Contractors must attach essential documents such as a detailed copy of the purchase order, timesheets or work logs, and any approved change orders when submitting an invoice. Including receipts or proof of materials purchased can also support the billing claim. These attachments help verify the accuracy of the invoice and expedite payment processing.

What Documents Does a Contractor Need to Attach with an Invoice?

| Number | Name | Description |

|---|---|---|

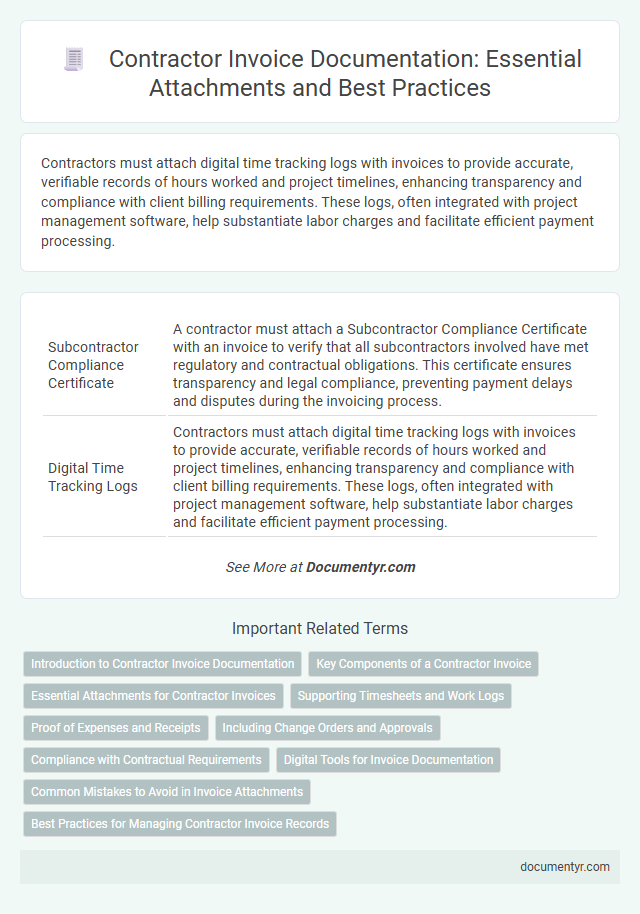

| 1 | Subcontractor Compliance Certificate | A contractor must attach a Subcontractor Compliance Certificate with an invoice to verify that all subcontractors involved have met regulatory and contractual obligations. This certificate ensures transparency and legal compliance, preventing payment delays and disputes during the invoicing process. |

| 2 | Digital Time Tracking Logs | Contractors must attach digital time tracking logs with invoices to provide accurate, verifiable records of hours worked and project timelines, enhancing transparency and compliance with client billing requirements. These logs, often integrated with project management software, help substantiate labor charges and facilitate efficient payment processing. |

| 3 | E-signature Authorization Sheet | A contractor must include an E-signature Authorization Sheet with the invoice to legally validate electronic signatures, ensuring compliance with contract terms and regulatory requirements. This document confirms the authenticity of digital approvals and facilitates secure, streamlined payment processing. |

| 4 | Automated Payment Request Form | A contractor must attach an Automated Payment Request Form with their invoice to ensure accurate and timely processing of payments. This form streamlines validation by providing essential project details, work completion status, and authorized signatures, reducing delays and errors in financial transactions. |

| 5 | Project Milestone Verification Report | Contractors must attach a Project Milestone Verification Report with their invoice to provide documented proof of completed project stages, ensuring transparency and validation of the work submitted for payment. This report details the specific milestones achieved, aligning with contract requirements and facilitating accurate and timely payment processing. |

| 6 | Electronic Delivery Confirmation | Contractors must include Electronic Delivery Confirmation documents such as signed delivery receipts, tracking information, or digital acknowledgment records to validate the receipt of goods or services. These attachments ensure invoice accuracy, facilitate payment processing, and provide proof of fulfillment in digital transactions. |

| 7 | AI-generated Work Summary | Contractors should attach an AI-generated Work Summary outlining detailed tasks, completion dates, and deliverables associated with the invoice to ensure transparency and accuracy. This summary enhances verification by providing a clear, data-driven record of performed services, facilitating faster approval and payment processing. |

| 8 | Blockchain-backed Proof of Completion | Contractors must attach blockchain-backed proof of completion with an invoice to ensure verifiable, tamper-proof evidence of project milestones and deliverables. This digital certificate, recorded on a decentralized ledger, enhances transparency and trust between contractors and clients throughout the payment process. |

| 9 | E-Waiver of Lien | Contractors must attach an E-Waiver of Lien with their invoice to electronically confirm that they waive any future lien rights on the project upon payment, ensuring clear legal protection for property owners. This digital document streamlines the billing process and verifies the contractor's release of lien rights in compliance with state regulations. |

| 10 | Smart Contract Activity Ledger | Contractors must attach a Smart Contract Activity Ledger to an invoice to provide detailed records of transaction milestones, payment schedules, and execution status verified on the blockchain. This ledger ensures transparency, accuracy, and compliance by documenting each contractual obligation fulfilled during the project. |

Introduction to Contractor Invoice Documentation

A contractor invoice serves as a formal request for payment detailing the services provided. Proper documentation ensures accuracy and facilitates smooth payment processing.

Key documents attached with a contractor invoice support verification and compliance with contract terms. These may include timesheets, purchase orders, and delivery receipts to validate the work done.

Key Components of a Contractor Invoice

| Document | Description | Importance |

|---|---|---|

| Signed Contract | Agreement outlining the scope of work, payment terms, and responsibilities. | Validates the terms under which the invoice is issued and ensures alignment on deliverables. |

| Work Completion Certificate | Proof that the contracted work or milestones have been completed satisfactorily. | Confirms that services or products have been delivered as agreed, supporting the invoice claim. |

| Timesheets or Labor Logs | Detailed record of hours worked by contractor personnel. | Provides transparency and justification for labor charges listed on the invoice. |

| Material Receipts or Purchase Orders | Evidence of materials or supplies procured that relate to the contract. | Supports charges related to materials, ensuring invoice accuracy and accountability. |

| Progress Reports | Documentation showing project milestones or percentage of completion. | Helps verify that invoiced amounts correspond with work progress. |

| Tax Identification and Compliance Documents | Tax ID numbers, VAT registration, and relevant tax certificates. | Ensures invoice meets tax regulations and facilitates proper tax processing. |

Essential Attachments for Contractor Invoices

Contractors need to attach essential documents with an invoice to ensure timely and accurate payment. These documents provide proof of work completed and help verify the billing details.

Common attachments include detailed work orders, time sheets, and delivery receipts. You should also attach signed contracts and any change order approvals to avoid payment disputes.

Supporting Timesheets and Work Logs

When submitting an invoice, contractors must include supporting timesheets and work logs to verify the hours worked and tasks completed. These documents provide detailed records that enhance the accuracy and transparency of the billing process. Including your timesheets and work logs ensures prompt payment and reduces the risk of disputes.

Proof of Expenses and Receipts

Contractors must attach relevant proof of expenses to validate the costs listed on an invoice. Receipts serve as essential documents, ensuring transparency and confirming the authenticity of incurred expenses. You should include all receipts and supporting documents to facilitate prompt and accurate payment processing.

Including Change Orders and Approvals

When submitting an invoice, a contractor must include all relevant supporting documents to ensure accurate processing and payment. Proper documentation verifies the scope of work and any modifications made during the project.

- Original Contract - This document outlines the agreed terms, scope, and payment schedule essential for invoice validation.

- Change Orders - Detailed records of approved project changes are crucial to explain variations in costs or timelines.

- Approvals and Sign-offs - Signed authorizations from clients or project managers confirm acceptance of completed work and modifications.

Attaching comprehensive documents, including change orders and approvals, helps you expedite invoice approval and payment processes.

Compliance with Contractual Requirements

Contractors must attach specific documents with an invoice to ensure full compliance with contractual requirements. Proper documentation verifies that all terms and conditions of the contract have been met accurately.

- Signed Work Completion Certificate - Confirms that the client has approved the work completed as per contract specifications.

- Timesheets and Labor Records - Provide detailed accounts of hours worked and labor costs incurred, aligning with the contract scope.

- Material and Expense Receipts - Validate expenses claimed for materials and other project-related costs outlined in the contract.

Digital Tools for Invoice Documentation

Contractors must attach specific documents to invoices to ensure accurate billing and prompt payment. Digital tools streamline the process by organizing and verifying these essential files efficiently.

- Purchase Orders - Digital systems allow contractors to upload and link purchase orders to invoices, confirming the scope of work and authorized expenses.

- Work Completion Proof - Photos, timesheets, or digital checklists serve as evidence of completed tasks and can be attached directly to electronic invoices.

- Expense Receipts - Scanned receipts and expense reports integrated via digital tools provide transparent cost verification for reimbursable items.

Common Mistakes to Avoid in Invoice Attachments

Contractors must attach relevant documents such as purchase orders, delivery receipts, and signed work completion certificates with their invoices. These attachments ensure payment accuracy and expedite the approval process.

Common mistakes include submitting incomplete documentation, attaching incorrect or unrelated files, and failing to label attachments clearly. Such errors can cause delays in payment and require additional follow-up. Carefully reviewing invoice attachments before submission avoids these pitfalls and maintains professionalism.

What Documents Does a Contractor Need to Attach with an Invoice? Infographic