Vendors must submit key documents such as purchase orders, delivery receipts, and proof of service alongside an electronic invoice to ensure proper verification and payment processing. Detailed descriptions of the goods or services, including quantities and prices, must be clearly included to match the invoice data. Compliance with legal and tax regulations requires attaching any necessary certifications or tax forms relevant to the transaction.

What Documents Must Vendors Submit with an Electronic Invoice?

| Number | Name | Description |

|---|---|---|

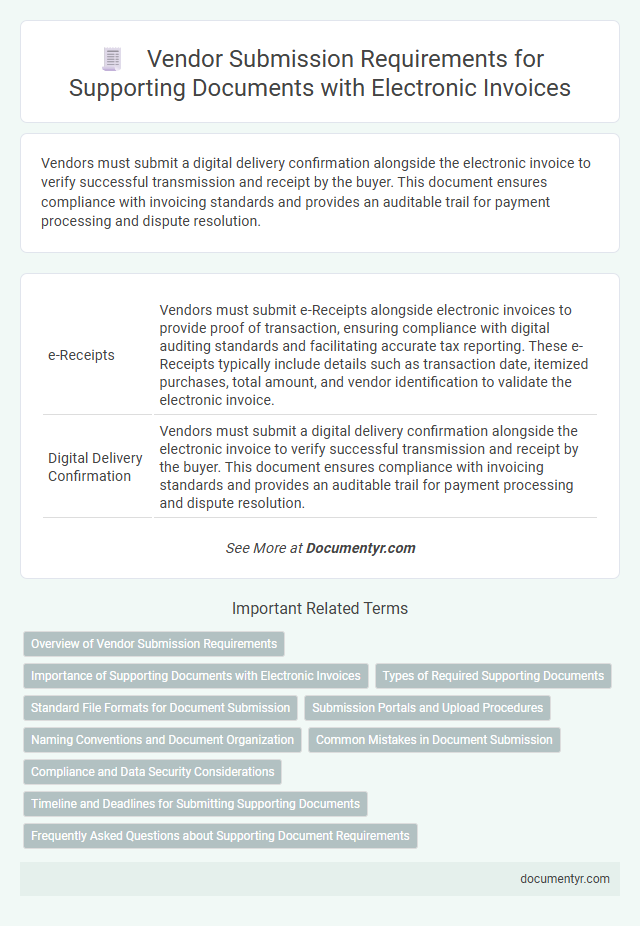

| 1 | e-Receipts | Vendors must submit e-Receipts alongside electronic invoices to provide proof of transaction, ensuring compliance with digital auditing standards and facilitating accurate tax reporting. These e-Receipts typically include details such as transaction date, itemized purchases, total amount, and vendor identification to validate the electronic invoice. |

| 2 | Digital Delivery Confirmation | Vendors must submit a digital delivery confirmation alongside the electronic invoice to verify successful transmission and receipt by the buyer. This document ensures compliance with invoicing standards and provides an auditable trail for payment processing and dispute resolution. |

| 3 | Electronic Purchase Order (e-PO) | Vendors must submit the Electronic Purchase Order (e-PO) alongside their electronic invoice to ensure proper transaction validation and facilitate automated processing within the procurement system. The e-PO contains essential details like purchase order number, item descriptions, quantities, and agreed prices, enabling accurate invoice matching and quicker payment cycles. |

| 4 | Tax e-Compliance Certificate | Vendors must submit a valid Tax e-Compliance Certificate along with their electronic invoice to ensure adherence to tax regulations and facilitate smooth processing. This document verifies the vendor's tax status and compliance, reducing the risk of invoice rejection or payment delays. |

| 5 | Vendor Onboarding e-Form | Vendors must submit a completed Vendor Onboarding e-Form along with their electronic invoice to ensure accurate identification and payment processing. This form typically includes essential details such as tax identification number, bank account information, and contact details, facilitating streamlined vendor verification and compliance. |

| 6 | e-Way Bill (for logistics validation) | Vendors must submit the e-Way Bill along with the electronic invoice to ensure logistics validation and compliance with transportation regulations, enabling real-time tracking of goods movement. This document is essential for verifying the authenticity and status of shipments, preventing tax evasion and streamlining audit processes. |

| 7 | E-signature Authorization | Vendors must submit an electronically signed authorization form as part of their electronic invoice documentation to validate the authenticity and approval of the transaction. This e-signature authorization ensures compliance with regulatory standards and prevents invoice fraud. |

| 8 | Electronic Proof of Service (e-POS) | Vendors must submit an Electronic Proof of Service (e-POS) along with an electronic invoice to verify that the goods or services were delivered as specified. The e-POS provides a digital record of completion, ensuring compliance and facilitating faster payment processing. |

| 9 | XML UBL Attachment | Vendors must submit the XML UBL attachment as a standardized electronic document format to ensure accurate data exchange and automatic processing of electronic invoices. This XML UBL attachment contains detailed invoice information, such as supplier and buyer identities, item descriptions, quantities, prices, and tax details, facilitating compliance with e-invoicing regulations. |

| 10 | Blockchain Audit Trail Report | Vendors must submit an electronic invoice accompanied by a Blockchain Audit Trail Report to ensure transparent verification of all transactional data and maintain an immutable record of invoice origin and modifications. This report provides a secured, time-stamped ledger that enhances accountability and supports regulatory compliance in digital invoicing processes. |

Overview of Vendor Submission Requirements

| Document Type | Description | Purpose | Submission Format |

|---|---|---|---|

| Electronic Invoice | A detailed invoice generated in an approved electronic format such as XML or PDF/A-3. | Serves as the official billing document for goods or services provided. | Mandatory electronic submission through specified invoicing platforms. |

| Purchase Order Reference | Copy or reference number of the purchase order associated with the transaction. | Validates authorization and links invoice to the procurement process. | Included within the electronic invoice or as an attached document. |

| Tax Compliance Certificates | Documents proving vendor's compliance with local tax regulations. | Ensures proper tax reporting and withholding requirements. | Uploaded as scanned documents or integrated digitally if available. |

| Delivery Confirmation | Proof of goods or services delivery, such as signed delivery notes or electronic confirmation receipts. | Supports payment authorization and dispute resolution. | Submitted electronically along with the invoice or on request. |

| Vendor Registration Details | Up-to-date business identification and banking information. | Facilitates accurate payment processing and vendor verification. | Maintained in vendor management systems, updated as necessary. |

To ensure compliance with electronic invoicing standards, your submission must include these critical documents in the specified formats. This reduces processing errors and accelerates payment timelines.

Importance of Supporting Documents with Electronic Invoices

Vendors must submit supporting documents such as purchase orders, delivery receipts, and contracts along with electronic invoices. These documents verify the legitimacy and accuracy of the invoiced amounts.

Supporting documents ensure compliance with financial regulations and facilitate faster invoice processing. Proper documentation reduces disputes and enhances transparency between vendors and buyers.

Types of Required Supporting Documents

Vendors must submit specific supporting documents alongside an electronic invoice to ensure proper validation and processing. Commonly required documents include purchase orders, delivery receipts, and proof of payment or service completion. These documents provide verification of the transaction details, facilitating accurate and timely payment.

Standard File Formats for Document Submission

Vendors must submit electronic invoices using standardized file formats to ensure seamless processing and compliance. Choosing the correct format facilitates accurate data exchange and reduces errors.

- XML (eXtensible Markup Language) - XML files enable structured data representation, making invoice details easily readable by automated systems.

- PDF/A (Portable Document Format - Archival) - PDF/A preserves the visual layout and ensures long-term accessibility without modification.

- EDI (Electronic Data Interchange) - EDI supports direct system-to-system invoice exchange in a widely accepted business standard format.

Submission Portals and Upload Procedures

Vendors must submit specific documents along with an electronic invoice through designated submission portals to ensure accurate processing. Following proper upload procedures guarantees that your invoice is compliant and accepted without delay.

- Invoice Document - The primary electronic invoice file must include all billing details and comply with the required digital format.

- Supporting Documents - Vendors often need to upload contracts, delivery receipts, or proof of service linked to the invoice.

- Submission Portal Credentials - Access to the official portal requires authentication details to securely upload all necessary documents.

Strict adherence to the portal's upload guidelines prevents rejection and speeds up invoice approval.

Naming Conventions and Document Organization

Vendors must submit electronic invoices accompanied by clearly named documents following standardized naming conventions to ensure efficient processing. Proper document organization, including distinct folders for invoices, receipts, and purchase orders, enhances accessibility and reduces errors. You should consistently use unique identifiers such as invoice numbers and dates in file names to maintain clarity and traceability.

Common Mistakes in Document Submission

Vendors must submit accurate supporting documents with an electronic invoice to ensure prompt processing and payment. Common errors can delay approval and affect your business relationships.

- Missing Required Documents - Failure to include purchase orders, delivery receipts, or tax certificates often leads to invoice rejection.

- Incorrect Document Formats - Submitting files in unsupported formats like images instead of PDFs hinders automated verification systems.

- Incomplete or Illegible Information - Documents with unclear details, missing signatures, or partial data cause discrepancies during invoice validation.

Compliance and Data Security Considerations

Vendors must submit key documents such as the electronic invoice itself, purchase orders, and proof of delivery to ensure compliance with regulatory requirements. These documents verify transaction authenticity and support audit trails.

Compliance mandates strict adherence to data security protocols, including encryption and secure transmission methods. Vendors should also include digital signatures to safeguard invoice integrity and prevent tampering.

Timeline and Deadlines for Submitting Supporting Documents

Vendors must submit all supporting documents with an electronic invoice within the specified timeline to ensure prompt processing. Missing or late submissions can result in payment delays or invoice rejection.

Your documents, such as purchase orders, delivery receipts, and tax certificates, should be uploaded within 7 business days of invoice submission. Some industries or clients may require stricter deadlines, often no more than 3 business days. Adhering to these timelines helps maintain compliance and accelerates invoice approval.

What Documents Must Vendors Submit with an Electronic Invoice? Infographic