Tax-deductible invoices must include the supplier's name, address, and tax identification number, along with the buyer's details and a clear description of the goods or services provided. The invoice should also show the date of issuance, a unique invoice number, the amount charged, and applicable tax rates. Keeping these documents organized and accessible is essential for accurate tax reporting and ensuring deductions are accepted by tax authorities.

What Documents Are Required for Tax-Deductible Invoices?

| Number | Name | Description |

|---|---|---|

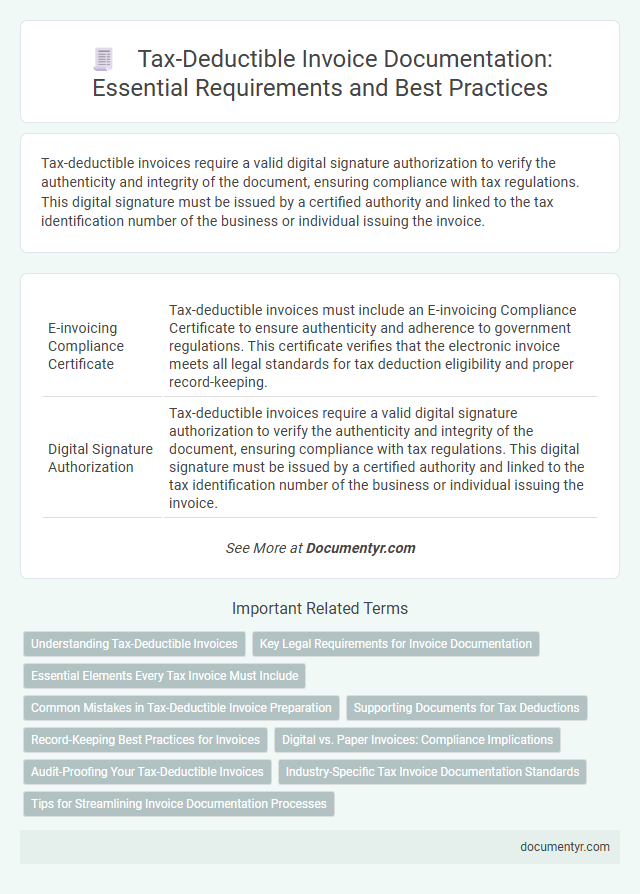

| 1 | E-invoicing Compliance Certificate | Tax-deductible invoices must include an E-invoicing Compliance Certificate to ensure authenticity and adherence to government regulations. This certificate verifies that the electronic invoice meets all legal standards for tax deduction eligibility and proper record-keeping. |

| 2 | Digital Signature Authorization | Tax-deductible invoices require a valid digital signature authorization to verify the authenticity and integrity of the document, ensuring compliance with tax regulations. This digital signature must be issued by a certified authority and linked to the tax identification number of the business or individual issuing the invoice. |

| 3 | QR Code Verification Sheet | Tax-deductible invoices must include a QR Code Verification Sheet to ensure authenticity and compliance with tax regulations. This sheet contains encrypted transaction details that facilitate accurate validation by tax authorities, preventing fraud and simplifying the audit process. |

| 4 | GST E-invoice JSON File | Tax-deductible invoice documentation must include the GST E-invoice JSON file, which contains the essential transaction details such as supplier GSTIN, invoice number, date, taxable value, and GST amount. This JSON file ensures compliance with e-invoicing mandates and facilitates seamless verification by tax authorities. |

| 5 | Invoice Reference Number (IRN) | The Invoice Reference Number (IRN) is a unique identifier generated during the e-invoice registration process, essential for verifying the authenticity of tax-deductible invoices. Including the IRN on all invoices ensures compliance with tax regulations and facilitates seamless validation by tax authorities. |

| 6 | Blockchain Invoice Audit Trail | Tax-deductible invoices require a verified blockchain invoice audit trail to ensure authenticity, immutability, and compliance with tax regulations. This audit trail documents every transaction detail, including timestamps and digital signatures, providing transparent and tamper-proof evidence for tax authorities. |

| 7 | Reverse Charge Invoice Declaration | Tax-deductible invoices must include a Reverse Charge Invoice Declaration specifying that the recipient is liable for VAT payment instead of the supplier, ensuring compliance with tax regulations. This declaration is essential for transactions involving reverse charge mechanisms, confirming the correct tax treatment and eligibility for input VAT deduction. |

| 8 | Supplier e-KYC Verification Document | Tax-deductible invoices require a supplier e-KYC verification document to confirm the authenticity and identity of the supplier, ensuring compliance with tax regulations. This document typically includes government-issued ID, business registration certificates, and KYC verification reports linked to the supplier's tax identification number. |

| 9 | Input Tax Credit (ITC) Mapping Sheet | The Input Tax Credit (ITC) Mapping Sheet is essential for tax-deductible invoices as it helps correlate purchase invoices with corresponding tax credits, ensuring proper documentation for GST compliance. Accurate details such as supplier GSTIN, invoice number, date, taxable value, and tax amount must be included for seamless ITC claims and audit verification. |

| 10 | Recipient Acknowledgment e-Receipt | Recipient acknowledgment e-receipts are essential documents for tax-deductible invoices, providing proof of transaction and confirming the recipient's acceptance. Ensuring these digital receipts comply with tax authority standards and include detailed transaction data enhances their validity for deductible claims. |

Understanding Tax-Deductible Invoices

Understanding tax-deductible invoices is essential for accurate financial record-keeping and tax reporting. These invoices must include specific details to be recognized by tax authorities.

The required documents typically include a valid tax invoice containing the supplier's name, tax identification number, and transaction date. Your invoice should also list the goods or services provided along with the corresponding amounts and applicable taxes.

Key Legal Requirements for Invoice Documentation

Tax-deductible invoices must meet specific legal criteria to qualify for deductions and audits. Proper documentation ensures compliance with tax authorities and validates business expenses.

- Supplier Details - The invoice must include the full name, address, and tax identification number of the supplier issuing the invoice.

- Buyer Information - Accurate details of the purchaser, including company name and tax ID, are required for accountability and verification purposes.

- Itemized Description - A clear breakdown of goods or services provided, including quantities, unit prices, and the total amount, must be present on the invoice.

Essential Elements Every Tax Invoice Must Include

| Essential Elements | Description |

|---|---|

| Seller's Information | Include the full name, address, and tax identification number of the seller issuing the invoice. |

| Buyer's Information | Full name and address of the buyer must be present to validate the transaction. |

| Invoice Number | A unique, sequential invoice number for proper record-keeping and traceability. |

| Date of Issue | The exact date when the invoice is created and issued. |

| Description of Goods or Services | Detailed explanation of the items sold or services rendered, including quantity and unit price. |

| Total Amount | Clear indication of the total amount payable, including any applicable taxes or discounts. |

| Tax Breakdown | Specific details showing the amount of tax charged, such as VAT or sales tax percentages and amounts. |

| Payment Terms | Conditions under which payment is to be made, including due date and accepted payment methods. |

| Authorized Signatory | Signature or digital authorization from the person responsible for the invoice for validation purposes. |

| Additional Legal Statements | Any mandatory disclaimers or notes required by tax authorities to ensure compliance. |

Ensuring your invoice contains these essential elements makes it eligible for tax deductions and complies with tax regulations.

Common Mistakes in Tax-Deductible Invoice Preparation

Accurate documentation is essential for tax-deductible invoices, including a clear description of goods or services, supplier details, and tax identification numbers. Missing or incomplete information can invalidate the invoice for tax deduction purposes.

Common mistakes include incorrect tax rates, absent invoice dates, and failure to include the buyer's tax ID. Ensuring all required fields are properly filled prevents rejection during tax audits and facilitates smooth tax processing.

Supporting Documents for Tax Deductions

Supporting documents for tax-deductible invoices are essential to validate your claims during tax filing. These include receipts, purchase orders, and proof of payment, which must clearly detail the transaction and the involved parties. Proper documentation ensures compliance with tax regulations and facilitates accurate deduction processing.

Record-Keeping Best Practices for Invoices

Tax-deductible invoices require specific documents such as the original invoice, proof of payment, and supporting receipts to validate expenses. Accurate record-keeping ensures these documents are organized and accessible for audits, reducing the risk of errors or disputes. You should maintain digital and physical copies securely to comply with tax regulations and streamline financial management.

Digital vs. Paper Invoices: Compliance Implications

Tax-deductible invoices must include specific documentation to comply with tax regulations. These documents validate the transaction and ensure eligibility for deductions.

Digital invoices require secure storage and authentication methods to meet legal standards, while paper invoices demand physical preservation and clear legibility. Compliance laws often mandate timestamping and verification for digital records to prevent fraud. Your business must align with these requirements to maintain valid tax deductions and avoid penalties.

Audit-Proofing Your Tax-Deductible Invoices

What documents are required for tax-deductible invoices to ensure audit-proofing? Proper documentation includes the original invoice, proof of payment, and detailed records of the transaction. Maintaining these documents helps verify expenses and supports compliance during tax audits.

Industry-Specific Tax Invoice Documentation Standards

Understanding the documents required for tax-deductible invoices is essential for compliance across various industries. Specific tax invoice documentation standards vary based on industry regulations and tax authorities.

- Invoice Details - Industry-specific invoices must include mandatory information such as tax identification numbers, timestamps, and itemized services or goods.

- Supporting Documentation - Depending on the sector, attachments like purchase orders, delivery receipts, or service completion certificates may be required to validate deductions.

- Compliance with Tax Codes - Your invoices should adhere to local tax authority guidelines to ensure the documents qualify for tax deductions and avoid audits.

What Documents Are Required for Tax-Deductible Invoices? Infographic