies that the exported goods do not violate restrictions on sensitive technology or materials. |

| 6 | Export Control Classification Number (ECCN) | Exporters must submit the Export Control Classification Number (ECCN) with an invoice to ensure compliance with U.S. export regulations; the ECCN identifies the specific category and level of control for the exported item. Accurate ECCN documentation helps customs authorities determine licensing requirements and prevent unauthorized exports of controlled products. |

| 7 | Blockchain-verified Packing List | An exporter must include a Blockchain-verified Packing List alongside the invoice to ensure authenticity and traceability of the shipment details, enhancing security and reducing fraud risks. This document provides immutable records of the contents, quantities, and packaging, facilitating smoother customs clearance and increased trust among trading partners. |

| 8 | Digital Sanitary and Phytosanitary Certificate | Exporters must submit a Digital Sanitary and Phytosanitary Certificate along with their invoice to verify that the products meet health and safety standards required by the importing country. This digital document ensures compliance with biosecurity regulations and facilitates smooth customs clearance during international trade. |

| 9 | Customs Self-Assessment Report | Exporters must submit a Customs Self-Assessment Report alongside the invoice to facilitate efficient customs clearance and verify compliance with trade regulations. This document provides detailed information on the shipment's value, classification, and origin, enabling customs authorities to assess duties accurately and expedite the import process. |

| 10 | ESG (Environmental, Social, and Governance) Declaration Form | An exporter must submit an ESG (Environmental, Social, and Governance) Declaration Form with the invoice to ensure compliance with sustainability and ethical standards in international trade. This document verifies the exporter's commitment to environmental protection, social responsibility, and transparent governance practices, which are increasingly required by global buyers and regulatory authorities. |

Introduction to Exporter Invoice Documentation

An exporter invoice is a critical document that facilitates international trade by detailing the goods sold and their transaction terms. Proper documentation ensures smooth customs clearance and compliance with global trade regulations.

Exporters must submit specific supporting documents along with the invoice to verify shipment details and regulatory adherence. These documents include packing lists, certificates of origin, and shipping bills, among others.

Importance of Accurate Invoicing in International Trade

Accurate invoicing in international trade ensures smooth customs clearance and minimizes delays. Proper documentation supports compliance with global regulations and protects your financial interests.

- Commercial Invoice - Details the transaction, including product description, quantity, and price, essential for customs valuation.

- Packing List - Lists the contents and packaging details to verify shipment accuracy and assist logistics providers.

- Certificate of Origin - Confirms the product's origin, enabling eligibility for preferential tariff treatment.

Submitting these documents correctly with your invoice facilitates efficient processing and reduces the risk of penalties.

Key Elements Included in an Exporter Invoice

An exporter must submit specific documents alongside the invoice to ensure smooth customs clearance and payment processing. Your invoice should clearly detail essential elements for international trade compliance.

- Commercial Invoice - This document provides a detailed description of goods, quantities, prices, and total value.

- Packing List - It outlines the contents, packaging type, and weight for accurate shipment verification.

- Certificate of Origin - It certifies the country where the goods were manufactured, required for customs duties.

Commercial Invoice: Core Document for Export Shipments

What documents are essential to submit with an invoice for export shipments? A commercial invoice is the core document that outlines the transaction details between the exporter and importer. This invoice serves as a critical reference for customs clearance and payment processing for your shipment.

Packing List: Detailing Shipment Contents

The packing list is a crucial document that exporters must submit along with the invoice. It provides a detailed breakdown of the shipment contents, ensuring transparency and accuracy during customs clearance.

The packing list specifies the quantity, description, and weight of each item included in the shipment. It helps customs officials verify the cargo against the invoice, preventing delays or disputes. Exporters rely on this document to maintain clear communication with buyers and logistics partners.

Bill of Lading: Proof of Shipment and Ownership

The Bill of Lading serves as crucial proof of shipment and ownership in the export process. This document confirms that the goods have been loaded onto the vessel and details the terms of carriage. You must submit the Bill of Lading along with the invoice to ensure smooth customs clearance and transfer of ownership.

Certificate of Origin: Verifying Product Source

| Document | Description | Purpose |

|---|---|---|

| Certificate of Origin | Official document certifying the country where the goods were manufactured or produced. | Verifies product source for customs clearance and trade agreements compliance. You must submit this with your invoice to confirm the origin of your products and facilitate smooth export processing. |

| Commercial Invoice | Detailed statement created by the exporter listing products, quantities, and prices. | Serves as the primary document for customs valuation and payment verification. |

| Packing List | Itemized list describing the contents, packaging type, and weight of each shipment package. | Helps customs inspect shipments and verifies merchandise during transit. |

| Bill of Lading | Transport document issued by the carrier confirming receipt of goods for shipment. | Acts as a contract of carriage and proof of shipment delivery. |

| Export License | Government authorization required for exporting certain controlled goods. | Ensures compliance with export regulations and controls. |

Export Licenses and Permits: Compliance Requirements

Exporters must provide specific documents alongside an invoice to ensure compliance with international trade regulations. Export licenses and permits are essential for authorizing the shipment of restricted or controlled goods across borders.

- Export Licenses - Required for goods subject to government controls, these licenses verify that the shipment meets legal export requirements.

- Permits for Controlled Goods - Certain products like pharmaceuticals, chemicals, and technology require special permits to comply with safety and security regulations.

- Regulatory Compliance - Submission of the proper licenses and permits prevents delays, fines, and confiscation by customs authorities during the export process.

Insurance Certificate: Safeguarding International Cargo

The Insurance Certificate is a critical document that protects your international cargo against loss or damage during transit. It verifies that your shipment is covered by an insurance policy, providing assurance to buyers and customs authorities. Submitting this certificate alongside your invoice helps facilitate smooth customs clearance and reduces financial risk in global trade.

What Documents Does an Exporter Need to Submit with an Invoice? Infographic