To open a brokerage account, you need to provide a valid government-issued photo ID, such as a passport or driver's license, along with your Social Security number for identity verification. Proof of address, like a utility bill or bank statement, is often required to confirm your residence. Financial institutions may also ask for employment information and investment objectives to tailor the account to your specific needs.

What Documents Are Needed for Opening a Brokerage Account?

| Number | Name | Description |

|---|---|---|

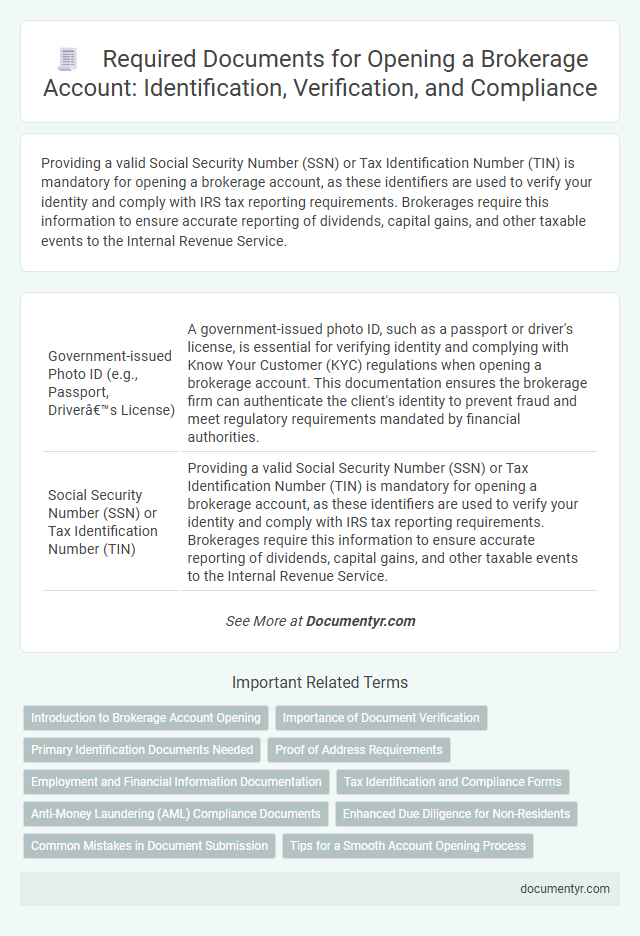

| 1 | Government-issued Photo ID (e.g., Passport, Driver’s License) | A government-issued photo ID, such as a passport or driver's license, is essential for verifying identity and complying with Know Your Customer (KYC) regulations when opening a brokerage account. This documentation ensures the brokerage firm can authenticate the client's identity to prevent fraud and meet regulatory requirements mandated by financial authorities. |

| 2 | Social Security Number (SSN) or Tax Identification Number (TIN) | Providing a valid Social Security Number (SSN) or Tax Identification Number (TIN) is mandatory for opening a brokerage account, as these identifiers are used to verify your identity and comply with IRS tax reporting requirements. Brokerages require this information to ensure accurate reporting of dividends, capital gains, and other taxable events to the Internal Revenue Service. |

| 3 | Proof of Address (e.g., Utility Bill, Bank Statement, Lease Agreement) | Proof of address documents required for opening a brokerage account typically include recent utility bills, bank statements, or lease agreements that clearly display the applicant's name and residential address. These documents must be dated within the last three months to ensure verification accuracy and compliance with regulatory standards. |

| 4 | Employment Information (Employer Name, Address, Occupation) | Providing accurate employment information, including your employer's name, address, and your occupation, is essential for opening a brokerage account to comply with regulatory requirements and verify your financial background. Brokerage firms use this data to assess your investment profile and ensure adherence to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. |

| 5 | Financial Information (Annual Income, Net Worth, Investment Experience) | Providing detailed financial information such as annual income, net worth, and investment experience is essential for opening a brokerage account, enabling firms to assess risk tolerance and suitability. Accurate disclosure of these metrics ensures compliance with regulatory requirements and helps tailor investment strategies aligned with individual financial profiles. |

| 6 | W-9 Form (U.S. Residents) | U.S. residents must submit a completed W-9 form to verify their Taxpayer Identification Number (TIN) and certify their tax status when opening a brokerage account. This form is essential for compliance with IRS regulations and enables accurate reporting of investment income and transactions. |

| 7 | W-8BEN Form (Non-U.S. Residents) | Non-U.S. residents opening a brokerage account must submit the W-8BEN form to certify foreign status and claim tax treaty benefits, reducing withholding tax on dividends and interest. This IRS-required document ensures compliance with U.S. tax regulations for non-resident investors engaging in securities trading. |

| 8 | Date of Birth Verification | Verifying your date of birth is essential when opening a brokerage account to comply with regulatory requirements and prevent identity fraud. Common documents accepted for date of birth verification include a government-issued passport, driver's license, or birth certificate, all of which must display a clear and accurate date of birth. |

| 9 | Bank Account Details (for fund transfers) | Bank account details are essential for opening a brokerage account, as they facilitate seamless fund transfers between your bank and the brokerage firm. Typically, you need to provide a valid bank account number, bank name, branch address, and a recent bank statement or canceled check to verify ownership and ensure accuracy in transactions. |

| 10 | Signature Card | A Signature Card is essential for opening a brokerage account as it verifies the client's identity through a handwritten signature, ensuring security and authenticity in transactions. This document helps financial institutions prevent fraud and maintain accurate records for regulatory compliance. |

| 11 | Account Agreement/Disclosure Forms | Account agreement and disclosure forms outline the terms, conditions, and risks associated with the brokerage account, ensuring legal compliance and transparency between the investor and the broker. These documents typically require the investor's signature to confirm understanding of fees, margin requirements, privacy policies, and regulatory disclosures critical for account opening. |

Introduction to Brokerage Account Opening

Opening a brokerage account requires specific documents to verify your identity and financial status. These documents help brokers comply with regulatory requirements and protect your investments. Understanding the necessary paperwork streamlines the account opening process for you.

Importance of Document Verification

Opening a brokerage account requires submitting specific documents to verify your identity and financial status. Proper document verification ensures compliance with regulatory standards and protects against fraud.

Key documents typically include a government-issued ID, proof of address, and Social Security number or Tax Identification Number. These documents confirm your identity and help the brokerage firm assess your eligibility and risk profile. Accurate verification helps prevent account freezes and delays in trading activities.

Primary Identification Documents Needed

Opening a brokerage account requires submitting specific primary identification documents to verify your identity. These documents ensure compliance with financial regulations and secure your investment activities.

- Government-Issued Photo ID - A valid passport, driver's license, or state ID card is essential for identity verification.

- Social Security Number (SSN) or Tax Identification Number (TIN) - This number is needed for tax reporting and regulatory purposes.

- Proof of Address - Utility bills, bank statements, or lease agreements confirm your residential address and prevent fraud.

Proof of Address Requirements

Proof of address is a critical document required for opening a brokerage account to verify the applicant's residential information. It ensures compliance with regulatory standards and helps prevent fraudulent activity.

- Recent Utility Bill - A utility bill dated within the last three months serves as an acceptable proof of address for most brokerage firms.

- Bank Statement - Official bank statements reflecting your current address are commonly used and must be recent and clear.

- Government-Issued Documents - Documents such as a driver's license or tax correspondence that display your current residential address are often required.

Employment and Financial Information Documentation

What employment information is necessary to open a brokerage account? You will typically need to provide details about your current employer, job title, and length of employment. This helps verify your income stability and financial background.

Which financial documents are required when opening a brokerage account? Brokerage firms usually ask for recent pay stubs, tax returns, or bank statements to assess your financial health. Providing accurate financial documentation ensures compliance with regulatory standards.

Tax Identification and Compliance Forms

| Document | Description |

|---|---|

| Tax Identification Number (TIN) | Essential for tax reporting and identity verification. Often this is your Social Security Number (SSN) or Employer Identification Number (EIN) for businesses. |

| W-9 Form | Required for U.S. persons to certify their TIN and confirm taxpayer status. Used by brokerages to report income and dividends to the IRS. |

| W-8BEN Form | Used by non-U.S. persons to certify foreign status and claim tax treaty benefits, reducing withholding taxes on investment income. |

| Proof of Identity | Government-issued photo ID such as a passport or driver's license required to comply with Know Your Customer (KYC) regulations. |

| Proof of Address | Recent utility bill or bank statement to verify residency. Important for regulatory compliance and account setup. |

Anti-Money Laundering (AML) Compliance Documents

Opening a brokerage account requires submitting specific documents to ensure compliance with financial regulations. Anti-Money Laundering (AML) compliance is a critical part of this process to prevent illicit activities.

- Government-Issued Identification - Valid IDs such as a passport or driver's license verify the account holder's identity and residency.

- Proof of Address - Utility bills or bank statements confirm the physical address linked to the account holder.

- Source of Funds Declaration - Documentation explaining the origin of the funds helps detect and prevent money laundering.

These AML compliance documents protect both the brokerage firm and clients by ensuring legal and transparent financial transactions.

Enhanced Due Diligence for Non-Residents

Opening a brokerage account requires submitting primary identification documents such as a valid passport, proof of address, and a Social Security Number or Tax Identification Number for residents. Non-residents must provide additional documentation to meet regulatory requirements and facilitate enhanced due diligence procedures.

Enhanced due diligence for non-residents includes submitting notarized identification, proof of foreign tax compliance such as a W-8BEN form, and possibly a bank reference letter. Brokerages may also request detailed information about the source of funds to ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

Common Mistakes in Document Submission

Opening a brokerage account requires several essential documents such as a government-issued ID, proof of address, and Social Security number or tax identification number. These documents verify your identity and comply with regulatory requirements.

Common mistakes in document submission include submitting expired identification or mismatched address details, which can cause delays or account rejection. Ensuring all documents are up-to-date and accurate is crucial for a smooth account opening process.

What Documents Are Needed for Opening a Brokerage Account? Infographic