Freelancers should attach essential documents such as a detailed work report or timesheet, proof of completed tasks or deliverables, and any prior agreements or contracts related to the project. Including receipts or expense reports is important when billing reimbursable costs. These attachments ensure transparency, facilitate payment processing, and help prevent disputes with clients.

What Documents Does a Freelancer Need to Attach to an Invoice?

| Number | Name | Description |

|---|---|---|

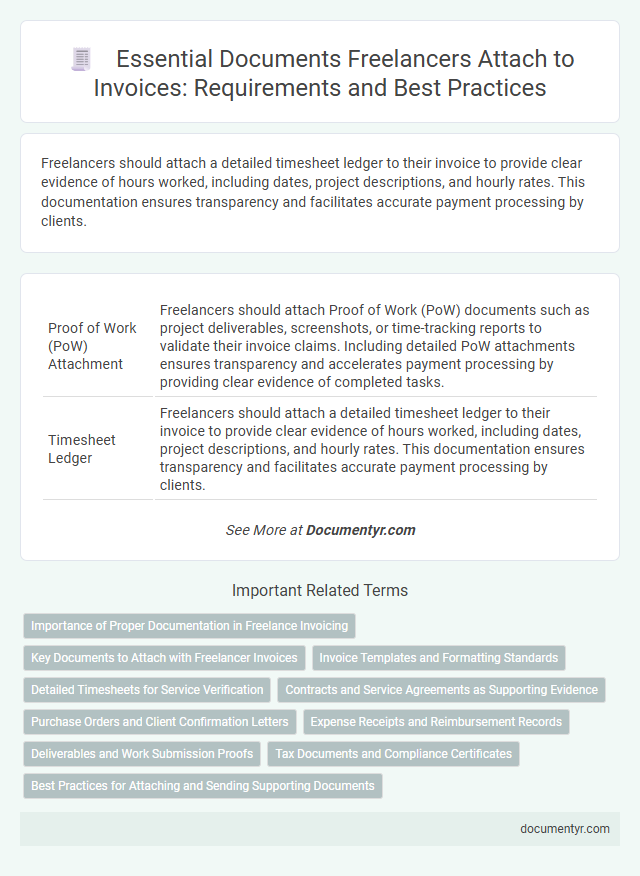

| 1 | Proof of Work (PoW) Attachment | Freelancers should attach Proof of Work (PoW) documents such as project deliverables, screenshots, or time-tracking reports to validate their invoice claims. Including detailed PoW attachments ensures transparency and accelerates payment processing by providing clear evidence of completed tasks. |

| 2 | Timesheet Ledger | Freelancers should attach a detailed timesheet ledger to their invoice to provide clear evidence of hours worked, including dates, project descriptions, and hourly rates. This documentation ensures transparency and facilitates accurate payment processing by clients. |

| 3 | Digital Source Files Link | Freelancers should attach a digital source files link to an invoice to provide clients with easy access to editable project files such as design documents, code repositories, or multimedia assets. Including this link ensures transparency, facilitates client revisions, and serves as proof of work completion tied directly to the billed amount. |

| 4 | Expense Receipts Ledger | Freelancers should attach expense receipts ledger to an invoice to provide detailed proof of costs incurred during a project, ensuring transparency and facilitating accurate reimbursement. This ledger typically includes scanned copies or digital records of receipts, dates, amounts, and descriptions of each expense related to the work performed. |

| 5 | Service Delivery Confirmation | Freelancers should attach a Service Delivery Confirmation document to their invoice, which serves as proof that the agreed services were completed and accepted by the client. This document typically includes a signed statement or email acknowledgment detailing the scope of work delivered, ensuring clarity and facilitating timely payment. |

| 6 | Milestone Completion Certificate | A Milestone Completion Certificate serves as critical proof of progress and approval for specific project phases, ensuring transparency and accountability between freelancers and clients. Attaching this document to an invoice validates the completion of agreed-upon deliverables, facilitating smoother payment processing and reducing disputes. |

| 7 | Client Approval Email PDF | Freelancers should attach a Client Approval Email PDF to their invoice as proof of project acceptance and agreement on deliverables, ensuring clear communication and reducing payment disputes. This document serves as a verified confirmation of client consent, which supports the invoice's validity during accounting and auditing processes. |

| 8 | Non-Disclosure Agreement (NDA) Acknowledgment | Freelancers should attach a Non-Disclosure Agreement (NDA) acknowledgment to their invoices to confirm the confidentiality terms between parties, ensuring sensitive information remains protected. Including this document reinforces trust and complies with contractual obligations, preventing unauthorized disclosure during the billing process. |

| 9 | Contract Amendment Snapshot | Freelancers should attach a Contract Amendment Snapshot to an invoice to clearly document any changes to the original agreement, ensuring transparency and legal clarity. This snapshot includes updated terms, revised project scope, or adjusted payment details essential for accurate billing and client verification. |

| 10 | Digital Asset Transfer Log | A Digital Asset Transfer Log must be attached to an invoice to document the delivery and ownership transfer of digital goods or services, ensuring clear evidence of transaction completion. This log typically includes detailed metadata such as timestamps, file versions, and recipient information to validate the legitimacy and scope of the transfer. |

Importance of Proper Documentation in Freelance Invoicing

Proper documentation is essential for freelancers to ensure clear communication and prompt payment. Attaching relevant documents to your invoice helps verify the work completed and supports accurate billing.

Common attachments include timesheets, project summaries, and receipts for expenses incurred during the project. These documents provide transparency and protect both parties in case of disputes or audits.

Key Documents to Attach with Freelancer Invoices

What documents should a freelancer attach to an invoice for smooth payment processing? Key documents include a detailed timesheet, proof of project completion, and any agreed-upon contracts. These attachments validate the work done and simplify client verification.

Invoice Templates and Formatting Standards

| Document Type | Description | Relevance to Invoice |

|---|---|---|

| Invoice Template | A predefined layout designed for clarity and completeness. Templates often include fields for client information, invoice number, date, services rendered, and payment terms. | Ensures consistency and professionalism, making your invoices easy to read and process. |

| Client Agreement or Contract | Proof of the work agreement outlining scope, deliverables, and payment terms. | Serves as a reference for service details and payment conditions, reducing disputes. |

| Timesheets or Work Logs | Records of hours worked or tasks completed, often used for hourly billing. | Supports billing accuracy and transparency for time-based projects. |

| Receipts for Expenses | Documents related to reimbursable costs incurred during a project. | Justifies additional charges beyond the agreed service fee. |

| Formatting Standards | Invoice design following accepted industry norms, such as clear headings, readable fonts, and logical section arrangement. | Enhances readability and compliance with accounting and tax requirements. |

Detailed Timesheets for Service Verification

Freelancers must attach detailed timesheets to an invoice to verify the services provided accurately. These timesheets break down hours worked and specific tasks completed, offering transparency to clients.

Detailed timesheets help ensure accurate billing by clearly documenting the time spent on each project component. This verification supports smoother payment processing and reduces disputes. You should maintain organized records to back up your invoice claims effectively.

Contracts and Service Agreements as Supporting Evidence

Freelancers must include relevant contracts and service agreements when submitting invoices to validate the scope and terms of their work. These documents serve as crucial supporting evidence to ensure clarity and avoid payment disputes.

- Contracts define project scope - They outline the agreed deliverables, timelines, and payment terms between the freelancer and client.

- Service agreements confirm services provided - These documents detail the specific work completed, ensuring transparency and accountability.

- Attachments support payment claims - Including contracts and agreements with the invoice substantiates the freelancer's entitlement to the invoiced amount.

Purchase Orders and Client Confirmation Letters

Freelancers must attach specific documents to their invoices to ensure smooth payment processing and clarity with clients. Purchase Orders and Client Confirmation Letters are critical attachments that validate the work and agreement.

- Purchase Orders - Official documents issued by the client authorizing the purchase and outlining the agreed-upon services and costs.

- Client Confirmation Letters - Written acknowledgments from clients confirming the completion and acceptance of the freelance work.

- Attachment Purpose - These documents serve as proof of agreement and help prevent payment disputes by clearly referencing the contracted work.

Including Purchase Orders and Client Confirmation Letters with invoices reinforces trust and ensures faster payment approval.

Expense Receipts and Reimbursement Records

Expense receipts are essential documents that verify the costs incurred during a project. Including these receipts with an invoice helps establish transparency and supports reimbursement claims.

Reimbursement records provide a clear trail of funds requested and paid for out-of-pocket expenses. Attaching these records to your invoice ensures accuracy and facilitates prompt payment from clients.

Deliverables and Work Submission Proofs

Invoices for freelancers must include clear evidence of completed work to ensure prompt payment. Providing deliverables and work submission proofs strengthens the invoice's validity and transparency.

- Final Deliverables - Attach the completed project files, such as designs, documents, or code, verifying the work performed.

- Work Submission Proofs - Include confirmation emails or platform submission receipts to demonstrate that the output was delivered and accepted.

- Milestone Completion Reports - Provide detailed progress updates or reports tied to specific payment milestones to validate partial deliveries.

Tax Documents and Compliance Certificates

Freelancers must attach essential tax documents such as a completed W-9 form or VAT registration certificate to their invoices for compliance and proper tax reporting. Including compliance certificates like business licenses or professional accreditations can validate the legitimacy of services provided. These attachments ensure transparency and facilitate smooth payment processing between freelancers and clients.

What Documents Does a Freelancer Need to Attach to an Invoice? Infographic