Small businesses need key documents for invoice auditing, including purchase orders, delivery receipts, and vendor invoices to verify transaction accuracy. Maintaining detailed payment records and contracts helps ensure compliance and detect discrepancies. Organizing these documents digitally streamlines the audit process and improves financial transparency.

What Documents Do Small Businesses Need for Invoice Auditing?

| Number | Name | Description |

|---|---|---|

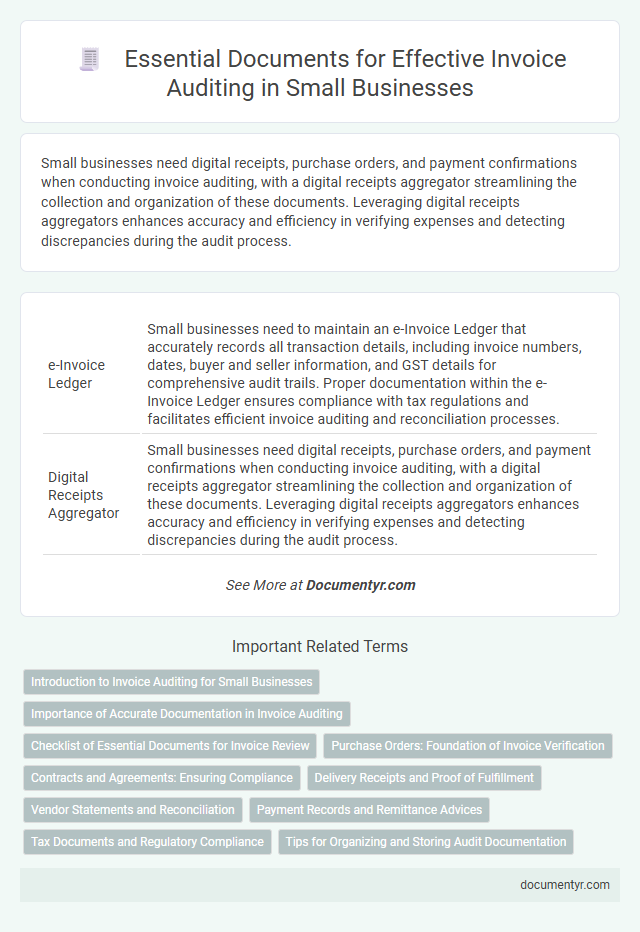

| 1 | e-Invoice Ledger | Small businesses need to maintain an e-Invoice Ledger that accurately records all transaction details, including invoice numbers, dates, buyer and seller information, and GST details for comprehensive audit trails. Proper documentation within the e-Invoice Ledger ensures compliance with tax regulations and facilitates efficient invoice auditing and reconciliation processes. |

| 2 | Digital Receipts Aggregator | Small businesses need digital receipts, purchase orders, and payment confirmations when conducting invoice auditing, with a digital receipts aggregator streamlining the collection and organization of these documents. Leveraging digital receipts aggregators enhances accuracy and efficiency in verifying expenses and detecting discrepancies during the audit process. |

| 3 | Audit Trail Log Files | Small businesses require detailed audit trail log files to ensure transparency and accuracy during invoice auditing, as these logs record every modification, approval, and transaction related to invoices. Maintaining comprehensive audit trails supports regulatory compliance and simplifies dispute resolution by providing verifiable evidence of invoice processing activities. |

| 4 | Supplier Onboarding Documents | Supplier onboarding documents essential for invoice auditing include signed contracts, purchase orders, tax identification forms, and proof of compliance certifications. Maintaining these records ensures accuracy in verifying invoice legitimacy, payment terms, and supplier credentials during audits. |

| 5 | Dynamic Discounting Agreements | Small businesses need to provide Dynamic Discounting Agreements, purchase orders, and payment terms documentation for thorough invoice auditing. These documents verify negotiated discount rates and payment schedules, ensuring accurate reconciliation and compliance with contract terms. |

| 6 | Invoice Matching Reports | Small businesses require Invoice Matching Reports to effectively verify that purchase orders, delivery receipts, and invoices align for accurate payment processing. These reports highlight discrepancies between ordered, received, and billed quantities, ensuring compliance and preventing fraud during invoice auditing. |

| 7 | Blockchain Validation Records | Small businesses require blockchain validation records for invoice auditing to ensure the authenticity and immutability of transaction data, enabling transparent verification of invoice legitimacy. These records provide tamper-proof evidence that supports accurate reconciliation and compliance with regulatory standards. |

| 8 | Automated Approval Workflows | Small businesses require purchase orders, vendor contracts, and delivery receipts for comprehensive invoice auditing to verify transaction accuracy. Implementing automated approval workflows accelerates validation by seamlessly routing invoices through predefined checkpoints, ensuring timely compliance and reducing human error. |

| 9 | Electronic Purchase Orders (EPOs) | Small businesses need Electronic Purchase Orders (EPOs) as essential documents for invoice auditing to verify purchase details and ensure accuracy in billing processes. EPOs digitally capture transaction specifics, streamline approval workflows, and provide a reliable audit trail for compliance and financial reporting. |

| 10 | Payment Reconciliation Statements | Payment reconciliation statements are essential documents for small businesses during invoice auditing, as they provide a detailed comparison between invoiced amounts and actual payments received, ensuring accuracy and detecting discrepancies. Maintaining accurate reconciliation statements helps verify transaction integrity, streamline the audit process, and support financial transparency. |

Introduction to Invoice Auditing for Small Businesses

What documents do small businesses need for effective invoice auditing? Invoice auditing helps ensure accuracy and prevent payment errors. Small businesses must gather key financial records to streamline this process.

Importance of Accurate Documentation in Invoice Auditing

Accurate documentation is crucial for effective invoice auditing as it ensures every transaction is verifiable and compliant with financial regulations. Small businesses must maintain organized records to streamline the audit process and prevent discrepancies.

- Invoices and Receipts - These documents provide proof of purchases and services rendered, essential for matching payments and verifying expenses.

- Purchase Orders - Purchase orders confirm the authorization and details of bought goods or services, supporting invoice validation.

- Payment Records - Payment confirmations and bank statements help verify that invoice amounts have been settled correctly and on time.

Checklist of Essential Documents for Invoice Review

Small businesses require several key documents for effective invoice auditing, including purchase orders, delivery receipts, and payment records. These documents help verify the accuracy and legitimacy of each invoice, ensuring that all billed items have been received and authorized. Maintaining a comprehensive checklist streamlines the review process and reduces the risk of errors or fraud.

Purchase Orders: Foundation of Invoice Verification

Purchase orders serve as the foundation of invoice verification for small businesses during auditing. These documents establish the initial agreement between buyer and supplier, ensuring accuracy and accountability in financial transactions.

- Proof of Authorized Purchase - Purchase orders confirm that the requested goods or services were approved internally before any financial commitment.

- Reference for Invoice Matching - They provide key data points such as quantities, prices, and descriptions to match against received invoices.

- Dispute Resolution - Purchase orders help resolve discrepancies by serving as official records of agreed terms between parties.

Accurate purchase orders streamline the invoice auditing process, promoting transparency and reducing errors in small business accounting.

Contracts and Agreements: Ensuring Compliance

Contracts and agreements form the foundation of invoice auditing for small businesses, ensuring that all transactions comply with the agreed terms. Accurate documentation helps verify pricing, payment schedules, and the scope of work delivered.

Maintaining up-to-date contracts allows you to detect discrepancies and prevent payment errors early in the audit process. Clear, well-organized agreements support transparency and streamline invoice verification, promoting financial accuracy and compliance.

Delivery Receipts and Proof of Fulfillment

| Document Type | Description | Importance in Invoice Auditing |

|---|---|---|

| Delivery Receipts | Documents that confirm the delivery of goods or services to the customer, including date, quantity, and condition upon delivery. | Verify that the services or products billed on the invoice were actually delivered, ensuring accuracy and preventing overbilling. |

| Proof of Fulfillment | Evidence such as signed work orders, completion certificates, or digital confirmations that show the contracted work or service was completed. | Validate the completion of obligations detailed in the invoice; critical for confirming that billing reflects actual work performed. |

Vendor Statements and Reconciliation

Invoice auditing requires careful examination of various documents to ensure accuracy and prevent discrepancies. Vendor statements and reconciliation records play a crucial role in verifying the validity of invoices.

- Vendor Statements - Detailed records from suppliers showing all transactions, balances, and payments, essential for cross-checking invoices received.

- Reconciliation Reports - Documents that compare your accounting records with vendor statements to identify mismatches or errors.

- Payment Records - Proof of payments made to vendors, helping confirm that invoiced amounts align with amounts paid.

Payment Records and Remittance Advices

Payment records are essential documents for invoice auditing, providing detailed information about amounts paid, payment dates, and transaction methods. Remittance advices serve as proof of payment and help reconcile invoices with payments received, ensuring accuracy and transparency. You should maintain organized copies of both documents to streamline the audit process and verify financial transactions effectively.

Tax Documents and Regulatory Compliance

Small businesses require accurate tax documents such as sales tax returns, VAT reports, and exemption certificates for thorough invoice auditing. These documents verify that all taxable transactions comply with prevailing tax regulations and prevent discrepancies during audits.

Regulatory compliance documents include business licenses, permits, and proof of adherence to industry standards. Maintaining these records ensures invoices reflect legal conformity and supports transparent financial reporting.

What Documents Do Small Businesses Need for Invoice Auditing? Infographic