To ensure invoice compliance in the EU, essential documents include a valid invoice containing the supplier's name, address, and VAT identification number, the date of issue, a unique invoice number, and a clear description of the goods or services provided. The invoice must also state the quantity, unit price, applicable VAT rate, and the total amount payable. Supporting documents such as delivery notes, contracts, and proof of payment may be required for validation and audit purposes.

What Documents are Necessary for Invoice Compliance in the EU?

| Number | Name | Description |

|---|---|---|

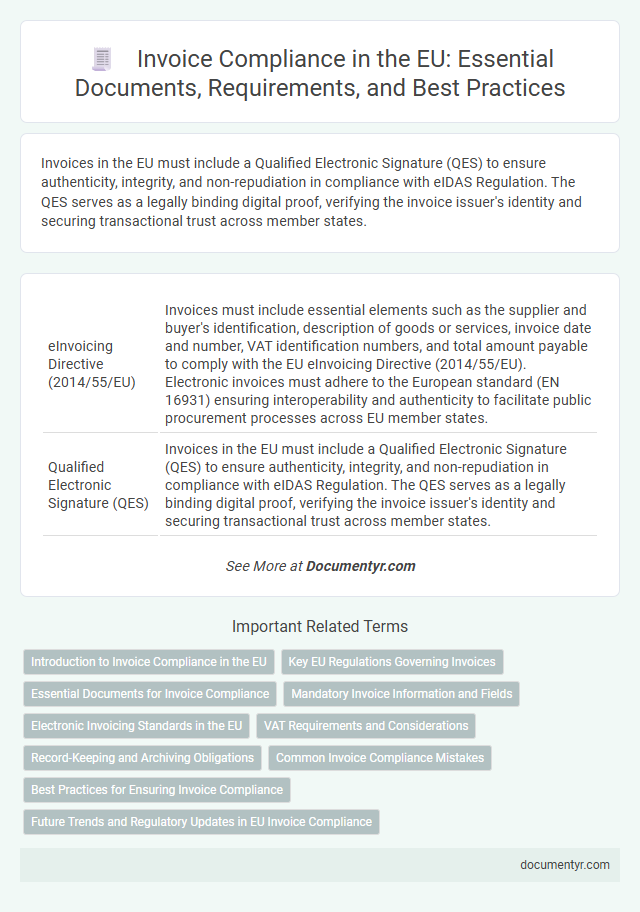

| 1 | eInvoicing Directive (2014/55/EU) | Invoices must include essential elements such as the supplier and buyer's identification, description of goods or services, invoice date and number, VAT identification numbers, and total amount payable to comply with the EU eInvoicing Directive (2014/55/EU). Electronic invoices must adhere to the European standard (EN 16931) ensuring interoperability and authenticity to facilitate public procurement processes across EU member states. |

| 2 | Qualified Electronic Signature (QES) | Invoices in the EU must include a Qualified Electronic Signature (QES) to ensure authenticity, integrity, and non-repudiation in compliance with eIDAS Regulation. The QES serves as a legally binding digital proof, verifying the invoice issuer's identity and securing transactional trust across member states. |

| 3 | Structured eInvoice (EN 16931) | Structured eInvoices complying with the EN 16931 standard must include key data elements such as supplier and buyer identification, invoice number, issue date, tax details, payment terms, and a detailed description of goods or services. To ensure EU invoice compliance, these documents must be in a machine-readable XML format adhering to the semantic data model defined by EN 16931, facilitating interoperability across member states. |

| 4 | Continuous Transaction Controls (CTC) | Continuous Transaction Controls (CTC) in the EU require invoices to include specific data elements such as supplier and buyer tax identification numbers, invoice number, date of issuance, description of goods or services, taxable amount, and VAT rate. Real-time or near-real-time transmission of these electronic invoices to tax authorities ensures compliance and facilitates automated VAT reporting and monitoring. |

| 5 | Peppol BIS Billing 3.0 | Peppol BIS Billing 3.0 requires invoices to include essential data such as buyer and supplier identification, invoice number, issue date, and detailed line item descriptions to ensure compliance with EU invoicing standards. Accurate digital signatures and VAT-related information are also mandatory to meet regulatory requirements and facilitate seamless cross-border transactions within the EU. |

| 6 | VAT-Inclusive Invoice (VAT Directive 2006/112/EC) | A VAT-inclusive invoice under the EU VAT Directive 2006/112/EC must contain the supplier's name and address, the customer's identification, a unique invoice number, date of issue, description of goods or services, quantity, the VAT rate applied, and the total VAT amount charged. Compliance also requires displaying the supplier's VAT identification number and the total invoice amount including VAT to ensure proper tax reporting and validation within EU member states. |

| 7 | Clearance Model Compliance | Invoice compliance in the EU under the Clearance Model requires submission of electronic invoices containing mandatory data elements such as supplier and buyer VAT numbers, invoice date, unique invoice number, detailed description of goods or services, tax rates, and total amounts. These documents must be transmitted through the designated tax authority clearance system to validate authenticity, integrity, and compliance before final delivery to the customer. |

| 8 | Real-Time Reporting (RTR) | Invoices in the EU must include essential data elements such as supplier and customer VAT numbers, invoice date, unique invoice identifier, description of goods or services, quantities, prices, and VAT rates to ensure Real-Time Reporting (RTR) compliance. Electronic invoicing systems integrated with tax authorities' platforms enable immediate transmission of invoice data, facilitating accurate VAT reporting and minimizing fraud risks under EU digital tax regulations. |

| 9 | Electronic Archiving Mandates | Electronic archiving mandates in the EU require invoices to be stored in a digital format that ensures authenticity, integrity, and legibility over the entire retention period, typically 10 years. Required documents for invoice compliance include the original electronic invoice, accompanying metadata, and evidence of secure, timestamped storage matching EU e-invoicing standards such as the eIDAS regulation. |

| 10 | Unique Invoice Identifier (UUID) | The Unique Invoice Identifier (UUID) is a mandatory component for invoice compliance in the EU, ensuring each invoice is distinctly recognizable and traceable within the electronic invoicing framework. Proper inclusion of the UUID facilitates accurate tax reporting, audit processes, and regulatory adherence across all member states. |

Introduction to Invoice Compliance in the EU

Invoice compliance in the EU requires adherence to specific documentation standards set by tax authorities. These documents ensure accurate tax reporting and legal validity across member states. Understanding the necessary paperwork helps your business maintain compliance and avoid penalties.

Key EU Regulations Governing Invoices

Compliance with invoice regulations in the EU requires adherence to specific documentation standards. Understanding the key EU regulations governing invoices is essential for accurate and lawful invoicing.

- Directive 2010/45/EU - This directive outlines the requirements for electronic invoicing and mandates essential invoice details for VAT purposes.

- VAT Directive 2006/112/EC - It establishes the core VAT invoicing rules, including mandatory information such as invoice date, supplier and customer identification, and VAT amounts.

- eInvoicing Standards - The EU promotes standardized electronic invoicing formats like PEPPOL to ensure interoperability and compliance across member states.

Essential Documents for Invoice Compliance

Essential documents for invoice compliance in the EU include a valid invoice containing the seller's and buyer's names and VAT identification numbers. The invoice must clearly state the date of issue, a unique invoice number, the description of goods or services provided, and the corresponding amounts excluding and including VAT. Supporting documents such as purchase orders or delivery notes may be required to validate the transaction and ensure full legal compliance.

Mandatory Invoice Information and Fields

Invoice compliance in the EU requires adherence to specific mandatory information and fields. These ensure legal validity and facilitate tax reporting across member states.

Your invoice must include the seller's and buyer's full names and addresses, a unique invoice number, and the date of issue. It also requires a detailed description of goods or services supplied along with the quantity and price excluding tax.

Electronic Invoicing Standards in the EU

What documents are necessary for invoice compliance in the EU? In the European Union, electronic invoicing standards require specific documentation to ensure legality and tax compliance. Your electronic invoice must include key elements such as the supplier's and buyer's identification, invoice date, unique invoice number, detailed description of goods or services, VAT rates, and total amounts.

VAT Requirements and Considerations

Invoice compliance in the EU requires specific documentation to meet VAT regulations. Essential documents include a valid invoice that clearly states VAT details as per the European Union guidelines.

Your invoice must include the supplier's name, address, and VAT identification number. It should also display the invoice date, a unique invoice number, a detailed description of goods or services, and the VAT rate applied. Accurate inclusion of these elements ensures compliance and facilitates proper VAT reporting and recovery.

Record-Keeping and Archiving Obligations

Invoices in the EU must include specific details such as the seller's and buyer's information, invoice number, date of issue, description of goods or services, and VAT details to ensure compliance. Accurate record-keeping is essential for audit trails and tax verification purposes.

Your business is required to archive invoices securely for a minimum of 10 years, depending on the member state's regulations. Electronic and paper formats must be stored in a manner that guarantees authenticity, integrity, and readability throughout the retention period.

Common Invoice Compliance Mistakes

| Necessary Documents for Invoice Compliance in the EU | Common Invoice Compliance Mistakes |

|---|---|

|

|

Best Practices for Ensuring Invoice Compliance

Invoices in the EU must meet strict compliance standards to ensure legal validity and facilitate tax audits. Proper documentation and accuracy are critical for adherence to these regulations.

- Mandatory Information - Invoices must include specific details such as seller and buyer information, invoice date, unique invoice number, description of goods or services, quantity, unit price, VAT rate, and total amount.

- Retention of Records - Businesses must securely store invoice copies for at least 10 years to comply with EU tax authority requirements and enable effective auditing.

- Digital Signature and Format - Electronic invoices require qualified digital signatures or secure electronic data interchange (EDI) to ensure authenticity and integrity.

Following these best practices minimizes compliance risks and supports seamless VAT reclaim processes across EU member states.

What Documents are Necessary for Invoice Compliance in the EU? Infographic