Trust fund disbursement requires key documents such as the trust agreement, identification of the trustee and beneficiaries, and proof of compliance with any specific conditions outlined in the trust. Financial statements or invoices may be necessary to justify distributions, along with court approvals if the trust is subject to legal oversight. Ensuring all required documents are accurate and complete is essential for seamless and timely release of funds.

What Documents Does a Trust Fund Require for Disbursement?

| Number | Name | Description |

|---|---|---|

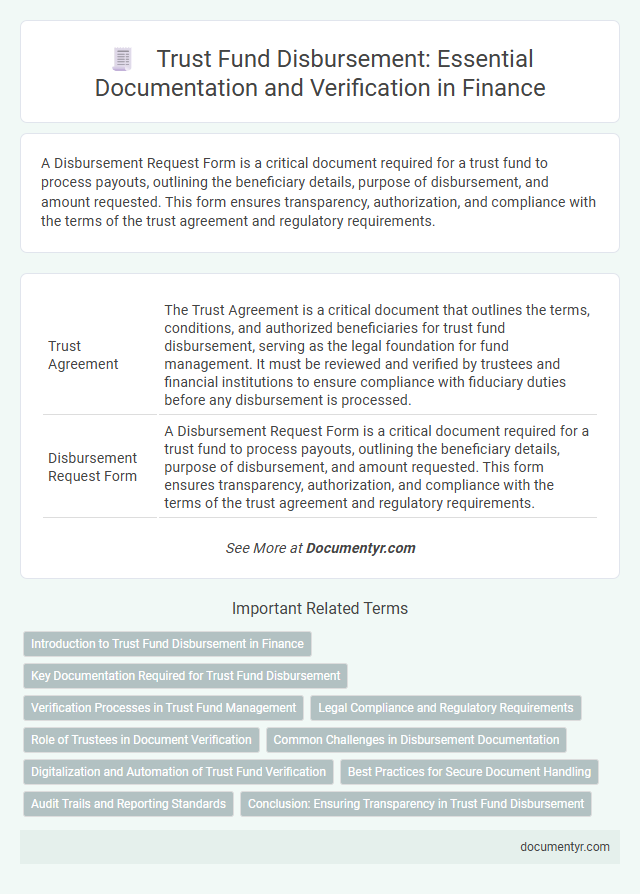

| 1 | Trust Agreement | The Trust Agreement is a critical document that outlines the terms, conditions, and authorized beneficiaries for trust fund disbursement, serving as the legal foundation for fund management. It must be reviewed and verified by trustees and financial institutions to ensure compliance with fiduciary duties before any disbursement is processed. |

| 2 | Disbursement Request Form | A Disbursement Request Form is a critical document required for a trust fund to process payouts, outlining the beneficiary details, purpose of disbursement, and amount requested. This form ensures transparency, authorization, and compliance with the terms of the trust agreement and regulatory requirements. |

| 3 | Beneficiary Identification (ID proof) | Trust fund disbursement requires valid beneficiary identification, such as a government-issued ID card, passport, or social security number, to verify identity and prevent fraud. Proof of identity ensures compliance with regulatory standards and secures authorized access to trust assets. |

| 4 | Trustee Resolution or Authorization | A trustee resolution or authorization is a crucial document required for trust fund disbursement, outlining the trustee's formal approval to release funds according to the trust's terms. This resolution ensures compliance with fiduciary duties and provides legal validation for financial institutions to process disbursements. |

| 5 | Bank Account Details/Verification | Trust funds require precise bank account details and verification documents, including a voided check or a bank statement, to ensure accurate and secure disbursement of funds. Verification processes often involve confirming the account holder's identity and matching the account information with the trust beneficiary records to prevent fraud and unauthorized transactions. |

| 6 | IRS Form W-9 (U.S.) / Tax Identification Documents | Trust fund disbursement requires submitting IRS Form W-9 to verify the beneficiary's Taxpayer Identification Number (TIN) and certify tax status under U.S. tax laws. Accurate tax identification documents ensure compliance with IRS regulations and facilitate proper reporting of distributions to avoid withholding penalties. |

| 7 | Payment Instruction Letter | A Payment Instruction Letter is a crucial document required for the disbursement of funds from a trust, detailing the beneficiary's information, payment amount, and authorized signatures to ensure proper authorization and compliance. This letter serves as formal instruction to the trust administrator or financial institution to release the specified funds according to the terms outlined in the trust agreement. |

| 8 | Beneficiary Consent or Acknowledgment | Trust fund disbursement requires a beneficiary consent or acknowledgment form, which verifies the beneficiary's approval and understanding of the terms and conditions associated with the fund release. This document ensures legal compliance and serves as proof that the beneficiary agrees to the disbursement amount and schedule. |

| 9 | Distribution Schedule | A trust fund requires a clearly defined distribution schedule outlining specific dates and amounts for disbursement to beneficiaries, which must be documented and approved by the trustee. This schedule often accompanies key financial documents such as the trust agreement, identification records, and signed beneficiary release forms to ensure proper and timely fund distribution. |

| 10 | Court Order (if applicable) | A trust fund disbursement often requires a court order, especially when the trust is under court supervision or involves minor beneficiaries. The court order must explicitly authorize the release of funds, specifying the amount and purpose to ensure compliance with legal and fiduciary obligations. |

| 11 | Invoice or Expense Receipts (if expense-related) | A trust fund requires detailed invoices or expense receipts to validate disbursement requests, ensuring accurate documentation of incurred costs. These documents must clearly itemize expenditures, including dates, amounts, and vendor information, to facilitate transparent and compliant financial management. |

| 12 | Compliance Certification | A trust fund requires a Compliance Certification to verify that all disbursement conditions outlined in the trust agreement and regulatory guidelines have been met, ensuring legal and fiduciary adherence. This document serves as an official attestation that the disbursement complies with applicable laws, tax regulations, and specified beneficiary criteria. |

| 13 | Legal Notice or Notification Letter | A trust fund requires a legally compliant notification letter outlining the disbursement terms and beneficiary details to initiate the release of funds. This legal notice serves as an official document ensuring adherence to fiduciary duties and trust agreement provisions. |

| 14 | Proof of Condition Fulfillment (if conditional trust) | Proof of condition fulfillment for a conditional trust fund disbursement typically includes certified affidavits, third-party verification letters, or official documentation demonstrating that all stipulated criteria, such as educational enrollment or medical milestones, have been met. Trust administrators require these documents to ensure compliance with the trust terms before releasing any funds. |

| 15 | Last Will and Testament (if related to estate) | A trust fund disbursement related to an estate typically requires the Last Will and Testament to verify the deceased's wishes and confirm the appointment of the trustee responsible for managing the trust. This document ensures proper authorization and compliance with legal and fiduciary duties before releasing assets to beneficiaries. |

| 16 | Tax Clearance/Final Tax Returns (if required) | Trust fund disbursement often requires submitting tax clearance certificates or final tax returns to verify that all tax obligations related to the trust assets have been settled. These documents ensure compliance with IRS regulations, prevent legal complications, and confirm that no outstanding tax liabilities will affect the distribution process. |

Introduction to Trust Fund Disbursement in Finance

What documents are essential for trust fund disbursement in finance? Trust fund disbursement requires a set of specific documents to ensure legal and financial compliance. Proper verification of these documents safeguards your fund's accurate and authorized distribution.

Key Documentation Required for Trust Fund Disbursement

Trust fund disbursement requires specific documentation to ensure legal compliance and proper fund allocation. Accurate paperwork safeguards the interests of all parties involved and facilitates a smooth transaction process.

- Trust Agreement - Details the terms and conditions governing the trust and authorizes specific disbursements.

- Disbursement Request Form - A formal written request specifying the amount and purpose of funds to be released from the trust.

- Identification Documents - Valid identification of the beneficiary or authorized representative to verify eligibility for the disbursement.

Properly compiled documentation streamlines the approval and release of trust funds, minimizing delays and legal risks.

Verification Processes in Trust Fund Management

Trust fund disbursement demands a series of verified documents to ensure compliance and authorized access. Verification processes in trust fund management protect beneficiaries and uphold fiduciary responsibilities.

- Identification Documents - Valid government-issued IDs confirm the identity of beneficiaries or authorized representatives during disbursement requests.

- Trust Agreement - The original trust deed outlines terms, authorizations, and conditions under which funds may be released, serving as a legal reference.

- Disbursement Request Form - A formal, signed request by the trustee or beneficiary details the amount and purpose, requiring verification against trust terms and available funds.

Legal Compliance and Regulatory Requirements

Trust fund disbursement requires strict adherence to legal compliance and regulatory requirements. Essential documents ensure the process aligns with jurisdictional laws and protects beneficiary rights.

Key documents include the trust agreement, which outlines the terms and conditions for disbursement. Court orders or trustee resolutions may be necessary to authorize payments. Identification documents and beneficiary consent forms verify eligibility and prevent fraud.

Role of Trustees in Document Verification

Trust fund disbursement requires several key documents, including the trust agreement, identification of beneficiaries, and financial statements. Trustees play a critical role in verifying the authenticity and accuracy of these documents to ensure compliance with the trust's terms and legal regulations. Their responsibility includes reviewing paperwork thoroughly to prevent fraud and guarantee proper distribution of assets.

Common Challenges in Disbursement Documentation

Trust fund disbursement requires specific documents such as the trust agreement, beneficiary identification, and proof of purpose for fund use. Accurate documentation ensures compliance with legal and fiduciary obligations.

Common challenges include incomplete paperwork, outdated identification, and unclear beneficiary instructions. These issues often delay disbursement and complicate the verification process.

Digitalization and Automation of Trust Fund Verification

Trust fund disbursement requires essential documents including the trust agreement, identification of beneficiaries, and proof of account ownership. Digitalization streamlines the submission of these documents, enabling secure and efficient access through electronic platforms.

Automation facilitates real-time verification by integrating AI and blockchain technologies, reducing manual errors and accelerating approval processes. This transformation enhances transparency and compliance while minimizing delays in fund distribution.

Best Practices for Secure Document Handling

Trust fund disbursement requires thorough documentation to ensure legal compliance and secure financial transactions. Proper handling of these documents protects sensitive information and prevents unauthorized access.

- Trust Agreement - This essential document outlines the terms and conditions of the trust and authorizes fund distribution.

- Identification Verification - Verifying the identity of beneficiaries ensures that disbursements are made to the rightful recipients.

- Secure Record Keeping - Storing documents in encrypted digital formats or secure physical locations helps maintain confidentiality and integrity.

Audit Trails and Reporting Standards

| Document Type | Description | Importance for Audit Trails | Relevance to Reporting Standards |

|---|---|---|---|

| Trust Agreement | Legal document establishing the trust's terms, beneficiaries, and trustee responsibilities. | Provides the foundational reference for all disbursement transactions ensuring traceability. | Sets the standard for compliance with fiduciary reporting and accountability requirements. |

| Disbursement Request Form | Document initiated by beneficiaries or trustees to authorize payment from the trust fund. | Records initiation details such as amount, purpose, and approval signatures essential for audit trails. | Ensures disbursements align with the trust's purpose as prescribed under regulatory reporting standards. |

| Approval Documentation | Formal approvals from trustees or authorized parties confirming legitimacy of disbursal. | Enables verification of authorized transactions during audits by maintaining a clear approval chain. | Maintains compliance with internal controls and external financial reporting frameworks such as GAAP or IFRS. |

| Transaction Records | Bank statements, canceled checks, and electronic payment confirmations related to disbursements. | Provide exact transactional data required to reconstruct the flow of funds and validate expenditures. | Supports transparent financial disclosures fulfilling statutory audit and reporting mandates. |

| Beneficiary Identification | Documentation verifying the identity and eligibility of beneficiaries receiving funds. | Prevents fraudulent disbursements and ensures all payments are traceable to legitimate recipients. | Aligns with anti-money laundering standards and regulatory beneficiary reporting requirements. |

| Periodic Financial Reports | Trust fund accounting statements detailing disbursements, income, and balances over a reporting period. | Creates a comprehensive audit trail illustrating financial activity and fiduciary compliance history. | Meets mandatory reporting standards for trustees to provide transparency and governance oversight. |

| Correspondence and Communication Records | Emails, letters, and meeting minutes documenting trust fund decisions and disbursement rationales. | Supports audit reviews by providing contextual evidence for disbursement decisions. | Helps satisfy governance and compliance frameworks requiring documented trustee communications. |

| Tax Documentation | Forms such as IRS 1041 or relevant tax filings related to trust fund income and disbursements. | Ensures the audit trail includes tax compliance verification for all financial activities. | Conforms with tax authority reporting requirements essential for lawful trust fund operations. |

When managing trust fund disbursements, maintaining accurate and complete documentation is critical for meeting audit trail expectations and adhering to reporting standards. Your compliance efforts rely heavily on these records to demonstrate transparency and fiduciary accountability.

What Documents Does a Trust Fund Require for Disbursement? Infographic