To complete e-invoice registration in India, key documents required include the GSTIN of the business, a valid PAN card, and proof of business registration such as the incorporation certificate or partnership deed. Additionally, authorized signatory details and their Aadhaar card are essential for verification. These documents ensure compliance with government regulations and facilitate smooth integration with the e-invoicing system.

What Documents are Necessary for E-Invoice Registration in India?

| Number | Name | Description |

|---|---|---|

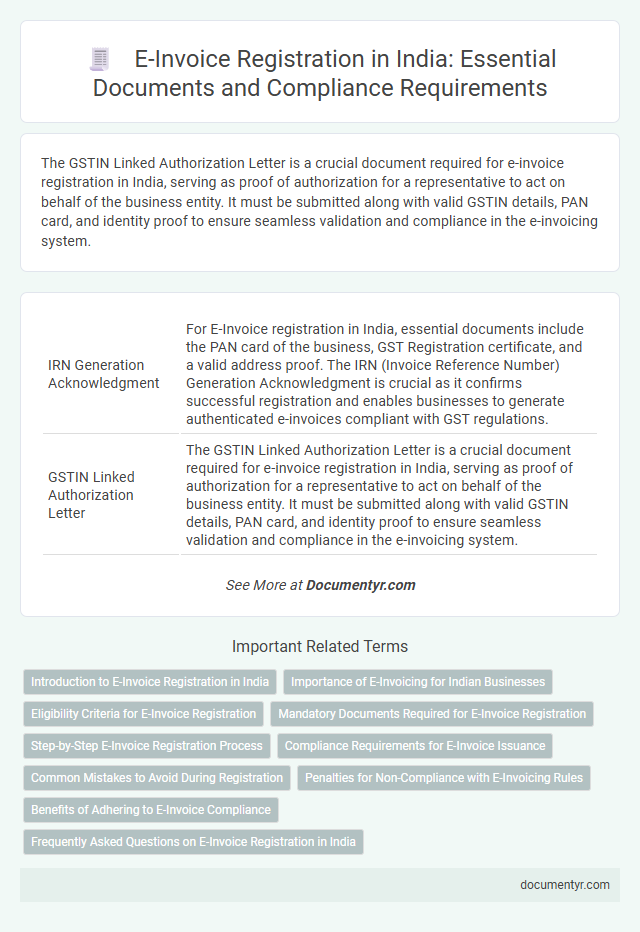

| 1 | IRN Generation Acknowledgment | For E-Invoice registration in India, essential documents include the PAN card of the business, GST Registration certificate, and a valid address proof. The IRN (Invoice Reference Number) Generation Acknowledgment is crucial as it confirms successful registration and enables businesses to generate authenticated e-invoices compliant with GST regulations. |

| 2 | GSTIN Linked Authorization Letter | The GSTIN Linked Authorization Letter is a crucial document required for e-invoice registration in India, serving as proof of authorization for a representative to act on behalf of the business entity. It must be submitted along with valid GSTIN details, PAN card, and identity proof to ensure seamless validation and compliance in the e-invoicing system. |

| 3 | API Sandbox Access Documents | API sandbox access for e-invoice registration in India requires submission of the GSTIN, PAN card, a valid digital signature certificate (DSC), and authorization letter from the business entity. These documents enable secure testing and integration with the government's e-invoice system, ensuring compliance and seamless API connectivity. |

| 4 | Digital Signature Certificate (DSC) Mapping File | For E-Invoice registration in India, the Digital Signature Certificate (DSC) Mapping File is essential as it authorizes the signatory to digitally sign invoices, ensuring secure and authenticated transactions. This mapping file links the DSC with the authorized signatory's details, enabling seamless and compliant electronic invoicing under the GST regime. |

| 5 | GSP/ASP Integration Proof | For e-invoice registration in India, proof of integration with a GST Suvidha Provider (GSP) or Application Service Provider (ASP) is essential, typically demonstrated through a signed agreement or registration certificate issued by the GSP/ASP. This document verifies the taxpayer's connectivity and compliance with the GSTN system, enabling seamless e-invoice generation and submission. |

| 6 | Master Data Upload Template | The Master Data Upload Template is essential for e-invoice registration in India, requiring accurate details of GSTIN, PAN, business address, and authorized signatory information. This document ensures seamless integration with the Invoice Registration Portal (IRP) by validating key data fields critical for generating valid e-invoices. |

| 7 | ERP Configuration Change Log | The ERP Configuration Change Log is essential for e-invoice registration in India, as it documents all system modifications related to GST compliance and invoice generation parameters. Maintaining a detailed log ensures transparency and aids in auditing the configuration settings tied to the e-invoicing process, facilitating accurate integration with the government's Invoice Registration Portal (IRP). |

| 8 | E-Way Bill Synchronization Consent | E-Invoice registration in India requires submitting key documents such as GST registration certificate, PAN card, and bank details, along with explicit consent for E-Way Bill synchronization to ensure seamless integration between e-invoicing and e-way bill systems. This synchronization consent enables automatic generation and linking of e-way bills from e-invoices, enhancing compliance and streamlining transportation documentation for registered businesses. |

| 9 | Invoice Reference Hash Validation Report | The Invoice Reference Hash Validation Report is a crucial document for e-invoice registration in India, serving as proof that the invoice details are accurately hashed and validated against the Government Invoice Registration Portal (IRP). This report ensures data integrity and compliance with GST regulations by confirming the uniqueness and authenticity of the invoice through the generated hash. |

| 10 | QR Code Schema Declaration | To complete e-invoice registration in India, businesses must submit documents including GST registration certificates, PAN cards, and bank details, with a critical emphasis on the QR Code Schema Declaration as per the Invoice Registration Portal (IRP) standards. The QR Code Schema Declaration ensures compliance with the GST e-invoicing system by encoding essential invoice details, facilitating seamless verification and validation across the GST network. |

Introduction to E-Invoice Registration in India

| Introduction to E-Invoice Registration in India | |

|---|---|

| E-invoicing is a mandatory process for businesses in India to streamline the generation and reporting of invoices electronically. It ensures accuracy, reduces errors, and improves compliance with GST regulations. Understanding the documentation required for e-invoice registration is crucial for seamless integration with the government's Invoice Registration Portal (IRP). | |

| Document | Description |

| GSTIN (Goods and Services Tax Identification Number) | Official registration number issued to your business under GST, essential for identification during e-invoice registration. |

| PAN (Permanent Account Number) | Unique 10-digit alphanumeric identifier issued to taxpayers in India, linked with your GSTIN for verification purposes. |

| Business Registration Proof | Documents such as Certificate of Incorporation or Partnership Deed that establish your legal business entity. |

| Contact Details | Valid email address and phone number to receive OTPs and communications related to e-invoice system registration. |

| Authorized Signatory Details | Information of the person responsible for your e-invoice registration, including name, designation, and contact information. |

Importance of E-Invoicing for Indian Businesses

E-invoicing is a crucial requirement for Indian businesses to ensure compliance with the Goods and Services Tax (GST) regulations. It streamlines the invoicing process, reduces errors, and enhances transparency across transactions.

For e-invoice registration, essential documents include your GSTIN, PAN card of the business, and valid Aadhaar details of the authorized signatory. A digital signature certificate (DSC) is also required for verification purposes. Submitting these documents helps your business integrate seamlessly with the government's e-invoice portal, improving accuracy and facilitating faster tax processing.

Eligibility Criteria for E-Invoice Registration

E-invoice registration in India requires specific documents to ensure compliance with GST regulations. The eligibility criteria focus on the business's turnover and taxpayer status.

- GSTIN Registration Certificate - Mandatory proof of the taxpayer's registration under GST.

- PAN Card - Essential identification document linked to the business for tax purposes.

- Business Address Proof - Valid proof such as utility bills or rental agreements confirming the business location.

Meeting these document requirements guarantees a smooth e-invoice registration process under the Indian GST framework.

Mandatory Documents Required for E-Invoice Registration

Registering for e-invoice in India requires specific mandatory documents to ensure compliance with government regulations. Gathering these documents beforehand streamlines the registration process.

- GSTIN (Goods and Services Tax Identification Number) - Your valid GSTIN is essential to link e-invoice registration with your tax identity.

- PAN Card - The Permanent Account Number validates your business entity for financial and tax purposes.

- Business Registration Proof - Documents like GST registration certificate or incorporation certificate confirm your legal business existence.

- Digital Signature Certificate (DSC) - DSC is necessary for authenticating documents electronically during e-invoice submission.

- Contact Details - Accurate email ID and mobile number help in correspondence and receiving OTP for verification.

Step-by-Step E-Invoice Registration Process

To complete the e-invoice registration in India, you must gather essential documents including the GSTIN, PAN card, and a valid Aadhaar number of the authorized signatory. Ensure you have the business's bank account details and digital signature certificate (DSC) ready for authentication. This documentation is necessary to authenticate your identity and link your business with the e-invoice system.

The e-invoice registration process begins by visiting the official Invoice Registration Portal (IRP) of the Government of India. After logging in with your GST credentials, upload the required documents such as PAN, GSTIN, and DSC for verification. Complete the form by providing business details and verify them before submitting the application for e-invoice generation access.

Once submitted, the IRP verifies the documents and issues a unique Invoice Reference Number (IRN) for each generated e-invoice. Regular monitoring of the portal is required to ensure compliance and timely updates. Successful registration enables seamless integration with your accounting or ERP software to automate e-invoice generation and reporting.

Compliance Requirements for E-Invoice Issuance

What documents are necessary for e-invoice registration in India? To comply with Government regulations, you must provide your GSTIN (Goods and Services Tax Identification Number) and PAN (Permanent Account Number). Additionally, details of your business such as legal name, address, and contact information are required for accurate e-invoice issuance.

Common Mistakes to Avoid During Registration

Registering for an e-invoice system in India requires specific documents to ensure compliance with GST regulations. Proper document submission helps avoid delays and errors during the registration process.

- PAN Card and GSTIN Documents - Ensure the correct PAN card and valid GSTIN details are submitted to prevent mismatches in the registration portal.

- Business Address Proof - Provide accurate business address proof such as electricity bills or rent agreements to verify the entity's location.

- Authorized Signatory Details - Submit valid identity proof and contact details of the authorized signatory to avoid authentication issues in the e-invoice system.

Penalties for Non-Compliance with E-Invoicing Rules

For e-invoice registration in India, essential documents include the GST registration certificate, PAN card, and a valid digital signature. Businesses must also provide proof of the primary place of business and bank account details.

Non-compliance with e-invoicing rules can attract severe penalties under the GST regime. Delays or failures in generating e-invoices may result in fines up to Rs 10,000 per invoice and potential blocking of e-way bill generation facilities.

Benefits of Adhering to E-Invoice Compliance

To register for e-invoicing in India, you need a valid GSTIN, the Aadhaar number of the authorized signatory, and details of the business entity. Additionally, a mobile number and an email ID linked to GST registration are essential for OTP verification and communication.

Adhering to e-invoice compliance ensures seamless GST return filing and reduces manual errors in invoicing. You benefit from faster invoice processing, improved transparency, and enhanced acceptance of invoices by business partners and tax authorities.

What Documents are Necessary for E-Invoice Registration in India? Infographic