To complete a FAFSA submission, students need key documents including their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Dependency status determines if parental financial information is also required, making tax documents from parents essential for dependent students. Accurate and up-to-date documentation ensures timely processing of financial aid applications.

What Documents Does a Student Need for FAFSA Submission?

| Number | Name | Description |

|---|---|---|

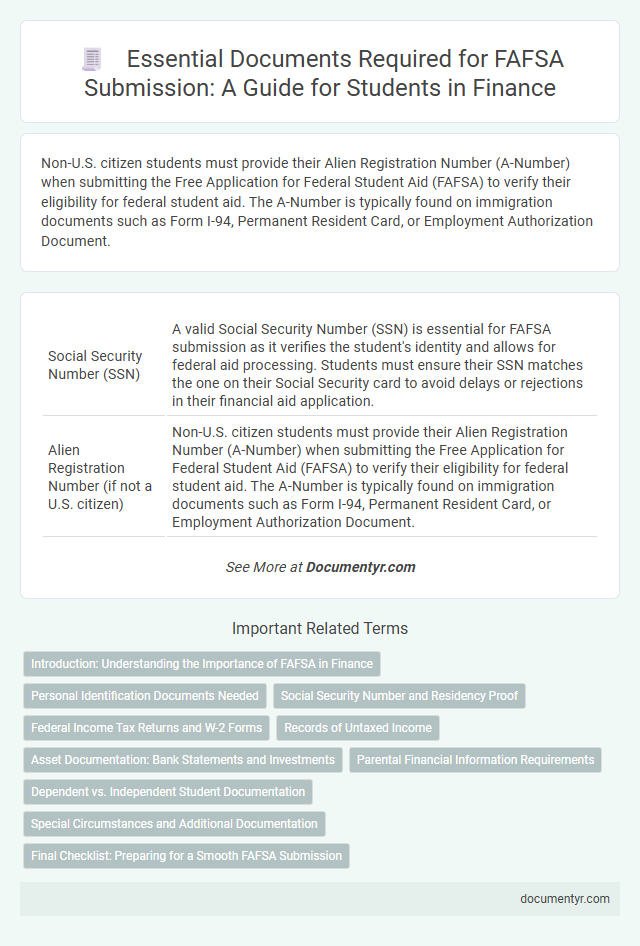

| 1 | Social Security Number (SSN) | A valid Social Security Number (SSN) is essential for FAFSA submission as it verifies the student's identity and allows for federal aid processing. Students must ensure their SSN matches the one on their Social Security card to avoid delays or rejections in their financial aid application. |

| 2 | Alien Registration Number (if not a U.S. citizen) | Non-U.S. citizen students must provide their Alien Registration Number (A-Number) when submitting the Free Application for Federal Student Aid (FAFSA) to verify their eligibility for federal student aid. The A-Number is typically found on immigration documents such as Form I-94, Permanent Resident Card, or Employment Authorization Document. |

| 3 | Federal Income Tax Returns (IRS 1040, 1040A, or 1040EZ) | Federal income tax returns such as IRS forms 1040, 1040A, or 1040EZ are essential documents for FAFSA submission as they verify a student's and family's financial information. These tax records provide critical data on income, deduction, and tax paid, which determine eligibility for federal financial aid programs. |

| 4 | W-2 Forms | Student applicants must submit W-2 forms to FAFSA as these documents provide essential income information from employers, crucial for calculating Expected Family Contribution (EFC). Accurate W-2 form details ensure FAFSA captures the student's and parents' earned income, impacting financial aid eligibility assessments. |

| 5 | Records of Untaxed Income (e.g., child support, interest income) | Students submitting the FAFSA must provide records of untaxed income, including amounts received from child support and documented interest income from savings or investments. Accurate reporting of these figures ensures the correct calculation of financial aid eligibility based on total family resources. |

| 6 | Current Bank Statements | Current bank statements provide critical proof of available financial resources required for FAFSA submission, ensuring accurate reporting of assets. These statements must reflect up-to-date balances from checking, savings, and investment accounts to accurately assess the student's and family's financial situation. |

| 7 | Records of Investments (e.g., stocks, bonds, real estate) | Students must provide detailed records of investments, including stocks, bonds, and real estate holdings, when submitting the FAFSA to accurately report their family's financial status. These documents ensure the FAFSA correctly calculates the Expected Family Contribution (EFC) for financial aid eligibility. |

| 8 | FSA ID (Federal Student Aid Identification) | The FSA ID is a critical electronic signature that allows students and parents to access and submit the Free Application for Federal Student Aid (FAFSA). Creating an FSA ID requires a valid Social Security number, email address, and mobile phone number, serving as a secure login for completing financial aid forms and accessing federal student aid information. |

| 9 | Driver’s License (if applicable) | A student submitting the FAFSA should include a valid driver's license number if they have one, as it helps verify identity and streamline application processing. Providing this information is optional but recommended to reduce the risk of identity mismatch and expedite financial aid verification. |

| 10 | Records of Qualifying Assets (e.g., trust funds, mutual funds) | Records of qualifying assets such as trust funds and mutual funds must be submitted for FAFSA to accurately report the student's or parents' financial status. Detailed statements including account balances, ownership details, and transaction history support proper evaluation of available resources for financial aid eligibility. |

| 11 | Parents’ Tax Returns and W-2 Forms (for dependent students) | Dependent students submitting FAFSA must include their parents' most recent federal tax returns, typically IRS Form 1040, to verify income and tax information accurately. Parents' W-2 forms are also required to provide detailed records of earned income, ensuring precise financial assessment for aid eligibility. |

| 12 | Documentation of Other Financial Information (e.g., welfare benefits, veterans’ benefits) | Students must provide documentation of other financial information such as statements of welfare benefits, veteran's benefits, and any untaxed income to ensure accurate FAFSA submission. Supporting documents may include letters from government agencies verifying benefits and records of any additional financial assistance received. |

Introduction: Understanding the Importance of FAFSA in Finance

```htmlWhat documents are essential for a successful FAFSA submission? FAFSA plays a critical role in securing financial aid for higher education. Your accurate documentation ensures eligibility for grants, loans, and scholarships that support college expenses.

```Personal Identification Documents Needed

Submitting the Free Application for Federal Student Aid (FAFSA) requires specific personal identification documents. These documents verify identity and are essential for processing your application.

Typically, you need a valid Social Security card or number, a driver's license if applicable, and a state-issued ID or passport. These documents confirm your identity and citizenship status. Accurate submission of these IDs helps prevent delays in receiving financial aid.

Social Security Number and Residency Proof

| Document | Description | Importance for FAFSA |

|---|---|---|

| Social Security Number (SSN) | A unique nine-digit number issued by the Social Security Administration used for identification and tracking earnings. | Essential for FAFSA submission to verify identity and eligibility for federal student aid. |

| Proof of Residency | Official documents demonstrating the student's state of residence, such as a state-issued ID, driver's license, utility bills, or lease agreements. | Required to determine residency status and qualify for in-state tuition rates or state financial aid programs. |

Federal Income Tax Returns and W-2 Forms

Federal income tax returns are essential documents for FAFSA submission as they provide a detailed record of your financial information. These returns help determine your eligibility for federal student aid by verifying your income.

W-2 forms from employers summarize earnings and taxes withheld, serving as proof of income for the FAFSA application. Accurate and up-to-date W-2 forms ensure the financial data submitted is correct, impacting your aid eligibility positively.

Records of Untaxed Income

When submitting the FAFSA, students must provide accurate records of untaxed income to ensure proper financial aid assessment. Untaxed income includes benefits such as child support received, interest income, and veterans' noneducation benefits.

Examples of untaxed income documents include IRS Form 1099-G for unemployment compensation and Social Security benefits statements. Maintaining these records helps verify reported amounts and prevents errors during the FAFSA review process.

Asset Documentation: Bank Statements and Investments

Students submitting the FAFSA must provide accurate asset documentation, including recent bank statements that reflect checking and savings account balances. Investment records are also essential, covering stocks, bonds, mutual funds, and other financial assets owned by the student or their family. These documents help determine the Expected Family Contribution, impacting financial aid eligibility and award amounts.

Parental Financial Information Requirements

Submitting the FAFSA requires specific parental financial documents to accurately assess a student's financial need. These documents verify income and tax details essential for aid determination.

- Tax Returns - Parents must provide signed federal income tax returns, such as IRS Form 1040, to report accurate income.

- W-2 Forms - Recent W-2 statements are required to document earned wages from employers for the previous year.

- Records of Untaxed Income - Documents detailing untaxed income, including Social Security benefits or child support, must be submitted if applicable.

Gathering these parental financial records ensures FAFSA submission meets eligibility criteria for federal student aid.

Dependent vs. Independent Student Documentation

Submitting the FAFSA requires providing specific documents based on whether you are considered a dependent or independent student. Understanding the distinction ensures accurate and complete financial information for aid consideration.

Dependent and independent students must gather different documentation reflecting their financial status and household.

- Identification Documents - Both dependent and independent students need a valid Social Security number and driver's license if applicable.

- Income Records - Dependent students must include their parents' income tax returns and W-2 forms, while independent students provide their own.

- Additional Verification - Independent students may need proof of independence such as a copy of a court order, military service papers, or documentation of emancipation.

Special Circumstances and Additional Documentation

Submitting your FAFSA requires standard documents such as your Social Security number, tax returns, and income records. Special circumstances like changes in income, dependency status, or unusual financial situations may necessitate additional documentation, including letters from employers, court orders, or medical bills. Providing accurate supporting papers ensures your financial aid application reflects your true financial need.

What Documents Does a Student Need for FAFSA Submission? Infographic