Export invoice verification requires several key documents to ensure compliance and accuracy, including the commercial invoice, packing list, bill of lading, and export license. Customs authorities may also request certificates of origin, inspection certificates, and insurance documents to validate the shipment details. Accurate documentation helps in smooth clearance and prevents delays in the export process.

What Documents are Required for Export Invoice Verification?

| Number | Name | Description |

|---|---|---|

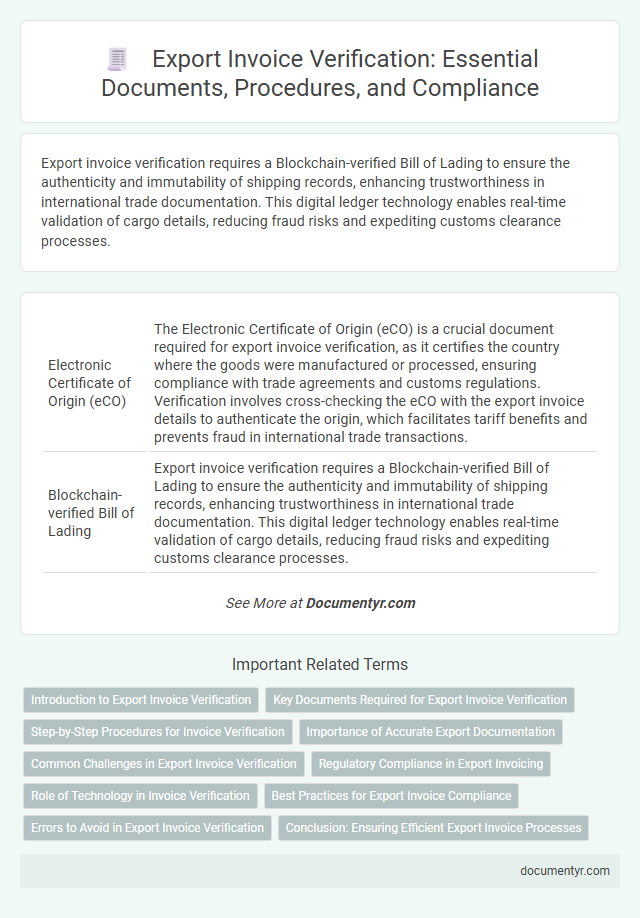

| 1 | Electronic Certificate of Origin (eCO) | The Electronic Certificate of Origin (eCO) is a crucial document required for export invoice verification, as it certifies the country where the goods were manufactured or processed, ensuring compliance with trade agreements and customs regulations. Verification involves cross-checking the eCO with the export invoice details to authenticate the origin, which facilitates tariff benefits and prevents fraud in international trade transactions. |

| 2 | Blockchain-verified Bill of Lading | Export invoice verification requires a Blockchain-verified Bill of Lading to ensure the authenticity and immutability of shipping records, enhancing trustworthiness in international trade documentation. This digital ledger technology enables real-time validation of cargo details, reducing fraud risks and expediting customs clearance processes. |

| 3 | Exporter Registration Number (ERN) | The Exporter Registration Number (ERN) is a crucial document required for export invoice verification, serving as a unique identifier for exporters in regulatory and customs processes. Verification of the ERN ensures the authenticity of the exporter and compliance with export regulations, facilitating smooth customs clearance and transaction validation. |

| 4 | Digital Proforma Invoice | Digital proforma invoice verification requires key documents such as the original purchase order, export license, and customs declaration forms to ensure compliance with international trade regulations. Accurate digital records must also include the invoice number, product descriptions, quantities, unit prices, and total value to facilitate seamless audit and approval processes. |

| 5 | Importer Security Filing (ISF) | The Importer Security Filing (ISF) requires detailed documentation including the manufacturer's name and address, consignee number, importer of record number, and shipment details to verify export invoices accurately. Proper ISF submission ensures compliance with U.S. Customs and Border Protection regulations and helps avoid penalties during export invoice verification. |

| 6 | Automated Export System (AES) Filing Confirmation | The Automated Export System (AES) Filing Confirmation is a critical document required for export invoice verification, providing proof that shipment data has been electronically filed with U.S. Customs and Border Protection. Exporters must present the AES Filing Confirmation along with the commercial invoice and packing list to ensure compliance with export regulations and facilitate customs clearance. |

| 7 | QR-code Embedded Packing List | Export invoice verification requires a QR-code embedded packing list that provides detailed shipment information, enabling quick and accurate cross-referencing of invoice data with physical goods. This document enhances traceability and ensures compliance with customs regulations by linking digital records to the physical content of the shipment. |

| 8 | E-Invoicing (Peppol Standard) | Export invoice verification requires documents such as the e-invoice generated under the Peppol standard, shipping bills, purchase orders, and customs declarations to ensure compliance and authenticity. The Peppol e-invoice must include standardized identifiers, digital signatures, and detailed transaction data to facilitate seamless cross-border verification and audit processes. |

| 9 | AI-validated Compliance Declarations | Export invoice verification requires AI-validated compliance declarations such as commercial invoices, packing lists, export licenses, and certificates of origin to ensure accuracy and regulatory adherence. These AI-verified documents reduce errors, expedite customs clearance, and enhance audit readiness by confirming authenticity and completeness. |

| 10 | HS Code-based Product Compliance Certificate | Export invoice verification requires a Product Compliance Certificate linked to the HS Code to ensure the goods meet regulatory standards and trade agreements. This document validates that the exported product adheres to classification norms under the Harmonized System, facilitating smooth customs clearance and preventing shipment delays. |

Introduction to Export Invoice Verification

| Introduction to Export Invoice Verification | |

|---|---|

| Export Invoice Verification | Process of validating documents related to an export shipment to ensure accuracy and compliance with regulatory requirements. |

| Required Documents for Export Invoice Verification | |

| Commercial Invoice | Primary document listing goods, quantity, price, and terms of sale for the exported items. |

| Packing List | Details packaging information, weights, and dimensions necessary for shipping and customs clearance. |

| Bill of Lading or Air Waybill | Transport document serving as proof of shipment and contract between shipper and carrier. |

| Export License | Official authorization required for shipping certain restricted goods internationally. |

| Certificate of Origin | Document certifying the country in which the goods were manufactured or produced. |

| Insurance Certificate | Proof of insurance coverage for the goods during transport, protecting your shipment against loss or damage. |

| Customs Declaration Forms | Paperwork submitted to customs authorities detailing the goods, value, and shipment details for clearance purposes. |

Key Documents Required for Export Invoice Verification

Key documents required for export invoice verification include the commercial invoice, packing list, and shipping bill. These documents authenticate the transaction details and ensure compliance with export regulations.

Customs authorities also require the bill of lading or airway bill as proof of shipment. Your export invoice must align accurately with these documents to avoid delays or penalties.

Step-by-Step Procedures for Invoice Verification

What documents are required for export invoice verification? The primary documents include the commercial invoice, packing list, export declaration, and shipping bill. These documents validate the export transaction and ensure compliance with customs regulations.

How do you begin the invoice verification process? Start by reviewing the commercial invoice for accurate details such as buyer and seller information, description of goods, quantity, and price. Verify these details against the purchase order and contract to confirm consistency.

What role does the packing list play in verification? The packing list provides detailed information about the contents, packaging, and weight of the shipment. Inspecting this document ensures that the goods match the invoice and conform to shipping requirements.

Why is the export declaration necessary for invoice verification? This document confirms that the shipment complies with export regulations and includes accurate export codes and descriptions. Checking the export declaration helps prevent legal issues during customs clearance.

How is the shipping bill used during the verification process? The shipping bill acts as a proof of export and records shipment details like port of departure, destination, and freight details. Cross-referencing this bill with the invoice guarantees the export transaction is correctly documented.

What is the final step in export invoice verification? After validating all documents for accuracy and completeness, approve the invoice for customs submission. Proper verification ensures smooth export clearance and timely payment processing.

Importance of Accurate Export Documentation

Accurate export documentation is crucial for the verification of export invoices to ensure compliance with international trade regulations. Proper documents prevent shipment delays, customs penalties, and financial losses.

Key documents required for export invoice verification include the commercial invoice, packing list, bill of lading, and export license. Customs authorities rely on these records to validate the transaction details, product descriptions, and shipment value. Ensuring accuracy in these documents facilitates smooth customs clearance and protects the exporter from legal disputes.

Common Challenges in Export Invoice Verification

Export invoice verification requires essential documents such as the commercial invoice, packing list, bill of lading, and export license to ensure compliance with customs regulations. Common challenges include discrepancies in product descriptions, incorrect HS codes, and mismatched quantities between documents, which can delay clearance and lead to penalties. You should carefully cross-check all paperwork to prevent errors and streamline the export verification process.

Regulatory Compliance in Export Invoicing

For export invoice verification, essential documents include the commercial invoice, packing list, and export declaration forms. Regulatory compliance requires verification of these documents to ensure adherence to international trade laws and customs regulations. Proper documentation facilitates smooth customs clearance and minimizes the risk of penalties or shipment delays.

Role of Technology in Invoice Verification

Export invoice verification requires accurate documentation to ensure compliance with international trade regulations and smooth customs clearance. Technology plays a crucial role in streamlining the validation process, improving accuracy, and reducing manual errors.

- Digital Document Management - Automates storage and retrieval of export invoices and related certificates for faster verification.

- Optical Character Recognition (OCR) - Enables quick extraction and validation of invoice data from scanned documents.

- Blockchain Technology - Provides transparent and tamper-proof records of invoices enhancing trust and security in verification.

Best Practices for Export Invoice Compliance

Export invoice verification requires accurate documentation to ensure compliance with international trade regulations and avoid shipment delays. Properly prepared documents validate the authenticity and accuracy of the exported goods, enabling smooth customs clearance.

- Commercial Invoice - This primary document details the transaction between the exporter and importer, including product descriptions, quantities, and values.

- Packing List - Provides specific information about how goods are packed, facilitating customs inspections and inventory checks.

- Shipping Bill or Export Declaration - Official government-issued document authorizing the export and confirming compliance with export regulations.

Errors to Avoid in Export Invoice Verification

Accurate export invoice verification requires submitting essential documents such as the commercial invoice, packing list, and bill of lading. Missing or incorrect documents often cause delays and compliance issues.

Common errors to avoid include mismatched quantities, incorrect HS codes, and inaccurate declared values on the invoice. Ensuring your documents are complete and error-free minimizes the risk of shipment holds and penalties.

What Documents are Required for Export Invoice Verification? Infographic