To open a business bank account, you typically need essential documents such as your business registration certificate, employer identification number (EIN), and a valid government-issued ID for all authorized signers. Financial institutions may also require your business formation documents, partnership agreements, or corporate bylaws, depending on the business structure. Proof of address and relevant licenses or permits ensure compliance with banking regulations and smooth account setup.

What Documents Are Required for Opening a Business Bank Account?

| Number | Name | Description |

|---|---|---|

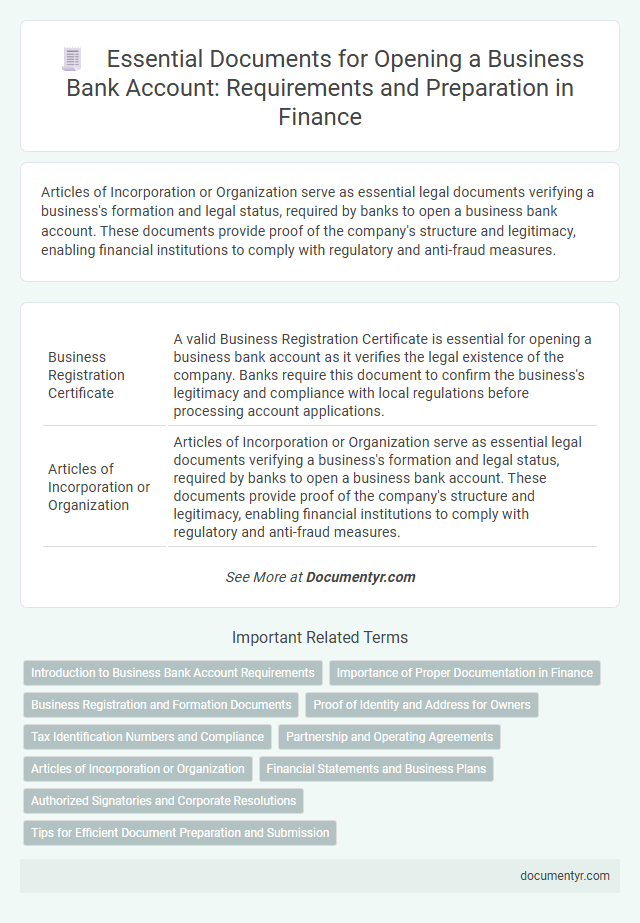

| 1 | Business Registration Certificate | A valid Business Registration Certificate is essential for opening a business bank account as it verifies the legal existence of the company. Banks require this document to confirm the business's legitimacy and compliance with local regulations before processing account applications. |

| 2 | Articles of Incorporation or Organization | Articles of Incorporation or Organization serve as essential legal documents verifying a business's formation and legal status, required by banks to open a business bank account. These documents provide proof of the company's structure and legitimacy, enabling financial institutions to comply with regulatory and anti-fraud measures. |

| 3 | Partnership Agreement | A Partnership Agreement is a crucial document required for opening a business bank account as it outlines the roles, responsibilities, and ownership percentages of each partner within the partnership. Banks use this agreement to verify the legitimacy of the business structure and ensure all partners are authorized signatories on the account. |

| 4 | Business License | A valid business license is essential for opening a business bank account, as it verifies legal authorization to operate and ensures compliance with local regulations. Banks require this document to prevent fraud and confirm the legitimacy of the business entity before account approval. |

| 5 | Employer Identification Number (EIN) Document | An Employer Identification Number (EIN) is a crucial document required for opening a business bank account, serving as a unique identifier for tax and business purposes. Banks mandate the EIN to verify the legal existence of the business and to comply with federal regulations related to financial transactions and reporting. |

| 6 | Operating Agreement | An Operating Agreement is a crucial document required for opening a business bank account because it outlines the ownership structure and operating procedures of an LLC, providing clarity and legitimacy to the bank. Banks use this document to verify the authority of the individuals opening the account and ensure compliance with regulatory requirements. |

| 7 | Certificate of Good Standing | A Certificate of Good Standing is essential for opening a business bank account as it verifies that the company is legally registered and compliant with state regulations. Banks rely on this document to ensure the business is in good legal standing and authorized to operate, reducing the risk of fraudulent activities. |

| 8 | Resolution of Authority | A Resolution of Authority is a legal document that authorizes specific individuals within a company to open and manage the business bank account, ensuring compliance and proper governance. Banks typically require this resolution to verify that the signatories have the official approval from the board or owners to conduct financial transactions on behalf of the business. |

| 9 | Personal Identification (Driver’s License, Passport) | Opening a business bank account requires valid personal identification such as a driver's license or passport to verify the identity of the account holder. Financial institutions mandate these government-issued IDs to comply with regulatory standards and prevent fraud. |

| 10 | Proof of Business Address (Utility Bill, Lease Agreement) | Proof of business address is a critical document for opening a business bank account, typically requiring a recent utility bill or a valid lease agreement clearly showing the business name and address. Banks use these documents to verify the physical location of the business, ensuring compliance with regulatory policies and preventing fraud. |

| 11 | Meeting Minutes (for Corporations or LLCs) | Meeting minutes are essential documents required for opening a business bank account for corporations or LLCs, as they formally authorize the opening of the account and identify the appointed signatories. These minutes, typically drafted during a board or member meeting, verify the legitimacy of the business decision and help banks comply with regulatory requirements. |

| 12 | Fictitious Business Name (DBA) Statement | A Fictitious Business Name (DBA) Statement is essential for opening a business bank account as it verifies the business operating under a trade name different from the owner's legal name. Banks require this document to ensure compliance with local regulations and to authenticate the business identity for account setup and financial transactions. |

| 13 | Shareholder Agreement | A Shareholder Agreement is often required to open a business bank account as it outlines the ownership structure, rights, and responsibilities of the shareholders, ensuring clarity and legal compliance. Banks use this document to verify the authenticity of business ownership and to understand decision-making authority within the company. |

| 14 | Corporate Bylaws | Corporate bylaws are essential documents required for opening a business bank account as they outline the internal rules and governance structure of the company. Banks review these bylaws to verify the authority of individuals opening the account and to ensure compliance with the company's legal framework. |

| 15 | Tax Identification Certificate | A Tax Identification Certificate is essential for opening a business bank account as it verifies the legal tax status of the entity and is required by banks to comply with regulatory standards. This document ensures accurate reporting and facilitates smooth financial transactions by linking the business to its tax obligations. |

Introduction to Business Bank Account Requirements

Opening a business bank account requires specific documentation to verify the identity and legitimacy of the business. Commonly requested documents include identification proof, business registration certificates, and tax identification numbers. Understanding these requirements helps streamline the account opening process and ensures compliance with banking regulations.

Importance of Proper Documentation in Finance

What documents are required for opening a business bank account? Proper documentation is essential to verify the identity and legitimacy of the business. Banks typically require a combination of personal identification, business registration, and financial information.

Why is proper documentation important in finance? Accurate and complete documents ensure compliance with legal regulations and prevent fraud. Proper documentation also facilitates smooth account management and access to financial services.

Which specific documents must a business provide to open an account? Common requirements include the business license or registration certificate, Employer Identification Number (EIN), and personal identification of business owners. Some banks may also ask for operating agreements or partnership agreements depending on the business structure.

How does proper documentation affect business banking operations? Clear, verified documents enable efficient transaction processing and minimize delays. Maintaining proper documentation supports credit applications, loans, and future banking needs.

What role does documentation play in financial accountability? Proper records allow tracking of all business income and expenses accurately. This supports tax reporting and financial audits, ensuring regulatory compliance.

Business Registration and Formation Documents

Opening a business bank account requires submitting specific business registration and formation documents to verify the company's legal status. Commonly needed documents include the Articles of Incorporation, Certificate of Formation, or Business Registration Certificate issued by the relevant government authority. These documents confirm the business's official registration and provide essential information such as the business name, registration number, and formation date.

Proof of Identity and Address for Owners

Opening a business bank account requires several key documents that verify the identity and address of the account owners. Proof of identity typically includes government-issued photo IDs such as a passport or driver's license.

Proof of address can be demonstrated through recent utility bills, lease agreements, or bank statements showing the owner's name and address. Banks often require these documents to comply with regulatory standards and prevent fraud. Your application process will be smoother if you prepare these documents in advance.

Tax Identification Numbers and Compliance

| Document | Description | Importance for Tax Identification and Compliance |

|---|---|---|

| Tax Identification Number (TIN) | A unique identifier issued by tax authorities to businesses and individuals. | Essential for verifying the entity's tax status and ensuring compliance with federal and state tax regulations. Required for reporting and payment of taxes. |

| Employer Identification Number (EIN) | Issued by the Internal Revenue Service (IRS) in the United States, it identifies a business entity for tax purposes. | Necessary for opening bank accounts, hiring employees, and filing business tax returns. Critical for compliance with IRS regulations. |

| Business Formation Documents | Includes Articles of Incorporation, Partnership Agreements, or LLC Operating Agreements. | Confirm the legal existence and structure of the business. These documents are linked to tax identification numbers and compliance checks by banks. |

| Personal Identification of Owners | Government-issued photo ID such as a driver's license or passport. | Required under Know Your Customer (KYC) rules to verify identities and prevent fraud, aligning with anti-money laundering (AML) compliance. |

| Business License | Official permission issued by a government agency to operate a business legally. | Helps banks verify the legitimacy of the business and its compliance with local regulations affecting taxation and operational licenses. |

| Proof of Address | Utility bill, lease agreement, or official correspondence displaying the business address. | Supports compliance with regulatory requirements and aids in the validation of tax jurisdiction. |

Partnership and Operating Agreements

Opening a business bank account requires specific documentation to verify your business structure and authority. Partnerships need to provide agreements that outline the terms and operational details agreed upon by the partners.

- Partnership Agreement - This document establishes the roles, responsibilities, and ownership percentages of each partner in the business.

- Operating Agreement - For limited liability partnerships, this outlines the management structure and operational guidelines.

- Identification Documents - Personal identification of partners, such as passports or driver's licenses, is required to confirm authorized signers.

Articles of Incorporation or Organization

Opening a business bank account requires specific documents that verify your company's legal status. One of the essential documents is the Articles of Incorporation or Organization, which serves as proof of your business's official formation.

- Articles of Incorporation or Organization - This document establishes the legal existence of your corporation or LLC with the state.

- Verification of Business Identity - Banks use this to confirm that your business is registered and recognized by government authorities.

- Key Information Included - The articles typically detail your business name, purpose, registered agent, and organizational structure.

Providing the Articles of Incorporation or Organization helps ensure your business bank account setup meets legal requirements and banking policies.

Financial Statements and Business Plans

Opening a business bank account requires presenting key documents that demonstrate your company's financial health and business strategy. Financial statements and business plans are essential to verify the legitimacy and potential of your business to the bank.

- Financial Statements - Include balance sheets, income statements, and cash flow statements to provide a clear overview of your company's financial status.

- Business Plan - A detailed plan outlining your business goals, market analysis, and revenue projections to illustrate your growth potential.

- Identity and Registration Documents - Official paperwork like business licenses and identification to confirm your company's legal standing and ownership.

Authorized Signatories and Corporate Resolutions

When opening a business bank account, authorized signatories must be clearly identified to ensure proper account management and transaction approval. Banks require official documentation listing these individuals, verifying their authority to act on behalf of the business.

Corporate resolutions serve as formal records that authorize the opening of the account and designate signatories. These resolutions, typically adopted by the board of directors, must be submitted to the bank to validate the decision and compliance with corporate governance.

What Documents Are Required for Opening a Business Bank Account? Infographic