Freelancers need to prepare a detailed invoice including their business information, client details, a clear description of services provided, payment terms, and the total amount due. It is essential to include a valid tax identification number or VAT details if applicable, along with the invoice date and a unique invoice number for tracking purposes. Attaching supporting documents such as contracts or work completion proofs can improve transparency and help ensure timely payment from clients.

What Documents Does a Freelancer Need to Send an Invoice to a Client?

| Number | Name | Description |

|---|---|---|

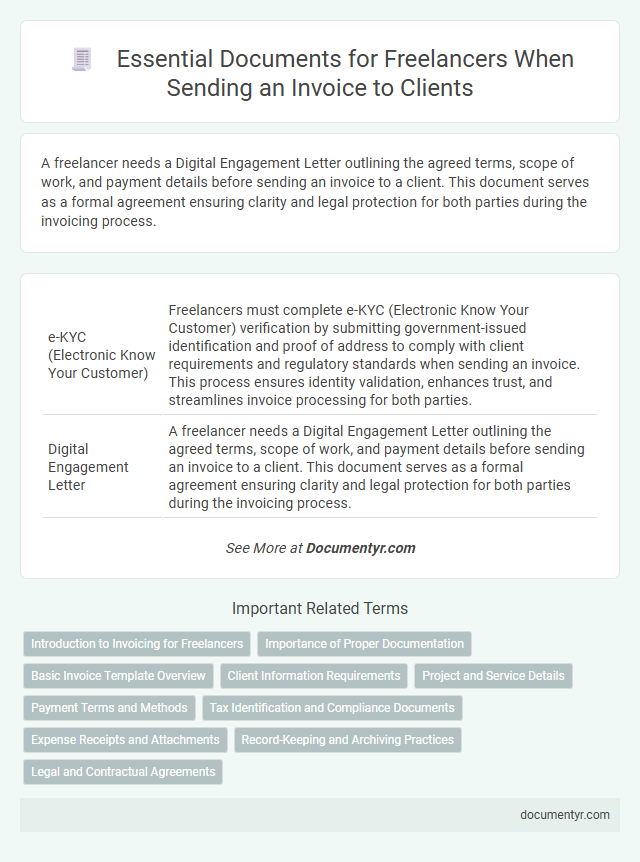

| 1 | e-KYC (Electronic Know Your Customer) | Freelancers must complete e-KYC (Electronic Know Your Customer) verification by submitting government-issued identification and proof of address to comply with client requirements and regulatory standards when sending an invoice. This process ensures identity validation, enhances trust, and streamlines invoice processing for both parties. |

| 2 | Digital Engagement Letter | A freelancer needs a Digital Engagement Letter outlining the agreed terms, scope of work, and payment details before sending an invoice to a client. This document serves as a formal agreement ensuring clarity and legal protection for both parties during the invoicing process. |

| 3 | E-signature Authorization | Freelancers must include an e-signature authorization within their invoice documentation to ensure legal validity and client approval. This digital signature acts as verifiable consent, streamlining payment processes and reinforcing contractual obligations between both parties. |

| 4 | GSTIN Declaration (for India) | Freelancers in India must include their GSTIN (Goods and Services Tax Identification Number) declaration on the invoice if their annual turnover exceeds the prescribed threshold, ensuring compliance with tax regulations. This declaration helps validate the invoice for input tax credit claims and facilitates seamless GST filing for both the freelancer and the client. |

| 5 | W-9 Form (for US freelancers) | Freelancers in the US typically need to provide a completed W-9 form along with their invoice to clients, as this form verifies their Taxpayer Identification Number (TIN) for accurate tax reporting. Including the W-9 ensures compliance with IRS regulations and facilitates the client's ability to issue Form 1099-NEC at year-end. |

| 6 | Remittance Advice Integration | Freelancers need to include remittance advice details within their invoices to streamline payment reconciliation and reduce errors for clients during transaction processing. Integrating remittance advice ensures accurate tracking of payment status, enhances transparency, and facilitates faster financial settlements between freelancers and clients. |

| 7 | UTR Reference (Unique Transaction Reference) | Freelancers must include their UTR (Unique Transaction Reference) on invoices to ensure accurate tracking of tax payments and compliance with HMRC regulations in the UK. This reference helps clients verify the freelancer's tax status and facilitates smoother processing of payments and VAT submissions. |

| 8 | e-Invoicing QR Code | Freelancers must include essential documents such as a detailed invoice with an e-Invoicing QR code, which facilitates quick verification and seamless digital payment processing. This QR code links directly to the invoice data, ensuring compliance with tax regulations and enhancing the accuracy of transaction records. |

| 9 | Payment Gateway Consent | Freelancers must obtain explicit payment gateway consent from clients to securely process transactions and ensure compliance with platform policies. This consent often involves signed agreements or authorization forms specifying preferred payment methods and transaction terms. |

| 10 | Self-Billing Agreement | A freelancer must provide a Self-Billing Agreement when sending invoices to clients who generate invoices on behalf of the freelancer, ensuring compliance with tax regulations and clarifying invoicing responsibilities. This document outlines the terms allowing the client to issue invoices, reduces administrative workload, and guarantees accurate VAT reporting. |

Introduction to Invoicing for Freelancers

Invoicing is a crucial part of managing your freelance business. Sending accurate invoices ensures timely payments and clear communication with clients.

To send an invoice, freelancers need essential documents such as a detailed contract or agreement outlining the scope of work. An itemized list of completed services or deliverables helps clarify charges. Including payment terms and your contact information completes a professional invoice package.

Importance of Proper Documentation

Proper documentation is essential when sending an invoice to a client to ensure clarity and avoid payment delays. Key documents include a detailed invoice, a signed contract, and any relevant work delivery confirmations. You must provide these to establish trust and facilitate smooth financial transactions.

Basic Invoice Template Overview

When sending an invoice to a client, freelancers need a clear and professional basic invoice template to ensure all necessary information is included. This template typically features your business details, client's information, invoice number, and date.

Itemized descriptions of services provided, along with quantities and rates, are essential for transparency. Including payment terms and accepted payment methods helps facilitate timely transactions and clear communication.

Client Information Requirements

When sending an invoice, accurate client information is essential for proper billing and record-keeping. Your invoice must clearly display key details to avoid delays and ensure payment.

- Client's Full Name or Business Name - This identifies who is responsible for payment and ensures the invoice is directed correctly.

- Client's Address - Including a full mailing address is crucial for formal communication and tax purposes.

- Client's Contact Information - Email and phone number allow prompt communication in case of questions or follow-up.

Project and Service Details

Freelancers must include precise project and service details in their invoices to ensure clarity and avoid payment disputes. Accurate descriptions help clients understand the scope and value of the work delivered.

- Detailed Project Description - Clearly outline the specific tasks or deliverables completed to provide transparency about the work done.

- Service Dates - Include the exact dates when services were rendered to establish a clear timeline for the client.

- Hours or Units Worked - Specify the number of hours or units involved to justify the invoiced amount accurately.

Payment Terms and Methods

| Document | Description |

|---|---|

| Invoice | A detailed statement including service descriptions, quantities, rates, and total amount due. |

| Payment Terms | Clear specifications of payment due date, late fees, and any early payment discounts. |

| Payment Methods | Accepted payment options such as bank transfer, credit card, PayPal, or other online payment platforms. |

| Tax Identification | Your tax ID or business registration number for legal and accounting purposes. |

| Contact Information | Accurate details for communication, including email and phone number. |

| Purchase Order (if applicable) | Client issued document confirming approval of services and prices. |

Tax Identification and Compliance Documents

Freelancers need to include their Tax Identification Number (TIN) on invoices to ensure compliance with tax regulations. This number helps clients verify your business legitimacy and report payments accurately to tax authorities.

Additional compliance documents such as VAT registration certificates or business licenses may be required depending on jurisdiction. Providing these documents with your invoice supports transparent tax reporting and avoids payment delays.

Expense Receipts and Attachments

Freelancers must include detailed expense receipts and relevant attachments when sending invoices to clients. These documents validate costs and support transparent billing processes.

- Expense Receipts - Provide proof of incurred expenses related to the project to ensure accurate reimbursement.

- Attachments - Include contracts, purchase orders, or approval emails as supporting documentation for the invoice.

- Itemized Costs - Break down expenses clearly to align with agreed terms and client expectations.

Submitting complete expense receipts and attachments enhances trust and facilitates smooth payment processing between freelancers and clients.

Record-Keeping and Archiving Practices

What documents are essential for a freelancer to send an invoice to a client? An accurate invoice typically includes a purchase order, contract, and proof of completed work such as timesheets or deliverables. Maintaining these documents supports transparent record-keeping and ensures you can verify all transactions during audits or disputes.

How important is proper record-keeping and archiving for freelancers? Keeping organized digital or physical copies of invoices, payment receipts, and correspondence helps streamline financial tracking and tax reporting. Efficient archiving safeguards your business by providing quick access to historical data when needed for legal or accounting purposes.

What Documents Does a Freelancer Need to Send an Invoice to a Client? Infographic