Invoice documents required for business tax filing typically include sales invoices, purchase invoices, and expense receipts, which provide proof of income and deductible expenses. These documents must accurately detail transaction dates, amounts, client or vendor information, and tax identification numbers to ensure compliance with tax regulations. Maintaining organized and complete invoice records simplifies tax reporting and supports audits by tax authorities.

What Invoice Documents are Required for Business Tax Filing?

| Number | Name | Description |

|---|---|---|

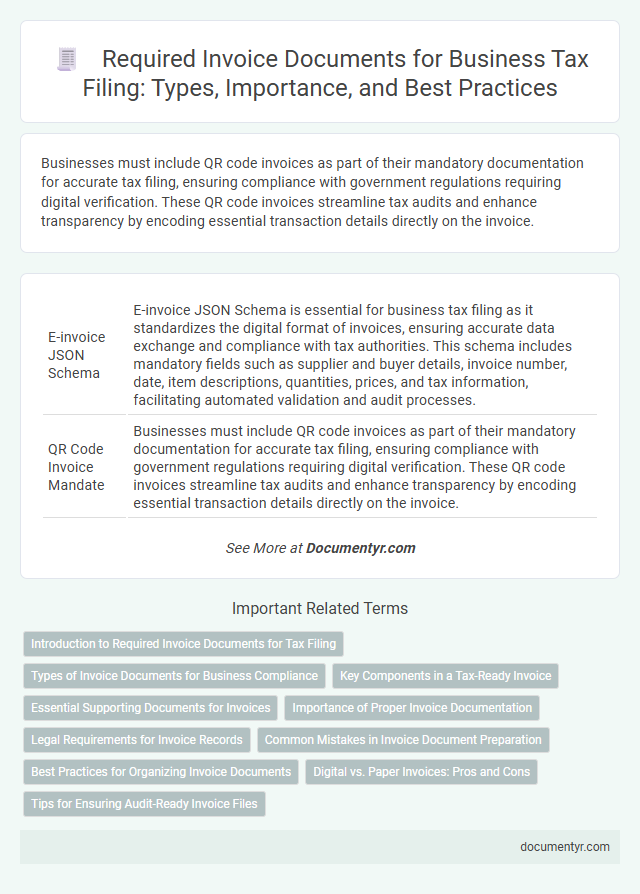

| 1 | E-invoice JSON Schema | E-invoice JSON Schema is essential for business tax filing as it standardizes the digital format of invoices, ensuring accurate data exchange and compliance with tax authorities. This schema includes mandatory fields such as supplier and buyer details, invoice number, date, item descriptions, quantities, prices, and tax information, facilitating automated validation and audit processes. |

| 2 | QR Code Invoice Mandate | Businesses must include QR code invoices as part of their mandatory documentation for accurate tax filing, ensuring compliance with government regulations requiring digital verification. These QR code invoices streamline tax audits and enhance transparency by encoding essential transaction details directly on the invoice. |

| 3 | GST-compliant Invoice | GST-compliant invoices must include the supplier's name, GSTIN, invoice number, date, recipient's details, description of goods or services, taxable value, GST rate, and amount of tax charged to ensure accurate business tax filing. Retaining these invoices is crucial for claiming input tax credit and maintaining compliance with tax authorities under the Goods and Services Tax framework. |

| 4 | Proforma Invoice Reconciliation | Proforma invoice reconciliation is crucial for accurate business tax filing as it verifies preliminary sales and purchase details against actual transactions, ensuring consistency in reported revenue and expenses. Maintaining detailed records of proforma invoices alongside final invoices and payment receipts supports compliance with tax regulations and simplifies audit processes. |

| 5 | Reverse Charge Mechanism Invoice | Businesses utilizing the Reverse Charge Mechanism must maintain specific invoice documents including the supplier's tax identification details, description of goods or services, and the notation specifying the reverse charge application. Accurate records of these invoices are essential for tax filing to ensure compliance with tax authorities and proper claim of Input Tax Credit under applicable laws. |

| 6 | Self-billed Invoice Statement | Self-billed invoice statements are crucial for business tax filing as they provide detailed documentation of transactions where the buyer generates the invoice on behalf of the seller. These statements must include accurate information such as supplier details, invoice dates, transaction amounts, and tax breakdowns to ensure compliance with tax authorities and facilitate accurate VAT reporting. |

| 7 | Continuous Transaction Controls (CTC) Invoice | Continuous Transaction Controls (CTC) invoices are critical documents required for business tax filing, ensuring real-time validation and compliance with tax authorities. These invoices must include detailed transaction data, unique control codes, and timestamps to facilitate accurate tax reporting and reduce errors in business tax submissions. |

| 8 | Digital Signature Invoice Authentication | Digital signature invoice authentication is essential for business tax filing as it ensures the integrity and authenticity of electronic invoices, complying with tax authority regulations. Properly signed digital invoices must include verifiable digital certificates, timestamps, and secure encryption to be accepted for tax deduction and audit purposes. |

| 9 | Real-time Invoice Reporting | Real-time invoice reporting requires businesses to submit digital invoice documents such as sales invoices, purchase invoices, and credit notes promptly to tax authorities, ensuring accurate and timely tax filing. These electronic records facilitate seamless validation, compliance with VAT regulations, and efficient audit trails for business tax reporting. |

| 10 | AP Automation Invoice Trail | AP automation invoice trails provide a detailed and organized record of all invoices, including purchase orders, delivery receipts, and payment confirmations, ensuring compliance with tax regulations during business tax filing. Maintaining accurate and comprehensive invoice documentation through AP automation enhances audit readiness and streamlines the submission of required financial records. |

Introduction to Required Invoice Documents for Tax Filing

Invoices play a crucial role in business tax filing by providing detailed records of sales and purchases. Required invoice documents include original sales invoices, credit notes, and debit notes that accurately reflect business transactions. Ensuring your invoices meet tax authority standards helps maintain compliance and supports accurate financial reporting.

Types of Invoice Documents for Business Compliance

Invoice documents play a critical role in business tax filing, serving as proof of transactions and financial activity. Accurate and organized invoices ensure compliance with tax regulations and help in claiming proper deductions.

Common types of invoice documents required for business tax filing include sales invoices, purchase invoices, and credit notes. Sales invoices record revenue earned from customers, while purchase invoices document expenses incurred from suppliers. Credit notes adjust previous invoices for returns or discounts, ensuring precise financial reporting for compliance.

Key Components in a Tax-Ready Invoice

What invoice documents are required for business tax filing? A tax-ready invoice must include specific key components to ensure compliance with tax regulations. These components provide clear evidence of the transaction and facilitate accurate tax reporting.

Which key elements should a tax-ready invoice contain? Essential components include the seller's name, address, and tax identification number, along with the buyer's details. It must also list the invoice number, date of issue, itemized description of goods or services, quantities, unit prices, and total amount due.

Why is it important to include the tax rates and amounts on an invoice? Clearly stating applicable tax rates and the corresponding tax amounts helps businesses calculate accurate tax liabilities. This transparency is crucial for both VAT/GST compliance and income tax filing requirements.

How can payment terms and conditions impact tax filing? Payment terms such as due date and method are important for tracking revenue recognition and matching expenses with income accurately. Proper documentation of payment status assists in avoiding discrepancies in tax audits and financial records.

What role does an authorized signature or company seal play on tax invoices? A signature or seal authenticates the invoice, confirming its validity as a legal document for tax authorities. This verification strengthens the credibility of the invoice during tax assessments and audits.

Essential Supporting Documents for Invoices

Essential supporting documents for invoices include purchase orders, payment receipts, and delivery or service confirmation documents. These records validate the transactions and ensure accurate reporting during business tax filing. Your organized collection of these documents simplifies the verification and auditing process with tax authorities.

Importance of Proper Invoice Documentation

Proper invoice documentation is crucial for accurate business tax filing. It ensures compliance with tax regulations and facilitates smooth audit processes.

Invoices provide detailed records of transactions, including dates, amounts, and tax information. Maintaining well-organized invoice documents helps avoid penalties and supports financial transparency.

Legal Requirements for Invoice Records

Invoice documents play a crucial role in business tax filing, serving as proof of transactions and financial records. Maintaining legally compliant invoice records ensures accurate reporting and adherence to tax regulations.

- Invoice Accuracy - Invoices must include essential details like the seller's and buyer's information, invoice date, unique invoice number, and a clear description of goods or services.

- Retention Period - Laws typically require keeping invoice records for a minimum of 5 to 7 years to comply with tax audits and legal obligations.

- Electronic Record Keeping - Digital invoices and electronic storage systems must meet legal standards for authenticity, integrity, and accessibility during tax filing audits.

Common Mistakes in Invoice Document Preparation

Accurate invoice documents are essential for smooth business tax filing and compliance. Common mistakes in invoice preparation can lead to audits, penalties, and delayed tax processing.

- Missing or Incomplete Information - Invoices lacking key details like tax identification numbers or dates often cause rejection during tax filing.

- Incorrect Tax Calculations - Errors in applying tax rates or totaling amounts can result in inaccurate tax submissions and financial discrepancies.

- Unclear or Illegible Invoices - Poorly formatted or hard-to-read invoices can hinder verification and delay tax approval by authorities.

Ensuring thorough and precise invoice documentation minimizes risks associated with business tax filing errors.

Best Practices for Organizing Invoice Documents

Accurate organization of invoice documents is crucial for smooth business tax filing and compliance. Proper management reduces errors and ensures all necessary information is readily accessible during audits.

- Maintain digital and physical copies - Keeping both digital backups and physical originals ensures invoices are preserved against data loss or damage.

- Categorize invoices by date and client - Organizing invoices chronologically and by customer simplifies retrieval and verification processes.

- Use consistent labeling conventions - Uniform file naming and indexing improve efficiency in locating specific invoice documents for tax reporting.

Digital vs. Paper Invoices: Pros and Cons

Invoice documents play a crucial role in business tax filing, serving as proof of transactions and supporting expense claims. Businesses must maintain accurate records, whether digital or paper, to meet tax authority requirements.

Digital invoices offer advantages such as easy storage, quick retrieval, and reduced physical space needs. Paper invoices provide a tangible backup but require more effort for organization and are prone to damage or loss.

What Invoice Documents are Required for Business Tax Filing? Infographic