Accountants require detailed invoices, payment receipts, and supporting documentation such as purchase orders and contracts to conduct thorough year-end invoice audits. They also need bank statements and expense reports to verify transaction accuracy and ensure compliance with financial regulations. Accurate record-keeping of these documents helps streamline the audit process and prevents discrepancies.

What Documents Does an Accountant Need for Year-End Invoice Audits?

| Number | Name | Description |

|---|---|---|

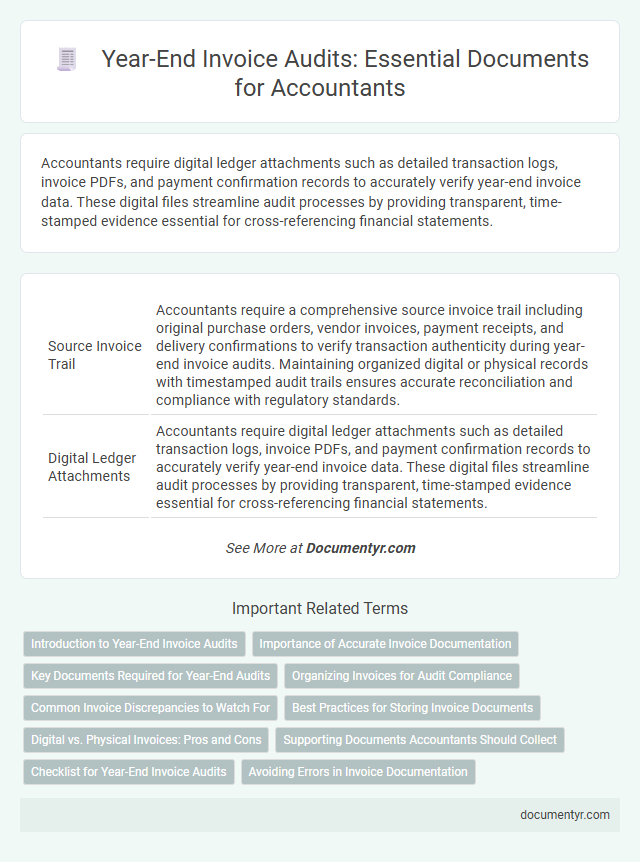

| 1 | Source Invoice Trail | Accountants require a comprehensive source invoice trail including original purchase orders, vendor invoices, payment receipts, and delivery confirmations to verify transaction authenticity during year-end invoice audits. Maintaining organized digital or physical records with timestamped audit trails ensures accurate reconciliation and compliance with regulatory standards. |

| 2 | Digital Ledger Attachments | Accountants require digital ledger attachments such as detailed transaction logs, invoice PDFs, and payment confirmation records to accurately verify year-end invoice data. These digital files streamline audit processes by providing transparent, time-stamped evidence essential for cross-referencing financial statements. |

| 3 | eReceipts Reconciliation Sheets | Accountants require eReceipts Reconciliation Sheets for year-end invoice audits to verify digital transaction accuracy and ensure all electronic payments are properly documented. These sheets facilitate cross-checking of eReceipts against invoice records, enhancing financial transparency and compliance. |

| 4 | Automated Approval Logs | Automated approval logs provide a detailed record of invoice authorizations, capturing timestamps, approver identities, and any modifications, which are essential for verifying compliance during year-end audits. These logs streamline the audit process by ensuring transparency and enabling quick validation of invoice approvals against company policies. |

| 5 | Vendor KYC Compliance Documents | Accountants require vendor KYC compliance documents such as government-issued identification, business registration certificates, tax identification numbers, and bank account details to verify vendor legitimacy during year-end invoice audits. These documents ensure accurate validation of vendor information and compliance with regulatory standards to prevent fraud and maintain financial integrity. |

| 6 | Tax Mapping Annotations | Accountants require tax mapping annotations that clearly link invoice line items to relevant tax codes and categories for accurate year-end invoice audits. These documents ensure compliance with tax regulations and facilitate efficient reconciliation of taxable amounts during financial reviews. |

| 7 | Expense Category Justifications | Accountants require detailed invoices, receipts, and supporting documentation categorized by expense type such as travel, office supplies, and utilities to verify legitimacy during year-end invoice audits. Proper expense category justifications ensure compliance with tax regulations and facilitate accurate financial reporting. |

| 8 | AI-Flagged Discrepancy Reports | Accountants require AI-flagged discrepancy reports that highlight anomalies in invoice data to efficiently identify potential errors or fraud during year-end audits. These reports, combined with original invoices and payment records, ensure thorough verification and compliance with financial regulations. |

| 9 | Blockchain-stamped Invoices | Accountants require blockchain-stamped invoices, which provide immutable and tamper-proof proof of transactions, ensuring accuracy and transparency during year-end invoice audits. These documents must be accompanied by corresponding transaction records, smart contract data, and digital signatures to verify authenticity and compliance with regulatory standards. |

| 10 | Payment Integration Proofs | Accountants require payment integration proofs such as bank statements, transaction confirmation receipts, and payment gateway reports to verify the accuracy of year-end invoice audits. These documents ensure seamless reconciliation between invoiced amounts and received payments, supporting compliance and financial transparency. |

Introduction to Year-End Invoice Audits

What documents does an accountant need for year-end invoice audits? Year-end invoice audits require a comprehensive collection of financial records to ensure accuracy and compliance. Accountants rely on detailed invoices, payment records, and supporting documentation to verify transactions effectively.

Importance of Accurate Invoice Documentation

Accurate invoice documentation is essential for a successful year-end audit. Clear and complete records ensure all financial transactions are verified efficiently.

Your accountant needs access to original invoices, purchase orders, and payment confirmations. These documents support the accuracy of reported expenses and revenues.

Key Documents Required for Year-End Audits

Year-end invoice audits require a collection of specific documents to ensure accuracy and compliance. Proper preparation of these documents can streamline the audit process significantly.

- Invoices and Receipts - Detailed records of all issued and received invoices provide the foundation for audit verification.

- Bank Statements - Bank statements help reconcile payments and validate transaction authenticity.

- Purchase Orders - Purchase orders support the legitimacy of invoices by confirming prior authorization of purchases.

Organizing Invoices for Audit Compliance

| Document Type | Purpose | Key Details |

|---|---|---|

| Original Invoices | Primary proof of transactions | Clearly display date, vendor name, items/services, amounts, and payment terms |

| Payment Receipts | Verification of invoice settlements | Include payment method, date, and reference to corresponding invoice numbers |

| Purchase Orders | Validate the authorization of purchases | Match purchase orders to invoices to ensure consistency in quantity and pricing |

| Expense Reports | Support employee-related invoice claims | Include approval signatures and detailed descriptions linked to specific invoices |

| Vendor Agreements | Confirm contract terms and rates | Ensure documented agreements align with invoiced amounts and billing cycles |

| Organized Filing System | Facilitate efficient audit reviews | Invoices sorted by date, vendor, and payment status; digitized copies backed up securely |

| Reconciliation Statements | Cross-check invoices against accounting records | Highlight discrepancies and confirm accurate ledger entries |

| Communication Records | Provide context for any invoice disputes or adjustments | Include emails, letters, or notes related to invoice clarifications or corrections |

Common Invoice Discrepancies to Watch For

Year-end invoice audits require thorough documentation to ensure accuracy and compliance. Understanding common invoice discrepancies helps you prepare necessary records effectively.

- Duplicate Invoices - Repeated billing entries can inflate expenses and lead to incorrect financial reporting.

- Mismatched Purchase Orders - Invoices that do not align with purchase orders may indicate unauthorized purchases or errors.

- Incorrect Tax Calculations - Errors in sales tax or VAT amounts can cause compliance issues and financial penalties.

Providing clear documentation and addressing these discrepancies streamlines your year-end audit process.

Best Practices for Storing Invoice Documents

Accountants require organized and complete invoice documents for accurate year-end audits. Best practices for storing invoices include using digital filing systems with clear labels and secure backups. Maintaining chronological order and easy retrieval saves time and ensures compliance during the audit process.

Digital vs. Physical Invoices: Pros and Cons

Accountants require comprehensive documentation for year-end invoice audits, including both digital and physical invoices to ensure accuracy and compliance. Digital invoices offer easy storage, quick retrieval, and enhanced security features, making audit processes more efficient. Physical invoices provide a tangible audit trail but can be prone to loss, damage, and slower access, impacting the overall audit timeline.

Supporting Documents Accountants Should Collect

Year-end invoice audits require a thorough review of supporting documents to ensure accuracy and compliance. Collecting the right paperwork helps streamline the audit process and minimizes discrepancies.

- Original Invoices - These provide evidence of transactions and are essential for verifying billed amounts and dates.

- Purchase Orders - Serve as authorization for expenditures and help match invoices to approved requests.

- Payment Records - Demonstrate proof of payment and assist in confirming that invoices have been settled correctly.

Checklist for Year-End Invoice Audits

Accountants require specific documents to conduct accurate year-end invoice audits. These documents ensure the validation of financial transactions and compliance with accounting standards.

A comprehensive checklist for year-end invoice audits includes purchase orders, vendor invoices, and payment receipts. Bank statements and general ledger entries also play crucial roles in verifying the accuracy of recorded transactions. Maintaining organized documentation helps streamline the audit process and reduces the risk of discrepancies.

What Documents Does an Accountant Need for Year-End Invoice Audits? Infographic