Key documents required for estate planning include a will, which outlines the distribution of assets and guardianship preferences, and a durable power of attorney, granting authority to manage financial affairs if incapacitated. A living trust helps avoid probate by transferring assets to beneficiaries efficiently, while an advance healthcare directive specifies medical wishes. Having these documents properly drafted ensures clear management of your estate and protects your financial interests.

What Documents Are Required for Estate Planning?

| Number | Name | Description |

|---|---|---|

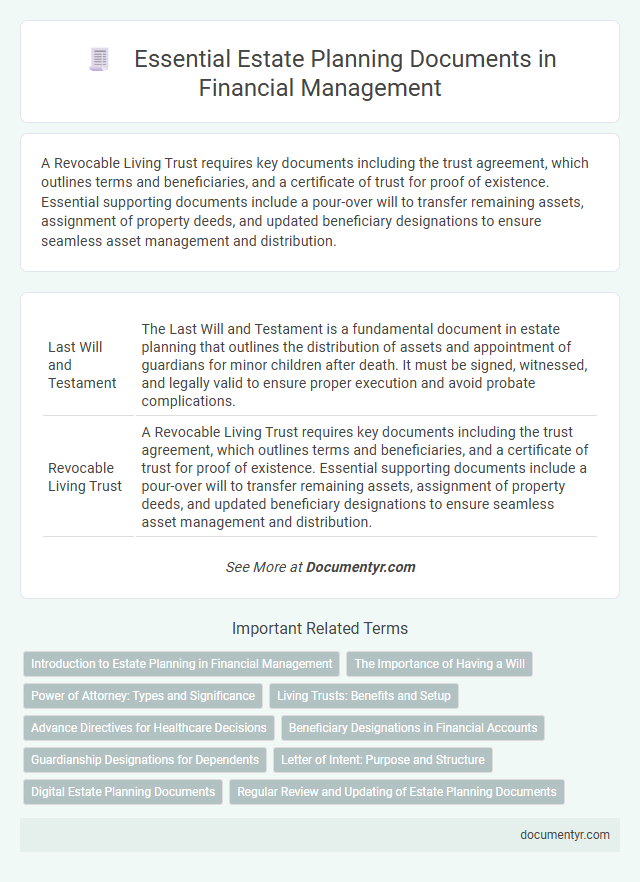

| 1 | Last Will and Testament | The Last Will and Testament is a fundamental document in estate planning that outlines the distribution of assets and appointment of guardians for minor children after death. It must be signed, witnessed, and legally valid to ensure proper execution and avoid probate complications. |

| 2 | Revocable Living Trust | A Revocable Living Trust requires key documents including the trust agreement, which outlines terms and beneficiaries, and a certificate of trust for proof of existence. Essential supporting documents include a pour-over will to transfer remaining assets, assignment of property deeds, and updated beneficiary designations to ensure seamless asset management and distribution. |

| 3 | Durable Power of Attorney | The Durable Power of Attorney is a critical estate planning document granting a trusted individual authority to manage financial and legal matters if the principal becomes incapacitated. It ensures uninterrupted control over assets without court intervention, safeguarding interests and facilitating timely decision-making. |

| 4 | Advance Healthcare Directive (Living Will) | An Advance Healthcare Directive, or Living Will, specifies an individual's medical treatment preferences in situations where they are unable to communicate, ensuring healthcare decisions align with their wishes. This document is essential in estate planning to provide clarity for healthcare providers and reduce family disputes during critical medical events. |

| 5 | HIPAA Authorization | HIPAA Authorization is a critical document in estate planning that grants designated individuals access to a person's private medical records, ensuring that healthcare decisions align with the individual's wishes. This authorization protects sensitive health information and facilitates communication between healthcare providers and authorized representatives during medical emergencies or incapacity. |

| 6 | Beneficiary Designation Forms | Beneficiary designation forms are critical documents in estate planning that specify who will receive assets like life insurance proceeds, retirement accounts, and payable-on-death accounts, ensuring these assets bypass the probate process. Properly completed forms help avoid disputes and facilitate a smooth transfer of wealth according to the account holder's wishes. |

| 7 | Guardianship Designation for Minor Children | Estate planning requires a guardianship designation document to legally appoint a guardian for minor children, ensuring their care and custody are managed according to the parents' wishes. This document must be clear, signed, and often notarized to be valid in court, safeguarding children's financial and personal well-being in the event of the parents' incapacity or death. |

| 8 | Financial Power of Attorney | A Financial Power of Attorney is a crucial document in estate planning that grants a designated agent authority to manage your financial affairs if you become incapacitated. This document must be properly executed according to state laws and often requires notarization and witnesses to ensure its validity. |

| 9 | Pour-Over Will | A Pour-Over Will requires key documents such as a revocable living trust, a detailed list of assets, and beneficiary designations to ensure all assets not included in the trust during the testator's lifetime are transferred upon death. This will acts as a safety net, funneling any overlooked property into the trust for streamlined estate administration and probate avoidance. |

| 10 | Letter of Intent | A Letter of Intent in estate planning outlines the testator's wishes and provides guidance to executors and beneficiaries regarding asset distribution, care of minor children, and funeral arrangements. Although not legally binding, it complements formal documents like wills and trusts by clarifying intentions and reducing potential disputes during probate. |

| 11 | Personal Property Memorandum | A Personal Property Memorandum is a crucial document in estate planning that specifically lists tangible personal assets and their designated beneficiaries, ensuring clear distribution without the need for extensive probate proceedings. This memorandum must typically be signed and referenced in the will to be legally effective, providing flexibility to update personal property wishes without altering the formal will. |

| 12 | Funeral and Burial Instructions | Funeral and burial instructions typically require a detailed document outlining preferences for cremation or burial, choice of funeral home, and any desired ceremonies or memorial services. Including this document in the estate plan ensures that personal wishes are honored and relieves family members from making difficult decisions during emotional times. |

| 13 | Deed for Real Estate Transfers | A deed is a crucial legal document required for real estate transfers in estate planning, as it specifies ownership and ensures the property is transferred according to the decedent's wishes. Types of deeds commonly used include warranty deeds, quitclaim deeds, and grant deeds, each serving different purposes in securing property interests and title clarity. |

| 14 | Inventory of Assets and Debts | An accurate inventory of assets and debts is essential for estate planning, including documentation such as bank statements, property deeds, retirement account summaries, loan agreements, and credit card statements. This detailed inventory ensures proper valuation and distribution of the estate, minimizing disputes and tax liabilities. |

| 15 | Certification of Trust | A Certification of Trust is a crucial document in estate planning that verifies the existence and terms of a trust without revealing its detailed contents, providing proof of its validity for financial institutions and third parties. This document typically includes the trustee's authority, trust date, and identification information, streamlining asset management and transfer processes while maintaining privacy. |

| 16 | Digital Asset Authorization | Digital asset authorization requires specific documents such as a digital asset inventory, powers of attorney with digital provisions, and instructions for accessing online accounts, passwords, and cryptocurrency wallets. These legal papers ensure seamless management and transfer of digital properties during estate settlement. |

Introduction to Estate Planning in Financial Management

Estate planning is a crucial aspect of financial management that involves organizing your assets to ensure their proper distribution after your passing. Key documents required for estate planning include a will, power of attorney, and healthcare directive. These legal papers help protect your financial interests and provide clear instructions to your beneficiaries.

The Importance of Having a Will

| Document | Description | Importance |

|---|---|---|

| Will | A legal document that outlines how your assets and properties should be distributed after your death. | Having a will provides clear instructions, prevents disputes among heirs, and ensures your wishes are honored. |

| Power of Attorney | Grants a trusted person authority to manage your financial and legal matters if you become incapacitated. | Essential for maintaining control over your financial affairs during unforeseen circumstances. |

| Living Trust | A trust created during your lifetime to hold and manage assets for beneficiaries without going through probate. | Helps avoid lengthy probate processes and keeps your estate matters private. |

| Advance Healthcare Directive | Specifies your preferences for medical treatment and appoints someone to make healthcare decisions on your behalf. | Ensures your medical wishes are followed and relieves family members from making difficult decisions. |

| Beneficiary Designations | Forms that name individuals who will inherit assets like retirement accounts and insurance policies. | Overrides wills in many cases, making it crucial to keep designations current. |

The importance of having a will cannot be overstated. It provides a foundation for all other estate planning documents and gives you peace of mind knowing your assets will be handled according to your intentions. Without a valid will, state laws will determine the distribution of your estate, which may not align with your preferences.

Power of Attorney: Types and Significance

Power of Attorney (POA) is a critical document in estate planning that grants an individual authority to act on another's behalf. Understanding its types and significance ensures proper management of financial and medical decisions.

- Durable Power of Attorney - Allows the agent to make financial decisions even if the principal becomes incapacitated.

- Medical Power of Attorney - Empowers a trusted person to make healthcare decisions when the principal is unable to do so.

- Limited Power of Attorney - Grants authority to act on specific matters or for a set period, protecting broader financial rights.

Living Trusts: Benefits and Setup

Living trusts are essential documents in estate planning that help manage and protect assets during an individual's lifetime and after their death. They provide a clear framework for asset distribution, potentially avoiding probate and ensuring privacy.

Setting up a living trust requires a trust agreement, a comprehensive list of assets, and proper titling of these assets within the trust. Consulting an estate planning attorney ensures the trust is correctly established and tailored to specific financial goals and family needs.

Advance Directives for Healthcare Decisions

Advance directives for healthcare decisions are essential documents in estate planning that outline a person's preferences for medical treatment if they become unable to communicate. These directives include living wills and durable powers of attorney for healthcare, ensuring that healthcare providers and family members understand the patient's wishes.

Living wills specify which medical treatments to accept or refuse in critical situations, while durable powers of attorney appoint a trusted individual to make healthcare decisions on behalf of the patient. Including advance directives in estate planning helps prevent disputes and provides clear guidance during medical emergencies.

Beneficiary Designations in Financial Accounts

Estate planning involves organizing your financial affairs to ensure your assets are distributed according to your wishes. Beneficiary designations in financial accounts play a critical role in this process by directing where your funds go upon your death.

- Updated Beneficiary Forms - These legal documents specify who will receive your financial assets, bypassing the will and probate process.

- Retirement Account Designations - Accounts such as IRAs and 401(k)s require clear beneficiary designations to avoid default state rules.

- Life Insurance Policies - Naming beneficiaries on your policies ensures proceeds are paid directly to the intended recipients.

Guardianship Designations for Dependents

Guardianship designations are a crucial part of estate planning, especially for individuals with minor dependents. These documents specify who will care for dependents if the primary guardians are unable to do so.

To establish guardianship, a legal document called a guardianship designation or nomination must be drafted, often as part of a will or a separate affidavit. This document should clearly name the chosen guardian and outline their responsibilities. Courts typically review these designations to ensure the guardian is suitable and acts in the best interest of the dependents.

Letter of Intent: Purpose and Structure

The Letter of Intent in estate planning serves as a guide for executors and beneficiaries, clarifying the testator's wishes beyond the formal will. It outlines specific instructions, personal messages, and details about asset distribution, helping to minimize misunderstandings. Structurally, this letter is informal, concise, and personalized, enhancing the clarity and effectiveness of the estate plan.

Digital Estate Planning Documents

Estate planning involves organizing your assets and wishes for the future, including digital assets. Digital estate planning documents ensure your online accounts and digital property are managed according to your preferences.

- Digital Will - Specifies how your digital assets and online accounts should be distributed or managed after your death.

- Power of Attorney for Digital Assets - Grants a trusted individual authority to manage your digital accounts if you become incapacitated.

- Inventory of Digital Assets - Lists all your digital accounts, login credentials, and important files you want to include in your estate.

Including digital estate planning documents is essential for comprehensive management of your financial and online legacy.

What Documents Are Required for Estate Planning? Infographic