Small businesses must issue tax-compliant invoices containing essential documents such as the seller's name, address, and tax identification number, along with the buyer's details. The invoice should clearly list the description, quantity, and price of goods or services provided, including applicable tax rates and total amounts. Accurate dates and unique invoice numbers are necessary to ensure proper record-keeping and compliance with tax regulations.

What Documents Does a Small Business Need to Issue a Tax-Compliant Invoice?

| Number | Name | Description |

|---|---|---|

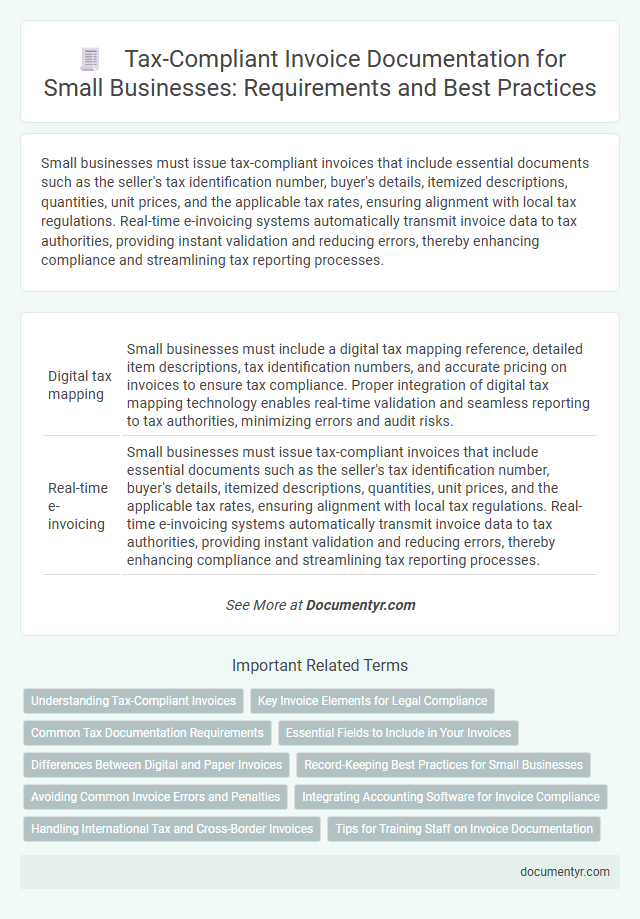

| 1 | Digital tax mapping | Small businesses must include a digital tax mapping reference, detailed item descriptions, tax identification numbers, and accurate pricing on invoices to ensure tax compliance. Proper integration of digital tax mapping technology enables real-time validation and seamless reporting to tax authorities, minimizing errors and audit risks. |

| 2 | Real-time e-invoicing | Small businesses must issue tax-compliant invoices that include essential documents such as the seller's tax identification number, buyer's details, itemized descriptions, quantities, unit prices, and the applicable tax rates, ensuring alignment with local tax regulations. Real-time e-invoicing systems automatically transmit invoice data to tax authorities, providing instant validation and reducing errors, thereby enhancing compliance and streamlining tax reporting processes. |

| 3 | QR code validation | Small businesses must include key documents such as a valid tax identification number and a QR code on invoices to ensure tax compliance and facilitate verification by tax authorities. The QR code encodes essential invoice details, enabling quick validation and reducing the risk of fraud during audits. |

| 4 | Dynamic invoice numbering | Small businesses must implement dynamic invoice numbering to ensure each tax-compliant invoice features a unique, sequential identifier that prevents duplication and facilitates accurate record-keeping for audit purposes. This system aids compliance with tax authorities by providing traceability and easy verification of issued invoices. |

| 5 | Embedded e-signature requirements | Small businesses must include an embedded e-signature on invoices to ensure authenticity and compliance with tax regulations set by authorities such as the IRS or VAT systems. This embedded e-signature must be secure, verifiable, and linked to the invoice data to prevent tampering and provide legal validity for audits and record-keeping. |

| 6 | Automated tax jurisdiction detection | Small businesses need to include accurate tax identification information, itemized purchase details, and the correct tax rates on invoices to ensure compliance with tax regulations; automated tax jurisdiction detection software helps by identifying the applicable tax rates based on the customer's location. This technology reduces errors, streamlines invoice processing, and ensures adherence to local and state tax laws essential for audit readiness. |

| 7 | Cloud-based invoice archive | A small business needs to maintain a cloud-based invoice archive that securely stores all issued invoices in a compliant, easily accessible digital format to meet tax regulations. This archive should include detailed invoice data such as client information, transaction dates, itemized services or products, tax rates applied, and payment status to ensure accuracy and audit readiness. |

| 8 | API-driven invoice generation | Small businesses must include essential documents such as the purchase order, sales receipt, and signed contracts when generating tax-compliant invoices through API-driven systems, ensuring accurate data integration and legal adherence. Leveraging API-driven invoice generation automates compliance by embedding tax identification numbers, itemized service descriptions, and VAT details directly into the invoice template for streamlined financial reporting and auditing. |

| 9 | Multi-currency tax adaptation | Small businesses issuing tax-compliant invoices in multi-currency settings must include essential documents such as the invoice itself, clearly stating the currency, exchange rate applied, and corresponding tax amounts in both the original and local currencies. Accurate documentation ensures compliance with tax regulations across different jurisdictions while facilitating transparent financial reporting and audit trails. |

| 10 | Blockchain-stamped proof of issuance | A small business needs a tax-compliant invoice that includes a blockchain-stamped proof of issuance, ensuring tamper-proof verification and enhanced authenticity. This document must contain essential elements such as the business identification, date of issuance, itemized transaction details, and the unique blockchain timestamp for regulatory compliance. |

Understanding Tax-Compliant Invoices

Understanding tax-compliant invoices is essential for small businesses to meet legal requirements and ensure accurate tax reporting. Proper documentation supports business credibility and smooth financial operations.

- Invoice Number - A unique identifier for each invoice ensures tracking and prevents duplication.

- Seller and Buyer Details - Include full names, addresses, and tax identification numbers for both parties.

- Detailed Description of Goods or Services - Clearly state the items sold or services provided with corresponding quantities and prices.

You must include the invoice date and applicable tax amounts to maintain compliance with tax authorities.

Key Invoice Elements for Legal Compliance

Issuing a tax-compliant invoice requires specific documents and key elements to meet legal standards. These elements ensure your business maintains clear records and adheres to tax regulations.

- Business Identification - The invoice must include your business name, address, and tax identification number for clear entity recognition.

- Invoice Details - A unique invoice number and issue date are essential for tracking and reference purposes.

- Transaction Information - Descriptions of goods or services, quantities, unit prices, and total amounts are required for transparency and accuracy.

Common Tax Documentation Requirements

Small businesses must include key documents to issue a tax-compliant invoice, such as the business registration certificate, tax identification number (TIN), and official company letterhead. These documents ensure the invoice meets legal standards and can be verified by tax authorities. Proper documentation supports accurate tax reporting and helps avoid penalties for non-compliance.

Essential Fields to Include in Your Invoices

| Essential Field | Description |

|---|---|

| Invoice Number | A unique identifier for each invoice to ensure accurate tracking and record-keeping. |

| Invoice Date | The date when the invoice is issued, important for payment terms and tax purposes. |

| Seller's Information | Include the business name, address, contact details, and tax identification number. |

| Buyer's Information | The name, address, and contact details of the customer receiving the invoice. |

| Description of Goods or Services | Clear details of products sold or services delivered, including quantity and unit price. |

| Total Amount | The full amount due before and after applying taxes, discounts, or other adjustments. |

| Tax Details | Applicable tax rates, tax amount, and any tax registration numbers as required by law. |

| Payment Terms | Defines the time frame in which payment should be made and acceptable payment methods. |

Differences Between Digital and Paper Invoices

Small businesses must include essential information such as seller and buyer details, invoice number, date, item descriptions, quantities, prices, and applicable taxes to ensure tax compliance. Both digital and paper invoices require these basic elements to meet legal standards and facilitate accurate record-keeping.

Digital invoices often incorporate features like electronic signatures, automatic tax calculations, and immediate delivery via email, enhancing efficiency and reducing errors. Paper invoices, while traditional, require manual entries and physical delivery, increasing the risk of delays and inaccuracies in tax reporting.

Record-Keeping Best Practices for Small Businesses

Small businesses must include essential documents such as a detailed invoice template, purchase order references, and proof of delivery to issue a tax-compliant invoice. Accurate record-keeping ensures all financial transactions are traceable and compliant with tax regulations.

Maintaining organized records involves keeping copies of issued invoices, receipts, and payment confirmations for a specified period, usually five to seven years. Digital storage solutions can enhance accessibility and security of these documents. You should regularly audit your records to ensure completeness and accuracy, which supports smooth tax filing and audit processes.

Avoiding Common Invoice Errors and Penalties

Small businesses must include key documents such as a detailed invoice, proof of transaction, and tax registration certificates to issue a tax-compliant invoice. Avoid common invoice errors like missing tax identification numbers, incorrect dates, or ambiguous descriptions to prevent penalties. Ensuring accuracy and completeness in Your invoices helps maintain compliance and reduces the risk of costly fines.

Integrating Accounting Software for Invoice Compliance

What documents does a small business need to issue a tax-compliant invoice? Small businesses must include essential documents such as a detailed invoice template, proof of business registration, and tax identification numbers. Integrating accounting software ensures accurate data capture and automated compliance with tax regulations.

How does integrating accounting software enhance invoice compliance? Accounting software streamlines the creation, storage, and validation of invoices by embedding mandatory fields like tax codes and digital signatures. This integration reduces human error and facilitates easy audit trails for tax authorities.

Which key invoice elements are managed by accounting software for tax compliance? Accounting software manages critical elements including invoice number, date of issue, client details, taxable amounts, and applicable tax rates. Proper management of these elements supports the legal requirements for tax reporting and filing.

Handling International Tax and Cross-Border Invoices

Small businesses issuing tax-compliant invoices must include essential details such as the seller's and buyer's information, invoice date, unique invoice number, description of goods or services, and applicable tax rates. Handling international tax and cross-border invoices requires additional compliance with VAT or GST regulations specific to each country involved.

Invoices for cross-border transactions often need to specify the tax identification numbers of both parties and indicate tax exemptions or reverse charge mechanisms if applicable. You must also adhere to currency conversion rules and documentation standards to ensure your invoice meets legal requirements and supports accurate tax reporting.

What Documents Does a Small Business Need to Issue a Tax-Compliant Invoice? Infographic