A nonprofit organization seeking 501(c)(3) status must prepare several key documents, including its Articles of Incorporation that define its purpose and structure, and bylaws that outline governance rules. The organization must complete IRS Form 1023 or 1023-EZ to apply for tax-exempt status, providing detailed financial data and descriptions of its activities. Maintaining accurate records such as a conflict of interest policy and annual financial statements strengthens compliance and supports the application process.

What Documents Does a Nonprofit Organization Need for 501(c)(3) Status?

| Number | Name | Description |

|---|---|---|

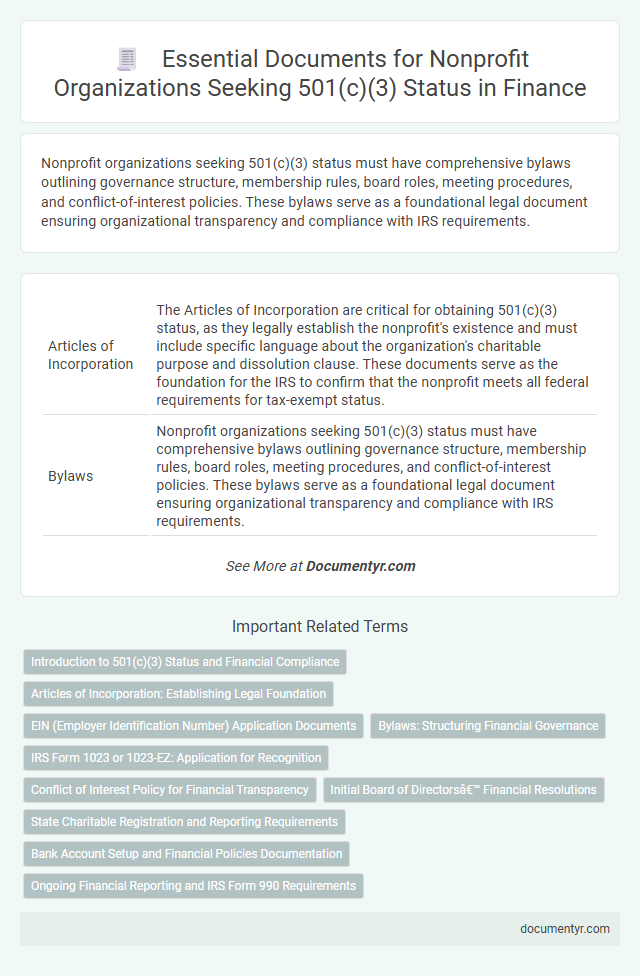

| 1 | Articles of Incorporation | The Articles of Incorporation are critical for obtaining 501(c)(3) status, as they legally establish the nonprofit's existence and must include specific language about the organization's charitable purpose and dissolution clause. These documents serve as the foundation for the IRS to confirm that the nonprofit meets all federal requirements for tax-exempt status. |

| 2 | Bylaws | Nonprofit organizations seeking 501(c)(3) status must have comprehensive bylaws outlining governance structure, membership rules, board roles, meeting procedures, and conflict-of-interest policies. These bylaws serve as a foundational legal document ensuring organizational transparency and compliance with IRS requirements. |

| 3 | IRS Form 1023 (Application for Recognition of Exemption) | IRS Form 1023, the Application for Recognition of Exemption, is the critical document a nonprofit must submit to obtain 501(c)(3) status, detailing organizational structure, governance, and financial information to demonstrate eligibility. Accurate completion of this form, along with supporting documents like articles of incorporation and bylaws, is essential for securing federal tax-exempt recognition from the IRS. |

| 4 | EIN Confirmation Letter (IRS Form SS-4) | The EIN Confirmation Letter, issued by the IRS upon submission of Form SS-4, is a crucial document for nonprofit organizations seeking 501(c)(3) status as it serves as official proof of the entity's Employer Identification Number (EIN). This letter is required to complete the IRS Form 1023 application and establishes the nonprofit's identity for tax-exempt recognition and banking purposes. |

| 5 | Conflict of Interest Policy | A Conflict of Interest Policy is essential for nonprofit organizations seeking 501(c)(3) status as it ensures transparency and accountability by requiring board members and key employees to disclose any potential conflicts. This document protects the organization's integrity, maintains public trust, and aligns with IRS expectations to prevent financial mismanagement and self-dealing. |

| 6 | Board of Directors List | A nonprofit organization applying for 501(c)(3) status must submit a comprehensive Board of Directors list detailing each member's name, address, and role within the organization. This document is crucial for demonstrating proper governance structure and accountability to the IRS. |

| 7 | Meeting Minutes (Initial and Ongoing) | Nonprofit organizations seeking 501(c)(3) status must maintain detailed meeting minutes documenting initial board resolutions and ongoing decisions, demonstrating compliance with governance and operational requirements. These minutes serve as evidence of organizational structure, policy adoption, and adherence to IRS regulations critical for tax-exempt designation. |

| 8 | Financial Statements (Projected Budget, Balance Sheet) | Nonprofit organizations seeking 501(c)(3) status must prepare detailed financial statements, including a projected budget outlining anticipated revenues and expenses, and a balance sheet reflecting current assets, liabilities, and net assets. These documents demonstrate financial accountability and help the IRS assess the organization's fiscal responsibility and sustainability. |

| 9 | Mission Statement | A clear and concise mission statement is essential for a nonprofit to obtain 501(c)(3) status, as it defines the organization's charitable purpose in alignment with IRS requirements. This document demonstrates the nonprofit's commitment to serving the public interest, which is critical for the IRS to determine eligibility for tax-exempt recognition. |

| 10 | Proof of State Nonprofit Status (e.g., Certificate of Incorporation) | The Certificate of Incorporation serves as the primary proof of state nonprofit status required for 501(c)(3) tax-exempt recognition, establishing the organization's legal existence and nonprofit purpose. This document must be filed with the state's business filing agency and include specific language demonstrating the nonprofit nature to satisfy IRS regulations. |

| 11 | Charitable Solicitation Registration (if applicable) | Nonprofit organizations seeking 501(c)(3) status must prepare and submit Charitable Solicitation Registration documents when required by state laws, ensuring compliance with fundraising regulations. These documents typically include the IRS determination letter, financial statements, and detailed descriptions of fundraising activities to maintain transparency and legal authorization. |

| 12 | Organizational Policies (Whistleblower, Document Retention) | Nonprofit organizations seeking 501(c)(3) status must include comprehensive organizational policies such as a whistleblower policy to protect individuals reporting misconduct and a document retention policy to ensure proper management and preservation of financial and operational records. These policies demonstrate governance transparency and compliance with IRS requirements, supporting the organization's tax-exempt application. |

| 13 | Description of Activities and Programs | A detailed Description of Activities and Programs outlines the nonprofit's specific charitable purposes and how it operates to fulfill its mission, essential for demonstrating eligibility under IRS 501(c)(3) requirements. This document must clearly define ongoing and planned activities, target beneficiaries, and the means of program delivery to establish the organization's commitment to public benefit and tax-exempt status compliance. |

| 14 | Narrative of Organization’s Purpose and Operations | A nonprofit organization seeking 501(c)(3) status must provide a detailed narrative describing its purpose, mission, and planned operations to demonstrate alignment with IRS requirements for charitable, educational, or religious activities. This narrative should clearly outline the organization's goals, target beneficiaries, and specific programs or services offered to support the tax-exempt designation. |

| 15 | List of Fundraising Methods | Nonprofit organizations seeking 501(c)(3) status must provide detailed documentation on fundraising methods such as grant applications, donation appeals, event fundraising plans, and crowdfunding strategies to demonstrate transparency and compliance with IRS regulations. Clear records of solicitation approaches, donor communication, and financial projections are essential to establish the nonprofit's capacity for lawful and effective fundraising activities. |

Introduction to 501(c)(3) Status and Financial Compliance

Obtaining 501(c)(3) status is essential for nonprofit organizations seeking federal tax-exempt recognition. Understanding the required documents ensures your organization meets both legal and financial compliance standards.

- Articles of Incorporation - This foundational document establishes your nonprofit's legal existence and purpose.

- Bylaws - Detailed rules governing your organization's operations and board structure are outlined in this document.

- IRS Form 1023 or 1023-EZ - These forms are the official applications submitted to the IRS to request tax-exempt status under section 501(c)(3).

Articles of Incorporation: Establishing Legal Foundation

The Articles of Incorporation serve as the legal foundation for a nonprofit seeking 501(c)(3) status. This document officially registers the organization with the state and outlines its purpose and structure.

Filing the Articles of Incorporation is a critical step to demonstrate the nonprofit's commitment to charitable objectives. It must include specific language required by the IRS to qualify for tax-exempt status under section 501(c)(3). The document typically defines the organization's name, mission, governance, and dissolution clause to ensure assets are dedicated to public benefit.

EIN (Employer Identification Number) Application Documents

To obtain 501(c)(3) status, a nonprofit organization must apply for an Employer Identification Number (EIN) from the IRS. The EIN serves as a unique identifier for tax purposes and is essential before submitting the IRS Form 1023 application.

The primary document needed for the EIN application is IRS Form SS-4, which collects detailed information about the nonprofit's structure and purpose. Supporting documents such as the nonprofit's articles of incorporation and bylaws may be required to verify legitimacy during the application process.

Bylaws: Structuring Financial Governance

Bylaws are essential for establishing the financial governance framework of a nonprofit seeking 501(c)(3) status. Your organization's bylaws must clearly define financial roles and procedures to ensure compliance and transparency.

- Define Financial Responsibilities - Bylaws should specify duties of officers and board members related to financial management and oversight.

- Establish Financial Controls - Procedures for budgeting, audits, and handling of funds must be outlined in the bylaws to prevent misuse.

- Outline Conflict of Interest Policies - Bylaws need to include policies that address potential financial conflicts to maintain organizational integrity.

IRS Form 1023 or 1023-EZ: Application for Recognition

Obtaining 501(c)(3) status requires submitting IRS Form 1023 or the streamlined 1023-EZ. These forms serve as the official application for recognition of tax-exempt status under federal law.

Form 1023 is a detailed document requiring comprehensive financial data, organizational structure, and operational information. The 1023-EZ offers a simplified alternative for smaller nonprofits, reducing the complexity of the application process.

Conflict of Interest Policy for Financial Transparency

What is the role of a Conflict of Interest Policy in obtaining 501(c)(3) status for a nonprofit organization? A Conflict of Interest Policy helps ensure financial transparency and accountability within the organization. It requires board members and key personnel to disclose any potential conflicts that could affect decision-making or financial integrity.

Initial Board of Directors’ Financial Resolutions

To obtain 501(c)(3) status, your nonprofit organization must prepare initial board of directors' financial resolutions. These resolutions outline the authorization of financial transactions, approval of budgets, and establishment of fiscal policies. Proper documentation ensures compliance with IRS requirements and strengthens your organization's financial governance.

State Charitable Registration and Reporting Requirements

State charitable registration is a crucial step for nonprofit organizations seeking 501(c)(3) status. Your nonprofit must comply with specific state requirements to maintain good standing and legal operation.

- State Registration Requirements - Most states require nonprofits to register with the state's charity official before soliciting donations.

- Annual Reporting - Many states mandate annual financial reports or renewal forms to ensure transparency and accountability.

- Compliance Deadlines - Timely submission of reports and registration renewals prevents penalties or suspension of fundraising privileges.

Meeting these state registration and reporting requirements is essential for sustaining your nonprofit's 501(c)(3) status and public trust.

Bank Account Setup and Financial Policies Documentation

Nonprofit organizations seeking 501(c)(3) status must prepare specific documents for bank account setup, including their IRS determination letter, an Employer Identification Number (EIN), and a copy of their articles of incorporation. Establishing clear financial policies documentation is critical, covering expense authorization, budgeting processes, and internal controls to ensure compliance and transparency. These documents support the organization's legal and financial integrity, facilitating prudent management and donor trust.

What Documents Does a Nonprofit Organization Need for 501(c)(3) Status? Infographic