Lenders require key documents for first-time homebuyer mortgage approval, including proof of income such as pay stubs, tax returns, and W-2 forms to verify financial stability. They also need credit information, including credit reports and scores, to assess creditworthiness and debt-to-income ratios. Additionally, applicants must provide identification, bank statements, and details of any existing debts to complete the evaluation process.

What Documents Are Required for First-Time Homebuyer Mortgage Approval?

| Number | Name | Description |

|---|---|---|

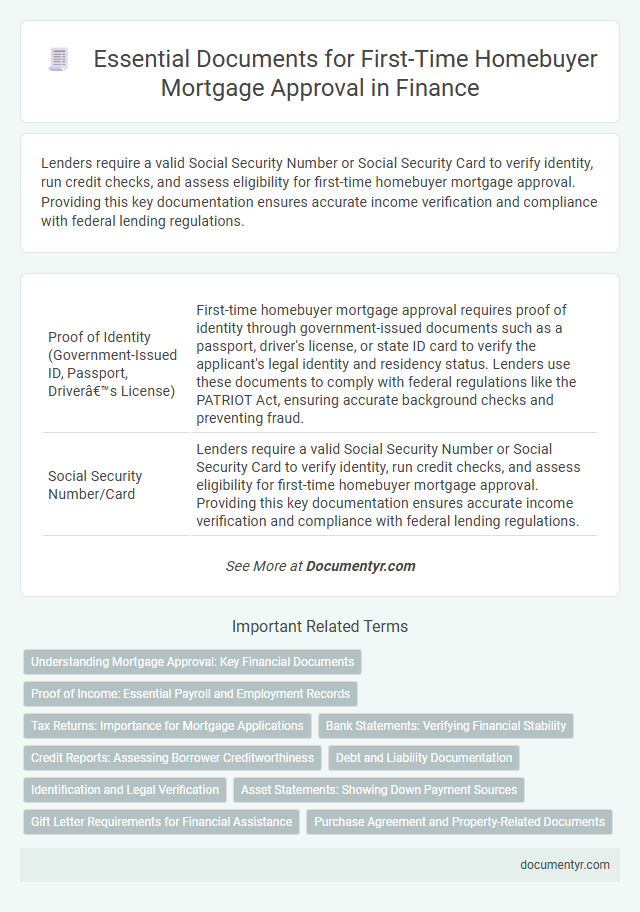

| 1 | Proof of Identity (Government-Issued ID, Passport, Driver’s License) | First-time homebuyer mortgage approval requires proof of identity through government-issued documents such as a passport, driver's license, or state ID card to verify the applicant's legal identity and residency status. Lenders use these documents to comply with federal regulations like the PATRIOT Act, ensuring accurate background checks and preventing fraud. |

| 2 | Social Security Number/Card | Lenders require a valid Social Security Number or Social Security Card to verify identity, run credit checks, and assess eligibility for first-time homebuyer mortgage approval. Providing this key documentation ensures accurate income verification and compliance with federal lending regulations. |

| 3 | Proof of Income (Recent Pay Stubs) | Recent pay stubs are essential for first-time homebuyer mortgage approval as they provide verifiable proof of consistent income, helping lenders assess the borrower's ability to repay the loan. Typically, lenders require pay stubs from the past 30 days to confirm employment status and earnings stability. |

| 4 | W-2 Forms (Past Two Years) | Lenders require W-2 forms from the past two years to verify income stability and employment history for first-time homebuyer mortgage approval. These documents provide crucial evidence of consistent earnings, helping assess the borrower's ability to repay the loan. |

| 5 | Federal Tax Returns (Past Two Years) | Lenders require first-time homebuyers to submit federal tax returns from the past two years to verify income stability and financial history. These documents provide crucial evidence of earnings, deductions, and tax compliance, ensuring accurate assessment of the borrower's repayment ability. |

| 6 | Bank Statements (Recent Two to Three Months) | Recent two to three months of bank statements are essential for first-time homebuyer mortgage approval, as they demonstrate consistent income, spending habits, and sufficient funds for down payments and closing costs. Lenders use these statements to verify financial stability and detect any irregular transactions that could impact loan eligibility. |

| 7 | Proof of Employment (Employment Verification Letter) | An Employment Verification Letter is a crucial document for first-time homebuyer mortgage approval, confirming current employment status, job title, length of employment, and income details directly from the employer. Lenders rely on this letter to assess income stability and job security, which significantly impacts the borrower's creditworthiness and loan eligibility. |

| 8 | Credit Report and Credit Score Authorization | Lenders require a credit report and credit score authorization to assess the financial reliability of first-time homebuyers, verifying credit history and score accuracy for mortgage approval. This documentation enables a detailed evaluation of creditworthiness, affecting loan terms and interest rates. |

| 9 | Proof of Down Payment (Bank Statements, Gift Letter) | Proof of down payment for first-time homebuyer mortgage approval typically includes recent bank statements showing sufficient funds and, if applicable, a gift letter verifying that funds received are non-repayable gifts from family or friends. Lenders require these documents to confirm the source and legitimacy of the down payment funds to mitigate loan risk. |

| 10 | Asset Statements (Retirement Accounts, Investments) | Lenders require detailed asset statements, including retirement accounts such as 401(k)s and IRAs, alongside investment portfolios like stocks and mutual funds, to verify financial stability and assess the ability to cover down payments and closing costs. Comprehensive documentation of these assets provides proof of reserves and strengthens first-time homebuyer mortgage approval chances by demonstrating sustained financial health. |

| 11 | Debt Information (Credit Card, Loan Statements) | First-time homebuyer mortgage approval requires detailed debt information, including recent credit card statements and loan documents to verify outstanding balances and payment history. Lenders use these records to assess debt-to-income ratio and evaluate the applicant's creditworthiness for mortgage qualification. |

| 12 | Rental History (Lease Agreements, Rent Receipts) | First-time homebuyers must provide rental history documents such as lease agreements and rent receipts to demonstrate consistent payment behavior and financial responsibility over time. These records enhance mortgage approval chances by verifying stable housing expenses and reliable creditworthiness to lenders. |

| 13 | Gift Letter (If Receiving Down Payment Assistance) | A Gift Letter is a crucial document for first-time homebuyers receiving down payment assistance from family or friends, confirming the money is a genuine gift and not a loan. Lenders require this letter to verify the source of funds and ensure the buyer does not have additional debt obligations affecting mortgage approval. |

| 14 | Purchase Agreement/Sales Contract | The Purchase Agreement or Sales Contract is essential for first-time homebuyer mortgage approval, detailing the agreed-upon sale price, property address, and terms between buyer and seller. Lenders use this document to verify transaction legitimacy, assess loan-to-value ratio, and confirm the buyer's commitment to purchasing the property. |

| 15 | Divorce Decree (If Applicable) | A divorce decree is essential for first-time homebuyers who are divorced, as it verifies property division, alimony, and child support obligations that may affect debt-to-income ratios. Lenders require this document to accurately assess financial liabilities and ensure mortgage approval aligns with the borrower's current financial status. |

| 16 | Bankruptcy or Foreclosure Documents (If Applicable) | Bankruptcy or foreclosure documents required for first-time homebuyer mortgage approval typically include discharge paperwork, court orders, and proof of debt satisfaction to demonstrate financial rehabilitation. Lenders need comprehensive documentation of past bankruptcies or foreclosures to assess risk and verify eligibility for mortgage terms. |

| 17 | Explanation Letters (For Credit Issues or Employment Gaps) | Explanation letters addressing credit issues or employment gaps are critical for first-time homebuyer mortgage approval, providing lenders with context and mitigating perceived risks. These letters should clearly detail the circumstances, such as temporary financial hardships or career transitions, and demonstrate steps taken to resolve or improve the situation. |

| 18 | Proof of Additional Income (Alimony, Child Support, Bonuses) | Lenders require first-time homebuyers to provide documented proof of additional income sources such as alimony, child support, and bonuses to verify financial stability and ensure accurate debt-to-income ratio calculation. Supporting documents typically include court orders for alimony and child support, tax returns or W-2 forms showing bonus income, and payment receipts or bank statements confirming consistent receipt of these funds. |

Understanding Mortgage Approval: Key Financial Documents

Understanding mortgage approval begins with gathering essential financial documents that demonstrate your ability to repay the loan. Lenders require proof of income, employment verification, and credit history to assess risk accurately.

Key documents include recent pay stubs, W-2 forms, tax returns, and bank statements to confirm stable income and savings. Providing these documents promptly accelerates the first-time homebuyer mortgage approval process.

Proof of Income: Essential Payroll and Employment Records

Proof of income is a critical component for first-time homebuyers seeking mortgage approval. Lenders require detailed payroll and employment records to verify financial stability and capacity to repay the loan.

Essential documents include recent pay stubs, typically covering the last 30 days, and W-2 forms from the previous two years. Employment verification letters or contracts may also be requested to confirm job status and income consistency.

Tax Returns: Importance for Mortgage Applications

Tax returns play a critical role in first-time homebuyer mortgage approval by providing lenders with a comprehensive view of an applicant's financial history. These documents verify income consistency and help assess the borrower's ability to repay the loan.

Lenders typically require the past two years of tax returns, including W-2s and 1099 forms, to evaluate employment stability and income sources. Accurate tax documentation supports debt-to-income calculations, influencing mortgage terms and interest rates. Missing or incomplete tax returns can delay approval or lead to loan denial.

Bank Statements: Verifying Financial Stability

Bank statements play a crucial role in first-time homebuyer mortgage approval by verifying financial stability. Lenders review these documents to assess your income consistency, spending habits, and savings patterns. Providing several months of accurate bank statements helps demonstrate your ability to manage finances and make timely mortgage payments.

Credit Reports: Assessing Borrower Creditworthiness

Credit reports play a crucial role in first-time homebuyer mortgage approval by assessing borrower creditworthiness. Lenders rely heavily on this data to determine the risk associated with lending.

- Credit Score Evaluation - Your credit score summarizes your credit history and helps lenders gauge reliability in repaying loans.

- Credit History Review - Detailed credit reports include accounts, payment history, and outstanding debts which indicate financial responsibility.

- Identifying Red Flags - Negative information such as late payments, defaults, or bankruptcies can impact mortgage approval decisions.

Debt and Liability Documentation

What debt and liability documents are necessary for first-time homebuyer mortgage approval? Lenders require detailed proof of all outstanding debts to assess your financial responsibility accurately. Providing recent credit card statements, loan agreements, and any court judgments ensures a thorough evaluation of your liabilities.

Identification and Legal Verification

First-time homebuyer mortgage approval requires specific documents focused on identification and legal verification. These documents confirm your identity and ensure all legal criteria are met for the mortgage process.

- Government-issued ID - A valid passport or driver's license is essential to verify your identity.

- Social Security Number (SSN) or Tax Identification Number (TIN) - Used to perform credit checks and confirm your financial history.

- Proof of Legal Residency - Documents such as a green card or visa validate your legal status to engage in property transactions.

Asset Statements: Showing Down Payment Sources

Asset statements play a crucial role in mortgage approval for first-time homebuyers by verifying the sources of the down payment. Lenders require recent bank statements, investment account summaries, and gift letters if applicable, to ensure funds are legitimate and readily available. Proper documentation of savings and assets demonstrates financial stability, increasing the likelihood of mortgage approval.

Gift Letter Requirements for Financial Assistance

| Document | Purpose | Details |

|---|---|---|

| Gift Letter | Proof of Financial Assistance | A gift letter verifies funds given by a relative or close friend to assist with a down payment. It must state that the money is a gift, not a loan, and will not require repayment. |

| Donor Information | Verification of Source | Includes the donor's name, address, phone number, and relationship to the borrower. This information confirms the legitimacy of the financial gift. |

| Amount of Gift | Financial Documentation | The exact dollar amount provided as a gift must be clearly stated, matching the deposit in the borrower's bank account. |

| Account Statements | Proof of Deposit | Bank statements showing the receipt of the gift funds into your account validate the transaction for mortgage approval purposes. |

| Compliance with Lender Guidelines | Mortgage Qualification | Lenders may have specific requirements for gift letters, including notarization or specific wording; ensure these conditions are met for smooth approval. |

What Documents Are Required for First-Time Homebuyer Mortgage Approval? Infographic