Freelancers need to provide identification documents such as a government-issued ID or passport, proof of business registration or a sole proprietorship certificate, and sometimes a tax identification number or social security number to open a business bank account. Bank requirements often include proof of address, like a utility bill, and a completed application form. Having these documents organized ensures a smooth account setup process tailored for freelance business operations.

What Documents Does a Freelancer Need to Open a Business Bank Account?

| Number | Name | Description |

|---|---|---|

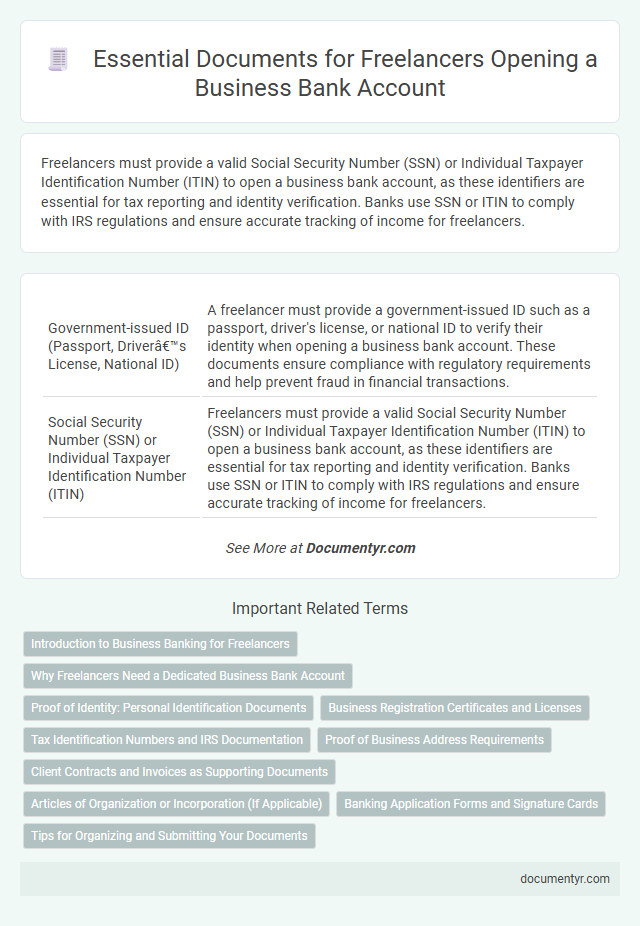

| 1 | Government-issued ID (Passport, Driver’s License, National ID) | A freelancer must provide a government-issued ID such as a passport, driver's license, or national ID to verify their identity when opening a business bank account. These documents ensure compliance with regulatory requirements and help prevent fraud in financial transactions. |

| 2 | Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) | Freelancers must provide a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to open a business bank account, as these identifiers are essential for tax reporting and identity verification. Banks use SSN or ITIN to comply with IRS regulations and ensure accurate tracking of income for freelancers. |

| 3 | Proof of Address (Utility Bill, Lease Agreement, Bank Statement) | Freelancers must provide proof of address documents such as a recent utility bill, lease agreement, or bank statement dated within the last three months to open a business bank account. These documents verify the freelancer's residential address, ensuring compliance with anti-fraud and Know Your Customer (KYC) regulations. |

| 4 | Business License or Registration Certificate | A freelancer must provide a valid business license or a registration certificate to open a business bank account, serving as proof of legal operation and compliance with local regulations. These documents validate the freelancer's business identity, enabling the bank to process transactions and offer tailored financial services. |

| 5 | Doing Business As (DBA) Certificate (if applicable) | Freelancers operating under a business name different from their legal name must present a Doing Business As (DBA) certificate to open a business bank account, as it legally registers their trade name with the state. Banks require the DBA certificate to verify the identity and legitimacy of the freelance business, ensuring compliance with financial regulations and proper account management. |

| 6 | Employer Identification Number (EIN) (if obtained) | Freelancers who have obtained an Employer Identification Number (EIN) must provide this unique nine-digit identifier when opening a business bank account to verify their business entity with the bank. The EIN serves as a vital tax identification number issued by the IRS, enabling freelancers to separate personal and business finances efficiently. |

| 7 | Articles of Organization/Incorporation (for LLCs and Corporations) | Freelancers forming LLCs or corporations must provide Articles of Organization or Articles of Incorporation when opening a business bank account to verify the legal existence and structure of the business. These documents include essential information such as the business name, registered agent, and filing date, ensuring compliance with bank requirements and legal regulations. |

| 8 | Partnership Agreement (if opening account as a partnership) | Freelancers forming a partnership must provide a signed Partnership Agreement when opening a business bank account, as this document verifies the terms of the partnership and the authority of each partner. Banks require the Partnership Agreement to ensure all parties' roles, profit sharing, and decision-making processes are clearly outlined and legally recognized. |

| 9 | Operating Agreement (for LLCs) | An Operating Agreement is a crucial document for freelancers forming an LLC, outlining ownership, management structure, and operational guidelines required by banks to open a business account. This agreement establishes the legal framework and authority needed to link the LLC's financial transactions with the business bank account. |

| 10 | Freelance Contract or Invoice Samples | Freelancers need to provide a freelance contract or invoice samples as proof of active business operations when opening a business bank account, demonstrating legitimate income sources and client relationships. These documents help banks verify the freelancer's business activity and ensure compliance with financial regulations. |

| 11 | Professional Certifications (if required by bank) | Freelancers may need to present professional certifications when opening a business bank account if the bank requires proof of expertise or licensing in their field, such as CPA credentials for accountants or legal licenses for consultants. These certifications help verify the legitimacy and professionalism of the freelancer's business, facilitating compliance with the bank's regulatory and risk assessment protocols. |

| 12 | Tax Documents (IRS correspondence or state documents) | Freelancers need to provide tax documents such as IRS correspondence, including their Employer Identification Number (EIN) issuance letter or Social Security Number verification, and recent state tax registration or sales tax permits. These documents verify the business's tax status and ensure compliance for opening a business bank account. |

Introduction to Business Banking for Freelancers

Opening a business bank account is a crucial step for freelancers to manage their finances professionally. Proper documentation ensures compliance with banking regulations and smooth account setup.

- Identification Documents - Valid government-issued ID like a passport or driver's license is required to verify the freelancer's identity.

- Business Registration Proof - Documents such as a sole proprietorship certificate or business license confirm the legitimacy of the freelance business.

- Tax Identification Number - A Social Security Number (SSN) or Employer Identification Number (EIN) is necessary for tax reporting and compliance.

Why Freelancers Need a Dedicated Business Bank Account

| Document | Description | Purpose |

|---|---|---|

| Identification Proof | Government-issued ID such as a passport or driver's license | Verify the freelancer's identity and comply with bank regulations |

| Business Registration Documents | Certificates like a Doing Business As (DBA), LLC formation papers, or sole proprietor registration | Validate the legal status of the freelance business |

| Tax Identification Number (TIN) | IRS-issued Employer Identification Number (EIN) or Social Security Number (SSN) | Facilitate tax reporting and compliance for business transactions |

| Proof of Address | Utility bill or lease agreement matching business registration address | Confirm physical location of the business for verification purposes |

| Business Plan or Description | Outline of business activities and income sources | Help the bank understand the nature and scope of freelance activities |

| Reason | Explanation |

|---|---|

| Financial Organization | Separates personal finances from freelance business income and expenses, enabling clearer budgeting and accounting. |

| Tax Compliance | Streamlines tracking of deductible business expenses and simplifies tax reporting with clear transaction records. |

| Professionalism | Enhances credibility with clients and vendors by using a dedicated business financial account. |

| Access to Financial Services | Opens doors to business-oriented banking features such as merchant services, loans, and credit lines designed for freelancers. |

| Legal Protection | Supports liability protection by maintaining distinct financial records for the freelance business entity. |

Proof of Identity: Personal Identification Documents

Opening a business bank account as a freelancer requires submitting valid proof of identity. Personal identification documents serve as the primary means to verify the freelancer's identity and ensure compliance with banking regulations.

Commonly accepted personal identification documents include government-issued passports, driver's licenses, and national identity cards. These documents must be current, clear, and contain matching information with the business registration details.

Business Registration Certificates and Licenses

Opening a business bank account as a freelancer requires specific documents, with Business Registration Certificates playing a crucial role. These certificates verify that your business is legally recognized and registered with the appropriate authorities.

Licenses relevant to your freelance services are also necessary, as they prove compliance with industry regulations. Your bank will require these to ensure your business operates lawfully. Having both Business Registration Certificates and licenses ready streamlines the account opening process significantly.

Tax Identification Numbers and IRS Documentation

Freelancers must provide a Tax Identification Number (TIN) when opening a business bank account, which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN) issued by the IRS. The IRS Form SS-4 is used to apply for an EIN, which is often necessary for freelancers operating as a formal business entity. Banks require IRS documentation to verify the freelancer's tax status and ensure compliance with federal regulations.

Proof of Business Address Requirements

What proof of business address do you need to open a business bank account as a freelancer? Banks typically require documents such as utility bills, lease agreements, or official business correspondence that display your business address. These documents must be recent and match the address registered with your business to ensure verification.

Client Contracts and Invoices as Supporting Documents

Opening a business bank account requires freelancers to present specific documents that verify their professional activities. Client contracts serve as primary proof of ongoing business relationships and income sources.

Invoices complement contracts by detailing completed work and payment requests, providing transparency and legitimacy. Together, client contracts and invoices demonstrate consistent business transactions required by banks for account approval.

Articles of Organization or Incorporation (If Applicable)

Freelancers aiming to open a business bank account must provide specific documentation to verify their business legitimacy. Articles of Organization or Incorporation serve as crucial legal proof, especially for registered entities.

- Proof of Legal Entity Formation - Articles of Organization or Incorporation confirm the freelancer's business is officially registered with the state.

- Required for LLCs and Corporations - Banks typically request these documents from freelancers operating as LLCs or corporations to establish business identity.

- Facilitates Business Banking Services - Presenting these articles helps access business accounts, credit lines, and other financial services under the business name.

Banking Application Forms and Signature Cards

When opening a business bank account, freelancers must complete banking application forms that capture essential personal and business information. Signature cards are required to authorize access to the account, documenting authorized signatories' signatures for security purposes. Providing accurate and complete forms ensures smooth verification and account setup for freelance financial management.

What Documents Does a Freelancer Need to Open a Business Bank Account? Infographic