First-time homebuyers need to provide proof of income, such as pay stubs, tax returns, and W-2 forms, to verify their financial stability for mortgage approval. Lenders also require identification documents like a valid government-issued ID and Social Security number to confirm identity and credit history. Additionally, bank statements and credit reports help assess the buyer's financial behavior and debt-to-income ratio, essential for qualifying for a mortgage.

What Documents Does a First-Time Homebuyer Need for Mortgage Approval?

| Number | Name | Description |

|---|---|---|

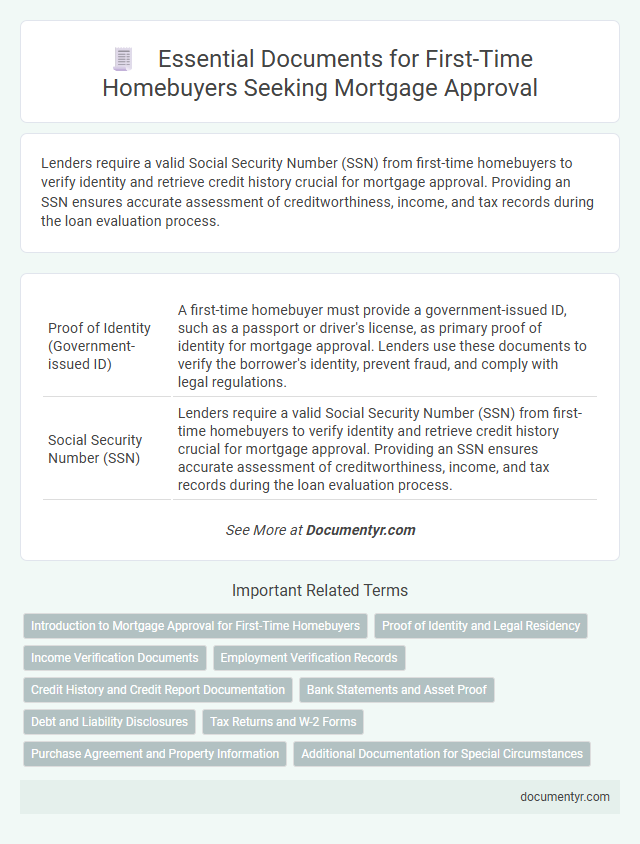

| 1 | Proof of Identity (Government-issued ID) | A first-time homebuyer must provide a government-issued ID, such as a passport or driver's license, as primary proof of identity for mortgage approval. Lenders use these documents to verify the borrower's identity, prevent fraud, and comply with legal regulations. |

| 2 | Social Security Number (SSN) | Lenders require a valid Social Security Number (SSN) from first-time homebuyers to verify identity and retrieve credit history crucial for mortgage approval. Providing an SSN ensures accurate assessment of creditworthiness, income, and tax records during the loan evaluation process. |

| 3 | Proof of Income (Pay Stubs, W-2 Forms) | First-time homebuyers must provide proof of income to secure mortgage approval, typically including recent pay stubs and W-2 forms from the past two years. These documents verify steady employment and consistent earnings, essential factors lenders assess to determine loan eligibility and repayment capacity. |

| 4 | Tax Returns (Past 2 Years) | Submitting tax returns from the past two years is crucial for first-time homebuyers seeking mortgage approval, as lenders use these documents to verify income stability and assess the borrower's ability to repay the loan. Typically, both personal and business tax returns, if applicable, must be accurate and complete to facilitate a smooth underwriting process. |

| 5 | Bank Statements (Recent 2-3 Months) | First-time homebuyers must provide recent bank statements from the past 2-3 months to verify their financial stability and demonstrate consistent income for mortgage approval. These documents help lenders assess cash flow, savings, and the ability to cover down payments and closing costs. |

| 6 | Employment Verification Letter | An employment verification letter is a critical document for first-time homebuyers seeking mortgage approval, as it confirms job stability and income consistency to lenders. This letter typically must include details such as job title, length of employment, salary, and employer contact information to validate the borrower's ability to repay the loan. |

| 7 | Proof of Down Payment (Bank Statements, Gifts, etc.) | First-time homebuyers must provide proof of down payment, which typically includes recent bank statements showing sufficient funds or documented gift letters if the down payment is partially or fully gifted. Lenders require these documents to verify the source and legitimacy of the funds, ensuring compliance with mortgage underwriting guidelines and reducing the risk of fraud. |

| 8 | Gift Letter (if applicable) | A Gift Letter is required when a first-time homebuyer receives financial assistance from family or friends to help with the down payment, confirming the funds are a gift and not a loan. This document must include the donor's name, relationship to the borrower, amount gifted, and a statement that repayment is not expected, ensuring compliance with mortgage lender requirements. |

| 9 | Credit Report | A first-time homebuyer must provide a current credit report to demonstrate their creditworthiness and repayment history, which lenders use to assess the risk of approving a mortgage. This report includes detailed information such as credit score, outstanding debts, and payment patterns, essential for mortgage qualification. |

| 10 | Debt Information (Loan Statements, Credit Card Balances) | First-time homebuyers must provide detailed debt information, including recent loan statements and current credit card balances, to verify outstanding liabilities and assess debt-to-income ratios. Lenders use this data to determine creditworthiness and the ability to manage monthly mortgage payments effectively. |

| 11 | Rental History (Lease Agreements, Rent Receipts) | First-time homebuyers should provide rental history documents such as lease agreements and rent receipts to demonstrate consistent on-time payments and financial responsibility to lenders. These records help establish creditworthiness and verify housing stability, which are critical factors in mortgage approval processes. |

| 12 | Asset Statements (Investments, Retirement Accounts) | First-time homebuyers seeking mortgage approval must provide asset statements, including detailed records of investments such as stocks, bonds, and mutual funds, as well as retirement account summaries like 401(k) or IRA statements, to verify financial stability and reserve funds. Lenders require these documents to assess the buyer's ability to cover down payments, closing costs, and maintain financial reserves throughout the loan term. |

| 13 | Purchase Agreement (Signed Contract) | A signed Purchase Agreement is a critical document for first-time homebuyers as it outlines the terms and conditions of the property sale, providing lenders with proof of the transaction and allowing the mortgage approval process to proceed. This contract includes details such as the purchase price, property address, buyer and seller information, and contingencies, ensuring the loan is tied to a specific property with agreed-upon terms. |

| 14 | Homeowners Insurance Quote | A first-time homebuyer must provide a homeowners insurance quote as part of mortgage approval documentation to ensure the property is protected against risks. Lenders require this insurance quote to verify coverage amounts, policy terms, and to confirm financial responsibility for the insured property. |

| 15 | Divorce Decree (if applicable) | A first-time homebuyer must provide a divorce decree if applicable, as it verifies alimony or child support obligations affecting debt-to-income ratios for mortgage approval. Lenders require this document to accurately assess financial responsibilities and ensure compliance with loan qualification criteria. |

| 16 | Bankruptcy Discharge Papers (if applicable) | Bankruptcy discharge papers are essential for first-time homebuyers who have a history of bankruptcy, providing lenders with proof that debts were legally discharged and demonstrating financial recovery. Including these documents in the mortgage application helps streamline the approval process by verifying the borrower's creditworthiness and compliance with lending criteria. |

| 17 | Child Support/Alimony Documentation (if applicable) | First-time homebuyers must provide court orders or legal agreements detailing child support and alimony payments to validate income stability for mortgage approval. Lenders require documentation such as payment history statements or bank records confirming consistent receipt of these funds to assess financial reliability. |

Introduction to Mortgage Approval for First-Time Homebuyers

Mortgage approval is a critical step for first-time homebuyers aiming to secure financing for their new home. Understanding the necessary documents helps streamline the approval process and improves the chances of loan acceptance.

- Proof of Income - Lenders require documentation such as pay stubs, tax returns, or W-2 forms to verify your ability to repay the mortgage.

- Credit History - A detailed credit report demonstrates your creditworthiness and influences loan eligibility and interest rates.

- Identification and Personal Information - Valid identification documents and personal details are essential for borrower verification and compliance with lending regulations.

Proof of Identity and Legal Residency

Proof of identity is essential for mortgage approval, requiring valid government-issued documents such as a passport, driver's license, or state ID card. Legal residency must be demonstrated with documentation like a green card, visa, or naturalization certificate to verify your eligibility to purchase property. Mortgage lenders rely on these records to confirm your identity and legal status before processing your loan application.

Income Verification Documents

Income verification is crucial for first-time homebuyers to secure mortgage approval. Lenders require detailed documentation to assess financial stability and repayment ability.

- Pay Stubs - Recent pay stubs demonstrate current earnings and consistent income flow over the past 30 to 60 days.

- Tax Returns - Federal tax returns from the last two years help verify overall income, including self-employment or additional income sources.

- Employment Verification - A written confirmation from an employer or HR department confirms job status and salary details.

Employment Verification Records

What employment verification records are required for a first-time homebuyer's mortgage approval?

Lenders require recent pay stubs, W-2 forms, and tax returns to confirm stable income. These documents help verify consistent employment history and the ability to repay the mortgage.

Credit History and Credit Report Documentation

| Document Type | Description | Importance for Mortgage Approval |

|---|---|---|

| Credit History Report | A detailed record of your past and current credit accounts, including loans, credit cards, and payment histories. | Shows lenders your ability to manage debt and make timely payments, a critical factor in mortgage approval decisions. |

| Credit Score | A numerical representation of creditworthiness derived from the credit history report. | Helps lenders assess risk quickly. Higher scores increase the chances of favorable mortgage terms. |

| Credit Report Documentation | Official documents from credit bureaus such as Equifax, Experian, or TransUnion verifying credit accounts and payment records. | Verifies the accuracy and authenticity of your credit information to the lender. |

Bank Statements and Asset Proof

Mortgage approval for first-time homebuyers requires thorough documentation to verify financial stability. Bank statements and proof of assets play a crucial role in this process.

- Bank Statements - Lenders review recent bank statements to confirm steady income and sufficient funds for down payment and closing costs.

- Asset Proof - Documentation of savings, investments, or other assets demonstrates financial readiness and capacity to handle mortgage payments.

- Transaction History - Clear and consistent transaction records in bank statements help verify financial responsibility and detect any unusual activity.

Collecting and submitting accurate bank statements and asset proof increases your chances of mortgage approval efficiently.

Debt and Liability Disclosures

First-time homebuyers must provide detailed debt and liability disclosures to secure mortgage approval. These documents include credit card statements, student loans, auto loans, and any outstanding personal debts.

Lenders review these disclosures to assess the borrower's debt-to-income ratio and overall financial stability. Accurate reporting of all liabilities ensures a smoother approval process and helps prevent delays in loan underwriting.

Tax Returns and W-2 Forms

First-time homebuyers must submit specific financial documents to secure mortgage approval. Tax returns and W-2 forms serve as critical proof of income and employment history.

Your tax returns from the past two years provide lenders with a comprehensive view of your earnings and financial stability. W-2 forms validate your annual income and verify your employer's information. These documents collectively help mortgage underwriters assess your ability to repay the loan and ensure you meet qualification criteria.

Purchase Agreement and Property Information

The Purchase Agreement is a critical document for first-time homebuyers seeking mortgage approval. It outlines the terms and conditions agreed upon by the buyer and seller, including the purchase price and contingencies.

Lenders use the Purchase Agreement to verify the transaction details and assess the loan's risk. Accurate property information such as the address, legal description, and appraised value must be included to proceed with the mortgage process.

What Documents Does a First-Time Homebuyer Need for Mortgage Approval? Infographic