A commercial invoice requires essential documents such as the purchase order, proof of shipment, and the buyer's details including name and address. Detailed product descriptions, quantities, unit prices, total amount, and payment terms must be clearly outlined. Customs declaration forms and any relevant export licenses are also necessary to ensure smooth international trade.

What Documents are Necessary for Issuing a Commercial Invoice?

| Number | Name | Description |

|---|---|---|

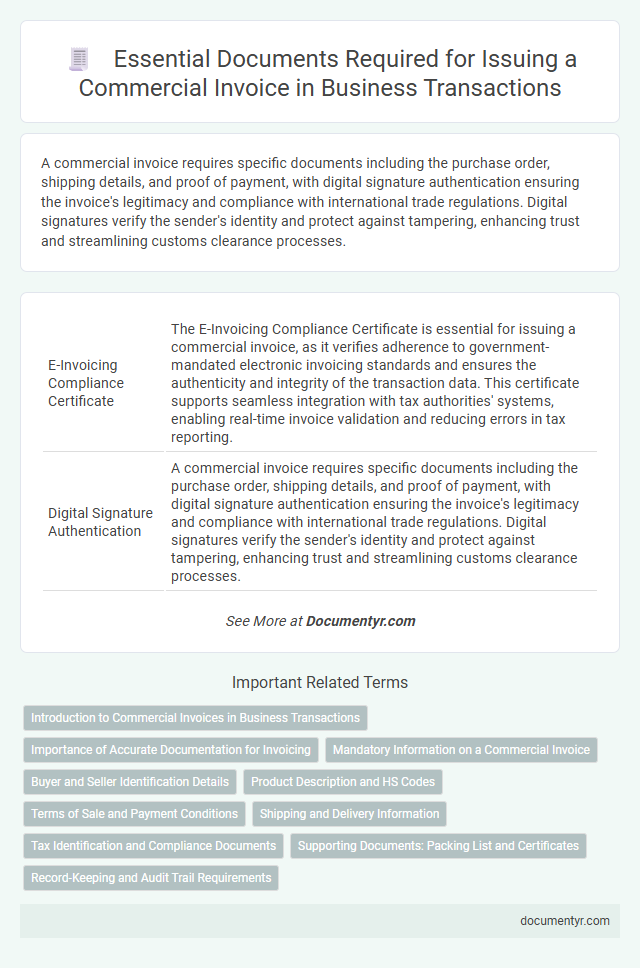

| 1 | E-Invoicing Compliance Certificate | The E-Invoicing Compliance Certificate is essential for issuing a commercial invoice, as it verifies adherence to government-mandated electronic invoicing standards and ensures the authenticity and integrity of the transaction data. This certificate supports seamless integration with tax authorities' systems, enabling real-time invoice validation and reducing errors in tax reporting. |

| 2 | Digital Signature Authentication | A commercial invoice requires specific documents including the purchase order, shipping details, and proof of payment, with digital signature authentication ensuring the invoice's legitimacy and compliance with international trade regulations. Digital signatures verify the sender's identity and protect against tampering, enhancing trust and streamlining customs clearance processes. |

| 3 | UBL (Universal Business Language) File | A commercial invoice issued through a UBL (Universal Business Language) file requires essential documents such as the purchase order, shipping details, payment terms, and product descriptions encoded in XML format to ensure standardized data exchange. The UBL schema facilitates accurate invoice processing by including necessary elements like buyer and seller information, itemized lists, tax details, and currency codes. |

| 4 | QR Code Verification Sheet | The QR Code Verification Sheet is essential for issuing a commercial invoice as it verifies the authenticity of the document through a scannable code linked to the transaction details. This sheet ensures compliance with tax regulations and facilitates efficient auditing and record-keeping. |

| 5 | Proof of Electronic Data Interchange (EDI) | Proof of Electronic Data Interchange (EDI) is essential for issuing a commercial invoice as it verifies the secure electronic transmission of invoice data between trading partners, ensuring accuracy and compliance with regulatory standards. EDI documents, including transaction sets like the ANSI X12 810 or EDIFACT INVOIC, serve as authoritative records that authenticate the invoice details and streamline customs clearance processes. |

| 6 | Blockchain Invoice Ledger Reference | Issuing a commercial invoice requires essential documents such as a purchase order, shipping documents, and proof of payment, with the blockchain invoice ledger reference providing an immutable, transparent record that ensures authenticity and traceability of transactions. This ledger enhances verification processes by linking the invoice data to a secure, decentralized digital record, preventing fraud and streamlining audits. |

| 7 | HS Code Mapping Sheet | The HS Code Mapping Sheet is essential for issuing a commercial invoice as it provides accurate Harmonized System codes that classify traded goods for customs purposes, ensuring compliance with international regulations. This document helps reduce errors in tariff classification, facilitates smoother customs clearance, and supports proper tax and duty assessment. |

| 8 | Country of Origin Digital Attestation | A commercial invoice must include a Country of Origin Digital Attestation to verify the product's manufacturing location, ensuring compliance with international trade regulations and customs requirements. This digital certification aids in accurate tariff classification, preferential duty claims, and prevents delays during customs clearance. |

| 9 | Dynamic Tax Jurisdiction Report | The Dynamic Tax Jurisdiction Report is essential for issuing a commercial invoice as it accurately identifies applicable tax codes and jurisdictional boundaries based on transaction details, ensuring compliance with regional tax regulations. This report integrates real-time tax rate data, facilitating precise tax calculation and reducing errors or audits related to misapplied tax rules. |

| 10 | AI-Powered Invoice Validation Summary | AI-powered invoice validation requires essential documents such as purchase orders, delivery receipts, and tax identification numbers to accurately verify transaction details. These inputs enable automated cross-referencing and error detection, ensuring the commercial invoice meets regulatory and contractual standards. |

Introduction to Commercial Invoices in Business Transactions

A commercial invoice is a critical document in international business transactions. It serves as a proof of sale between the exporter and the importer.

You need specific documents to issue a commercial invoice accurately. These documents ensure compliance with customs regulations and smooth trade processes.

Importance of Accurate Documentation for Invoicing

Accurate documentation is essential for issuing a commercial invoice, ensuring clarity and compliance with international trade regulations. Key documents include the purchase order, delivery receipt, and any customs declarations needed for the transaction.

These documents verify the details of the goods sold, their quantities, and values, which helps prevent disputes and delays in payment. Precise invoicing supports smooth customs clearance and maintains trust between buyers and sellers.

Mandatory Information on a Commercial Invoice

A commercial invoice must include specific documents to ensure compliance with customs and tax regulations. Accurate and complete information helps avoid delays and penalties during international shipments.

- Seller and Buyer Details - Your commercial invoice must clearly list the full names, addresses, and contact information of both parties involved in the transaction.

- Description of Goods - A detailed description including quantity, type, and unit price of the products being sold must be included.

- Invoice Number and Date - Each commercial invoice requires a unique invoice number and the date of issuance for proper tracking and record-keeping.

Providing all mandatory information on a commercial invoice is essential for successful cross-border trade and customs clearance.

Buyer and Seller Identification Details

Accurate buyer and seller identification details are essential documents for issuing a commercial invoice. These details ensure legal compliance and facilitate smooth transaction processing across international borders.

- Seller Identification - Include the official business name, address, tax identification number, and contact information of the seller to verify the invoice's origin.

- Buyer Identification - Provide the buyer's full legal name, address, and any relevant tax or import identification numbers to confirm the recipient of the goods or services.

- Verification Documents - Attach or reference licenses, registration certificates, or official identification numbers that validate the authenticity of both buyer and seller.

Product Description and HS Codes

A detailed product description is essential for issuing a commercial invoice, as it ensures clarity and compliance with customs regulations. Precise terminology helps avoid disputes and facilitates smooth international trade.

HS codes, or Harmonized System codes, classify products uniformly across countries, streamlining tariff assessments and import/export procedures. Including accurate HS codes on the invoice reduces the risk of delays and penalties. This classification supports transparency and efficiency in global commerce.

Terms of Sale and Payment Conditions

Issuing a commercial invoice requires clear documentation of the terms of sale, which detail the agreement between the buyer and seller regarding the transaction. Payment conditions must be explicitly stated, including payment methods, deadlines, and any applicable penalties for late payments. You should ensure these elements are accurately captured to avoid disputes and facilitate smooth financial processing.

Shipping and Delivery Information

Shipping and delivery information is essential for issuing a commercial invoice, including the recipient's full address and contact details. Documentation must specify the shipping method, expected delivery date, and tracking number if available. Accurate details ensure smooth customs clearance and timely delivery of goods.

Tax Identification and Compliance Documents

Issuing a commercial invoice requires specific tax identification and compliance documents to ensure legal accuracy. These documents verify the legitimacy of the transaction and support tax reporting obligations.

- Tax Identification Number (TIN) - Your TIN confirms your registered tax identity for authorities.

- VAT Registration Certificate - This certifies your compliance with value-added tax regulations where applicable.

- Export/Import Licenses - Required to demonstrate adherence to international trade laws and customs requirements.

Supporting Documents: Packing List and Certificates

What supporting documents are necessary for issuing a commercial invoice? The packing list is essential as it details the contents, quantity, and weight of the shipment. Certificates, such as certificates of origin or quality, verify product authenticity and compliance with regulations.

What Documents are Necessary for Issuing a Commercial Invoice? Infographic