Invoice compliance in international trade requires key documents such as a commercial invoice, packing list, bill of lading, and certificate of origin to ensure accurate customs clearance. Proper documentation helps verify the transaction details, including product description, value, and terms of sale, preventing delays and fines. Maintaining these documents in accordance with regulatory standards is essential for smooth cross-border shipping and legal compliance.

What Documents are Required for Invoice Compliance in International Trade?

| Number | Name | Description |

|---|---|---|

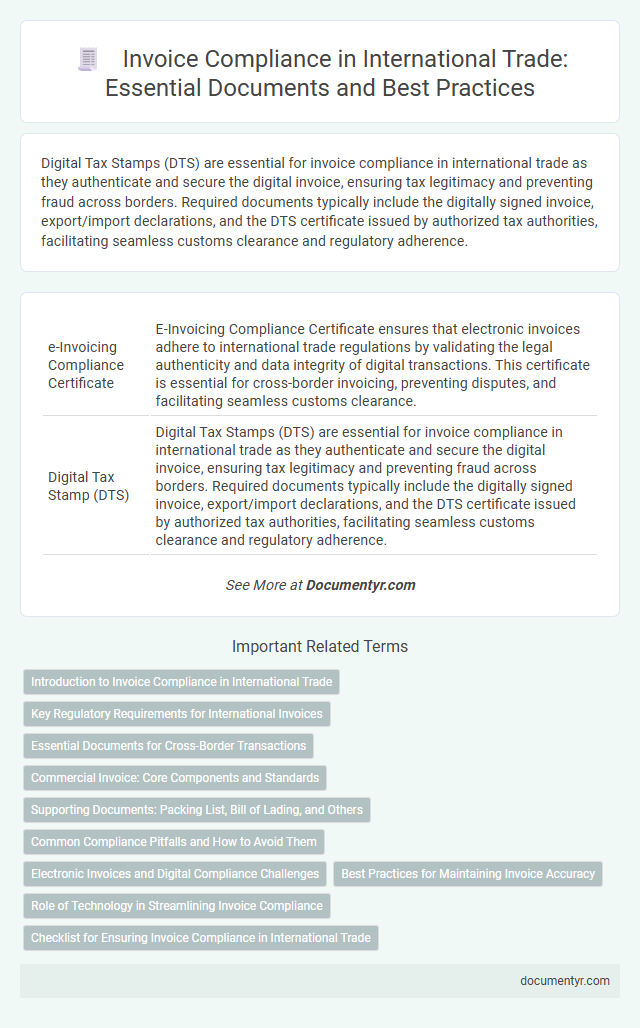

| 1 | e-Invoicing Compliance Certificate | E-Invoicing Compliance Certificate ensures that electronic invoices adhere to international trade regulations by validating the legal authenticity and data integrity of digital transactions. This certificate is essential for cross-border invoicing, preventing disputes, and facilitating seamless customs clearance. |

| 2 | Digital Tax Stamp (DTS) | Digital Tax Stamps (DTS) are essential for invoice compliance in international trade as they authenticate and secure the digital invoice, ensuring tax legitimacy and preventing fraud across borders. Required documents typically include the digitally signed invoice, export/import declarations, and the DTS certificate issued by authorized tax authorities, facilitating seamless customs clearance and regulatory adherence. |

| 3 | Invoice QR Code Validation | Invoice compliance in international trade requires essential documents such as the commercial invoice, packing list, bill of lading, and certificate of origin, with the inclusion of a validated invoice QR code to ensure authenticity and streamline customs verification. The invoice QR code validation enables fast, error-free authentication by linking detailed transaction data to official records, enhancing security and regulatory adherence across borders. |

| 4 | Cross-Border e-Document Exchange (CBEE) | Cross-Border e-Document Exchange (CBEE) requires electronic invoices, customs declarations, bills of lading, and certificates of origin to comply with international trade regulations. Strict adherence to standardized data formats such as UBL or EDIFACT ensures seamless and legally compliant document transmission across global trading partners. |

| 5 | Electronic Export Information (EEI) Filing | Electronic Export Information (EEI) filing is mandatory for shipments valued over $2,500 or those requiring an export license, ensuring accurate customs reporting and regulatory compliance in international trade. The EEI document, filed through the Automated Export System (AES), must include detailed shipment data such as the exporter's EIN, commodity description, Harmonized Tariff Schedule (HTS) code, and destination country to avoid penalties and shipment delays. |

| 6 | Global VAT ID Authentication | Global VAT ID authentication is crucial for invoice compliance in international trade, requiring accurate inclusion of valid VAT identification numbers for both exporter and importer on all cross-border invoices. Supporting documents typically include the commercial invoice, customs declaration, and proof of VAT registration to ensure proper tax validation and avoid penalties. |

| 7 | Customs Data Harmonization Sheet | The Customs Data Harmonization Sheet is a critical document required for invoice compliance in international trade, ensuring standardized data exchange between customs authorities and businesses to facilitate efficient clearance processes. It lists essential harmonized codes and detailed shipment information, aligning with international trade regulations to prevent delays and penalties. |

| 8 | Real-Time Invoice Clearance Protocol | Real-Time Invoice Clearance Protocol requires submission of digitally signed invoices, customs declaration forms, and proof of shipment documents to ensure instant validation and compliance in international trade. Electronic data interchange (EDI) systems facilitate seamless transmission and verification, reducing errors and processing time for customs authorities. |

| 9 | Blockchain-Stamped Commercial Invoice | A Blockchain-stamped commercial invoice requires a valid purchase order, shipping documents, and digital signatures securely recorded on the blockchain to ensure authenticity and tamper-proof compliance in international trade. This method enhances transparency, reduces fraud risk, and streamlines verification processes across global supply chains. |

| 10 | Sustainable Trade Declaration Annex | The Sustainable Trade Declaration Annex is essential for invoice compliance in international trade, as it certifies adherence to environmental and social standards, ensuring transparent and responsible supply chains. Required documents often include the signed annex itself, sustainability certificates, and evidence of compliance with relevant international regulations and standards. |

Introduction to Invoice Compliance in International Trade

Invoice compliance in international trade ensures that your transactions meet legal and regulatory requirements across different countries. Proper documentation prevents delays, penalties, and disputes by verifying the accuracy of product descriptions, quantities, and values. Understanding the necessary documents helps streamline customs clearance and supports smooth cross-border trade.

Key Regulatory Requirements for International Invoices

In international trade, key regulatory requirements for invoice compliance include a detailed commercial invoice containing the seller's and buyer's information, a full description of the goods, and the transaction value. Your invoice must also feature relevant customs codes, country of origin, and payment terms to meet customs and tax regulations efficiently. Proper documentation ensures smooth customs clearance, reduces delays, and avoids penalties in global transactions.

Essential Documents for Cross-Border Transactions

| Document | Description | Purpose |

|---|---|---|

| Commercial Invoice | Detailed bill issued by the exporter to the importer listing goods, quantities, and prices. | Serves as proof of sale and basis for customs declaration and tariff calculation. |

| Bill of Lading | Transport document issued by the carrier acknowledging receipt of goods for shipment. | Acts as a contract of carriage and proof of ownership of the cargo during transit. |

| Certificate of Origin | Official statement declaring the country where the goods were manufactured or produced. | Determines applicable tariffs, trade restrictions, and eligibility for trade agreements. |

| Packing List | Itemized list showing details of the goods, packaging types, and weights. | Facilitates customs inspection and inventory verification at destination. |

| Insurance Certificate | Document proving that insurance coverage is in place for the shipment. | Ensures protection against loss or damage during international transit. |

| Import/Export Licenses | Government-issued permits required for certain restricted goods. | Complies with legal regulations and controls on cross-border trade. |

| Customs Declaration | Formal statement providing detailed information about the shipment to customs authorities. | Enables customs clearance and calculation of duties and taxes. |

Commercial Invoice: Core Components and Standards

Invoice compliance in international trade depends heavily on accurate documentation. The commercial invoice serves as a critical document for customs clearance and payment processes.

- Exporter and Importer Details - Your commercial invoice must include full names, addresses, and contact information of both the exporter and importer to ensure proper identification.

- Description of Goods - Detailed descriptions, including quantity, unit price, total value, and Harmonized System (HS) codes, are essential for customs classification and valuation.

- Payment Terms and Currency - Clearly stated payment terms and the currency used in the transaction help prevent disputes and clarify financial arrangements.

Supporting Documents: Packing List, Bill of Lading, and Others

Invoice compliance in international trade requires various supporting documents to ensure smooth customs clearance and accurate transaction verification. Key documents include the packing list, bill of lading, and several additional certifications tailored to specific shipments.

The packing list details the contents, dimensions, and weight of the shipment, aiding customs agents in inspection and verification. The bill of lading serves as proof of shipment and contract of carriage between the exporter and the carrier. Other essential documents may include certificates of origin, insurance certificates, and export licenses, depending on the goods and destination requirements.

Common Compliance Pitfalls and How to Avoid Them

Invoice compliance in international trade demands precise documentation to ensure smooth customs clearance and legal adherence. Understanding common pitfalls in this process helps maintain efficiency and avoid costly delays.

- Accurate Commercial Invoice - This document must detail the buyer, seller, product descriptions, quantities, and prices clearly to prevent disputes and customs issues.

- Properly Completed Packing List - It provides essential information about shipment contents and packaging, facilitating accurate inspection and handling.

- Correct Certificates of Origin - These certify the product's manufacturing location, crucial for tariff determination and trade agreement benefits.

Ensuring your invoice and associated documents comply with international trade regulations reduces risks of compliance failures and shipment delays.

Electronic Invoices and Digital Compliance Challenges

What documents are required for invoice compliance in international trade, especially concerning electronic invoices? Electronic invoices must include detailed transaction information, such as buyer and seller identification, goods description, quantities, and pricing, to meet legal standards. Digital compliance challenges often involve adhering to different countries' regulations on data format, encryption, and electronic signature requirements.

How do electronic invoices affect compliance requirements in international trade? Electronic invoices streamline documentation processes but require robust digital infrastructure and software that can handle various formats like XML or EDI. Ensuring compliance also means understanding local tax laws and electronic invoice mandates to avoid penalties and customs delays.

What are the main digital compliance challenges associated with electronic invoicing in global trade? Challenges include ensuring interoperability between different electronic invoicing systems, maintaining data security and integrity, and meeting storage and archiving regulations. Companies must implement compliant digital solutions that support real-time invoice validation and audit trails to satisfy regulatory bodies worldwide.

Best Practices for Maintaining Invoice Accuracy

Invoice compliance in international trade requires essential documents such as the commercial invoice, packing list, bill of lading, and certificate of origin. Accurate documentation ensures smooth customs clearance and prevents delayed shipments.

Best practices for maintaining invoice accuracy include verifying product descriptions, quantities, and prices against purchase orders and shipping records. You should also ensure all regulatory requirements and tax codes are correctly applied to avoid compliance issues.

Role of Technology in Streamlining Invoice Compliance

Invoice compliance in international trade requires several key documents, including commercial invoices, packing lists, bills of lading, and certificates of origin. These documents ensure accuracy in customs clearance, taxation, and regulatory adherence.

Technology plays a critical role in streamlining invoice compliance by automating document generation, validation, and submission processes. Electronic invoicing systems reduce errors and enhance real-time tracking, improving efficiency and reliability in global transactions.

What Documents are Required for Invoice Compliance in International Trade? Infographic