A contractor needs to verify supporting documents such as purchase orders, delivery receipts, and service completion certificates with an invoice to ensure accuracy and legitimacy. Proper verification helps confirm that the billed items or services match the agreed terms and quantities. Maintaining detailed records of these documents is essential for audit compliance and smooth payment processing.

What Documents Does a Contractor Need to Verify with an Invoice?

| Number | Name | Description |

|---|---|---|

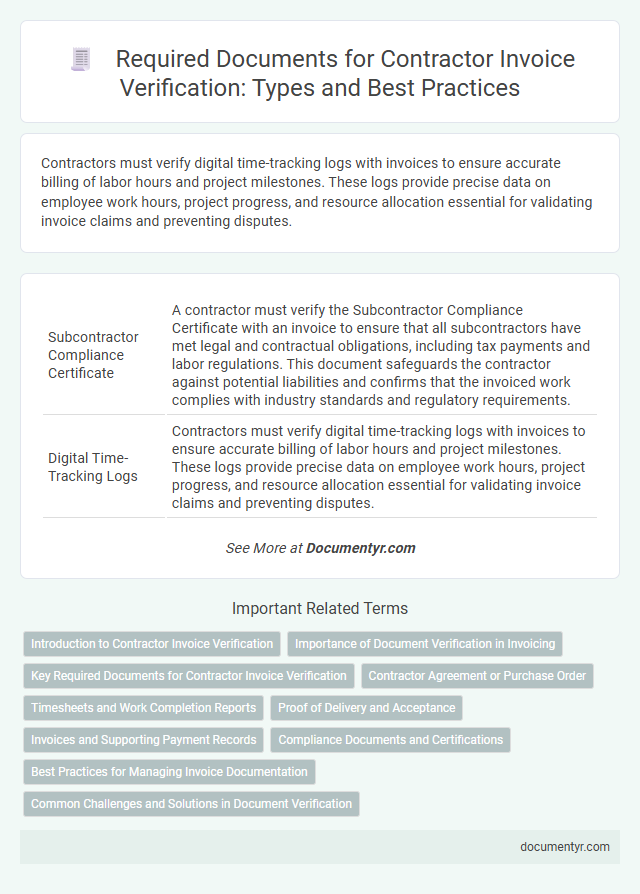

| 1 | Subcontractor Compliance Certificate | A contractor must verify the Subcontractor Compliance Certificate with an invoice to ensure that all subcontractors have met legal and contractual obligations, including tax payments and labor regulations. This document safeguards the contractor against potential liabilities and confirms that the invoiced work complies with industry standards and regulatory requirements. |

| 2 | Digital Time-Tracking Logs | Contractors must verify digital time-tracking logs with invoices to ensure accurate billing of labor hours and project milestones. These logs provide precise data on employee work hours, project progress, and resource allocation essential for validating invoice claims and preventing disputes. |

| 3 | Electronic Purchase Orders (EPOs) | Contractors must verify Electronic Purchase Orders (EPOs) with invoices to ensure accuracy in quantities, pricing, and order details, matching them precisely with contract terms. This verification prevents payment discrepancies and supports seamless transaction auditing by validating the EPO against delivery receipts and payment records. |

| 4 | Material Certification Sheets | Contractors need to verify material certification sheets with an invoice to ensure that all supplied materials meet project specifications and comply with industry standards such as ASTM or ISO. These documents confirm the quality, origin, and compliance of materials, which is critical for project audits and regulatory approvals. |

| 5 | AI-Powered Audit Trails | Contractors need to verify purchase orders, delivery receipts, and payment authorizations to ensure invoice accuracy while leveraging AI-powered audit trails for automated discrepancy detection and transaction validation. These advanced systems enhance compliance by providing real-time tracking and immutable records of all invoice-related documents. |

| 6 | Blockchain-Stamped Delivery Notes | Contractors must verify blockchain-stamped delivery notes alongside invoices to ensure authenticity, traceability, and tamper-proof confirmation of goods or services delivered. These documents provide an immutable digital record that aligns transaction details with invoice data, reducing disputes and enhancing payment accuracy. |

| 7 | E-Signature Summary Documents | A contractor needs to verify the e-signature summary documents accompanying an invoice to ensure authenticity and compliance with contract terms. These documents confirm the validity of digital approvals, providing legal assurance and streamlining payment processing. |

| 8 | Insurance Endorsement Addenda | Contractors need to verify the Insurance Endorsement Addenda accompanying an invoice to ensure compliance with project insurance requirements and coverage limits. These documents confirm that the insurance policies meet contractual obligations, protecting both parties from potential liabilities during the project. |

| 9 | Retention Release Confirmation | Contractors must verify Retention Release Confirmations with invoices to ensure that withheld retention amounts are accurately documented and authorized for payment release. This document validates the contractor's eligibility to receive withheld funds, preventing payment disputes and ensuring compliance with project contract terms. |

| 10 | Smart Contract Verification Report | A contractor must verify the Smart Contract Verification Report alongside the invoice to ensure all terms and deliverables are accurately met according to the blockchain-based agreement. This report confirms the authenticity, compliance, and execution status of the smart contract, preventing discrepancies and payment disputes. |

Introduction to Contractor Invoice Verification

| Introduction to Contractor Invoice Verification | |

|---|---|

| Purpose of Verification | Ensures accuracy and legitimacy of charges submitted by contractors. |

| Key Documents Required | Purchase orders, signed contracts, timesheets, delivery receipts, and expense reports. |

| Verification Process | Compare invoice details against contract terms and supporting documentation to confirm correctness. |

| Importance for You | Protects against overbilling and fraud while maintaining clear financial records. |

Importance of Document Verification in Invoicing

Contractors must verify essential documents like purchase orders, delivery receipts, and work completion certificates when processing invoices. Accurate document verification ensures all billed items and services are valid and authorized.

Proper verification prevents payment disputes and supports transparent financial records for both contractors and clients. This process is crucial for maintaining trust and ensuring timely, accurate payments in project management.

Key Required Documents for Contractor Invoice Verification

Contractors must verify several key documents to ensure the accuracy and legitimacy of an invoice. These typically include the purchase order, proof of delivery, and timesheets or work completion reports.

Purchase orders confirm the authorized services or materials, while proof of delivery validates that goods or services were received. Timesheets or work reports provide evidence of labor hours and project progress, essential for accurate invoicing.

Contractor Agreement or Purchase Order

Contractors must verify the Contractor Agreement or Purchase Order when reviewing an invoice to ensure all billed services align with the agreed terms. These documents outline the scope, pricing, and payment schedules critical for accurate invoice validation. Reviewing your Contractor Agreement or Purchase Order helps prevent discrepancies and supports timely, correct payments.

Timesheets and Work Completion Reports

Contractors must verify timesheets to confirm the exact hours worked on a project before approving an invoice. Work Completion Reports provide critical evidence that tasks have been finished according to contract specifications. Reviewing these documents ensures accurate billing and prevents payment disputes.

Proof of Delivery and Acceptance

What documents does a contractor need to verify with an invoice to ensure proper Proof of Delivery and Acceptance?

Contractors must provide delivery receipts or signed delivery notes as evidence of Proof of Delivery. Proof of Acceptance typically requires client-signed acceptance forms or confirmation emails verifying that the work or goods meet agreed standards.

Invoices and Supporting Payment Records

Contractors must verify the invoice details to ensure accurate payment processing. Key documents include the invoice itself and supporting payment records such as purchase orders and delivery receipts.

Invoices provide a breakdown of services rendered or goods supplied, serving as the primary proof of the transaction. Supporting payment records verify the legitimacy and terms agreed upon, confirming quantities, prices, and deadlines. These documents collectively prevent discrepancies and facilitate timely contractor payments.

Compliance Documents and Certifications

Contractors must verify several compliance documents and certifications when submitting an invoice to ensure accuracy and legal adherence. These documents confirm that the work complies with relevant regulations and standards before payment is processed.

- Licenses and Permits - Confirm that all necessary business licenses and permits are valid and up to date for the contracted work.

- Insurance Certificates - Verify that liability insurance and worker's compensation certificates are current to protect against potential claims.

- Safety and Compliance Certifications - Ensure that safety standards and industry-specific compliance certifications are documented and attached to support the invoice.

Best Practices for Managing Invoice Documentation

Accurate invoice documentation is essential for contractors to ensure timely payment and maintain transparency. Verifying the correct documents with an invoice reduces errors and supports clear financial records.

- Purchase Orders - Confirm that the invoice matches the purchase order details to validate the scope of work and agreed pricing.

- Work Completion Certificates - Verify these certificates to ensure the services or projects billed have been completed as specified.

- Timesheets and Material Receipts - Cross-check timesheets for labor hours and material receipts to substantiate the charges listed on the invoice.

What Documents Does a Contractor Need to Verify with an Invoice? Infographic