Suppliers need a purchase order, a commercial invoice, and a packing slip to process drop shipping invoices accurately. The purchase order confirms the customer's order details, while the commercial invoice provides necessary transaction information for customs and payment. A packing slip ensures the correct items are shipped directly to the customer, facilitating smooth delivery and record-keeping.

What Documents Does a Supplier Need for Drop Shipping Invoices?

| Number | Name | Description |

|---|---|---|

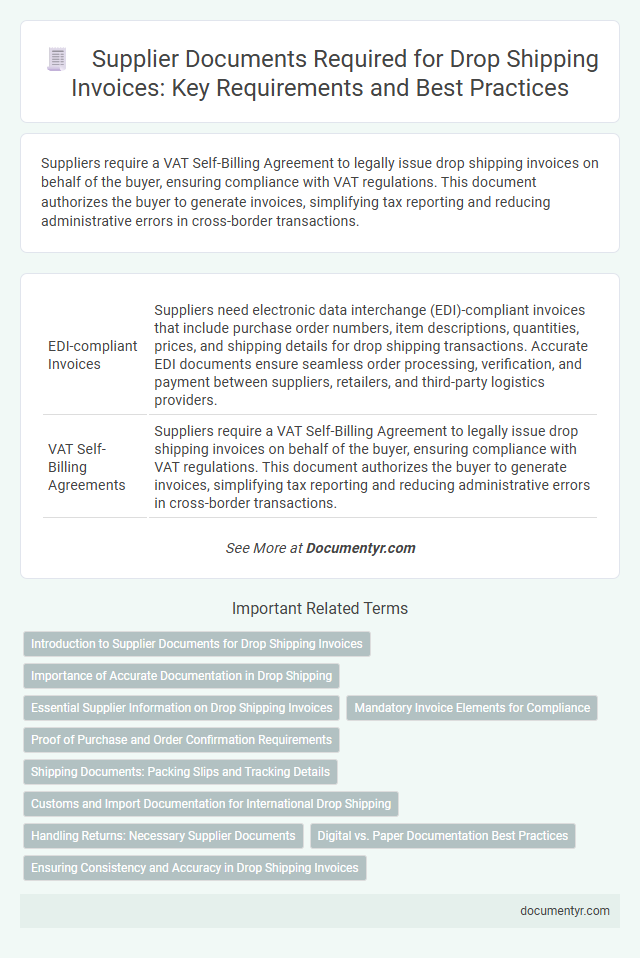

| 1 | EDI-compliant Invoices | Suppliers need electronic data interchange (EDI)-compliant invoices that include purchase order numbers, item descriptions, quantities, prices, and shipping details for drop shipping transactions. Accurate EDI documents ensure seamless order processing, verification, and payment between suppliers, retailers, and third-party logistics providers. |

| 2 | VAT Self-Billing Agreements | Suppliers require a VAT Self-Billing Agreement to legally issue drop shipping invoices on behalf of the buyer, ensuring compliance with VAT regulations. This document authorizes the buyer to generate invoices, simplifying tax reporting and reducing administrative errors in cross-border transactions. |

| 3 | Digital Packing Slips | Suppliers need digital packing slips as essential documents for drop shipping invoices to verify shipment details and ensure accurate order fulfillment. These digital packing slips provide itemized product information, shipment dates, and recipient data critical for seamless invoicing and supply chain transparency. |

| 4 | Supplier Declaration of Conformity | The Supplier Declaration of Conformity is essential for drop shipping invoices as it certifies that the products meet regulatory standards and comply with safety requirements. This document ensures transparency and legal compliance, facilitating smoother customs clearance and reducing the risk of shipment delays. |

| 5 | Proof of Fulfillment Statement | A Proof of Fulfillment Statement is essential for drop shipping invoices as it verifies that the supplier has completed the order shipment according to the purchase agreement. This document typically includes order details, shipment date, tracking information, and confirmation that the goods were delivered to the end customer, ensuring transparency and compliance in the transaction. |

| 6 | Automated Tax Calculation Sheets | Suppliers require automated tax calculation sheets to ensure accuracy in drop shipping invoices, capturing detailed tax rates and jurisdiction-specific information for seamless compliance. These sheets integrate with invoicing software to automatically calculate taxes based on product origin, destination, and applicable laws, minimizing errors and streamlining the billing process. |

| 7 | Chain of Custody Documentation | Suppliers need detailed chain of custody documentation for drop shipping invoices to verify product origin, handling, and transfer between parties, ensuring transparency and regulatory compliance. This includes bills of lading, delivery receipts, and transfer of custody records to maintain traceability throughout the supply chain. |

| 8 | ASN (Advance Shipping Notice) Tags | Suppliers need to include ASN (Advance Shipping Notice) tags on drop shipping invoices to ensure accurate tracking and timely communication of shipment details. ASN tags provide essential data such as item quantities, descriptions, and expected delivery dates, facilitating seamless inventory management and order processing. |

| 9 | Platform-Specific SKU Mapping | Suppliers require accurate platform-specific SKU mapping documents to ensure seamless integration and tracking of drop shipping invoices. These SKU mappings enable precise identification of products across various e-commerce platforms, reducing errors and facilitating efficient order fulfillment. |

| 10 | Eco-Certification Disclosures | Suppliers engaged in drop shipping must include eco-certification disclosures on invoices to verify product sustainability and compliance with environmental standards, enhancing transparency for buyers concerned with ecological impact. These documents may include certifications like FSC, Energy Star, or Organic labels, which support claims of eco-friendly sourcing and manufacturing practices. |

Introduction to Supplier Documents for Drop Shipping Invoices

Accurate documentation is essential for suppliers managing drop shipping invoices to ensure smooth transactions and compliance. Understanding the key documents helps streamline invoicing processes and facilitates transparency between parties.

- Purchase Order - The official buyer request specifying products, quantities, and agreed prices required to initiate the drop shipping order.

- Shipping Label - A clear, detailed label that ensures correct delivery directly from the supplier to the customer without intermediaries.

- Invoice - A detailed billing statement generated by the supplier outlining the products shipped, costs, and payment terms for record-keeping and payment processing.

Importance of Accurate Documentation in Drop Shipping

What documents does a supplier need for drop shipping invoices? Accurate documentation ensures seamless transactions and reduces disputes between suppliers and buyers. Proper invoices include detailed product descriptions, purchase orders, and shipping confirmations to validate each shipment.

Essential Supplier Information on Drop Shipping Invoices

Suppliers require specific documents for drop shipping invoices to ensure smooth transaction processing and accurate record-keeping. Essential supplier information includes the supplier's legal business name, tax identification number, and contact details.

The drop shipping invoice must also contain detailed product descriptions, quantity, and pricing to comply with accounting and regulatory standards. Accurate supplier documentation helps prevent payment delays and facilitates transparent communication between all parties involved.

Mandatory Invoice Elements for Compliance

| Mandatory Invoice Elements | Description | Importance for Compliance |

|---|---|---|

| Supplier Information | Legal business name, address, and contact details of the supplier | Ensures traceability and verification of the supplier's identity |

| Customer Information | Full name, shipping address, and billing details of the customer | Confirms the recipient and supports accurate delivery and billing |

| Invoice Number | Unique and sequential identifier for the invoice | Mandatory for record-keeping and audit trails |

| Invoice Date | Date when the invoice is issued | Defines the transaction timeline and payment terms |

| Detailed Description of Goods | Clear list of items shipped, including quantity, unit price, and SKU | Essential for goods verification and inventory control |

| Total Amount Due | Complete payable amount including taxes, shipping, and fees | Critical for financial accuracy and tax compliance |

| Tax Identification Numbers | Supplier's and customer's VAT or tax registration numbers where applicable | Required for tax reporting and compliance with local regulations |

| Payment Terms | Details on payment methods, due dates, and conditions | Defines obligations and timelines to avoid disputes |

Proof of Purchase and Order Confirmation Requirements

Suppliers require specific documents to validate drop shipping invoices accurately. Proof of purchase and order confirmation are essential to ensure transparency and traceability in the transaction process.

- Proof of Purchase - This document verifies the supplier's acquisition of goods from the manufacturer or distributor, confirming the legitimacy of the transaction.

- Order Confirmation - A formal acknowledgment from the supplier detailing the buyer's order, including quantities, descriptions, and shipping instructions.

- Compliance Requirement - Both documents ensure compliance with accounting standards and facilitate dispute resolution in case of discrepancies.

Shipping Documents: Packing Slips and Tracking Details

Shipping documents are essential for drop shipping invoices, particularly packing slips and tracking details. Packing slips provide a detailed list of the items included in the shipment, ensuring accuracy and transparency for both the supplier and the customer.

Tracking details allow you to monitor the shipment's progress and confirm delivery status. These documents help maintain clear communication and streamline the invoicing process between all parties involved.

Customs and Import Documentation for International Drop Shipping

Customs and import documentation are critical when preparing drop shipping invoices for international shipments. Proper documentation ensures smooth customs clearance and compliance with import regulations.

- Commercial Invoice - Contains detailed information about the goods, value, and parties involved to facilitate customs assessment and duty calculation.

- Packing List - Describes the contents, weight, and dimensions of each package to assist customs officials in verifying shipments.

- Import Licenses and Permits - Required for regulated products to comply with destination country laws and avoid shipment delays.

Your drop shipping invoice must include all relevant customs documents to avoid clearance issues and ensure timely delivery.

Handling Returns: Necessary Supplier Documents

Handling returns in drop shipping requires specific supplier documents to ensure a smooth process. These documents include the original invoice, return authorization forms, and proof of shipment for the returned items.

Suppliers must provide detailed return policies clearly outlining conditions and timeframes. A return merchandise authorization (RMA) document is essential to track and approve returns. You should keep copies of all correspondence and shipping receipts to resolve disputes efficiently.

Digital vs. Paper Documentation Best Practices

Suppliers require accurate invoicing documents to ensure smooth drop shipping transactions, including purchase orders, packing slips, and sales invoices. Digital documentation offers advantages such as faster processing, easier storage, and enhanced accuracy through automated data entry. Paper documentation, while still in use, is less efficient and can lead to delays and errors, making digital files the best practice for modern drop shipping invoicing.

What Documents Does a Supplier Need for Drop Shipping Invoices? Infographic