For VAT-compliant invoicing in the EU, the invoice must include specific details such as the seller's and buyer's full names and addresses, VAT identification numbers, a unique invoice number, and the date of issue. It is essential to list a clear description of the goods or services provided, the quantity, unit price, applicable VAT rate, and the total amount payable including VAT. These documents ensure transparency and meet the legal requirements to claim VAT deductions within EU member states.

What Documents Needed for VAT-Compliant Invoicing in the EU?

| Number | Name | Description |

|---|---|---|

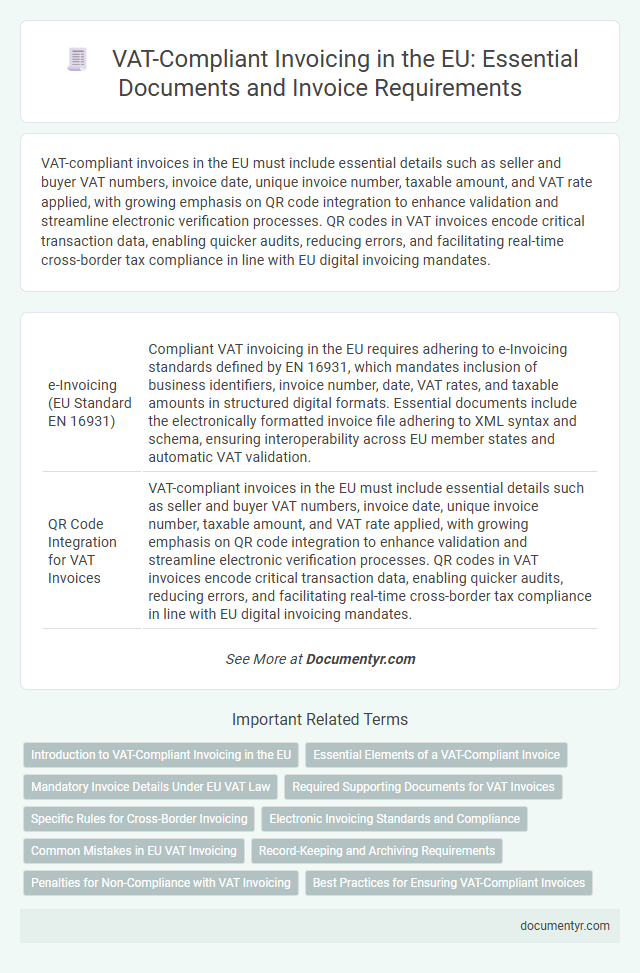

| 1 | e-Invoicing (EU Standard EN 16931) | Compliant VAT invoicing in the EU requires adhering to e-Invoicing standards defined by EN 16931, which mandates inclusion of business identifiers, invoice number, date, VAT rates, and taxable amounts in structured digital formats. Essential documents include the electronically formatted invoice file adhering to XML syntax and schema, ensuring interoperability across EU member states and automatic VAT validation. |

| 2 | QR Code Integration for VAT Invoices | VAT-compliant invoices in the EU must include essential details such as seller and buyer VAT numbers, invoice date, unique invoice number, taxable amount, and VAT rate applied, with growing emphasis on QR code integration to enhance validation and streamline electronic verification processes. QR codes in VAT invoices encode critical transaction data, enabling quicker audits, reducing errors, and facilitating real-time cross-border tax compliance in line with EU digital invoicing mandates. |

| 3 | Real-Time Invoice Reporting (RTR Directive) | VAT-compliant invoicing in the EU under the Real-Time Invoice Reporting (RTR Directive) requires submitting electronic invoices with detailed transaction data, including supplier and customer VAT identification numbers, invoice date, unique invoice number, and VAT amounts, to tax authorities in real time or near real time. Compliance ensures accurate VAT reporting, reduces fraud, and enables tax authorities to monitor cross-border transactions efficiently across member states. |

| 4 | PEPPOL Network Invoicing | VAT-compliant invoices in the EU using the PEPPOL network must include the supplier and customer VAT identification numbers, a unique invoice number, invoice date, detailed description of goods or services, unit prices, VAT rates applied, and total VAT amount. The digital format adhering to PEPPOL BIS Billing 3.0 ensures standardized data exchange, facilitating automated validation and compliance across member states. |

| 5 | SAF-T (Standard Audit File for Tax) Attachments | SAF-T (Standard Audit File for Tax) attachments are essential for VAT-compliant invoicing in the EU, providing a standardized digital format that facilitates tax audits and ensures accurate VAT reporting. These files must include detailed transactional data such as invoice lines, tax codes, and customer information to comply with local tax authority requirements and enable seamless cross-border VAT verification. |

| 6 | Qualified Electronic Signature (QES) | A Qualified Electronic Signature (QES) is essential for VAT-compliant invoicing in the EU, ensuring the authenticity and integrity of electronic invoices as mandated by the e-Invoicing Directive 2014/55/EU. Invoices must include a QES issued by a trusted service provider to meet EU tax regulations and enable valid input VAT deduction. |

| 7 | Reverse Charge Statement Documentation | VAT-compliant invoicing in the EU requires including a reverse charge statement when the reverse charge mechanism applies, clearly indicating that the customer is responsible for reporting the VAT. This documentation must detail the supplier's and customer's VAT identification numbers, a description of the goods or services, and the applicable legal reference for the reverse charge to ensure compliance with EU VAT directives. |

| 8 | Intracommunity Supply Declaration | For VAT-compliant invoicing in the EU, the Intracommunity Supply Declaration must include the supplier's and customer's VAT identification numbers, a clear description of goods or services supplied, the transaction date, and the value of the supply without VAT. Ensuring these details are accurately documented validates the transaction as an intracommunity supply, exempting it from VAT under EU regulations. |

| 9 | VAT Group Invoice Certification | VAT Group Invoice Certification in the EU requires a consolidated invoice that includes all group members' VAT identification numbers and the VAT registration details of the representative entity. This certification ensures compliance with EU VAT directives by validating that intra-group transactions are exempt from VAT, provided the invoice contains the requisite documentation such as the member companies' names, addresses, and a clear indication of the VAT group status. |

| 10 | Continuous Transaction Controls (CTC) | Continuous Transaction Controls (CTC) require real-time submission of invoice data to tax authorities, mandating inclusion of detailed information such as supplier and customer VAT numbers, invoice dates, unique invoice identifiers, VAT rates, taxable amounts, and total VAT charged. Compliance with CTC ensures VAT-compliant invoicing by enabling instant validation and fraud prevention across EU member states. |

Introduction to VAT-Compliant Invoicing in the EU

| Introduction to VAT-Compliant Invoicing in the EU | |

|---|---|

| Definition | VAT-compliant invoicing ensures invoices meet EU tax regulations for value-added tax (VAT) purposes. |

| Importance | Correct invoicing is crucial for proper VAT reporting, claimable tax credits, and avoiding penalties from tax authorities. |

| Scope | Applies to all businesses issuing invoices within the European Union member states subject to VAT laws. |

| Key Requirement | Invoices must include mandatory data such as VAT numbers, invoice date, taxable amount, VAT rate, and total VAT amount. |

| Purpose | Ensures transparency, legal compliance, and facilitates cross-border VAT transactions within the EU. |

| Your Role | You must provide and retain accurate, detailed invoices that comply with EU VAT regulations to support tax audits and VAT refunds. |

Essential Elements of a VAT-Compliant Invoice

In the EU, a VAT-compliant invoice must include specific documents ensuring accurate tax reporting. Essential elements are mandatory to validate your invoice for VAT purposes.

The invoice should feature the seller's name, address, and VAT identification number. The buyer's details and a unique invoice number are also required for compliance.

Mandatory Invoice Details Under EU VAT Law

VAT-compliant invoicing in the EU requires specific documents to ensure legal and tax adherence. These documents must contain mandatory details as stipulated by EU VAT law to validate the invoice for tax purposes.

Essential mandatory invoice details include the seller's and buyer's full names and addresses, the VAT identification numbers of both parties, and a unique, sequential invoice number. The invoice date, the date of supply or payment, and a clear description of goods or services provided must also be included. The total amount payable, VAT rate applied, and the VAT amount charged are critical to comply fully with VAT regulations.

Required Supporting Documents for VAT Invoices

VAT-compliant invoices in the EU must include key supporting documents such as the original invoice, proof of delivery or service completion, and customer identification details. These documents ensure the accurate recording of VAT amounts and verify the legitimacy of transactions for tax authorities. Maintaining these records is essential for businesses to claim VAT deductions and comply with EU tax regulations.

Specific Rules for Cross-Border Invoicing

What documents are needed for VAT-compliant invoicing in the EU, especially for cross-border transactions?

Invoices must include specific information such as the VAT identification numbers of both the supplier and the recipient. For cross-border invoicing within the EU, the invoice should clearly state that the VAT reverse charge mechanism applies.

Electronic Invoicing Standards and Compliance

VAT-compliant invoicing in the EU requires adherence to specific electronic invoicing standards to ensure legal validity and accurate tax reporting. Proper documentation supports seamless cross-border transactions and compliance with EU tax regulations.

- Invoice Content Requirements - The invoice must include mandatory details such as seller and buyer identification, VAT number, invoice date, and a clear description of goods or services provided.

- Electronic Format Standards - Invoices must follow formats like XML or PDF/A-3, compliant with EU Directive 2014/55/EU, enabling standardized processing and validation.

- Authentication and Integrity - Digital signatures or electronic seals ensure the authenticity of the origin and integrity of the invoice content throughout the electronic lifecycle.

Your compliance with these electronic invoicing standards helps avoid penalties and facilitates efficient VAT reclaim processes.

Common Mistakes in EU VAT Invoicing

Correct VAT-compliant invoicing within the European Union requires specific documents such as a valid VAT number, invoice date, and a clear description of goods or services. Missing these elements can lead to non-compliance issues and penalties.

Common mistakes include incorrect or missing VAT numbers, unclear invoice details, and failure to mention the VAT rate or amount. Ensuring all required information is accurately included helps maintain compliance and facilitates smooth cross-border transactions.

Record-Keeping and Archiving Requirements

Proper record-keeping is essential for VAT-compliant invoicing in the EU to ensure accuracy and legal compliance. You must archive all relevant documents securely for the required retention period defined by local regulations.

- Invoice Copies - Retain original and duplicate invoices for audit and verification purposes.

- Supporting Documentation - Keep purchase orders, delivery notes, and payment records linked to each invoice.

- Retention Duration - Store all VAT-related documents for a minimum of 10 years, as mandated in most EU member states.

Penalties for Non-Compliance with VAT Invoicing

VAT-compliant invoicing in the EU requires specific documents to avoid penalties and ensure legal adherence. Non-compliance with VAT invoicing rules can lead to severe financial and legal consequences for businesses.

- Incorrect or Missing Invoice Information - Failing to provide mandatory invoice details such as VAT number or invoice date can trigger fines and disallow input VAT deductions.

- Late Submission of Invoices - Issuing invoices beyond the legally required timeframe can result in penalties and potential tax audits by EU tax authorities.

- Failure to Store Invoices Properly - Not maintaining digital or physical invoice records as per EU VAT regulations may lead to administrative sanctions and increased scrutiny during compliance checks.

What Documents Needed for VAT-Compliant Invoicing in the EU? Infographic