Invoice factoring applications require essential documents such as copies of the invoices to be factored, proof of delivery or service completion, and an accounts receivable aging report. Business financial statements, including balance sheets and income statements, are also necessary to demonstrate the company's creditworthiness. Additionally, identity verification documents for business owners and customers may be requested to comply with regulatory standards.

What Documents are Necessary for Invoice Factoring Applications?

| Number | Name | Description |

|---|---|---|

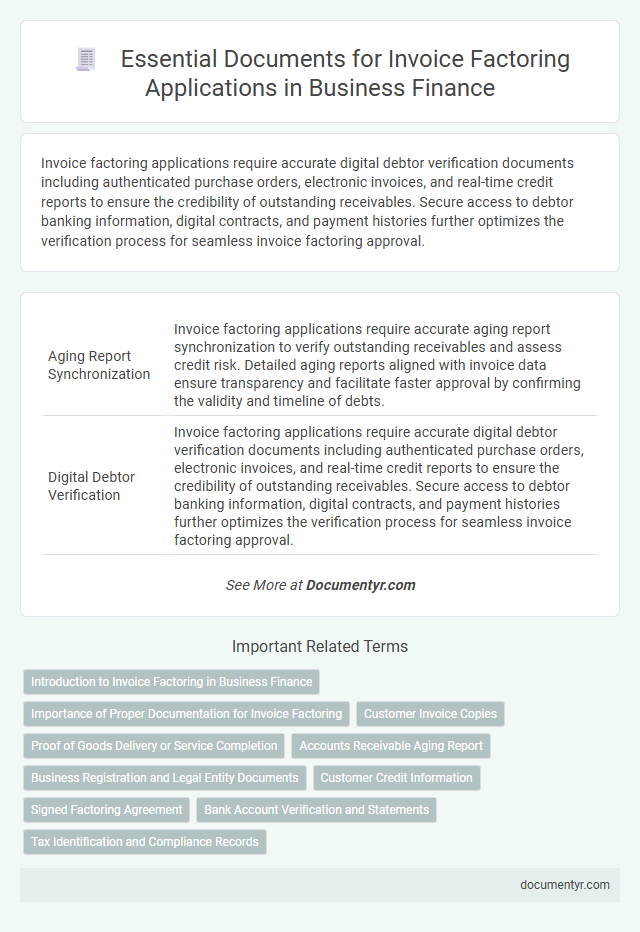

| 1 | Aging Report Synchronization | Invoice factoring applications require accurate aging report synchronization to verify outstanding receivables and assess credit risk. Detailed aging reports aligned with invoice data ensure transparency and facilitate faster approval by confirming the validity and timeline of debts. |

| 2 | Digital Debtor Verification | Invoice factoring applications require accurate digital debtor verification documents including authenticated purchase orders, electronic invoices, and real-time credit reports to ensure the credibility of outstanding receivables. Secure access to debtor banking information, digital contracts, and payment histories further optimizes the verification process for seamless invoice factoring approval. |

| 3 | E-invoice Compliance Certificates | E-invoice Compliance Certificates are crucial documents for invoice factoring applications, verifying that the submitted electronic invoices adhere to regulatory standards and ensuring authenticity and accuracy. These certificates streamline the approval process by providing legal proof of invoice validation, reducing the risk of fraud and enhancing confidence for factoring companies. |

| 4 | Purchase Order Blockchain Trace | To apply for invoice factoring leveraging purchase order blockchain trace, businesses must provide authenticated purchase orders with verifiable blockchain records ensuring transaction transparency and legitimacy. Supplementary documents include complete invoices, proof of delivery, and contract agreements, all linked via blockchain to enhance trust and expedite approval processes. |

| 5 | Dynamic Invoice Ledger Extract | A Dynamic Invoice Ledger Extract is essential for invoice factoring applications as it provides a real-time, detailed record of all outstanding invoices, payment statuses, and client details, facilitating accurate risk assessment and validation by the factoring company. This live data stream enhances transparency and ensures that the factoring provider can monitor invoice flow dynamically, improving the efficiency and reliability of the funding process. |

| 6 | UBO (Ultimate Beneficial Owner) Disclosure | Invoice factoring applications require UBO disclosure documents to verify the identity of individuals who ultimately own or control the business, ensuring compliance with anti-money laundering regulations. Providing accurate UBO details, such as ownership percentages and identification documents, is essential for a smooth approval process and risk assessment. |

| 7 | AML (Anti-Money Laundering) Screening Report | Invoice factoring applications require an AML (Anti-Money Laundering) Screening Report to verify the legitimacy of the invoice and involved parties, ensuring compliance with regulatory standards. This report includes identity verification, risk assessment, and transaction history to detect and prevent fraudulent activities during the factoring process. |

| 8 | Automated Trade Credit Insurance Policy | An automated trade credit insurance policy requires submission of key documents such as the original invoice, the buyer's credit rating report, and the trade credit insurance application form for invoice factoring applications. These documents ensure risk mitigation by verifying buyer creditworthiness and securing coverage against unpaid receivables. |

| 9 | API-Based Financial Statement Feed | Invoice factoring applications require essential documents such as sales invoices, purchase orders, and proof of delivery, with an API-based financial statement feed providing real-time access to verified financial data for faster approval. This automated integration streamlines the submission process, ensuring accurate liquidity assessment and reducing manual document handling. |

| 10 | Digital KYC (Know Your Customer) Packet | Digital KYC Packet for invoice factoring applications typically includes a government-issued ID, proof of business registration, bank statements, and utility bills to verify the identity and legitimacy of the business. These documents ensure compliance with anti-fraud regulations and enable faster, secure approval of factoring requests. |

Introduction to Invoice Factoring in Business Finance

Invoice factoring is a financial solution that allows businesses to convert outstanding invoices into immediate cash. This method improves cash flow by selling unpaid invoices to a factoring company.

Several documents are essential for invoice factoring applications, including copies of outstanding invoices, accounts receivable aging reports, and proof of business identity such as tax identification or business registration certificates. Financial statements like balance sheets and income statements also support the application process. Providing accurate and complete documentation helps streamline approval and funding timelines.

Importance of Proper Documentation for Invoice Factoring

Proper documentation is crucial for smooth approval in invoice factoring applications. It ensures accuracy, builds trust, and accelerates the funding process.

- Invoice Copies - Clear and detailed invoices validate the amount owed and payment terms.

- Proof of Delivery - Documents confirming goods or services were delivered support invoice legitimacy.

- Customer Credit Information - Reliable credit data helps assess the risk associated with invoice factoring.

Customer Invoice Copies

Customer invoice copies are essential documents for invoice factoring applications as they provide proof of the outstanding receivables. These copies must clearly detail the goods or services sold, payment terms, and the customer's information. You should ensure the invoices are accurate and complete to facilitate a smooth factoring approval process.

Proof of Goods Delivery or Service Completion

| Document Type | Description | Importance for Invoice Factoring |

|---|---|---|

| Proof of Goods Delivery | Documents such as delivery receipts, signed bills of lading, or shipping confirmations that verify the buyer has received the goods. | Essential for confirming that the invoiced products have been physically delivered and accepted, reducing risk for the factoring company. |

| Proof of Service Completion | Work completion certificates, service reports, or customer approval forms that demonstrate the contracted services were rendered as agreed. | Validates service fulfillment, ensuring the invoice is based on completed work which supports the legitimacy of the factoring application. |

| Customer Signatures or Acknowledgments | Signed documents or digital confirmation from the client verifying receipt of goods or completion of services. | Provides legal evidence of transaction authenticity, crucial for invoice factoring verification processes. |

| Supporting Photographic Evidence | Images or videos showing goods delivered on-site or services completed. | Enhances proof of delivery or service fulfillment, offering visual confirmation for the factoring company. |

Accounts Receivable Aging Report

Invoice factoring applications require specific documents to assess the creditworthiness and validity of your accounts receivable. One of the most critical documents is the Accounts Receivable Aging Report, which provides detailed information on outstanding invoices.

- Accounts Receivable Aging Report - This report categorizes unpaid invoices by the length of time they have been outstanding, offering a clear view of payment delays.

- Invoice Copies - Copies of the original invoices help verify the transaction details between you and your customers.

- Customer Credit Information - Financial data on your customers allows the factoring company to evaluate risk and the likelihood of payment.

Business Registration and Legal Entity Documents

Business registration documents are essential for invoice factoring applications as they verify the legal existence of the company. Legal entity documents, such as articles of incorporation or partnership agreements, confirm the business structure and ownership details. These documents ensure the factoring company can assess the legitimacy and creditworthiness of the applicant.

Customer Credit Information

Customer credit information is essential for invoice factoring applications to assess risk and verify the reliability of your clients. This data ensures that the factoring company can make informed decisions about advancing funds against outstanding invoices.

- Credit Reports - Detailed credit reports from recognized agencies highlight the financial stability and payment history of the customers.

- Trade References - Trade references provide insights into the payment behavior and creditworthiness based on past business transactions.

- Financial Statements - Recent financial statements of the customer help evaluate their current profitability and liquidity.

Providing accurate customer credit information accelerates the approval process for invoice factoring applications.

Signed Factoring Agreement

Invoice factoring applications require several essential documents to initiate the process. A signed factoring agreement is the most critical document, as it legally binds both parties to the terms and conditions of the transaction.

This agreement outlines the responsibilities, fees, and payment schedules involved in factoring. Without a signed factoring agreement, the application cannot proceed, making it indispensable for securing financing through invoice factoring.

Bank Account Verification and Statements

Invoice factoring applications require thorough documentation to verify the legitimacy of the business and its financial health. Bank account verification is a critical component in this process, providing proof of active and operational accounts linked to the business.

Applicants must submit recent bank statements to demonstrate consistent cash flow and transaction history. These statements help factoring companies assess risk and validate the authenticity of invoices being sold.

What Documents are Necessary for Invoice Factoring Applications? Infographic