To qualify for early retirement withdrawal penalty exceptions, specific documents must be provided, including medical records for disability claims, proof of substantially equal periodic payments, or documentation of a qualified domestic relations order. Tax forms such as IRS Form 5329 may also be required to report exceptions and avoid penalties. Maintaining accurate and detailed records ensures compliance with IRS rules and smooth processing of penalty-free withdrawals.

What Documents are Needed for Early Retirement Withdrawal Penalty Exceptions?

| Number | Name | Description |

|---|---|---|

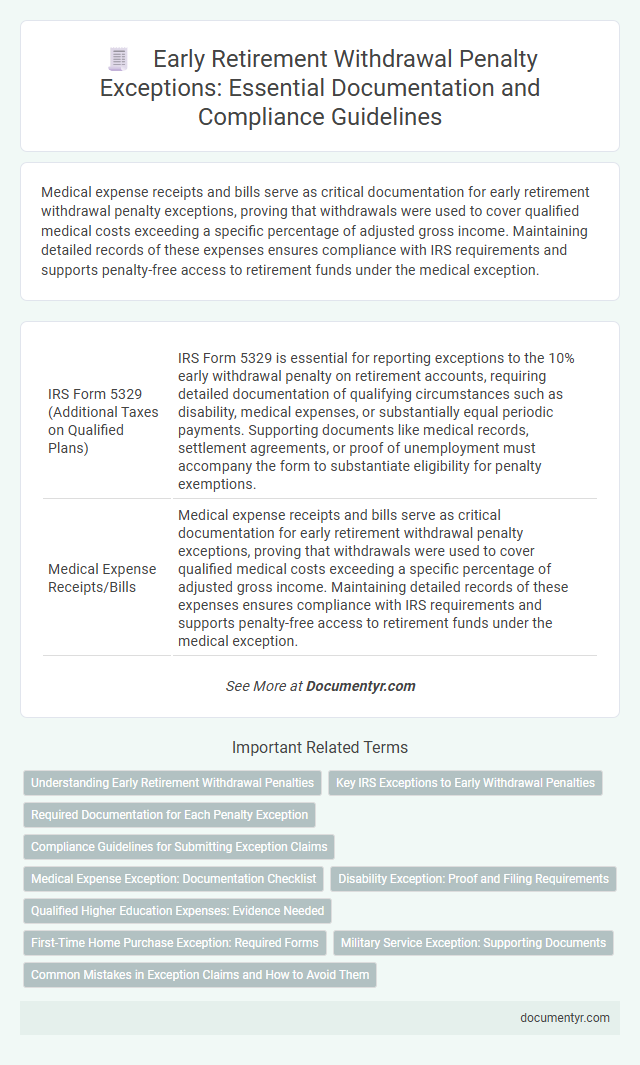

| 1 | IRS Form 5329 (Additional Taxes on Qualified Plans) | IRS Form 5329 is essential for reporting exceptions to the 10% early withdrawal penalty on retirement accounts, requiring detailed documentation of qualifying circumstances such as disability, medical expenses, or substantially equal periodic payments. Supporting documents like medical records, settlement agreements, or proof of unemployment must accompany the form to substantiate eligibility for penalty exemptions. |

| 2 | Medical Expense Receipts/Bills | Medical expense receipts and bills serve as critical documentation for early retirement withdrawal penalty exceptions, proving that withdrawals were used to cover qualified medical costs exceeding a specific percentage of adjusted gross income. Maintaining detailed records of these expenses ensures compliance with IRS requirements and supports penalty-free access to retirement funds under the medical exception. |

| 3 | Permanent Disability Proof Letter | Permanent Disability Proof Letter must be issued by a licensed medical professional confirming the retiree's total and permanent disability status to qualify for early retirement withdrawal penalty exceptions. This document ensures compliance with IRS regulations, serving as critical evidence to avoid the 10% early withdrawal penalty on qualified retirement accounts. |

| 4 | Military Order Documents (IRS-qualified reservists) | Military order documents, such as official deployment orders or activation notices, are essential for IRS-qualified reservists to qualify for early retirement withdrawal penalty exceptions under Internal Revenue Code Section 72(t)(2)(G). These documents must clearly indicate active duty service lasting at least 180 days or an indefinite period to validate penalty-free access to retirement funds. |

| 5 | Qualified Domestic Relations Order (QDRO) | To qualify for an early retirement withdrawal penalty exception under a Qualified Domestic Relations Order (QDRO), individuals must provide the official QDRO document issued by the court, detailing the division of retirement plan assets due to divorce or legal separation. This document, along with the plan administrator's approval, ensures that the withdrawal is exempt from the 10% early withdrawal penalty imposed by the IRS. |

| 6 | Separation from Service Verification (age 55+) | For early retirement withdrawal penalty exceptions based on separation from service at age 55 or older, necessary documents include a formal letter of separation, employment termination records, or a signed statement from the employer verifying the separation date and age. These documents substantiate eligibility under IRS Rule 72(t) to avoid the 10% early withdrawal penalty on retirement accounts. |

| 7 | College Tuition Invoices/Statements (for qualified higher education expenses) | College tuition invoices or statements serve as critical documentation to qualify for early retirement withdrawal penalty exceptions when used for higher education expenses. These documents must clearly specify the student's name, institution, amount billed, and dates of enrollment to validate the exemption under IRS rules. |

| 8 | First-Time Homebuyer Purchase Agreement/Settlement Statement | To qualify for early retirement withdrawal penalty exceptions for a first-time home purchase, individuals must provide a signed Purchase Agreement or Settlement Statement as proof of the transaction. These documents verify the use of the distribution towards home acquisition costs, meeting IRS criteria for penalty-free withdrawals. |

| 9 | Death Certificate (for distributions after plan owner’s death) | For early retirement withdrawal penalty exceptions due to the plan owner's death, a certified death certificate is required to validate eligibility for penalty-free distributions. This document verifies the event triggering the exception and must be submitted to the plan administrator alongside the withdrawal request. |

| 10 | Health Insurance Premium Bills (for unemployed distributions) | Health insurance premium bills serve as essential documentation when qualifying for early retirement withdrawal penalty exceptions related to unemployed distributions. These bills must clearly indicate the payment period and policyholder details to validate eligibility and avoid penalties under IRS rules. |

| 11 | Substantially Equal Periodic Payments (SEPP) Calculation Documentation | Substantially Equal Periodic Payments (SEPP) calculation documentation for early retirement withdrawal penalty exceptions requires a detailed calculation method such as the IRS-approved amortization, annuitization, or required minimum distribution method, supported by official worksheets or financial statements from a qualified actuary or tax professional. Documentation must include proof of consistent periodic payment amounts and the schedule duration to validate compliance with IRS rules and avoid the 10% early withdrawal penalty. |

| 12 | IRS Notice of Levy (for IRS-levied withdrawals) | For early retirement withdrawal penalty exceptions due to IRS levies, the primary document required is the IRS Notice of Levy, which must be presented to the plan administrator to prove the levy. This official IRS notification authorizes withdrawal without incurring the 10% early withdrawal penalty under IRS rules. |

| 13 | Birth Certificate/Adoption Papers (for childbirth or adoption exceptions) | A birth certificate or adoption papers are essential documents for qualifying under early retirement withdrawal penalty exceptions related to childbirth or adoption, verifying the event's occurrence and date. These documents must be submitted to the plan administrator or financial institution to substantiate eligibility for penalty-free withdrawals up to $5,000 within one year of the child's birth or adoption. |

| 14 | Disaster Declaration or FEMA Documentation (for disaster-related withdrawals) | For early retirement withdrawal penalty exceptions related to disasters, individuals must provide official disaster declaration proof or FEMA documentation verifying the affected area and the date of the disaster. This documentation substantiates eligibility for penalty-free withdrawals under IRS disaster relief provisions, ensuring compliance with tax regulations. |

Understanding Early Retirement Withdrawal Penalties

Early retirement withdrawal penalties typically apply when funds are taken from retirement accounts before age 59 1/2. Understanding the exceptions to these penalties requires careful review of specific documents that prove eligibility.

Key documents needed for penalty exceptions include medical records for disability claims, IRS Form 5329 for penalty waivers, and proof of qualified expenses such as higher education or first-time home purchase receipts. Pension plan statements or retirement account withdrawal forms must clearly indicate the reason for withdrawal. Accurate documentation helps avoid unexpected taxes and penalties, ensuring compliance with IRS regulations.

Key IRS Exceptions to Early Withdrawal Penalties

What documents are needed to qualify for key IRS exceptions to early retirement withdrawal penalties?

IRS exceptions require specific documentation such as medical bills, proof of disability, or court orders for qualified domestic relations orders. Pension plan statements and IRS Form 5329 may also be necessary to support your claim for penalty exemption.

Required Documentation for Each Penalty Exception

To qualify for early retirement withdrawal penalty exceptions, specific documents are required to verify eligibility. Medical expenses require detailed receipts and a physician's statement, while disability exceptions need a certified proof of disability. For first-time home purchases, a purchase agreement or closing statement is necessary to support your claim.

Compliance Guidelines for Submitting Exception Claims

Submitting claims for early retirement withdrawal penalty exceptions requires adherence to strict compliance guidelines. Proper documentation ensures your exception request is processed accurately and without delays.

- Valid Proof of Exception Reason - Documentation such as medical records, court orders, or permanent disability certifications must be included to justify the penalty exception.

- Completed Exception Claim Form - A fully filled and signed claim form specifying the nature of the exception must accompany your submission to meet regulatory standards.

- Proof of Identity and Account Ownership - Official identification and retirement account statements are necessary to verify the claimant's identity and account authenticity.

Medical Expense Exception: Documentation Checklist

| Document Type | Description | Purpose |

|---|---|---|

| Medical Bills and Statements | Official invoices and statements from hospitals, clinics, or healthcare providers. | Proof of unreimbursed medical expenses qualifying for the penalty exception. |

| Insurance Explanation of Benefits (EOB) | Documents detailing what medical costs were covered or denied by insurance. | Demonstrates out-of-pocket medical expenses exceeding 7.5% of adjusted gross income. |

| Physician's Certification | Written statement from a licensed medical professional outlining the medical need. | Validates the necessity of medical expenses linked to early withdrawal. |

| Tax Returns | Federal tax filings, particularly Form 1040 with detailed medical expense deductions. | Confirms adjusted gross income and eligible expense thresholds. |

| Withdrawal Request Form | Completed form required by the retirement plan administrator for early distributions. | Initiates the penalty exception claim based on documented medical expenses. |

| Proof of Payment | Receipts, cancelled checks, or bank statements evidencing payment of medical expenses. | Verifies that medical costs have been paid and are unreimbursed. |

Disability Exception: Proof and Filing Requirements

To qualify for the disability exception from early retirement withdrawal penalties, individuals must provide official medical documentation confirming the disabling condition. This typically includes a letter from a licensed physician detailing the nature and severity of the disability. The documentation must be submitted with the withdrawal request to the plan administrator or the IRS when filing tax returns to avoid the 10% early withdrawal penalty.

Qualified Higher Education Expenses: Evidence Needed

For early retirement withdrawal penalty exceptions related to qualified higher education expenses, you must provide detailed proof of the educational costs. Documentation includes tuition invoices, payment receipts, and official enrollment verification from the educational institution.

Receipts for required supplies and textbooks may also be necessary to support the withdrawal claim. These documents demonstrate that the funds were used exclusively for eligible higher education expenses, ensuring compliance with IRS regulations.

First-Time Home Purchase Exception: Required Forms

Early retirement withdrawal penalty exceptions require specific documentation to qualify. The first-time home purchase exception mandates particular forms to prove eligibility and use of funds.

- IRS Form 5329 - Used to report and claim the early withdrawal penalty exception on your tax return.

- Settlement Statement (Closing Disclosure) - Verifies the use of withdrawn funds toward purchasing a first home.

- Qualified Homebuyer Certification - Confirms the withdrawal is for a first-time home purchase as defined by IRS guidelines.

Military Service Exception: Supporting Documents

Early retirement withdrawal penalty exceptions allow individuals to access their retirement funds without incurring a 10% penalty. One key exception applies to military service members who meet specific criteria.

- Military Orders - Official documentation verifying active duty status or deployment dates is required.

- Separation Papers (DD-214) - Proof of military service and honorable discharge supports eligibility for the exception.

- Retirement or Disability Documentation - Records confirming retirement or disability status related to military service validate the penalty waiver.

Submitting these documents with the withdrawal request ensures compliance with IRS regulations for penalty-free early distributions under the military service exception.

What Documents are Needed for Early Retirement Withdrawal Penalty Exceptions? Infographic