Nonprofits must maintain donation invoices that include donor information, donation amount, date of contribution, and a clear description of the donated items or services. These records ensure compliance with IRS regulations and facilitate accurate financial reporting. Proper documentation also supports transparency and accountability in nonprofit operations.

What Documents Does a Nonprofit Need for Donation Invoice Records?

| Number | Name | Description |

|---|---|---|

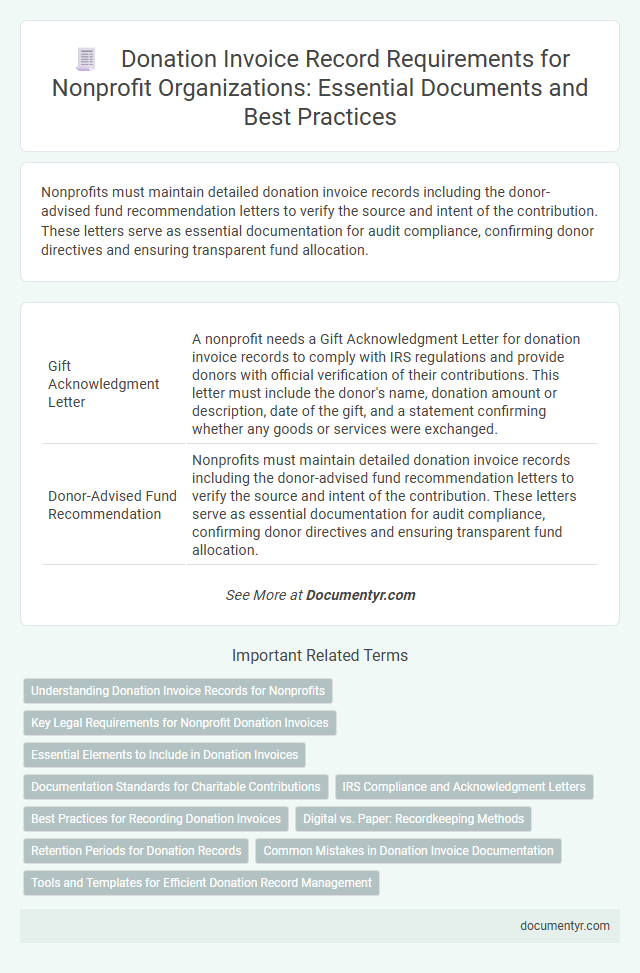

| 1 | Gift Acknowledgment Letter | A nonprofit needs a Gift Acknowledgment Letter for donation invoice records to comply with IRS regulations and provide donors with official verification of their contributions. This letter must include the donor's name, donation amount or description, date of the gift, and a statement confirming whether any goods or services were exchanged. |

| 2 | Donor-Advised Fund Recommendation | Nonprofits must maintain detailed donation invoice records including the donor-advised fund recommendation letters to verify the source and intent of the contribution. These letters serve as essential documentation for audit compliance, confirming donor directives and ensuring transparent fund allocation. |

| 3 | IRS Form 8283 | Nonprofits must retain IRS Form 8283, particularly Section A for donations valued over $500, as proof when issuing donation invoices for tax compliance and audit purposes. This form verifies the donor's claim of non-cash contributions and supports the nonprofit's record-keeping for substantiating charitable donations. |

| 4 | Digital Donation Receipt Blockchain Ledger | Nonprofits require digital donation receipts securely recorded on a blockchain ledger to provide transparent and immutable proof of transactions for donation invoice records. This technology ensures accuracy and compliance by maintaining a tamper-proof, time-stamped ledger accessible for audits and donor verification. |

| 5 | In-Kind Donation Valuation Statement | Nonprofits must include an In-Kind Donation Valuation Statement in donation invoice records to accurately document the fair market value of donated goods or services, ensuring compliance with IRS guidelines. This statement supports tax deduction claims and enhances transparency in financial reporting. |

| 6 | Donor Privacy Compliance Document | Nonprofits must maintain donor privacy compliance documents, including donor consent forms and privacy policies, to ensure compliance with data protection regulations and safeguard sensitive information. Proper record-keeping of these documents supports transparency and legal accountability during donation invoice audits. |

| 7 | Automated Tax Receipt Generator Report | Nonprofits require detailed donation invoices featuring donor information, donation amount, date, and tax receipt numbers to ensure compliance and transparency. An automated tax receipt generator report streamlines record-keeping by automatically producing accurate, IRS-compliant receipts that include unique identifiers and necessary legal disclaimers. |

| 8 | Non-Cash Contribution Appraisal Certification | Nonprofits must obtain a Non-Cash Contribution Appraisal Certification for donations exceeding $5,000 to comply with IRS regulations and substantiate the fair market value of donated assets. This documentation is crucial for maintaining accurate donation invoice records and ensuring transparency during audits or donor inquiries. |

| 9 | Recurring Gift Authorization Record | A nonprofit must retain a Recurring Gift Authorization Record to document donor consent for automated, recurring donations, ensuring compliance with financial and tax regulations. This record typically includes donor information, payment schedule, authorization details, and terms of the recurring gift agreement. |

| 10 | Donor Data Retention Consent Form | Nonprofits must maintain a Donor Data Retention Consent Form to comply with privacy regulations and document donor approval for storing personal information related to donation invoices. This form ensures transparency and legal compliance by explicitly authorizing the nonprofit to retain donor data for record-keeping and audit purposes. |

Understanding Donation Invoice Records for Nonprofits

| Document Type | Description | Importance for Nonprofit Donation Invoice Records |

|---|---|---|

| Donation Receipts | Official acknowledgment issued to donors detailing the donation amount, date, and purpose. | Essential for verifying donations and providing proof for tax deductions. |

| Donation Invoices | Invoices specifying the goods or services provided in exchange for donations, if applicable. | Helps track exchange transactions and maintain transparency in donation handling. |

| Bank Statements | Records of deposits reflecting donation payments received by the nonprofit. | Supports reconciliation of donation invoices with actual payments received. |

| Grant Agreements | Contracts outlining terms and conditions of funds granted to the nonprofit. | Crucial for compliance and documenting the source and use of funds. |

| Donor Correspondence | Communication records including emails, letters, or messages related to donations. | Provides context and confirmation of donation intentions and agreements. |

| Internal Donation Logs | Detailed records maintained by the nonprofit tracking all incoming donations and related invoices. | Supports auditing processes and accurate financial reporting. |

Understanding donation invoice records for nonprofits ensures accurate tracking, compliance, and transparency. Your proper documentation supports donor trust and regulatory requirements.

Key Legal Requirements for Nonprofit Donation Invoices

What documents does a nonprofit need for donation invoice records? Nonprofit organizations must retain donation receipts and acknowledgment letters that detail the donor's information, donation amount, and date. These records serve as critical evidence for tax purposes and legal compliance.

What are the key legal requirements for nonprofit donation invoices? Your donation invoice must include the nonprofit's name, tax-identification number, and a clear statement of whether any goods or services were provided in exchange for the donation. This ensures transparency and adherence to IRS regulations for charitable contributions.

Essential Elements to Include in Donation Invoices

Nonprofits must maintain accurate donation invoice records to ensure compliance with tax regulations and to provide clear documentation for donors. Essential elements in these invoices include the donor's name, donation date, and the amount contributed.

Other critical details are a detailed description of the donation, the nonprofit's name and contact information, and a statement confirming whether any goods or services were provided in exchange for the donation. Including Your nonprofit's tax-exempt status and a unique invoice number enhances record-keeping transparency and accountability.

Documentation Standards for Charitable Contributions

Nonprofits must maintain detailed documentation to comply with IRS standards for charitable contribution records. Required documents include written acknowledgments from donors for contributions over $250, containing the organization's name, the donation amount, date, and statement of any goods or services provided in return. Your donation invoice records should also include bank records, canceled checks, or credit card statements to verify the transaction for audit purposes.

IRS Compliance and Acknowledgment Letters

Nonprofit organizations must maintain accurate donation invoice records to ensure IRS compliance. These records typically include acknowledgment letters and detailed documentation of donations.

Your donation invoice records should contain a clearly written acknowledgment letter stating the donation amount, date, and donor information. The IRS requires nonprofits to provide these letters for any single donation of $250 or more to validate tax deductions. Maintaining these documents helps protect your organization during audits and supports transparent financial practices.

Best Practices for Recording Donation Invoices

Nonprofit organizations must maintain clear documentation for donation invoice records, including donation receipts, donor acknowledgment letters, and detailed invoices specifying the nature and value of the donation. Accurate record-keeping ensures compliance with legal requirements and enhances transparency for audits and donor trust. Implementing a standardized system for tracking donation invoices helps you efficiently manage contributions and support financial accountability.

Digital vs. Paper: Recordkeeping Methods

Nonprofit organizations must maintain accurate donation invoice records to ensure compliance and transparency. Essential documents include donation receipts, acknowledgment letters, and payment records.

Digital recordkeeping offers secure, searchable storage and easy backup options, reducing the risk of document loss. Paper records provide a tangible audit trail but require organized filing systems and physical storage space.

Retention Periods for Donation Records

Nonprofit organizations must maintain accurate donation invoice records to ensure compliance with legal and tax regulations. Proper retention of these records safeguards the organization during audits and supports transparency with donors.

- Retention Period Compliance - Most nonprofit donation invoices should be retained for at least seven years to meet IRS and state regulatory requirements.

- Documentation Types - Retain copies of donation receipts, bank statements, and acknowledgment letters as proof of contributions for audit trails.

- Electronic vs. Paper Records - Both digital and physical donation records must be securely stored and easily accessible for the entire retention period to ensure proper record-keeping.

Common Mistakes in Donation Invoice Documentation

Accurate documentation is essential for nonprofit organizations to maintain transparent donation records and comply with tax regulations. Common mistakes in donation invoice documentation can lead to compliance issues and donor mistrust.

- Missing Donor Information - Omitting the donor's name, address, or contact details weakens the validity of donation records.

- Lack of Receipt Details - Failing to include the date, donation amount, and description of non-cash contributions reduces invoice reliability.

- Inadequate Record Retention - Not retaining donation invoices for the required period risks noncompliance during audits.

What Documents Does a Nonprofit Need for Donation Invoice Records? Infographic