Small businesses need to maintain accurate sales invoices that include essential documents such as purchase orders, delivery receipts, and payment proofs to ensure compliance. Each sales invoice must contain clear details like the seller's and buyer's information, item descriptions, quantities, prices, and applicable taxes. Proper documentation safeguards against disputes and meets regulatory requirements for seamless financial auditing and tax reporting.

What Documents Does a Small Business Need for Sales Invoice Compliance?

| Number | Name | Description |

|---|---|---|

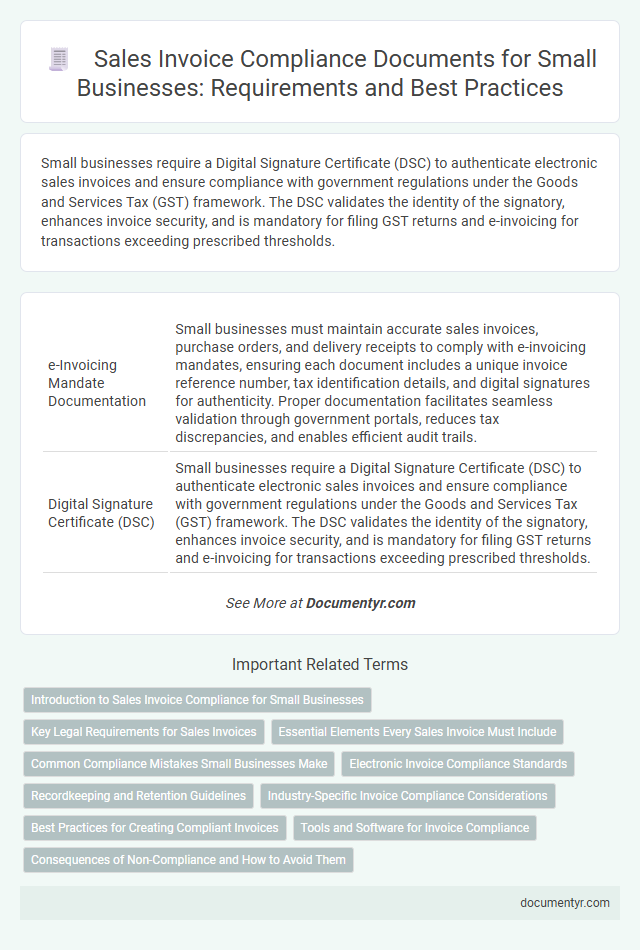

| 1 | e-Invoicing Mandate Documentation | Small businesses must maintain accurate sales invoices, purchase orders, and delivery receipts to comply with e-invoicing mandates, ensuring each document includes a unique invoice reference number, tax identification details, and digital signatures for authenticity. Proper documentation facilitates seamless validation through government portals, reduces tax discrepancies, and enables efficient audit trails. |

| 2 | Digital Signature Certificate (DSC) | Small businesses require a Digital Signature Certificate (DSC) to authenticate electronic sales invoices and ensure compliance with government regulations under the Goods and Services Tax (GST) framework. The DSC validates the identity of the signatory, enhances invoice security, and is mandatory for filing GST returns and e-invoicing for transactions exceeding prescribed thresholds. |

| 3 | QR Code Integration Record | Small businesses must maintain accurate sales invoices that include detailed transaction information and a digitally embedded QR code to ensure compliance with tax authorities and facilitate quick verification. The QR code integration record serves as a secure, machine-readable document linking invoice details to the official tax system, enhancing transparency and reducing fraud risks. |

| 4 | Reverse Charge Mechanism Statement | A small business must include a Reverse Charge Mechanism statement on the sales invoice when applicable, specifying that the recipient is liable for VAT payment instead of the supplier. This statement ensures compliance with tax regulations and clarifies the tax responsibility under cross-border or specified domestic transactions. |

| 5 | GST Reconciliation Report | A small business must maintain a GST Reconciliation Report alongside sales invoices to ensure accurate tax reporting and compliance with government regulations. This report consolidates invoice data, enabling verification of GST collected versus GST paid, which is crucial during tax audits and filing returns. |

| 6 | E-way Bill Attachment Sheet | Small businesses must attach an E-way Bill Attachment Sheet to their sales invoices to comply with GST regulations, ensuring transportation details of goods are properly documented. This sheet includes the E-way bill number, vehicle number, consignor and consignee details, and the date of transportation to facilitate seamless audit and verification processes. |

| 7 | HSN/SAC Code Mapping File | Small businesses must include an HSN/SAC code mapping file in their sales invoices to ensure GST compliance by accurately categorizing goods and services for tax purposes. This document links each product or service to its corresponding HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code) code, facilitating proper tax calculation and reporting. |

| 8 | Anti-fraud Control Trail | Small businesses must maintain a detailed anti-fraud control trail for sales invoice compliance, including original invoice copies, customer purchase orders, delivery receipts, and audit logs. This documentation supports transaction authenticity, prevents invoice tampering, and ensures adherence to tax regulations. |

| 9 | Payment Reconciliation Ledger | Small businesses require a Payment Reconciliation Ledger to ensure sales invoice compliance by systematically recording all payment transactions linked to issued invoices, facilitating accurate tracking and verification of received funds. This ledger supports audit readiness and financial transparency by matching payments to invoices and identifying discrepancies promptly. |

| 10 | Multi-Tax Jurisdiction Matrix | A comprehensive Multi-Tax Jurisdiction Matrix helps small businesses identify specific documentation requirements, such as sales tax certificates, exemption forms, and purchase orders, tailored to each jurisdiction's regulations. Maintaining accurate records according to this matrix ensures sales invoice compliance across federal, state, and local tax authorities, reducing audit risks and facilitating tax reporting. |

Introduction to Sales Invoice Compliance for Small Businesses

Sales invoice compliance is essential for small businesses to ensure legal accuracy and financial transparency in transactions. Proper documentation supports tax reporting, audit readiness, and smooth business operations.

- Sales Invoice - A detailed record of the goods or services sold, including quantity, price, and transaction date.

- Tax Registration Certificates - Proof of business registration and tax identification numbers required for legal compliance.

- Payment Receipts - Documentation of payments received to verify and reconcile sales transactions.

Key Legal Requirements for Sales Invoices

Sales invoice compliance requires small businesses to maintain specific documentation to meet legal standards. Ensuring these documents are accurate helps protect your business from regulatory issues.

- Invoice Number - Each sales invoice must have a unique, sequential number for proper tracking and audit purposes.

- Seller and Buyer Information - Both parties' names, addresses, and tax identification numbers must be clearly stated on the invoice.

- Detailed Description of Goods or Services - The invoice must specify the quantities, prices, and nature of the products or services sold for transparency and verification.

Essential Elements Every Sales Invoice Must Include

Small businesses must ensure their sales invoices include key elements to maintain compliance with tax and accounting regulations. Essential details provide clarity for both the seller and buyer, reducing disputes and facilitating accurate record-keeping.

Every sales invoice should contain the business name, address, and contact information, along with a unique invoice number for tracking. Additionally, it must list the date of issue, detailed descriptions of goods or services, quantities, unit prices, and total amounts due.

Common Compliance Mistakes Small Businesses Make

Small businesses must maintain accurate sales invoices that include essential details such as the seller's information, buyer's details, item descriptions, quantities, prices, and tax information to ensure compliance with taxation authorities. Common compliance mistakes include omitting tax identification numbers, failing to record transaction dates properly, and not issuing invoices for all sales, leading to potential fines and audits. Proper documentation and adherence to local regulations help small businesses avoid penalties and maintain transparent financial records.

Electronic Invoice Compliance Standards

Small businesses must adhere to electronic invoice compliance standards to ensure their sales invoices meet legal and tax regulations. Proper documentation supports accurate record-keeping and helps avoid penalties during audits.

Key documents include the electronic sales invoice itself, which must follow specific formatting and data requirements such as invoice number, date, seller and buyer details, item descriptions, quantities, prices, and tax information. Compliance with standards like the Universal Business Language (UBL) or Facturae ensures interoperability and acceptance by tax authorities. Maintaining digital signatures and secure storage of electronic invoices is essential to verify authenticity and integrity over time.

Recordkeeping and Retention Guidelines

Small businesses must maintain accurate and thorough records to ensure sales invoice compliance. Proper documentation supports tax reporting and audit readiness.

- Sales Invoices - Keep detailed copies of all sales invoices issued to customers for proof of transactions.

- Payment Records - Retain payment confirmations and receipts to verify amounts received and outstanding balances.

- Retention Period - Store all sales-related documents for a minimum of 5 to 7 years according to tax authority requirements.

Consistent recordkeeping and adherence to retention guidelines safeguard businesses from compliance risks and legal penalties.

Industry-Specific Invoice Compliance Considerations

| Industry | Required Documents for Sales Invoice Compliance | Specific Considerations |

|---|---|---|

| Retail | Sales invoice, Proof of payment, Delivery receipt | Include detailed product descriptions, barcode or SKU numbers, and tax identification numbers; comply with point-of-sale transaction records |

| Healthcare | Sales invoice, Medical service documentation, Patient consent forms | Ensure compliance with HIPAA for patient information; itemize services and medications separately; include provider license numbers |

| Construction | Sales invoice, Work order, Material delivery slips | Include detailed labor and material costs; compliance with lien waivers; track partial or milestone payments clearly |

| Manufacturing | Sales invoice, Purchase orders, Shipping documentation | List serial or batch numbers for products; specify manufacturing dates; comply with export documentation if applicable |

| Professional Services | Sales invoice, Service agreement, Timesheets | Provide clear descriptions of services rendered; comply with billing regulations for consulting, legal, or financial services; include project codes if used |

Best Practices for Creating Compliant Invoices

What documents does a small business need for sales invoice compliance? A small business must have purchase orders, delivery receipts, and tax registration certificates to ensure sales invoice compliance. These documents help verify transactions and support tax reporting requirements.

What are the best practices for creating compliant invoices? Use clear item descriptions, include mandatory information like tax identification numbers, and follow local tax laws. Consistent formatting and timely issuance improve accuracy and legal compliance for your invoices.

Tools and Software for Invoice Compliance

Small businesses require reliable tools and software to ensure sales invoice compliance by accurately capturing transaction details and maintaining proper records. Invoicing software with built-in tax calculation, digital signature capabilities, and audit trail features helps meet regulatory requirements efficiently. Cloud-based platforms enable secure storage and easy retrieval of compliant invoices, minimizing errors and enhancing transparency during tax audits.

What Documents Does a Small Business Need for Sales Invoice Compliance? Infographic