To open a business bank account, essential documents typically include a valid government-issued ID, proof of business registration or incorporation, and an Employer Identification Number (EIN) or tax identification number. Banks may also require ownership agreements, such as partnership agreements or operating agreements, and recent financial statements. Having these documents prepared streamlines the account setup process and ensures compliance with financial regulations.

What Documents are Needed for Opening a Business Bank Account?

| Number | Name | Description |

|---|---|---|

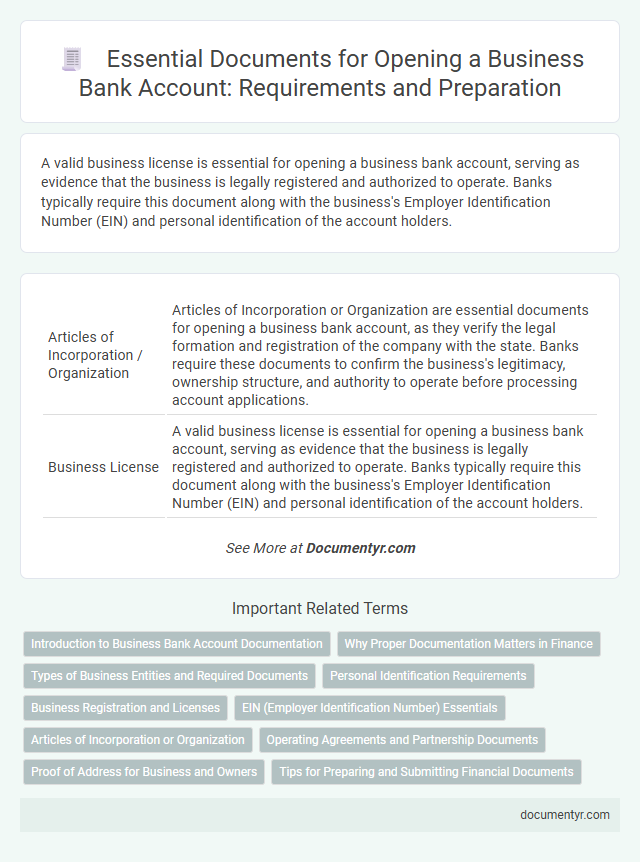

| 1 | Articles of Incorporation / Organization | Articles of Incorporation or Organization are essential documents for opening a business bank account, as they verify the legal formation and registration of the company with the state. Banks require these documents to confirm the business's legitimacy, ownership structure, and authority to operate before processing account applications. |

| 2 | Business License | A valid business license is essential for opening a business bank account, serving as evidence that the business is legally registered and authorized to operate. Banks typically require this document along with the business's Employer Identification Number (EIN) and personal identification of the account holders. |

| 3 | Employer Identification Number (EIN) Letter | An Employer Identification Number (EIN) letter from the IRS is essential for opening a business bank account, serving as official proof of your company's tax identification. Banks rely on the EIN letter to verify the legitimacy of your business and ensure compliance with federal tax regulations. |

| 4 | Partnership Agreement (if applicable) | A Partnership Agreement is essential when opening a business bank account for a partnership, as it verifies the partnership's structure and outlines each partner's authority. Banks typically require a signed and notarized Partnership Agreement to ensure compliance and proper account management. |

| 5 | Operating Agreement (LLC) | An Operating Agreement is essential for opening a business bank account for an LLC, as it outlines the company's ownership structure and management policies. Banks use this document to verify the authority of members and managers to conduct financial transactions on behalf of the LLC. |

| 6 | Certificate of Assumed Name / DBA Filing | A Certificate of Assumed Name or DBA (Doing Business As) filing is crucial for opening a business bank account as it legally establishes the business's trade name. Banks require this document to verify the legitimacy of the business identity and ensure compliance with state regulations. |

| 7 | Corporate Bylaws | Corporate bylaws serve as a critical document for opening a business bank account, outlining the company's governance structure and operational rules required by banks to verify legitimacy. Providing certified copies of the corporate bylaws along with articles of incorporation and an employer identification number (EIN) ensures compliance with financial institutions' account opening protocols. |

| 8 | Board Resolution (for authorized signers) | A board resolution is a critical legal document required for opening a business bank account, authorizing designated individuals to act as signers on behalf of the company, ensuring compliance with banking regulations and internal governance. Banks typically mandate a certified copy of the resolution, detailing the names and signatures of authorized signatories to prevent unauthorized transactions and safeguard corporate funds. |

| 9 | Ownership Agreements | Ownership agreements such as partnership agreements or shareholder agreements are essential documents for opening a business bank account, as they verify the structure and stakeholders of the company. Banks require these agreements to ensure clarity on authorization, control, and profit distribution among owners before account approval. |

| 10 | Government-issued ID (Personal) | A government-issued personal ID, such as a driver's license, passport, or state ID card, is essential for verifying identity when opening a business bank account. Banks require this official identification to comply with Know Your Customer (KYC) regulations and prevent fraud. |

| 11 | Social Security Number (for sole proprietors) | Sole proprietors must provide their Social Security Number (SSN) when opening a business bank account to verify their identity and ensure compliance with federal regulations. The SSN serves as a primary identifier in the bank's Know Your Customer (KYC) process and is essential for tax reporting purposes. |

| 12 | Certificate of Good Standing | A Certificate of Good Standing is a crucial document required for opening a business bank account, as it verifies that the company is legally registered and compliant with state regulations. Banks rely on this certificate to ensure the business is active and authorized to operate, reducing the risk of fraud. |

| 13 | Tax Identification Number (TIN) | A Tax Identification Number (TIN) is essential for opening a business bank account as it verifies the business's tax obligations and identity. Banks require the TIN alongside other documents like business registration certificates and identification to ensure compliance with tax regulations. |

| 14 | Formation Documents | Formation documents required for opening a business bank account typically include the Articles of Incorporation or Articles of Organization, which verify the legal creation of the business entity. Banks also commonly request an Employer Identification Number (EIN) issued by the IRS, alongside operating agreements or partnership agreements to confirm ownership structure and authority. |

| 15 | Business Address Proof | Businesses must provide valid proof of their registered address to open a business bank account, such as utility bills, lease agreements, or official government correspondence. This documentation verifies the legitimacy of the business location and ensures compliance with banking regulations. |

| 16 | Banking Resolution | A banking resolution is a critical document required for opening a business bank account, authorizing specific individuals to act on behalf of the company in financial matters. This resolution, typically approved by the board of directors, ensures compliance with banking regulations and provides the bank with official confirmation of the business's authorized signatories. |

| 17 | Professional Licenses (if required) | Opening a business bank account may require submission of professional licenses relevant to the industry, such as a contractor's license or medical board certification, to verify legitimacy and compliance. Banks use these documents to ensure the business operates within legal regulations and meets state or federal licensing requirements. |

| 18 | Organizational Chart (for large entities) | A detailed organizational chart is essential for opening a business bank account for large entities as it clearly outlines the company structure, key management personnel, and ownership hierarchy, which helps the bank assess authorization and risk. This document complements foundational paperwork such as articles of incorporation, tax identification numbers, and personal identification of authorized signers, ensuring comprehensive verification. |

| 19 | Trade Name Registration | Trade name registration documents, including the certificate of trade name or "doing business as" (DBA) certificate, are essential when opening a business bank account to verify the legitimacy of the business identity. Banks typically require this documentation alongside employer identification number (EIN) and personal identification to ensure compliance with regulatory and anti-fraud policies. |

| 20 | Partnership Certificate | A Partnership Certificate is a crucial document required for opening a business bank account as it legally verifies the existence and registration of the partnership firm. Banks also typically require the partnership deed, identification proofs of partners, and the business registration number to ensure compliance with regulatory standards. |

Introduction to Business Bank Account Documentation

Opening a business bank account requires specific documentation to verify the identity and legitimacy of the business. Proper documentation ensures compliance with banking regulations and smooth account setup.

- Proof of Business Identity - Includes articles of incorporation, business licenses, or a partnership agreement to confirm the business's legal status.

- Personal Identification - Government-issued IDs like a passport or driver's license of the business owner or authorized signatories are necessary for identity verification.

- Tax Identification Number (TIN) - A valid Employer Identification Number (EIN) or Social Security Number (SSN) must be provided for tax reporting purposes.

Having these documents prepared in advance expedites the business bank account opening process and ensures regulatory compliance.

Why Proper Documentation Matters in Finance

Opening a business bank account requires specific documents such as a valid business license, employer identification number (EIN), and personal identification of the account holders. These documents verify the legitimacy of the business and the identities involved.

Proper documentation matters in finance because it ensures compliance with legal and regulatory standards, reducing the risk of fraud and financial discrepancies. Accurate records facilitate smooth banking operations and build trust with financial institutions.

Types of Business Entities and Required Documents

Opening a business bank account requires specific documents based on your business entity type. Understanding the required paperwork ensures a smooth account setup process.

- Sole Proprietorship - Provide your personal identification, business license, and a Trade Name Certificate or Doing Business As (DBA) document.

- Partnership - Submit personal IDs of all partners, the partnership agreement, and an Employer Identification Number (EIN) from the IRS.

- Corporation or LLC - Present Articles of Incorporation or Articles of Organization, corporate resolution authorized by the board, and the EIN.

Personal Identification Requirements

Opening a business bank account requires specific personal identification documents to verify the identity of the account holder. Banks mandate these documents to comply with legal and regulatory standards, ensuring security and preventing fraud.

Acceptable personal identification typically includes a government-issued photo ID such as a passport or driver's license. Proof of address, like a utility bill or rental agreement, may also be required. Some banks ask for a Social Security Number (SSN) or Tax Identification Number (TIN) to confirm tax-related information.

Business Registration and Licenses

Opening a business bank account requires submitting official business registration documents as proof of legal ownership. These documents include certificates of incorporation, partnership agreements, or sole proprietorship registration papers. Banks also require business licenses relevant to the industry to verify compliance with local regulations.

EIN (Employer Identification Number) Essentials

Opening a business bank account requires specific documentation to verify your company's identity and financial legitimacy. The Employer Identification Number (EIN) is a critical element for this process, serving as the business's federal tax ID.

- EIN Overview - The EIN is issued by the IRS to uniquely identify your business for tax purposes.

- Application Requirement - Banks mandate the EIN to open a business account as proof of your business's official registration.

- Obtaining an EIN - You can apply for an EIN online through the IRS website quickly and at no cost.

Articles of Incorporation or Organization

| Document | Description | Purpose |

|---|---|---|

| Articles of Incorporation or Organization | Official legal document filed with the state government to establish a corporation or limited liability company (LLC). | Proves the business's legal existence and entity type, required to verify legitimacy and register the bank account under the business name. |

| Employer Identification Number (EIN) | Issued by the Internal Revenue Service (IRS) as a unique identifier for the business. | Required to manage tax accounts and open a business bank account. |

| Operating Agreement or Bylaws | Internal document outlining ownership, management structure, and operating procedures of the business. | Used by banks to understand ownership roles and authorization for account access. |

| Personal Identification | Government-issued photo ID such as driver's license or passport. | Verifies identity of business owners and authorized signers. |

| Business License | Legal permission granted by local or state authorities to operate the business. | Confirms the business complies with regulatory requirements. |

Operating Agreements and Partnership Documents

Opening a business bank account requires specific documents to verify the company's legal structure and ownership. Operating agreements and partnership documents are crucial for businesses formed as LLCs or partnerships.

Operating agreements outline the management structure and member roles of an LLC, providing banks with proof of authority and internal organization. Partnership documents, such as partnership agreements, define the terms and responsibilities between partners and are necessary to establish the legitimacy of the business relationship.

Proof of Address for Business and Owners

What documents are required to prove the address when opening a business bank account? Proof of address is essential for both the business and its owners to confirm legitimacy and ensure compliance with banking regulations. Common documents include utility bills, lease agreements, or official government correspondence that clearly display the relevant address.

What Documents are Needed for Opening a Business Bank Account? Infographic