Freelancers need key documents such as bank statements, tax returns, and invoices to verify their income accurately. Consistent records like profit and loss statements and 1099 forms further support financial credibility. Maintaining organized documentation streamlines the income verification process for loans, rentals, or other financial assessments.

What Documents Does a Freelancer Need for Income Verification?

| Number | Name | Description |

|---|---|---|

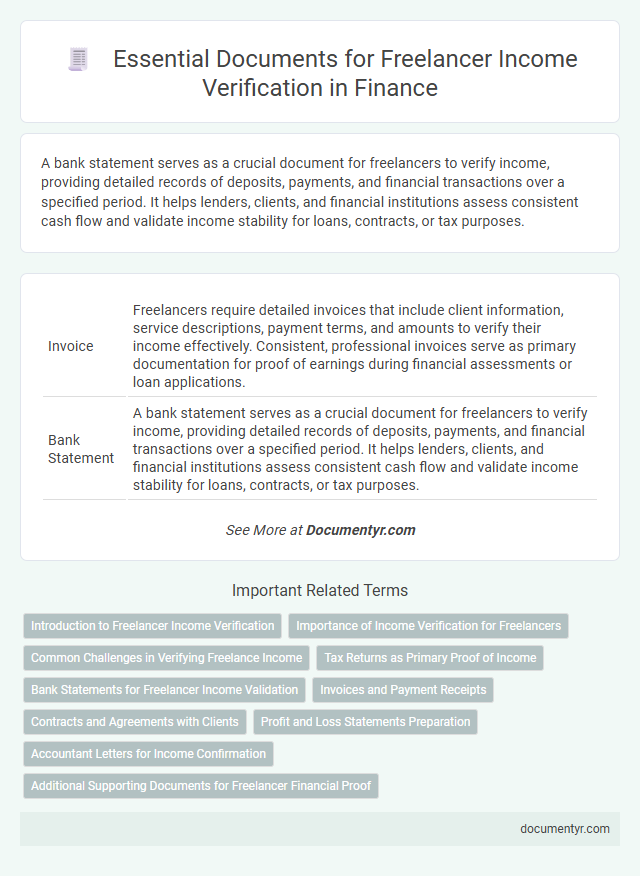

| 1 | Invoice | Freelancers require detailed invoices that include client information, service descriptions, payment terms, and amounts to verify their income effectively. Consistent, professional invoices serve as primary documentation for proof of earnings during financial assessments or loan applications. |

| 2 | Bank Statement | A bank statement serves as a crucial document for freelancers to verify income, providing detailed records of deposits, payments, and financial transactions over a specified period. It helps lenders, clients, and financial institutions assess consistent cash flow and validate income stability for loans, contracts, or tax purposes. |

| 3 | Pay Stub | Freelancers typically use pay stubs to verify their income, providing detailed records of payments received, tax deductions, and client information. Accurate pay stubs help establish steady cash flow and financial reliability when applying for loans, credit, or rental agreements. |

| 4 | Tax Return (Form 1040) | Freelancers must provide their Tax Return (Form 1040) as a primary document for income verification, as it comprehensively details their annual earnings, deductions, and tax liabilities. This IRS form substantiates reported income and supports applications for loans, rentals, and other financial assessments requiring proof of consistent revenue. |

| 5 | 1099 Form | Freelancers primarily rely on the IRS Form 1099-NEC to verify income, as it reports non-employee compensation received from clients. This document is essential for tax filing and financial applications, providing clear evidence of earnings without traditional pay stubs. |

| 6 | Profit and Loss Statement | Freelancers need a detailed Profit and Loss Statement to verify income, highlighting total earnings, business expenses, and net profit over a specific period. This document provides lenders and clients with a clear financial overview, ensuring accurate assessment of the freelancer's cash flow and profitability. |

| 7 | Client Payment Receipt | Client payment receipts serve as primary evidence for freelancers to verify income, detailing transaction dates, amounts, and client information. These receipts, often accompanied by invoices and bank statements, provide credible documentation for tax filings and loan applications. |

| 8 | Statement of Work | A freelancer needs a detailed Statement of Work (SOW) outlining project scope, deliverables, timelines, and payment terms for accurate income verification, as this document substantiates their contractual obligations and earnings. Including a signed SOW with invoices and bank statements enhances the credibility of income claims during financial assessments. |

| 9 | Contract Agreement | A freelancer's contract agreement serves as a primary document for income verification, detailing the scope of work, payment terms, and project duration agreed upon with the client. This legally binding document establishes proof of anticipated income and provides financial institutions with concrete evidence of freelance earnings during loan applications or financial assessments. |

| 10 | Financial Statement | Freelancers need detailed financial statements such as profit and loss statements or income summaries to verify their income accurately. These documents provide a clear record of earnings, expenses, and net profit, essential for loan applications, tax filings, and financial planning. |

| 11 | Letter from Client | A letter from a client serves as a critical document for income verification, detailing the scope of work, payment amounts, and dates of service which validate the freelancer's earnings. This letter must include the client's contact information and signature to ensure authenticity and strengthen the freelancer's financial credibility. |

| 12 | Payment Platform Statement (e.g., PayPal, Stripe) | Freelancers need payment platform statements such as PayPal and Stripe to substantiate their income reliably, as these documents provide detailed transaction histories and reflect consistent payment flows. These statements serve as credible proof of earnings in financial processes like loan applications or tax filings. |

| 13 | Accounting Ledger | Freelancers need an accounting ledger to accurately track all income and expenses, providing clear documentation for income verification during tax filings or loan applications. This ledger should include detailed records of invoices, payments received, and dates of transactions to substantiate reported earnings. |

| 14 | Freelance Platform Earnings Report | Freelancers must provide a freelance platform earnings report as a primary document for income verification, detailing their total payments received, transaction dates, and client information. This report serves as proof of consistent income and is often required by lenders, tax authorities, and financial institutions to validate earnings. |

| 15 | Affidavit of Self-Employment | An Affidavit of Self-Employment serves as a legally binding document where freelancers declare their income, providing financial institutions with a reliable source for income verification. This affidavit includes essential details such as business name, duration of self-employment, income amount, and signature, facilitating loan approvals and financial assessments. |

Introduction to Freelancer Income Verification

Verifying income is a crucial step for freelancers when applying for loans, rental agreements, or other financial services. Unlike traditional employees, freelancers often rely on various documents to prove their earnings.

Your income verification may include tax returns, bank statements, and invoices that demonstrate consistent cash flow. Understanding these essential documents helps streamline the approval process and builds financial credibility.

Importance of Income Verification for Freelancers

| Document Type | Description | Purpose in Income Verification |

|---|---|---|

| Bank Statements | Monthly records showing deposits and payments. | Proof of consistent cash flow and income deposits over time. |

| Invoices | Records issued to clients for services provided. | Demonstrates amount billed and expected income from projects. |

| Tax Returns (Schedule C or Form 1099) | Official filings reporting annual freelance earnings. | Confirms reported income to tax authorities; essential for loan and credit applications. |

| Profit and Loss Statements | Summary of income and expenses over a specific period. | Reflects net income and overall financial health of your freelance business. |

| Contracts or Client Agreements | Written agreements outlining scope and payment terms. | Validates expected future income and contractual obligations. |

Income verification is crucial for freelancers to establish financial credibility when applying for loans, mortgages, or rental agreements. It provides lenders and service providers with reliable evidence of Your earnings and business stability, reducing uncertainty about income variability common in freelancing. Proper documentation ensures access to financial products and services by proving Your ability to meet financial commitments.

Common Challenges in Verifying Freelance Income

What documents are essential for verifying freelance income? Typical paperwork includes bank statements, 1099 forms, and invoices. These documents help establish a consistent income flow for financial assessments.

What are common challenges in verifying freelance income? Irregular payment schedules and varying client contracts complicate income tracking. This unpredictability often requires multiple proof sources to confirm earnings accurately.

Tax Returns as Primary Proof of Income

Tax returns serve as the primary proof of income for freelancers during income verification processes. Lenders and clients rely on these documents to assess financial stability and earning consistency.

- Tax Returns - These official documents verify your reported income and provide a comprehensive overview of your earnings over the fiscal year.

- Schedule C Form - This form details profit or loss from a business operated as a sole proprietor, supplementing the tax return with specific freelance income data.

- Supporting Financial Statements - Bank statements and invoices can accompany tax returns to further corroborate income claims and payment history.

Bank Statements for Freelancer Income Validation

Bank statements serve as a primary document for freelancer income verification, providing a detailed record of transactional history. These statements highlight deposits that reflect consistent earnings, essential for validating self-employment income.

Lenders and financial institutions analyze bank statements to assess income stability and cash flow patterns. Your bank statements must be clear, consecutive, and cover a specific period, often three to six months, to support income claims effectively.

Invoices and Payment Receipts

Invoices play a crucial role in income verification for freelancers by detailing the services provided, payment terms, and amounts due. Payment receipts confirm the funds received, serving as proof of completed transactions and consistent earnings. Maintaining organized records of both invoices and payment receipts strengthens your financial credibility during audits or loan applications.

Contracts and Agreements with Clients

Contracts and agreements with clients serve as primary evidence of your income as a freelancer. These documents outline the scope of work, payment terms, and deadlines, providing clear proof of engagements and earnings. Maintaining organized and signed contracts helps streamline the income verification process for financial institutions and tax authorities.

Profit and Loss Statements Preparation

Income verification for freelancers relies heavily on accurate financial documentation. Preparing detailed Profit and Loss Statements is essential to showcase your income.

- Profit and Loss Statement - Summarizes your revenues and expenses over a specific period to determine net profit.

- Bank Statements - Provides transaction records that support the income and expenses listed in your Profit and Loss Statement.

- Invoices and Receipts - Verifies individual income entries and business-related expenditures to ensure accurate financial reporting.

Accountant Letters for Income Confirmation

Freelancers must provide reliable documents to verify their income when applying for loans or rental agreements. Accountant letters serve as credible evidence, confirming your earnings in a formal and verifiable manner.

- Accountant Letter - A professional document issued by a licensed accountant verifying your income for a specific period.

- Income Breakdown - The letter typically includes a detailed summary of your freelance earnings, showing monthly or annual income.

- Official Validation - It is signed and stamped by the accountant, adding authenticity and credibility to your income statement.

Accountant letters provide lenders and landlords with trusted verification of your freelance income.

What Documents Does a Freelancer Need for Income Verification? Infographic