Invoice reconciliation requires several key documents to ensure accuracy, including the original invoice, purchase order, and receiving reports. These documents help verify that the billed items match the goods or services received and agree with the terms of the purchase agreement. Accurate reconciliation prevents payment errors and ensures proper financial record-keeping.

What Documents Are Required for Invoice Reconciliation?

| Number | Name | Description |

|---|---|---|

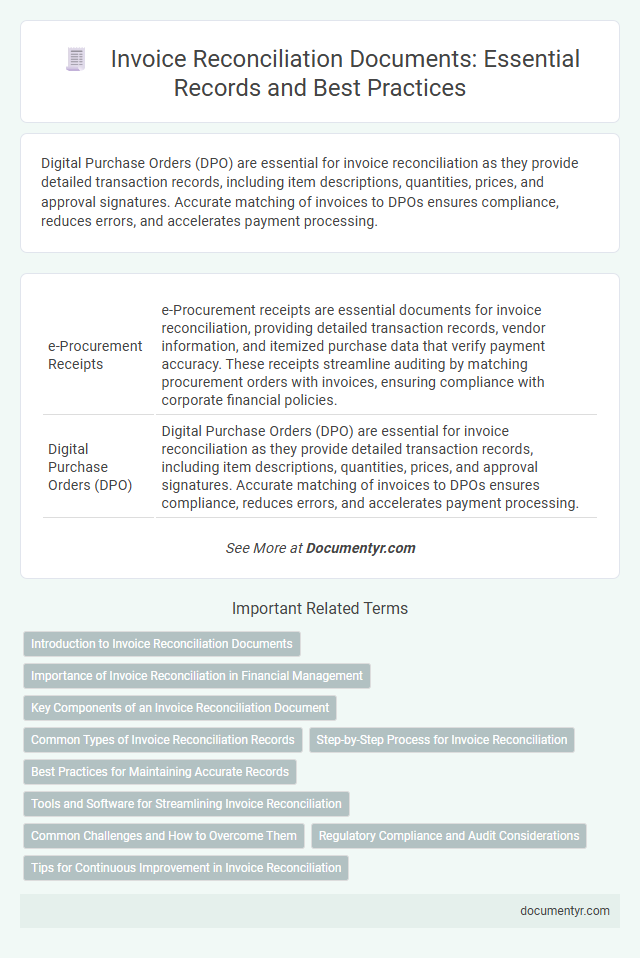

| 1 | e-Procurement Receipts | e-Procurement receipts are essential documents for invoice reconciliation, providing detailed transaction records, vendor information, and itemized purchase data that verify payment accuracy. These receipts streamline auditing by matching procurement orders with invoices, ensuring compliance with corporate financial policies. |

| 2 | Digital Purchase Orders (DPO) | Digital Purchase Orders (DPO) are essential for invoice reconciliation as they provide detailed transaction records, including item descriptions, quantities, prices, and approval signatures. Accurate matching of invoices to DPOs ensures compliance, reduces errors, and accelerates payment processing. |

| 3 | Three-Way Match Audit Trail | Invoice reconciliation requires a three-way match audit trail consisting of the purchase order, receiving report, and the vendor's invoice to verify accuracy and prevent payment errors. This process ensures the quantities, prices, and terms align across all documents, creating a reliable record for financial audits and compliance. |

| 4 | Electronic Goods Receipt Notice (e-GRN) | The Electronic Goods Receipt Notice (e-GRN) is a critical document required for invoice reconciliation as it confirms the receipt of goods by the buyer and links the delivery details with the invoice. Accurate matching of the invoice with the e-GRN ensures validation of quantities, specifications, and delivery dates, facilitating seamless payment processing and audit compliance. |

| 5 | Blockchain-Stamped Delivery Notes | Invoice reconciliation requires accurate supporting documents such as purchase orders, payment receipts, and delivery notes authenticated with blockchain-stamped signatures to ensure tamper-proof verification. Blockchain-stamped delivery notes provide a secure, transparent record that enhances trust and expedites the matching process between invoiced goods and received shipments. |

| 6 | Smart Contract Payment Confirmations | Smart contract payment confirmations serve as essential documents for invoice reconciliation by providing immutable, automated proof of transaction fulfillment on blockchain networks. These confirmations link payment execution directly to invoice terms, reducing disputes and enhancing transparency in financial auditing processes. |

| 7 | AI-Generated PO Variance Reports | AI-generated PO variance reports are essential for invoice reconciliation, providing detailed comparisons between purchase orders and invoices to identify discrepancies. Key documents required include the original purchase order, invoice copies, and these variance reports to ensure accurate validation and payment processing. |

| 8 | Supplier Self-Billing Statements | Supplier self-billing statements must include detailed transaction records, purchase order references, and agreed pricing to ensure accuracy during invoice reconciliation. These documents verify the legitimacy of charges and facilitate seamless matching with internal financial records for efficient payment processing. |

| 9 | Secure PDF Invoice Hash Codes | Invoice reconciliation requires secure PDF invoice hash codes to verify the document's authenticity and integrity, ensuring the invoice has not been altered after issuance. These hash codes facilitate accurate matching between invoices and corresponding purchase orders or payment records, reducing errors and fraud risks during financial audits. |

| 10 | Dynamic Discounting Settlement Files | Dynamic Discounting Settlement Files are essential for invoice reconciliation as they provide detailed transaction data, including payment terms, discount rates, and settlement dates. These files enable accurate matching of payments to invoices, ensuring precise calculation of discounts and timely financial reporting. |

Introduction to Invoice Reconciliation Documents

What documents are required for invoice reconciliation? Invoice reconciliation ensures that the amounts billed match the received goods or services and the purchase orders. Essential documents include the original invoice, purchase order, and delivery receipt to verify all transaction details accurately.

Importance of Invoice Reconciliation in Financial Management

Invoice reconciliation requires key documents such as purchase orders, delivery receipts, and vendor invoices to verify transaction accuracy. This process ensures that payments correspond to received goods or services, preventing discrepancies and financial losses. Your careful attention to invoice reconciliation strengthens financial management by promoting accurate record-keeping and budget control.

Key Components of an Invoice Reconciliation Document

Invoice reconciliation requires specific documents to ensure accurate matching of payments and records. Key components include the original invoice, purchase order, and delivery receipt.

These documents verify the details of the transaction, such as quantities, prices, and dates. You must also provide payment records and any correspondence related to discrepancies for complete reconciliation.

Common Types of Invoice Reconciliation Records

Invoice reconciliation requires a set of key documents to ensure accuracy and proper validation of payments. Common types of invoice reconciliation records include purchase orders, delivery receipts, and payment confirmations.

Purchase orders verify the details of the goods or services requested, while delivery receipts confirm that the items were received as agreed. Payment confirmations indicate that the transaction has been settled. Keeping these documents organized helps you maintain clear and efficient invoice reconciliation processes.

Step-by-Step Process for Invoice Reconciliation

Invoice reconciliation requires several key documents to ensure accuracy and transparency. Essential documents include the original purchase order, the vendor's invoice, and the receiving report confirming goods or services delivered. These documents serve as the foundation for verifying that the billed amounts align with the agreed terms and actual receipt of products or services.

The step-by-step process for invoice reconciliation begins with matching the vendor invoice to the purchase order details, such as quantities, prices, and terms. Next, cross-check the receiving report to confirm the delivery of the goods or services billed. If discrepancies arise, flag them for resolution before processing payment to maintain financial integrity and prevent errors.

After completing the document matching and verification, update your accounting system with the reconciled invoice details. Retain all related documents for audit purposes and future reference. Consistent application of this process streamlines accounts payable and enhances your organization's financial control.

Best Practices for Maintaining Accurate Records

Invoice reconciliation requires specific documents to verify accuracy and resolve discrepancies. Maintaining detailed records ensures smooth financial auditing and accountability.

- Purchase Orders - Confirm the agreed terms and quantities for the goods or services purchased.

- Delivery Receipts - Provide proof that goods or services were received as stated in the invoice.

- Payment Records - Track payments made to reconcile amounts and detect any outstanding balances.

Tools and Software for Streamlining Invoice Reconciliation

Invoice reconciliation requires key documents such as purchase orders, vendor invoices, and payment receipts for accurate verification. These records help ensure that all transactions match and discrepancies are identified promptly.

Tools and software like ERP systems, digital invoice management platforms, and automated matching solutions streamline the reconciliation process. Your efficiency improves significantly when integrated tools automate data capture and validation, reducing manual errors and saving time.

Common Challenges and How to Overcome Them

| Documents Required for Invoice Reconciliation | Common Challenges | How to Overcome Challenges |

|---|---|---|

| Purchase Orders (PO) | Missing or mismatched purchase order numbers cause delays in matching invoices with orders. | Implement a centralized system to verify PO numbers before invoice submission. |

| Invoices Detailing Product/Service Descriptions | Vague or inconsistent descriptions lead to confusion and reconciliation errors. | Standardize invoice templates to ensure clear and consistent item descriptions. |

| Delivery Receipts or Proof of Service | Lack of delivery confirmation results in payment disputes and audit issues. | Use electronic delivery tracking systems to provide real-time proof of delivery. |

| Payment Terms and Credit Notes | Unclear payment terms cause misalignment between invoicing and payment schedules. | Define explicit payment terms within contracts and enforce them during invoice processing. |

| Bank Details for Payment Verification | Incorrect or outdated bank information leads to failed payments or delays. | Regularly update vendor banking details and validate before processing payments. |

| Supporting Contracts or Agreements | Lack of contract references complicates validation of invoice legitimacy. | Maintain digital copies of all contracts linked to vendor invoices for quick reference. |

Regulatory Compliance and Audit Considerations

Invoice reconciliation requires specific documentation to ensure regulatory compliance and facilitate smooth audit processes. These documents serve as proof of transaction accuracy and adherence to legal standards.

- Purchase Order - Confirms the original agreement details and authorized spending limits supporting invoice validity.

- Delivery Receipt - Verifies that the goods or services were received as specified, aligning with invoice charges.

- Payment Records - Demonstrates that the invoice payments correspond with contractual terms and comply with financial regulations.

What Documents Are Required for Invoice Reconciliation? Infographic