An international invoice must include key documents such as the commercial invoice, packing list, and certificate of origin to ensure smooth customs clearance. Shipping documents like the bill of lading or air waybill are essential to verify the transportation details. Import permits, insurance certificates, and any relevant customs declarations may also be required depending on the destination country's regulations.

What Documents are Required to Attach with an International Invoice?

| Number | Name | Description |

|---|---|---|

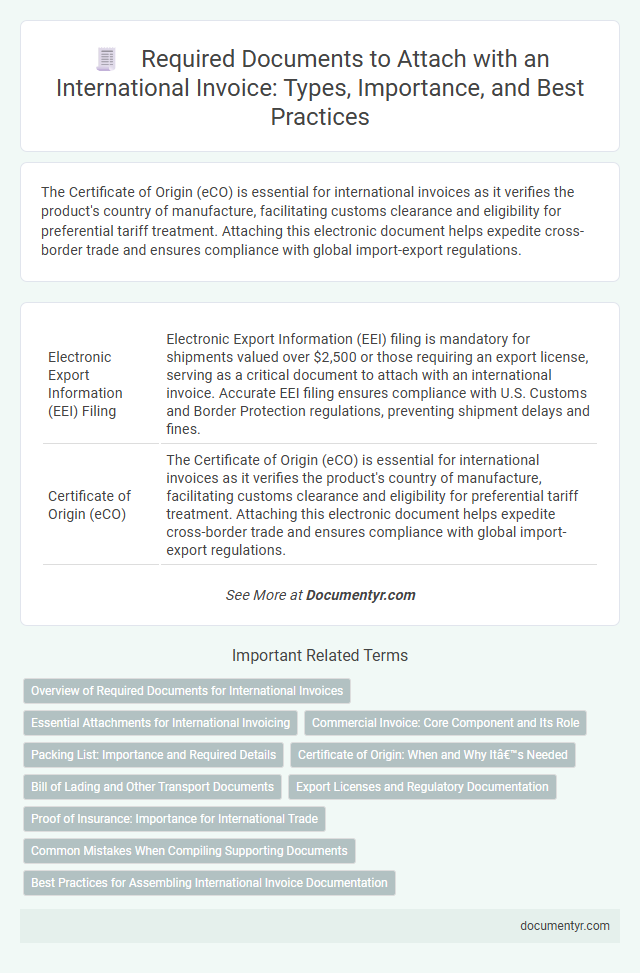

| 1 | Electronic Export Information (EEI) Filing | Electronic Export Information (EEI) filing is mandatory for shipments valued over $2,500 or those requiring an export license, serving as a critical document to attach with an international invoice. Accurate EEI filing ensures compliance with U.S. Customs and Border Protection regulations, preventing shipment delays and fines. |

| 2 | Certificate of Origin (eCO) | The Certificate of Origin (eCO) is essential for international invoices as it verifies the product's country of manufacture, facilitating customs clearance and eligibility for preferential tariff treatment. Attaching this electronic document helps expedite cross-border trade and ensures compliance with global import-export regulations. |

| 3 | Proforma Invoice | A Proforma Invoice must be attached with an international invoice to provide a detailed preliminary bill outlining the goods, prices, and terms agreed upon by the buyer and seller. Essential supporting documents include the commercial invoice, packing list, bill of lading or airway bill, certificate of origin, and any required export licenses or customs declarations to ensure smooth customs clearance and transaction verification. |

| 4 | Authorized Economic Operator (AEO) Certificate | Attaching an Authorized Economic Operator (AEO) Certificate with an international invoice verifies compliance with global trade security standards, expediting customs clearance and reducing inspections. This document ensures preferential treatment under customs procedures, enhancing credibility and trust in cross-border transactions. |

| 5 | Digital Bill of Lading (eBL) | An international invoice must be accompanied by a Digital Bill of Lading (eBL), which serves as an electronic document of title and proof of shipment essential for customs clearance and cargo tracking. The eBL enhances transaction efficiency by enabling secure, real-time access to shipment details and reducing paperwork compared to traditional paper bills of lading. |

| 6 | Commercial Invoice with HS Code | A commercial invoice with the Harmonized System (HS) code is essential for an international invoice, serving as the primary document detailing product descriptions, quantities, and values for customs clearance. Additional required documents may include packing lists, certificates of origin, and compliance certificates, all of which facilitate accurate tariff classification and smooth cross-border transactions. |

| 7 | Letter of Credit (LC) Document Set | The Letter of Credit (LC) document set attached to an international invoice typically includes the LC itself, the commercial invoice, packing list, bill of lading, certificate of origin, and inspection certificate. These documents ensure compliance with payment terms, verify shipment details, and facilitate customs clearance for smooth international trade transactions. |

| 8 | Sanctions Screening Declaration | International invoices must include a Sanctions Screening Declaration to verify that the transaction complies with global trade restrictions and embargoes. This document ensures due diligence by confirming that neither party is subject to sanctions imposed by authorities such as the UN, OFAC, or the EU. |

| 9 | Dual-use Goods End-User Statement | The Dual-use Goods End-User Statement must be attached with an international invoice to certify the intended use and prevent diversion of items with both civilian and military applications. This document ensures compliance with export control regulations by confirming the end-user's identity and purpose for the dual-use products shipped. |

| 10 | Blockchain-based Trade Facilitation Certificate | An international invoice must include a Blockchain-based Trade Facilitation Certificate to ensure the authenticity and traceability of transaction records, enhancing transparency and reducing fraud risks in cross-border trade. This digital certificate verifies shipment details and customs compliance, streamlining clearance processes and accelerating payment cycles. |

Overview of Required Documents for International Invoices

| Document | Description | Purpose |

|---|---|---|

| Commercial Invoice | Primary document detailing the sale transaction, buyer and seller information, product description, quantity, price, and payment terms. | Serves as proof of sale and billing, used for customs clearance and payment processing. |

| Packing List | Lists the contents of the shipment, including item descriptions, quantities, and packaging details. | Facilitates customs inspection, verifies shipment contents, and aids in logistics handling. |

| Bill of Lading (B/L) or Air Waybill (AWB) | Transport document issued by the carrier confirming shipment receipt and contract of carriage. | Proof of shipment, used for customs and claims processing. |

| Certificate of Origin | Official document certifying the country where goods were manufactured or produced. | Determines tariff rates and complies with trade agreements. |

| Export License | Authorization issued by a government to export specific goods. | Ensures legal compliance and controls on restricted items. |

| Insurance Certificate | Proof of insurance coverage for the goods in transit. | Protects parties against loss or damage during shipment. |

| Proforma Invoice | Preliminary invoice outlining estimated costs before the shipment. | Used for customs declaration and buyer's approval prior to sale. |

Essential Attachments for International Invoicing

Essential attachments for international invoicing include a commercial invoice, packing list, and a certificate of origin. Customs authorities require these documents to verify the shipment details and facilitate smooth clearance. Ensure you include all necessary paperwork to avoid delays and comply with international trade regulations.

Commercial Invoice: Core Component and Its Role

Attaching the correct documents with an international invoice is crucial for smooth customs clearance and payment processes. The commercial invoice serves as the core component among these documents, providing detailed transaction information.

- Commercial Invoice as Legal Document - It acts as a legally binding document between the seller and buyer, specifying the terms of the sale.

- Details of Goods and Pricing - The invoice lists descriptions, quantities, unit prices, and total amounts for the shipped goods.

- Customs and Regulatory Compliance - Customs authorities use the commercial invoice to assess duties and verify shipment contents.

Including a precise and complete commercial invoice ensures efficient international trade and minimizes delays at border clearance.

Packing List: Importance and Required Details

What documents are required to attach with an international invoice?

One of the most crucial documents to include is the packing list, which provides detailed information about the shipment. This document helps customs officials verify the contents, quantity, and packaging of your goods, ensuring smooth clearance.

Why is the packing list important for an international shipment?

The packing list aids in preventing delays or disputes by clearly describing the items, weights, and dimensions included in your shipment. It acts as a reference for both the shipper and the recipient, enhancing transparency throughout the delivery process.

What specific details must a packing list contain?

A thorough packing list should include item descriptions, quantities, weight and dimensions of each package, carton numbers, and the shipment's total volume. Including the consignee's and consignor's information on the list further supports accurate customs processing.

Certificate of Origin: When and Why It’s Needed

When preparing an international invoice, attaching the Certificate of Origin is often essential to confirm where the goods were manufactured. Customs authorities use this document to determine tariffs and enforce trade policies.

You need the Certificate of Origin if your shipment falls under specific trade agreements or is subject to import restrictions. This document helps ensure smoother customs clearance and can reduce delays or additional taxes.

Bill of Lading and Other Transport Documents

When preparing an international invoice, attaching a Bill of Lading is essential as it serves as proof of shipment and ownership of goods. Other transport documents, such as air waybills or consignment notes, provide detailed information on the mode of transport and shipment tracking. These documents ensure smooth customs clearance and facilitate verification of the shipment's legitimacy during international trade.

Export Licenses and Regulatory Documentation

When sending an international invoice, attaching proper export licenses is crucial to comply with global trade regulations. These licenses authorize the shipment of specific goods to designated countries, ensuring legal export processes.

Your documentation should also include regulatory paperwork that meets both the exporting and importing countries' requirements. This may consist of certificates of origin, health certificates, or safety data sheets, depending on the product category. Proper adherence to these regulations prevents shipment delays and customs issues.

Proof of Insurance: Importance for International Trade

Proof of insurance is a critical document to attach with an international invoice, ensuring goods are covered against risks during shipment. It safeguards financial interests and facilitates smooth customs clearance in global trade.

- Risk Mitigation - Insurance proof guarantees compensation in case of loss, damage, or theft during transit.

- Customs Compliance - Customs authorities often require insurance documentation to verify shipment security and value.

- Financial Protection - An insured shipment reduces liabilities, protecting exporters and importers from unforeseen costs.

Common Mistakes When Compiling Supporting Documents

When submitting an international invoice, it is crucial to attach all required supporting documents such as the commercial invoice, packing list, bill of lading, and certificate of origin. Missing or incorrect documentation can cause delays in customs clearance and payment processing.

Common mistakes include providing unclear invoices, forgetting to include export licenses, or attaching inconsistent product descriptions. You must ensure all documents are accurate, legible, and consistent to avoid complications in cross-border transactions.

What Documents are Required to Attach with an International Invoice? Infographic