Freelancers must include key documents to issue a legally valid invoice, such as their tax identification number, business registration details, and customer information. Essential invoice elements include a unique invoice number, date of issue, description of services rendered, and payment terms. Proper documentation ensures compliance with tax regulations and facilitates smooth financial transactions.

What Documents Does a Freelancer Need to Issue an Invoice Legally?

| Number | Name | Description |

|---|---|---|

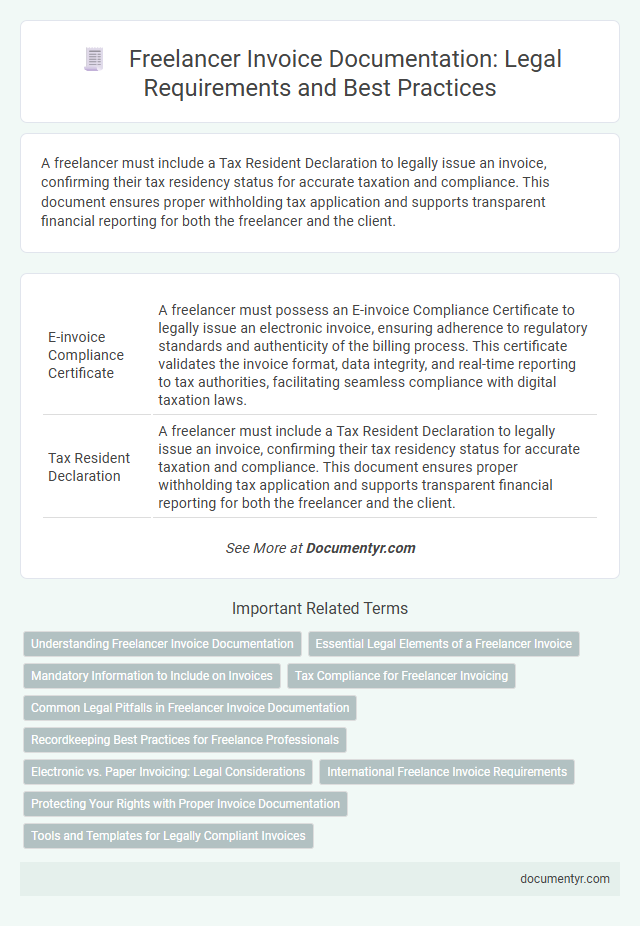

| 1 | E-invoice Compliance Certificate | A freelancer must possess an E-invoice Compliance Certificate to legally issue an electronic invoice, ensuring adherence to regulatory standards and authenticity of the billing process. This certificate validates the invoice format, data integrity, and real-time reporting to tax authorities, facilitating seamless compliance with digital taxation laws. |

| 2 | Tax Resident Declaration | A freelancer must include a Tax Resident Declaration to legally issue an invoice, confirming their tax residency status for accurate taxation and compliance. This document ensures proper withholding tax application and supports transparent financial reporting for both the freelancer and the client. |

| 3 | UDYAM Registration (for Indian freelancers) | Freelancers in India must include their UDYAM Registration number on invoices to comply with legal requirements and validate their micro or small business status. This registration not only legitimizes the invoice but also enables access to government benefits and tax concessions under the MSME Act. |

| 4 | GSTIN Self-Declaration | Freelancers must include a GSTIN self-declaration on their invoices when registered under the Goods and Services Tax (GST) to comply with legal requirements and ensure tax accountability. This declaration includes the freelancer's unique GST Identification Number (GSTIN), allowing proper tax reporting and validation by clients and tax authorities. |

| 5 | Digital Signature Certificate (DSC) | Freelancers must obtain a valid Digital Signature Certificate (DSC) to legally issue invoices, ensuring authenticity and compliance with electronic invoicing standards. The DSC secures the digital invoice by verifying the freelancer's identity, making it legally binding and admissible as evidence in government and tax-related transactions. |

| 6 | Self-billing Authorisation | Freelancers require a self-billing authorization document signed by the client to issue invoices legally under self-billing arrangements, ensuring compliance with tax regulations and accurate VAT reporting. This authorization must clearly state that the client, not the freelancer, is responsible for issuing invoices, and both parties should retain copies for tax audit purposes. |

| 7 | EU VAT MOSS Statement | Freelancers issuing invoices legally within the EU must include a valid VAT MOSS statement to ensure compliance with EU VAT regulations for digital services. This statement certifies the correct application of VAT rates based on the customer's location, simplifying cross-border tax obligations under the EU VAT Mini One Stop Shop system. |

| 8 | Invoice Reference Number (IRN) | A Freelancer must include a unique Invoice Reference Number (IRN) on each invoice to ensure legal compliance and facilitate accurate transaction tracking. The IRN acts as a distinct identifier that helps verify the authenticity of the invoice and prevents duplication in financial records. |

| 9 | E-way Bill (for physical service delivery) | Freelancers delivering physical services must generate an E-way Bill when transporting goods valued above Rs50,000 under GST regulations to legally issue an invoice. This E-way Bill serves as a mandatory electronic document that validates the movement of goods and ensures compliance with tax laws during invoicing. |

| 10 | National Freelance License (country-specific, emerging) | Freelancers must possess a National Freelance License to legally issue invoices, ensuring their services comply with country-specific regulations and tax requirements. This license authenticates their freelance status, facilitating proper documentation and seamless invoicing within the emerging national legal framework. |

Understanding Freelancer Invoice Documentation

| Document | Description | Purpose |

|---|---|---|

| Freelancer Identification | Valid government-issued ID or business registration number | Verifies identity and legal status of the freelancer |

| Tax Identification Number (TIN) | Unique taxpayer reference assigned by tax authorities | Required for tax reporting and compliance |

| Service Agreement or Contract | Written agreement outlining services provided, terms, and payment details | Defines scope of work and supports invoice validity |

| Invoice Template or Format | Structured layout including freelancer details, client info, invoice number, date, description, and payment terms | Ensures standardized and legally compliant invoicing |

| Proof of Service Delivery | Documents such as project reports, delivery receipts, or final work files | Confirms that services were rendered as invoiced |

| Bank Account Information | Freelancer's bank details for receiving payments | Facilitates smooth financial transactions |

| Compliance with Local Tax Laws | Documentation or certifications required by local tax authorities | Ensures legality and prevents tax disputes |

Essential Legal Elements of a Freelancer Invoice

A freelancer must include specific documents to issue an invoice legally, ensuring compliance with tax and business regulations. Essential legal elements of a freelancer invoice include the freelancer's full name, business address, and tax identification number. The invoice must also detail the services provided, payment terms, invoice number, issue date, and the total amount due, including applicable taxes.

Mandatory Information to Include on Invoices

Freelancers must ensure their invoices comply with legal standards by including all mandatory details. These elements guarantee the invoice's validity and facilitate smooth payment processes.

- Freelancer's Identification Information - Include full name, business name if applicable, and tax identification number to verify the invoice issuer.

- Client's Details - Clearly state the client's name and address for accurate record-keeping and validation.

- Invoice Date and Number - Assign a unique invoice number and specify the date of issue to maintain chronological tracking.

- Detailed Description of Services - Provide a clear explanation of the work performed or products delivered to avoid disputes.

- Payment Terms and Amounts - Specify the total amount due, currency, applicable taxes, and payment deadlines to ensure timely transactions.

Tax Compliance for Freelancer Invoicing

Freelancers must ensure their invoices comply with tax regulations to avoid legal issues. Proper documentation supports accurate reporting and timely tax payments.

- Tax Identification Number (TIN) - A valid TIN is required to identify the freelancer for tax purposes on the invoice.

- Detailed Service Description - The invoice must clearly describe services rendered to meet tax authority requirements.

- Invoice Number and Date - Sequential numbering and date stamping are essential for tax record keeping and audit trails.

Maintaining these documents ensures freelancer invoices are legally recognized and compliant with tax laws.

Common Legal Pitfalls in Freelancer Invoice Documentation

Freelancers must include essential documents such as a valid tax identification number, a clear description of services rendered, and the agreed payment terms to issue an invoice legally. Missing or incorrect information can lead to tax complications and delayed payments.

Common legal pitfalls in freelancer invoice documentation involve omitting the freelancer's registered business address or failing to specify the invoice date and number. Errors in tax calculations or neglecting to include applicable VAT details also create legal issues. Ensuring all mandatory fields are accurately completed helps maintain compliance and strengthens the invoice's legal validity.

Recordkeeping Best Practices for Freelance Professionals

Freelancers must maintain accurate records such as contracts, payment receipts, and time logs to issue invoices legally. Proper documentation ensures compliance with tax regulations and supports financial transparency.

Organize your invoices by date and client to streamline accounting processes and ease tax filing. Digital tools for invoicing and recordkeeping enhance accuracy and simplify audit preparation for freelance professionals.

Electronic vs. Paper Invoicing: Legal Considerations

Freelancers must understand the legal requirements for issuing invoices, whether electronic or paper. Electronic invoices often require digital signatures and compliance with specific tax regulations to ensure authenticity and integrity. Paper invoices must include all mandatory details such as tax identification numbers and dates to be legally valid and accepted by authorities.

International Freelance Invoice Requirements

Freelancers working internationally must include essential details on their invoices to comply with legal standards. Key documents include a valid tax identification number, proof of business registration, and clear client information.

Invoices must specify the service description, date of issue, payment terms, and applicable taxes like VAT or GST based on the country of operation. Including these elements ensures transparency and legal recognition across borders.

Protecting Your Rights with Proper Invoice Documentation

What documents does a freelancer need to issue an invoice legally? Essential documents include a valid business registration or freelancer license, proof of identity, and tax identification number. Accurate invoice details such as client information, service description, dates, and payment terms protect your rights and ensure compliance with tax regulations.

What Documents Does a Freelancer Need to Issue an Invoice Legally? Infographic