Cross-border invoice transactions require essential documents such as the commercial invoice, bill of lading, and certificate of origin to ensure smooth customs clearance and payment processing. Accurate documentation includes detailed descriptions of goods, quantities, prices, and shipping terms to comply with international trade regulations. Properly prepared invoices reduce delays, prevent disputes, and facilitate efficient tracking across borders.

What Documents are Needed for Cross-Border Invoice Transactions?

| Number | Name | Description |

|---|---|---|

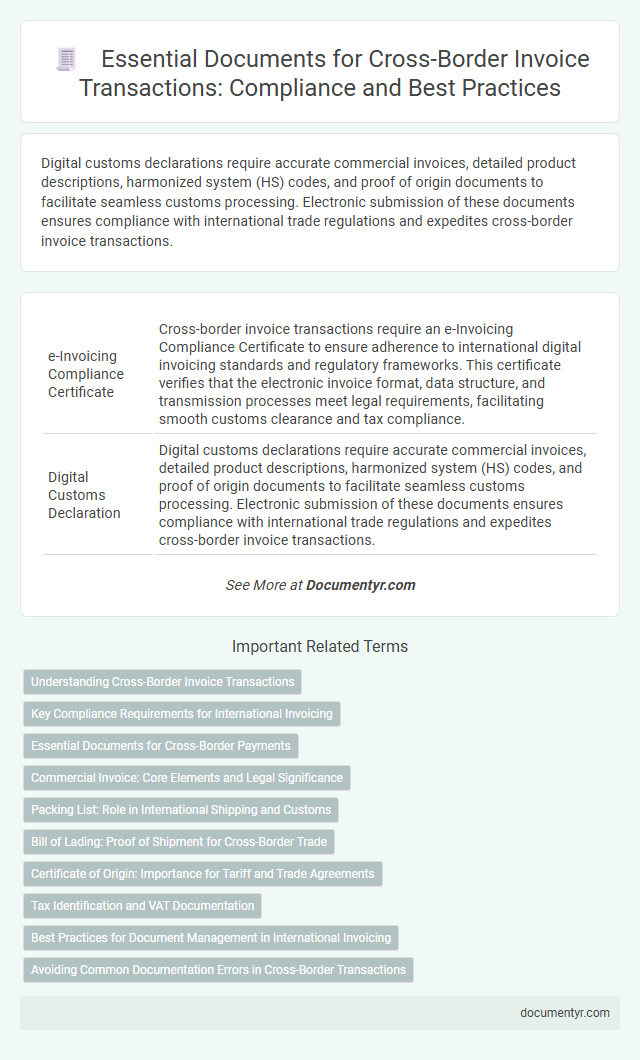

| 1 | e-Invoicing Compliance Certificate | Cross-border invoice transactions require an e-Invoicing Compliance Certificate to ensure adherence to international digital invoicing standards and regulatory frameworks. This certificate verifies that the electronic invoice format, data structure, and transmission processes meet legal requirements, facilitating smooth customs clearance and tax compliance. |

| 2 | Digital Customs Declaration | Digital customs declarations require accurate commercial invoices, detailed product descriptions, harmonized system (HS) codes, and proof of origin documents to facilitate seamless customs processing. Electronic submission of these documents ensures compliance with international trade regulations and expedites cross-border invoice transactions. |

| 3 | Electronic Advance Shipping Notice (e-ASN) | Electronic Advance Shipping Notice (e-ASN) is essential for cross-border invoice transactions as it provides detailed shipment information prior to delivery, facilitating customs clearance and inventory management. Integrating e-ASN with invoices ensures accurate tracking, reduces delays, and enhances compliance with international trade regulations. |

| 4 | Blockchain-Authenticated Trade Document | Cross-border invoice transactions require blockchain-authenticated trade documents, including the original invoice, bill of lading, and customs declaration, which provide tamper-proof verification and enhance transparency for international payment settlements. These documents, stored on a blockchain ledger, ensure data integrity, reduce fraud risks, and streamline customs clearance processes by enabling real-time access and validation across all involved parties. |

| 5 | Digital Certificate of Origin | A Digital Certificate of Origin is essential for cross-border invoice transactions to verify the country where goods are produced, facilitating customs clearance and preferential tariff application. This electronic document must be issued by authorized chambers of commerce and securely linked to the digital invoice for seamless international trade compliance. |

| 6 | Automated Export System (AES) Filing Receipt | Cross-border invoice transactions require an Automated Export System (AES) Filing Receipt to confirm electronic export data submission to U.S. Customs and Border Protection, ensuring compliance with export regulations. This document validates export details such as shipment date, commodity classification, and destination, facilitating smooth customs clearance and accurate trade reporting. |

| 7 | Invoice Reference Data XML | Invoice Reference Data XML is essential for cross-border invoice transactions as it standardizes the exchange of invoice details like supplier identification, transaction data, tax information, and monetary values across different jurisdictions. This document facilitates compliance with international regulations, ensuring accurate customs declarations and smooth financial reconciliation between trading partners. |

| 8 | Tax Authority e-Validation Token | Cross-border invoice transactions require a Tax Authority e-Validation Token to authenticate and validate the invoice electronically, ensuring compliance with international tax regulations and minimizing the risk of fraud. Essential supporting documents include the invoice itself, proof of shipment or delivery, customs declarations, and any applicable tax certificates to facilitate seamless tax authority verification. |

| 9 | PEPPOL Network Access Receipt | Cross-border invoice transactions via the PEPPOL network require the PEPPOL Network Access Receipt as a crucial document to verify successful message delivery between trading partners. This access receipt ensures compliance with electronic invoicing standards and provides legal proof of invoice submission across international borders. |

| 10 | Smart Contract-Enabled Letter of Credit | Cross-border invoice transactions utilizing Smart Contract-Enabled Letters of Credit require documents such as the commercial invoice, bill of lading, certificate of origin, and a digitally signed smart contract embedded with payment terms and conditions. These documents ensure compliance, automate payment release upon fulfillment of contract milestones, and enhance security through blockchain verification. |

Understanding Cross-Border Invoice Transactions

Cross-border invoice transactions require specific documentation to ensure smooth processing and compliance with international trade regulations. These documents provide essential details about the goods, services, and parties involved in the transaction.

Key documents include the commercial invoice, packing list, and bill of lading, each facilitating customs clearance and shipment tracking. Accurate invoices help prevent delays, reduce risks of disputes, and ensure proper tax and duty calculations in cross-border trade.

Key Compliance Requirements for International Invoicing

Cross-border invoice transactions require strict adherence to key compliance requirements to ensure smooth processing and avoid legal issues. Proper documentation supports accurate customs clearance and tax compliance in international trade.

- Commercial Invoice - This document details the buyer, seller, product description, quantity, and price, serving as the primary evidence of the transaction.

- Bill of Lading - Acts as a contract and receipt for shipped goods, verifying shipment details and facilitating ownership transfer.

- Customs Declaration - Required to comply with customs authorities, this document ensures the proper assessment of duties and taxes on imported or exported goods.

Essential Documents for Cross-Border Payments

| Document | Description | Purpose |

|---|---|---|

| Commercial Invoice | Detailed statement of goods or services provided, including quantities, prices, and terms | Serves as the primary record for customs clearance and payment processing |

| Bill of Lading | Legal document issued by the carrier to acknowledge receipt of cargo for shipment | Confirms shipment and transfer of goods ownership; essential for customs and delivery validation |

| Certificate of Origin | Official document verifying the country where the goods were manufactured or produced | Used to determine tariffs, trade policies, and eligibility for preferential duty rates |

| Proforma Invoice | Preliminary invoice sent before shipment to specify details of goods, prices, and payment terms | Facilitates payment arrangements and import licensing requirements |

| Customs Declaration | Document submitted to customs authorities declaring the nature, quantity, and value of goods imported or exported | Required for legal clearance and calculation of duties and taxes |

| Import/Export License | Authorization granted by a government agency allowing the import or export of specific goods | Ensures compliance with national trade regulations and restrictions |

| Insurance Certificate | Proof of insurance coverage for goods in transit against loss or damage | Provides financial protection and fulfills contractual or legal obligations |

Commercial Invoice: Core Elements and Legal Significance

A commercial invoice is a vital document in cross-border invoice transactions, detailing the sale and terms between exporter and importer. Core elements include the seller and buyer information, detailed description of goods, quantity, price, payment terms, and shipment details. This document holds legal significance by serving as proof of sale, a basis for customs clearance, and a key reference for tax and duty assessments in international trade.

Packing List: Role in International Shipping and Customs

The packing list is a crucial document in cross-border invoice transactions, detailing the contents and specifications of a shipment. It facilitates smooth customs clearance and accurate cargo handling during international shipping.

- Identification of Contents - The packing list itemizes each product, quantity, and packaging type to verify shipment details.

- Customs Compliance - It supports customs authorities by providing precise information required for duties and inspections.

- Logistics Coordination - The packing list aids carriers and freight forwarders in managing cargo efficiently throughout transit.

Accurate packing lists minimize delays and enhance transparency in cross-border trading processes.

Bill of Lading: Proof of Shipment for Cross-Border Trade

What documents are required for cross-border invoice transactions? A comprehensive invoice process demands accurate documentation to ensure smooth customs clearance and payment verification. The Bill of Lading serves as crucial proof of shipment in international trade, confirming the goods have been dispatched.

Certificate of Origin: Importance for Tariff and Trade Agreements

The Certificate of Origin is a crucial document in cross-border invoice transactions. It certifies the country where the goods were manufactured, impacting tariff application and trade compliance.

This certificate helps customs authorities determine the correct duties and taxes based on trade agreements between countries. It supports eligibility for preferential tariffs under trade agreements like USMCA, EU trade deals, or ASEAN Free Trade Area. Without it, shipments may face delays, higher tariffs, or rejection by customs.

Tax Identification and VAT Documentation

For cross-border invoice transactions, tax identification numbers are essential to verify the legitimacy of both parties involved. VAT documentation must include accurate VAT registration details to ensure compliance with international tax regulations. You should provide these documents to streamline customs clearance and avoid tax-related disputes.

Best Practices for Document Management in International Invoicing

Cross-border invoice transactions require several essential documents, including commercial invoices, packing lists, and bills of lading. Proper documentation ensures compliance with customs regulations and facilitates smooth international trade.

Best practices for document management in international invoicing involve digitizing records and maintaining organized, accessible files. Implementing secure cloud-based storage solutions helps reduce errors and expedites the verification process during audits and customs checks.

What Documents are Needed for Cross-Border Invoice Transactions? Infographic