To set up a Health Savings Account (HSA), you need valid identification such as a driver's license or passport, proof of High Deductible Health Plan (HDHP) coverage, and your Social Security number or tax identification number. Some providers may also require your bank account details for funding purposes. Keep these documents ready to ensure a smooth and efficient HSA account setup process.

What Documents are Necessary for HSA Account Setup?

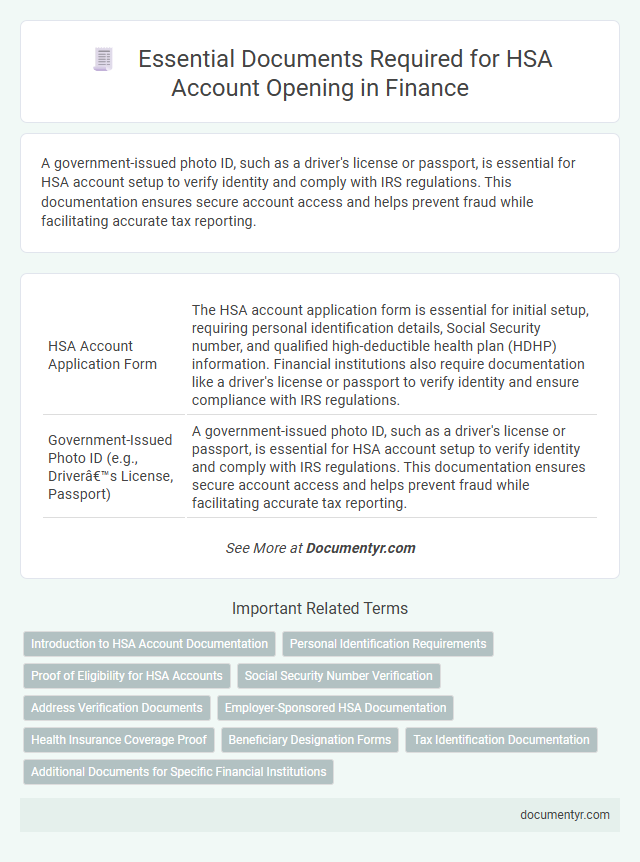

| Number | Name | Description |

|---|---|---|

| 1 | HSA Account Application Form | The HSA account application form is essential for initial setup, requiring personal identification details, Social Security number, and qualified high-deductible health plan (HDHP) information. Financial institutions also require documentation like a driver's license or passport to verify identity and ensure compliance with IRS regulations. |

| 2 | Government-Issued Photo ID (e.g., Driver’s License, Passport) | A government-issued photo ID, such as a driver's license or passport, is essential for HSA account setup to verify identity and comply with IRS regulations. This documentation ensures secure account access and helps prevent fraud while facilitating accurate tax reporting. |

| 3 | Social Security Number (SSN) | A valid Social Security Number (SSN) is essential for Health Savings Account (HSA) setup to verify identity and ensure IRS compliance. Financial institutions require the SSN to link the HSA to the account holder's tax records for accurate reporting and contribution tracking. |

| 4 | Proof of High Deductible Health Plan (HDHP) Coverage | To set up an HSA account, individuals must provide official documentation verifying their enrollment in a High Deductible Health Plan (HDHP), such as a health insurance card or a coverage confirmation letter from the insurer indicating plan details and effective dates. This proof is essential to ensure eligibility and compliance with IRS requirements governing Health Savings Accounts. |

| 5 | Employer Verification Letter (if applicable) | An Employer Verification Letter is crucial for HSA account setup when contributions are made through an employer-sponsored plan, confirming eligibility and contribution limits based on the employee's health coverage. This document typically includes the employee's name, employer details, coverage dates, and confirmation of a high-deductible health plan (HDHP) to ensure compliance with IRS regulations. |

| 6 | Beneficiary Designation Form | The Beneficiary Designation Form is essential for HSA account setup as it ensures the account holder's funds are transferred according to their wishes upon death. This document requires accurate personal information of the beneficiary and must be submitted alongside proof of identity and HSA application forms to establish the account effectively. |

| 7 | Direct Deposit Authorization Form (optional) | A Direct Deposit Authorization Form is an optional but highly recommended document for HSA account setup, enabling automatic contributions from your employer or bank to streamline fund management. Providing this form ensures timely deposits, reduces manual processing errors, and improves overall HSA account efficiency. |

| 8 | Proof of Address (e.g., Utility Bill, Lease Agreement) | Proof of address is a crucial document for HSA account setup, typically requiring a recent utility bill, lease agreement, or mortgage statement to verify residential information. Financial institutions use these documents to comply with identity verification regulations and ensure account security. |

| 9 | Initial Contribution Form (if making a deposit) | To set up an HSA account with an initial deposit, you must complete the Initial Contribution Form, which details the amount and source of funds being contributed. This form, along with valid identification such as a government-issued ID and your HSA plan documentation, ensures your deposit is accurately recorded and compliant with IRS regulations. |

| 10 | Taxpayer Identification Number (TIN, if applicable) | To open a Health Savings Account (HSA), individuals must provide a valid Taxpayer Identification Number (TIN), such as a Social Security Number (SSN) or Employer Identification Number (EIN), to verify identity and enable proper tax reporting. The TIN ensures compliance with IRS regulations and facilitates contributions, distributions, and tax deductibility associated with the HSA. |

Introduction to HSA Account Documentation

What documents are necessary for HSA account setup? Health Savings Account (HSA) setup requires specific documentation to verify eligibility and identity. Proper documentation ensures compliance with IRS regulations and smooth account activation.

Personal Identification Requirements

To set up an HSA account, personal identification is crucial for verification and compliance with federal regulations. You must provide a government-issued photo ID, such as a driver's license or passport, to confirm your identity. Proof of Social Security number, like a Social Security card or a W-2 form, is also required to complete the setup process.

Proof of Eligibility for HSA Accounts

Proof of eligibility is essential for setting up a Health Savings Account (HSA). Required documents typically include a high-deductible health plan (HDHP) insurance card or coverage summary.

Other necessary proofs may involve documentation confirming no other disqualifying health coverage exists. Valid identification like a driver's license or Social Security number is also required to verify your eligibility.

Social Security Number Verification

Setting up a Health Savings Account (HSA) requires several key documents to verify your identity and eligibility. One of the most critical elements in this process is Social Security Number (SSN) verification.

- Government-issued ID - A valid driver's license or passport is required to confirm your identity alongside your SSN.

- Social Security Card - Presenting your original or a copy of the Social Security card helps ensure accurate SSN verification for account setup.

- Tax Identification Compliance - The SSN verification aligns with IRS policies to validate your eligibility for HSA tax benefits.

Providing precise SSN documentation streamlines your HSA account approval and compliance with federal regulations.

Address Verification Documents

Setting up an HSA account requires specific documents to verify your identity and address. Address verification is crucial to ensure compliance with financial regulations and secure account access.

- Utility Bills - Recent utility bills such as electricity, water, or gas statements prove your current residential address.

- Bank Statements - Official bank statements typically display your name and address to confirm residence.

- Government-Issued Mail - Documents like a property tax receipt or voter registration card can serve as reliable address verification.

Employer-Sponsored HSA Documentation

Setting up an employer-sponsored Health Savings Account (HSA) requires specific documentation from both the employee and employer. These documents help verify eligibility and facilitate the proper management of contributions and benefits.

- Employer HSA Plan Summary - Details the specific terms, contribution limits, and administrative procedures for the employer-sponsored HSA plan.

- Employment Verification Letter - Confirms current employment status and eligibility to participate in the employer's HSA program.

- High Deductible Health Plan (HDHP) Certification - Provides proof that the employee is enrolled in a qualified HDHP, meeting IRS requirements for HSA eligibility.

Health Insurance Coverage Proof

Proof of health insurance coverage is essential when setting up a Health Savings Account (HSA). This document verifies that you are enrolled in a high-deductible health plan (HDHP), which is a requirement for HSA eligibility.

Acceptable forms of health insurance coverage proof include insurance cards, policy statements, or letters from your insurance provider. Ensuring accurate and up-to-date documentation helps streamline the HSA account setup process.

Beneficiary Designation Forms

Setting up a Health Savings Account (HSA) requires specific documents, with the Beneficiary Designation Form being essential. This form ensures that your HSA funds are transferred according to your wishes in the event of your passing. Providing accurate beneficiary information helps avoid complications and secures your account's future benefits for your designated recipients.

Tax Identification Documentation

| Document Type | Description | Purpose |

|---|---|---|

| Social Security Number (SSN) | Unique nine-digit number issued to U.S. citizens and eligible residents by the Social Security Administration. | Used as the primary Tax Identification Number (TIN) for verifying identity and tax reporting in Health Savings Account (HSA) setup. |

| Individual Taxpayer Identification Number (ITIN) | Tax processing number issued by the IRS to individuals not eligible for an SSN, such as non-resident aliens. | Serves as an alternative TIN for HSA account holders who cannot obtain an SSN, ensuring tax compliance. |

| Employer Identification Number (EIN) | Nine-digit number assigned to businesses and organizations by the IRS. | Used for establishing HSAs sponsored by employers or self-employed individuals acting as business entities. |

| Valid Government-Issued ID | Documents include driver's license, state ID card, or passport. | Confirms identity alongside tax identification documents during HSA account setup. |

What Documents are Necessary for HSA Account Setup? Infographic