For VAT-compliant invoicing, essential documents include a valid invoice containing the seller's name, address, and VAT identification number, the buyer's details, a unique invoice number, issue date, and a clear description of goods or services provided. The invoice must also show the net amount, applicable VAT rate, VAT amount, and the total payable amount. Maintaining proof of supply and payment records further supports accurate VAT reporting and compliance.

What Documents are Needed for VAT-Compliant Invoicing?

| Number | Name | Description |

|---|---|---|

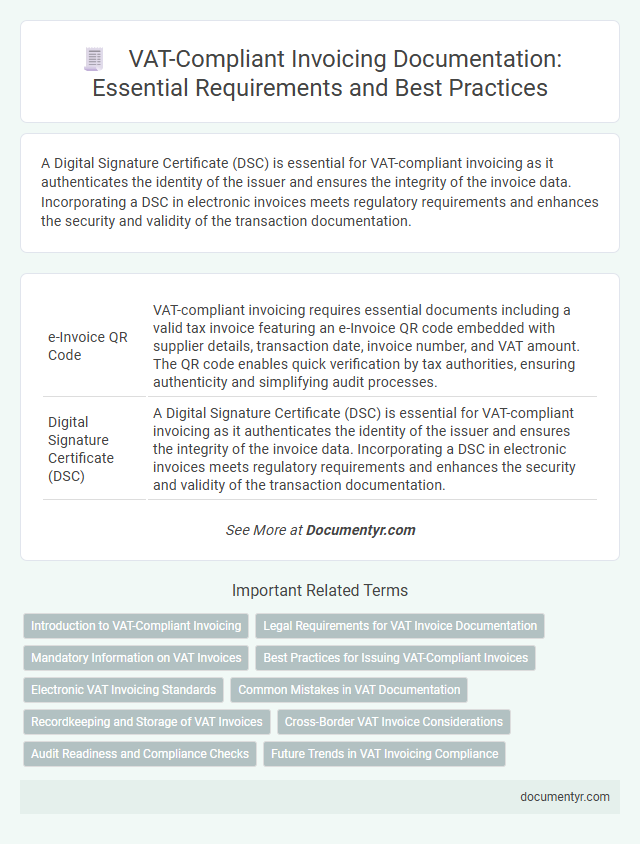

| 1 | e-Invoice QR Code | VAT-compliant invoicing requires essential documents including a valid tax invoice featuring an e-Invoice QR code embedded with supplier details, transaction date, invoice number, and VAT amount. The QR code enables quick verification by tax authorities, ensuring authenticity and simplifying audit processes. |

| 2 | Digital Signature Certificate (DSC) | A Digital Signature Certificate (DSC) is essential for VAT-compliant invoicing as it authenticates the identity of the issuer and ensures the integrity of the invoice data. Incorporating a DSC in electronic invoices meets regulatory requirements and enhances the security and validity of the transaction documentation. |

| 3 | GST e-Way Bill | A GST e-Way Bill is essential for transporting goods worth over INR 50,000, containing invoice number, value, HSN code, and transporter details to ensure VAT-compliant invoicing. Accurate documentation including a tax invoice, delivery challan, and the e-Way Bill with the unique e-Way Bill number (EBN) supports seamless GST compliance and audit trails. |

| 4 | IRN (Invoice Reference Number) | A VAT-compliant invoice must include an Invoice Reference Number (IRN), a unique identifier issued through the e-invoicing system, ensuring authenticity and traceability. This IRN, generated after submitting the invoice JSON to the government portal, is essential for validating the invoice's legality and seamless GST filing. |

| 5 | Dynamic QR Compliance | Dynamic QR compliance requires invoices to include a scannable QR code containing essential VAT data such as the supplier's tax identification number, invoice number, date of issue, and total taxable amount. Ensuring these documents meet regulatory standards enables seamless verification and enhances transparency in VAT reporting processes. |

| 6 | HSN/SAC Code Documentation | Accurate HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code) documentation is essential for VAT-compliant invoicing, as it classifies goods and services for proper tax calculation. Including the correct HSN/SAC code on invoices ensures adherence to GST regulations and facilitates seamless tax filing and input credit claims. |

| 7 | Reverse Charge Invoice | A VAT-compliant reverse charge invoice must include the supplier's and recipient's names and addresses, VAT identification numbers, a clear mention of the reverse charge mechanism, a detailed description of the goods or services supplied, invoice date and number, and the total VAT-exempt amount. Essential documents also consist of proof that the customer is a taxable person entitled to apply the reverse charge, ensuring proper tax reporting and compliance with local VAT regulations. |

| 8 | Self-Billed Invoice Agreement | A self-billed invoice agreement requires prior authorization between the supplier and customer, clearly outlining responsibilities for VAT compliance, including invoice issuance and record-keeping. Essential documents include the signed agreement, detailed self-billed invoices containing the supplier's VAT number, invoice date, description of goods or services, VAT amount, and the customer's acknowledgment to ensure regulatory adherence. |

| 9 | Continuous Transaction Control (CTC) Register | To ensure VAT-compliant invoicing under Continuous Transaction Control (CTC) Register requirements, invoices must include the supplier's VAT identification number, detailed description of goods or services, total VAT amount, and a unique transaction reference code generated by the CTC system. Complementary documentation such as proof of transaction date, customer VAT number (if applicable), and electronically signed records must also be maintained to comply with real-time reporting mandates. |

| 10 | Real-Time Invoice Reporting Statement | A VAT-compliant invoice must include the seller's tax identification number, invoice date, unique invoice number, buyer's details, description of goods or services, quantity, unit price, VAT rate, and total VAT amount. Real-time invoice reporting requires these documents to be electronically submitted to tax authorities immediately upon issuance to ensure transparency and prevent tax evasion. |

Introduction to VAT-Compliant Invoicing

VAT-compliant invoicing is essential for businesses to ensure legal and financial accuracy in their transactions. Understanding the required documents helps maintain compliance and facilitates smooth tax reporting.

- Valid VAT Invoice - Contains detailed information such as supplier and customer details, VAT number, invoice date, and amount.

- Proof of Supply - Documentation verifying the delivery of goods or services related to the invoice.

- Tax Registration Certificates - Official certificates confirming the VAT registration status of the business and client.

Your ability to provide and maintain these documents supports accurate VAT reporting and audit readiness.

Legal Requirements for VAT Invoice Documentation

| Document | Description | Legal Requirement |

|---|---|---|

| Invoice | A detailed document issued by the seller to the buyer, specifying goods or services supplied and payment terms. | Must include seller and buyer names, addresses, VAT identification numbers, invoice date, unique invoice number, description of goods or services, quantity, unit price, total amount, and applicable VAT rate and amount. |

| Purchase Order (PO) | A buyer's formal request for goods or services. | Supports invoice accuracy and VAT claim eligibility but is not mandatory as a VAT invoice component. |

| Delivery Note | Document confirming delivery of goods or completion of services. | Used to verify the supply date and quantity; not legally required for VAT invoices but recommended for audit trails. |

| VAT Registration Certificate | Proof of the seller's VAT registration issued by tax authorities. | Essential when issuing VAT invoices to confirm legitimacy and enable compliance. |

| Payment Records | Documents such as bank statements or receipts confirming payment. | Supports VAT invoice records for accounting and tax audit purposes. |

| Credit Notes | Issued to correct or reduce previously issued invoices. | Required to adjust VAT amounts declared; must follow VAT invoice documentation standards. |

Mandatory Information on VAT Invoices

VAT-compliant invoices must include the seller's and buyer's full names, addresses, and VAT identification numbers. The invoice should clearly state the date of issue, a unique invoice number, and a detailed description of the goods or services provided. Mandatory information also includes the quantity, price per unit, VAT rate applied, total VAT amount, and the overall invoice total.

Best Practices for Issuing VAT-Compliant Invoices

What documents are needed for VAT-compliant invoicing? A VAT-compliant invoice must include the supplier's name, address, and VAT identification number. It should also feature the invoice date, a unique invoice number, and a clear description of the goods or services provided.

What are the best practices for issuing VAT-compliant invoices? Ensure that all mandatory information, such as the customer's details and VAT rate applied, is accurately recorded. Keep copies of all invoices for at least the legally required retention period to support tax audits and compliance verification.

Electronic VAT Invoicing Standards

Electronic VAT invoicing standards require specific documents to ensure compliance with tax authorities. Key documents include the electronic invoice itself, which must contain mandatory VAT information such as supplier and customer details, VAT rates applied, and total amounts. Digital signatures or electronic seals are also essential to verify authenticity and integrity of the electronic invoice.

Common Mistakes in VAT Documentation

Accurate documentation is essential for VAT-compliant invoicing to avoid penalties and ensure smooth tax audits. Understanding the common mistakes in VAT documentation helps businesses maintain compliance and improve record-keeping.

- Missing Seller or Buyer Details - Incomplete or incorrect names, addresses, or VAT identification numbers can invalidate the invoice for tax purposes.

- Incorrect or Absent VAT Rates - Using wrong VAT rates or omitting the VAT rate leads to calculation errors and non-compliance.

- Failure to Include Invoice Date and Number - Missing unique invoice numbers or dates disrupts traceability and violates legal invoicing requirements.

Recordkeeping and Storage of VAT Invoices

VAT-compliant invoicing requires accurate recordkeeping to ensure all transaction details are properly documented. Essential documents include the original VAT invoices, purchase orders, and payment receipts.

These records must be securely stored for a minimum period defined by tax authorities, often five to seven years. Digital storage solutions are commonly accepted, provided they maintain data integrity and are easily accessible for audits.

Cross-Border VAT Invoice Considerations

Cross-border VAT invoicing requires specific documents to ensure compliance with international tax regulations. Proper documentation supports VAT reclaim and prevents penalties in cross-border transactions.

- Valid VAT Identification Numbers - Both the supplier and customer must provide accurate VAT numbers to verify tax status across EU member states.

- Invoice Details According to Legal Requirements - Cross-border invoices must include the supplier's and customer's full names, addresses, VAT numbers, invoice date, and a clear description of goods or services.

- Proof of Goods or Services Transfer - Documentation such as delivery notes or transport documents is essential to demonstrate the movement of goods between countries for VAT exemption.

Audit Readiness and Compliance Checks

Proper documentation is essential for VAT-compliant invoicing to ensure audit readiness and smooth compliance checks. Key documents include valid VAT registration certificates, detailed invoices with unique serial numbers, and proof of tax payments.

Invoices must clearly show the supplier's and customer's VAT identification numbers, along with a detailed description of goods or services supplied. Maintaining organized records of these documents minimizes the risk of errors and facilitates quick retrieval during tax audits.

What Documents are Needed for VAT-Compliant Invoicing? Infographic